Biotech's Bearish Turn In 2023, But Eyeing Bullish Seasonal Trends In IBB

Summary

- The Biotech space has not caught much of a tailwind from lower interest rates lately.

- After a stellar relative return in the second half of 2022, the trend has turned in favor of the bears.

- I outline key price levels to monitor following a bearish breakdown below a key chart pattern.

Sean Anthony Eddy

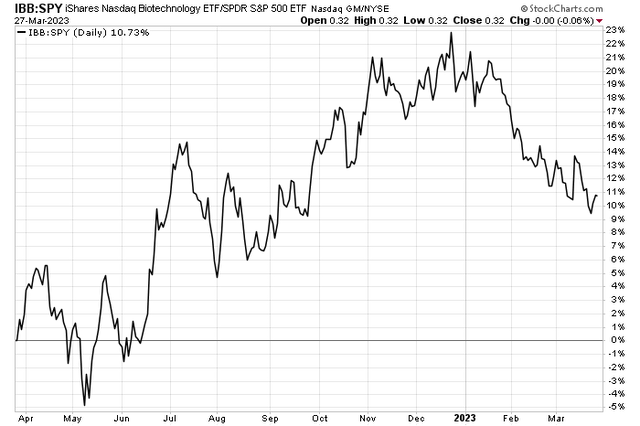

Biotech has not participated in the relative strength of growth stocks so far this year. Often, when that style is in favor, biotech performs well. I notice significant relative weakness over the past three months in the IBB ETF.

IBB vs SPY: Bearish Relative Trend For Biotech in 2023

According to the issuer, the iShares Biotechnology ETF (NASDAQ:IBB) seeks to track the investment results of an index composed of U.S.-listed equities in the biotechnology sector. The fund carries a moderate annual expense ratio of 44 basis points and has nearly $8 billion in assets under management. With a 30-day median bid/ask spread of just two basis points and 30-day average volume of more than 1.8 million shares, tradeability is high. The ETF houses 271 equities and pays a small yield of 0.3% as most of its companies use cash flow and take on debt for potentially lucrative research and development investments.

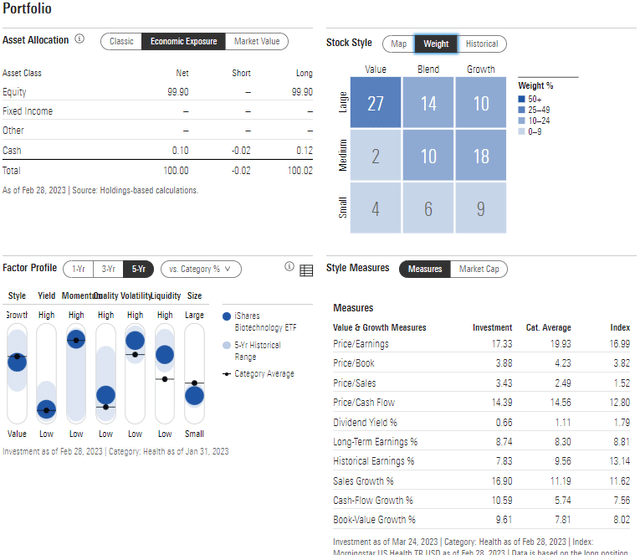

Biotech is a low-yield, high-momentum space with low-quality and highly volatile stocks. But the space can outperform during growth scares since the area is one of the few secular growers in the broad market. So now could be a favorable time during the economic cycle to scoop up shares. IBB trades at a forward operating earnings multiple of just 15.7 though its price-to-book ratio is high at 4.4, so the valuation picture is mixed.

Digging into the portfolio, data from Morningstar show that IBB is primarily a large-cap fund, but there's significant mid-cap exposure, too. I see IBB as more of a growth fund versus value, despite what the Style Box shows. It's also important to consider that the ETF is not purely Biotech on some metrics - Morningstar classifies 17% of the portfolio as being in the Life Sciences Tools & Services industry. Still, it is a risk-on play on innovation and developments in a hike-stakes niche of the Health Care sector.

