FDA Hands Sarepta A Positive Catalyst

Summary

- The Agency shifted gears and decides to convene advisors for SRP-9001.

- Sarepta Therapeutics' gene therapy has a novel mechanism for increasing a different type of dystrophin to treat a rare disease.

- Biomarker and clinical data indicate the drug candidate will sail through the meeting.

- Gene therapies generally cost in the high six-to-seven figures and should give an immediate revenue boost.

jittawit.21/iStock via Getty Images

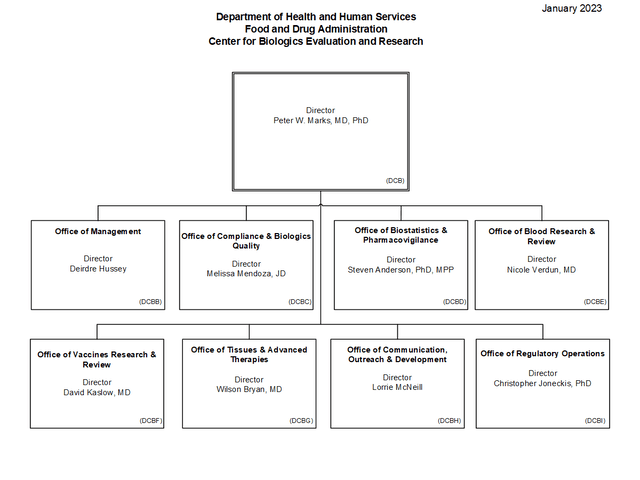

Sarepta Therapeutics (NASDAQ:SRPT) is a large ($11.5 billion market cap) biopharmaceutical company that markets 3 RNA-targeted products for Duchenne muscular dystrophy (DMD) patients. Since the previous coverage, they had two successive earnings calls showing 20+% growth (Table 1) that was met positively by the market. As part of full-year 2022 financial results on February 28, they headlined that the "FDA does not plan to hold advisory committee for SRP-9001." However, the Agency reorganized around the same time, establishing a "super" Office of Therapeutic Products ("OTP") with 6 new acting directors, which replaced the old Office of Tissues and Advanced Therapies and its Director, Wilson Bryan, who retired this month. The new OTP leadership decided to change its mind and there will be an Ad Comm meeting before the May 29, 2023 regulatory action date. With the about-face, the stock relinquished its gains from the Q4 call and tanked 18% that Friday, although it has recovered somewhat. Investors should not be fearing this development.

Table 1. Quarterly Revenues (in $ thousands)

Q1 2021 | Q2 2021 | Q3 2021 | Q1 2022 | Q2 2022 | Q3 2022 | |||

EXONDYS 51 | 107,185 | 112,461 | 115,598 | 119,117 | 117,133 | 126,377 | 122262 | 145,977 |

AMONDYS 45 | 193 | 6,936 | 26,655 | 34,745 | 43,614 | 54,676 | 54893 | 61,399 |

VYONDYS 53 | 17,548 | 22,442 | 24,658 | 24,863 | 28,078 | 30,184 | 30619 | 28,557 |

Products, net | 124,926 | 141,839 | 166,911 | 178,725 | 188,825 | 211,237 | 207,774 | 235,933 |

Collaboration | 22,005 | 22,250 | 22,495 | 22,736 | 22,005 | 22,250 | 22495 | 22,494 |

Total revenues | 146,931 | 164,089 | 189,406 | 201,461 | 210,830 | 233,487 | 230,269 | 258,427 |

Figure 1. Old FDA CBER Organization Chart

SRP-9001 (delandistrogene moxeparvovec) is an investigational intravenous ("IV") gene transfer therapy being co-developed with Roche (OTCQX:RHHBY). It has several components that as a whole appear well-designed: a shortened but functional transgene version of human dystrophin (mini-dystrophin), a recombinant adeno-associated virus serotype rh74 (rAAVrh74) delivery vector, and driven by a skeletal and cardiac muscle-specific promoter (MHCK7). The gene therapy allows the production of replacement proteins in patients with loss of function mutations. Systemic IV administration allows widespread drug distribution via the blood stream to different muscle groups throughout the body. Mini-dystrophin is required because the full-length protein is too big to fit 5-kb packaging limit of the AAV viral vector. As dystrophin protects muscles from injury during contractions, the enhanced cardiac muscle expression from the promoter benefits the heart, which contracts all the time.

