CEE: Too Risky A Play On Russia Upside

Summary

- The Central and Eastern Europe Fund has been hit particularly hard by Russian sanctions over the last year.

- The Russian book has been marked to zero but could yield substantial recovery value should sanctions be lifted.

- With the fund already at a NAV premium, however, and the ex-Russia book also likely to be weighed down by an extended tightening cycle, the risk/reward isn't particularly compelling.

Leestat

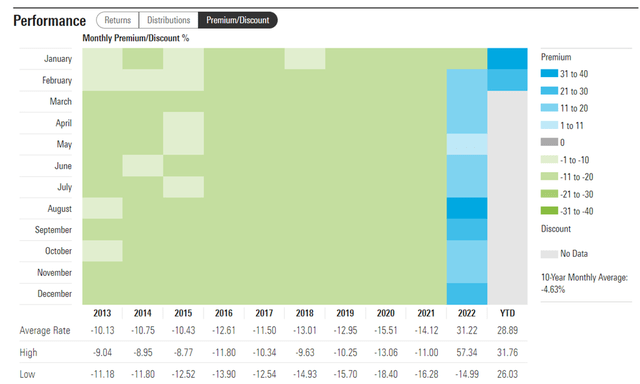

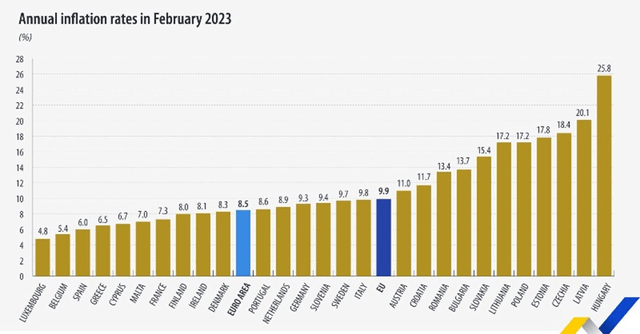

The Central and Eastern Europe Fund (NYSE:CEE) has been severely beaten down over the last year, as sanctions on major Russian holdings like Gazprom (OTCPK:OGZPY) and Sberbank (OTCPK:SBRCY) led to a significant portion of the fund's NAV being impaired in 2022. Outside of UK-listed precious metals miner Polymetal (OTCPK:POYYF), the Russian holdings are currently marked at zero, which has led to investors speculating on the potential optionality of buying into CEE as a low-cost bet on an eventual reversal of Russian sanctions. At a ~19% premium to NAV, some of the optionality has been priced in, but the implied recovery value of the non-DR (depositary receipts) Russian portfolio holdings remain fairly low at ~33%, by my estimates. Depending on your risk appetite and time horizon, the risk/reward could go either way here, though the relatively high fees at ~1.7% (~1.5% net) don't help. With inflation also running hot across the major CEE regional exposures (>25% YoY for Hungary and >17% YoY for Poland), a 'higher for longer' rate scenario is likely on the cards, which will pressure equity valuations for the ex-Russia holdings in the interim.