IBB: Portfolio & Factor Profiles

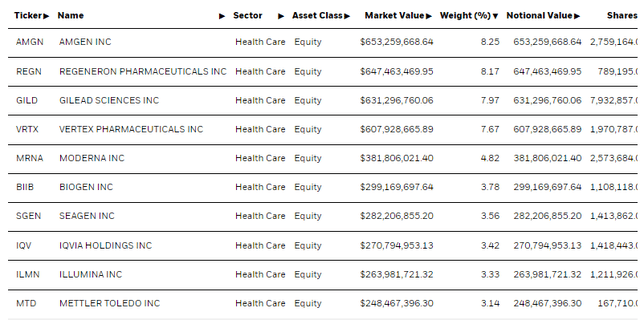

Unlike the SPDR S&P Biotech ETF (XBI), IBB is market cap weighted, so there's a larger percentage allocated to large caps such as Amgen (AMGN), Regeneron (REGN), and Gilead (GILD). Monitoring events among the fund's top-4 holdings, which account for more than 30% of the portfolio, is critical. Also, volatile names like Vertex (VRTX) and Moderna (MRNA) will lead to significant swings in IBB.

IBB's Concentrated Portfolio

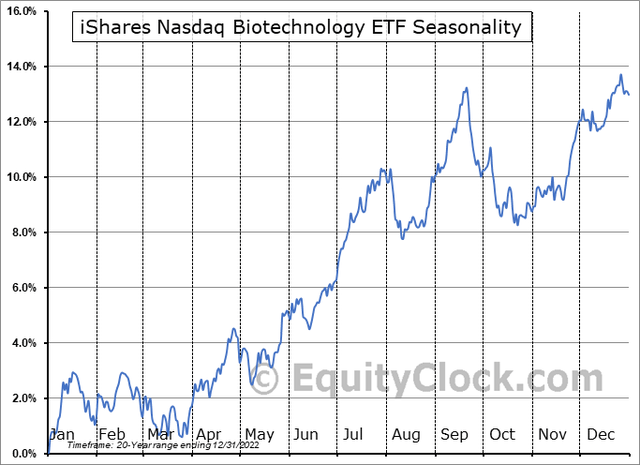

Checking in on the seasonality, data from Equity Clock show that IBB tends to trough versus the S&P 500 during the first several weeks of Q2, so we are coming up on a potentially optimal time to buy the fund. The relative strength picks up in late May through the first half of July.

IBB: Bullish Seasonal Trends

The Technical Take

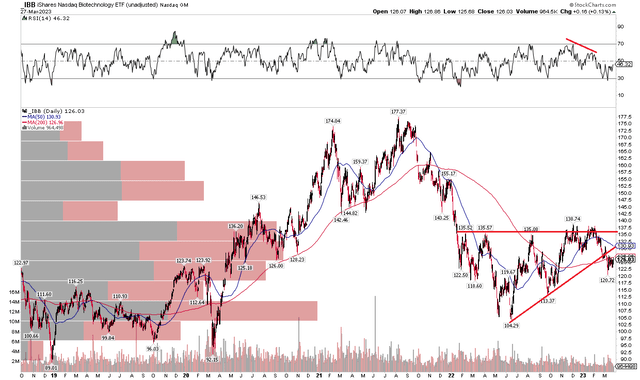

With intriguing economic cycle bullish potential and strong seasonal trends about to take hold, the chart is a bit more bearish. Notice in the graph below that shares have broken below an ascending triangle pattern, with key resistance in the $135 to $139 range. If shares can climb above that resistance hurdle, then a bullish measured move price objective to just about $165 would be triggered.

For now, there's downside risk to three obvious prior lows: $121, $113, and $104. What's more, there's high volume by price in the $105 to $110 range that should further protect the bulls - that would be a favorable risk/reward buy zone along with the momentum breakout play above $140. So, we are in no man's land at the moment.

One final indicator - check out the RSI momentum line above the price graph. That shows bearish divergence as the ETF attempted to make a new high back in February - another arrow in the bearish quiver. I was a bit premature in my breakout call in December, but the fund has held the $120 level I noted as the prior stop-out level.

IBB: Breakdown From Consolidation

The Bottom Line

I'm a hold on IBB here as the fund struggles technically despite a decent valuation and favorable seasonal patterns.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.