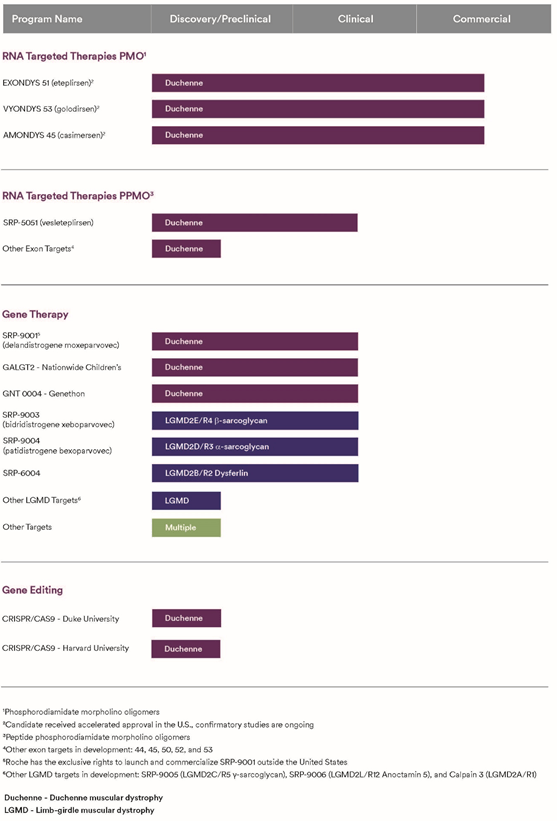

The chosen vector has wide applicability. A very recent study published this year found 86% of patients with DMD in the U.S. are seronegative for pre-existing antibodies to rAAVrh74. Tests known as total binding antibodies assays can screen patients for whom rAAVrh74-based gene therapy would be a safe choice. The vector is the same used by Nationwide Children's Hospital to investigate GALGT2 gene therapy in DMD (Figure 2), as well as SRP-9003, a gene therapy with its first person dosed last month to treat limb-girdle muscular dystrophy Type 2E/R4.

Figure 2. Sarepta Pipeline as of 1/1/2023

Sarepta

In September 2022, Sarepta submitted a biologics license application ("BLA") seeking accelerated approval of SRP-9001 for the treatment of ambulant individuals with Duchenne, which was accepted in November by the FDA for priority review. Accelerated approvals are based on biomarker results rather than clinical benefit, and require confirmatory trials. In oncology, the FDA has taken a more urgent stance and "strongly recommends that the confirmatory trial(s) be well underway if not fully enrolled at the time of accelerated approval." SRP-9001's confirmatory trial EMBARK is fully enrolled, with topline results anticipated in Q4 2023.

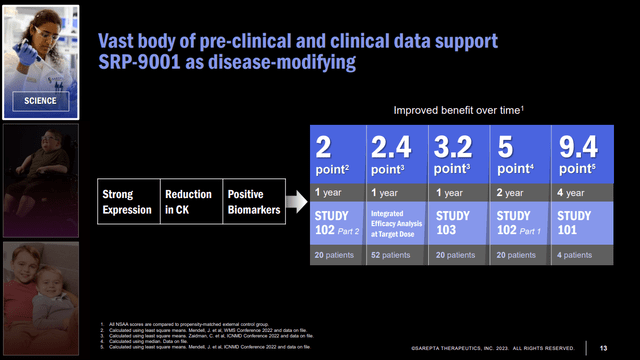

EMBARK's primary endpoint is change in baseline ("CFB") on the North Star Ambulatory Assessment (NSAA) total score at Week 52. The NSAA is a 17-item scale evaluating motor tasks in ambulatory DMD patients, with a score range of 0-34. Tasks are scored from 0 (Unable to perform the task) to 2 (Can perform the task independently, without difficulty). Although not required for accelerated approval, clinical benefits on this validated scale have been measured against external controls (Figure 3). There is risk of bias in comparing to external controls; however, a 2022 study of DMD trial placebo arms and real-world or natural history data found no statistically significant differences in NSAA scores after 48 weeks, and the FDA approved 36 drugs from 2000-2019 that used external controls. EMBARK has a placebo group.

Figure 3. NSAA improvements compared to propensity-matched external control group

41st Annual J.P. Morgan Healthcare Conference Presentation

Risks and Takeaways

The greatest risk is the FDA's acceptance of surrogacy. To date, only exon-skipped dystrophins, and an increase of their production (not the amount or the distribution into specific muscle groups), were considered sufficient as a surrogate endpoint for approved DMD drugs. Sarepta's exon-skipping products showed a mean CFB (% normal dystrophin) of 0.28-0.8% (0.28% for EXONDYS, 0.92% for VYONDYS, and 0.8% for AMONDYS). The same Western blot assay that measures the quantity of dystrophin as a percentage of healthy control skeletal muscle tissue was employed for ENDEAVOR, a two-part, open-label, Phase 1b study assessing the expression and safety of SRP-9001 in five cohorts of male patients with DMD. Baseline levels were below the limit of quantification. At Week 12, in 20 patients from Cohort 1, the mean CFB was 54.2% ± 42.6 standard deviation, which is magnitudes higher than levels previously thought necessary for muscle protection. Furthermore, using immunofluorescence, which reports the total number of fibers expressing dystrophin, CFB was 48.3% + 25.4 SD. These numbers will make Ad Comm much less contentious than the one held for EXONDYS.