Fund Overview - A Pricey and Relatively Concentrated Portfolio of CEE Large Caps

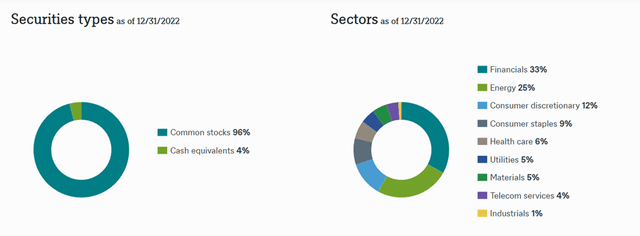

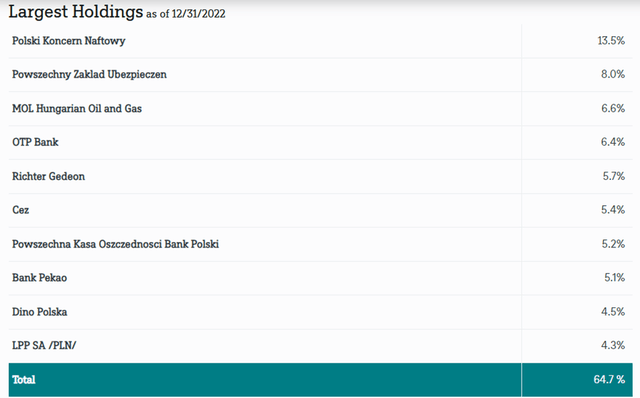

After a difficult year, DWS Group's closed-end Central and Eastern Europe Fund ended 2022 with ~$43m in net assets. Its gross expense ratio remained at a relatively pricey 1.7% for a portfolio of Central and Eastern European large caps that are mostly available to Western investors via depositary receipts. As reflected in the graphic below, the fund's sector allocation skews toward the financials, energy, and consumer discretionary sectors, which accounted for a combined 70% of the total portfolio as of December 31, 2022.

By geography, the fund's largest exposures are to Poland (57%), Hungary (20%), and the Czech Republic (10%), contributing a cumulative ~87% of the overall portfolio. The fund's single-stock holdings reflect this profile, with Polish names like energy conglomerate PKN Orlen (OTC:PSKOF) at 13.5% and insurance giant PZU (OTC:PWZYF) at 8.0% leading the holdings list. The largest Hungarian holding is oil and gas company MOL Group (OTCPK:MGYOY) at 6.6% and OTP Bank (OTCPK:OTPGF) at 6.4%. All in all, the top five holdings account for a cumulative ~40% of a 59-stock portfolio (~65% for the top-ten holdings), so the fund is fairly top-heavy.

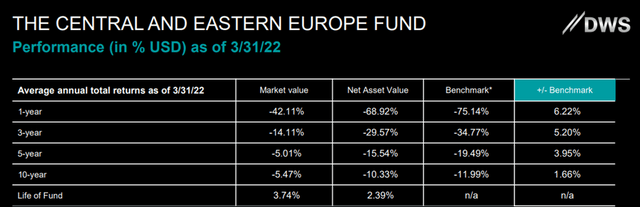

On a YTD basis, the CEE fund's returns have underwhelmed at -4.2%, extending the poor 2022 run, which saw the fund mark down its Russian book (~71% of its assets as of January 2022). Zooming out, the fund has still compounded its NAV at 1.8% since inception (2.2% in market price terms) despite a one- and five-year NAV drawdown of 76.8% and -21.2%, respectively. And while CEE had outperformed its benchmark MSCI Emerging Markets Europe ex-Greece Index (in market value terms) across all timelines as of March last year, much of the outperformance was due to the wide NAV premium vs. stock picking skill.

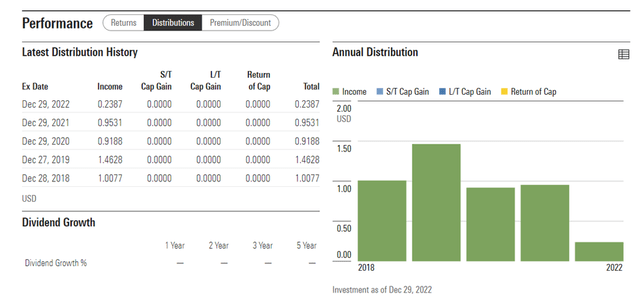

While the CEE fund has paid attractive distributions over the years, the lack of contributions from its Russian book adds uncertainty to the outlook going forward. In 2022, the fund paid out $0.2387/share in total income distribution, which was down from $0.9531/share in 2021 and 0.9188/share in 2020. Still, the payout equates to a respectable ~3% yield as of the latest market price and ~3.5% in NAV terms. With the ex-Russia portfolio continuing to be heavy on through-cycle cash generators in the energy and financials, expect near-term income distributions to remain steady going forward.

CEE Inflation Remains an Issue; Monetary Tightening to Continue

Having proved surprisingly resilient in the immediate aftermath of the Russia-Ukraine conflict last year, cracks are starting to show in the CEE economies, particularly for countries most exposed to the effects of the conflict. This year has seen some improvement but nowhere near enough - manufacturing PMIs remain down in the 40s (signaling contraction) for the Czech Republic and Poland, while Hungarian PMI numbers continue to decelerate from a strong December print despite still being in expansion.