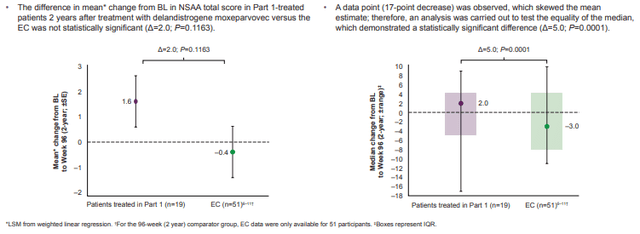

As far as efficacy, the single black eye was the topline for Part 1 of SRP-9001-102 (Study 102), a double-blind, randomized, placebo-controlled trial in 41 DMD patients. Study 102 met its primary biological endpoint, micro-dystrophin expression of 28.1% as measured by western blot at Week 12 (P<0.0001). However, the primary functional endpoint, increase in NSAA total score compared to placebo at Week 48, was not statistically significant (P=0.37). Sarepta blamed it on the super coil titering method that employed by one of the Study's two sites, Nationwide Children's Hospital, that the company suspected led to underdosing, as "60% of the batches were less than the target dose." Unfortunately, it may have led to a single patient suffering a 17-point drop that skewed the mean, which was found to be significantly different than the median showing a 5-point improvement after 2 years (Figure 4).

Figure 4. Post hoc analyses of Study 102, Part 1: Mean and median CBL in NSAA total score versus EC

2023 Muscular Dystrophy Association Clinical and Scientific Conference

Safety issues such as immunogenic responses and a fatality led to the FDA placing a clinical hold on competing gene therapy candidates SGT-001 from Solid Biosciences (SLDB) and PF-06939926 from Pfizer (PFE). To better understand these serious adverse events (SAEs), a historic information-sharing and collaboration between these rival sponsors led to a joint presentation at the American Society of Gene & Cell Therapy (ASGCT) conference last May. The ASGCT website is currently broken, but the abstract stated that, "Given that similar events were observed across multiple investigational gene therapy products with different capsids, promoters, and transgene sequences, they are most likely to be a specific transgene/genotype-related 'class effect'" occurring in patients with certain genetic anomalies, which could be screened for and excluded from participation in the trials. In the integrated analysis of the SRP-9001 program, seven patients (8.3%) of the 72 who received the commercial 1.33×10^14 vg/kg dose experienced treatment-related SAEs: vomiting (2 events), increased transaminases (2 events), rhabdomyolysis (2 events), liver injury (1 event), immune-mediated myositis (1 event), myocarditis (1 event). The latter two were experienced in ENDEAVOR's Cohort 2, so it is always possible that some heretofore unknown SAE could come to light in the future.

Sarepta had $2.0 billion in cash, investments and long-term restricted cash as of December 31, 2022. Net loss in Q4 was $109.2 million and $257.7 million in Q3. The first gene therapy targeting the genetic root cause of disease was the spinal muscular atrophy ("SMA") treatment Zolgensma from Novartis (NVS). Approved in May 2019, it debuted and reigned until November as the world's most expensive drug at $2,125,000 (paid at $425,000 for 5 years) and generated U.S. sales exceeding $300 million that year. People are more frequently affected by DMD (1 in 3,500 male births) than SMA (1 in 10,000), so SRP-9001 will cost much less but there will be more patients utilizing it. The point is that there will not likely be a Sarepta stock offering shortly after approval and expected subsequent price rally. Given the debilitating effects of the disease which can't be reversed once damage is done, patients and their physicians will be unlikely to sit around and wait the few months for confirmatory data. The additional potential income should lead to upgrades on all components of Seeking Alpha's Quant system.

To conclude, Sarepta should at least fill the gap before the meet. By then, SRP-9001 is unlikely to have detractors at Ad Comm unless they have ties to competitors. Even so, they won't have the numbers to derail a positive vote. Unlike Sarepta's other DMD drugs, SRP-9001 demonstrated encouraging clinical benefits, reduced the creatine kinase enzyme that in high levels denote muscle damage, and has no obvious safety problems. For investors who remain unconvinced, the June 16 $135 strike is becoming more affordable.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SRPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.