More worrying is the inflationary pressure in the region. Energy has been the main culprit over the last year, but a decline in global energy prices should drive a quick deceleration in fuel and household energy price inflation in the coming months. Yet, inflationary pressures have spread to core, domestic components - core Polish inflation rose to +12% YoY in February (high-teens percentage YoY headline inflation), and Hungarian core inflation is running at >25% YoY (ex-energy and unprocessed food, as well as tobacco and alcohol). So even against a backdrop of normalizing non-core pressures from energy and food, the monetary policy tightening by CEE central banks likely isn't ending anytime soon. An extended rate hike runway will weigh on earnings growth and equity valuations, which doesn't bode well for the CEE fund's exposure.

Sizing the Russia Opportunity

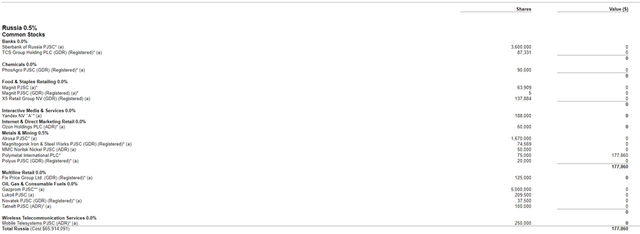

One of the more interesting aspects of CEE is its wide NAV premium at ~19% (vs. most CEFs' NAV discount). A key reason for the premium is ongoing speculation about the value of the Russia book - recall that the fund had a substantial portion of its book invested in Russian stock and depositary receipts prior to the imposition of sanctions. Since then, the fund has "participated in four mandatory share conversion schemes" and now holds bigger direct shareholdings in major Russian companies like Sberbank, Gazprom, and Lukoil (OTC:LUKOY), among others. While many of CEE's Russian-listed shares are traded on the MOEX, the fund manager has marked all Russian-listed assets at zero, with only UK-listed Polymetal, marked to market. The FY22 filing provides a clear breakdown of its Russian holdings:

Given the MOEX-listed shares are thinly traded, and the RUB is arguably being supported by capital controls, conservatively marking the Russian assets at zero is probably the right move. Still, marking CEE's holdings at current MOEX prices would yield substantial recovery value. Assuming the fund's historical ~14% NAV discount as a base, the market is pricing in an implied ~33% recovery, by my estimates. Note that this excludes any future conversion of the remaining depositary receipts or valuation uplift should the shares become redeemable by overseas investors. So, in a scenario where the sanctions are lifted, there is a good chance that CEE holders will eventually realize significant upside. The issue is the timing and the expenses investors will have to foot in the meantime. In my view, the risk/reward isn't ideal here, and I would wait for the fund to trade below NAV before considering a position. With a US election catalyst next year, expect the CEE premium to be volatile and throw out some opportunities.

Russian Holdings (Non-DR) | Shares | Implied Value (USD) |

Sberbank of Russia PJSC | 3,600,000 | 9,914,112 |

Magnit PJSC | 63,909 | 3,751,970 |

Yandex NV | 188,000 | 4,691,502 |

Alrosa PJSC | 1,670,000 | 1,420,702 |

Gazprom PJSC | 5,000,000 | 11,201,450 |

Lukoil PJSC | 209,500 | 11,770,967 |

Total Market Value (Non-DR) | 42,750,703 | |

NAV Premium vs. 14% discount | 13,963,949.39 | |

Implied Recovery Value | 32.7% |

Source: CEE Annual Report Filing

Too Risky a Play on Russia Upside

CEE was slow to fully exit its significant Russian exposure last year and has since been forced to mark its remaining (ex-Polymetal) holdings in the likes of Gazprom, Lukoil, and Sberbank to zero. Yet, the fund continues to trade at a premium (albeit a narrowing one) on speculation that the Russian positions currently marked at zero cost could one day be worth something. The current NAV premium implies an ~33% recovery on an already discounted ~$43m Russian book (marked to MOEX prices), so if the sanctions do get lifted within the next few years, investors could still come out ahead. But timing this outcome is a near-impossible task, and investors could end up stuck in a non-performing asset instead while simultaneously losing out on fees and a narrowing NAV premium. The outlook for CEE's remaining regional exposures (Poland, Hungary, and the Czech Republic) isn't great either, with their low double-digits percentage inflation and tightening monetary policies likely to weigh on growth and valuations.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.