Assertio Holdings Stock: The Rally Is Likely Not Over Yet

Summary

- Since my previous bullish article on ASRT stock, it has gained 68.54% and continues thriving. Time to update my thesis.

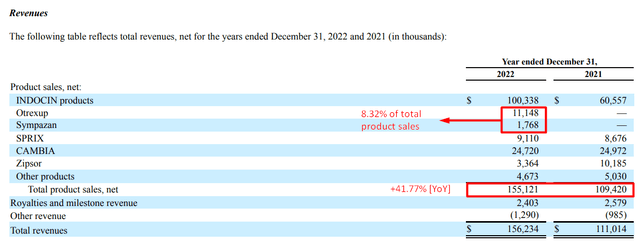

- Thanks to the addition of 2 new drugs to its sales structure, which now account for over 8% of total sales, ASRT increased its top line by almost 42% [YoY].

- I expect ASRT to show a further improvement in its already good solvency and debt indicators in the next reporting period.

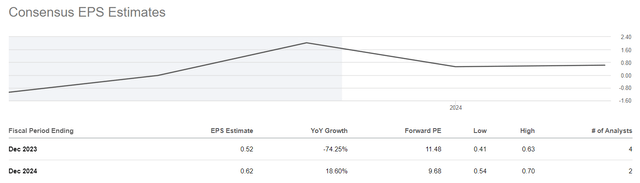

- Assertio will not have the same positive tax effect in FY2023 as it did in FY2022, but this moment seems to be already priced in by the Street.

- I reaffirm my Buy rating for ASRT with a projected 100% long-term stock growth, but caution to monitor for potential short-term mean-reversion.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

Jatuporn Tansirimas/iStock via Getty Images

Intro & Thesis

Assertio Holdings, Inc. (NASDAQ:ASRT) is ranked as one of the best names in its industry based on Seeking Alpha's Quant System - anything is possible thanks to the decisive momentum factor that has prevailed since the middle of last year.

I was fortunate to catch a moment of weakness when the stock fell to $3.65 - at which point I published my bullish article. Since then, ASRT has gained 68.54% and continues thriving.

I think this rally remains strong enough to continue for the foreseeable future as the company grows out of its already cheap valuation. This is my thesis, based on which I am again updating my previous Buy rating.

What Does Assertio Holdings Do?

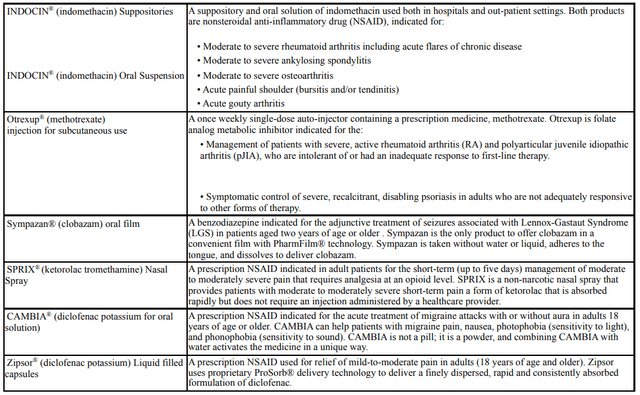

Assertio Holdings is a commercial pharmaceutical firm valued at over $325 million that provides differentiated products to patients, utilizing a non-personal promotional model. The main focus of ASRT's sales is a variety of nonsteroidal anti-inflammatory drugs [NSAIDs], including the following ones:

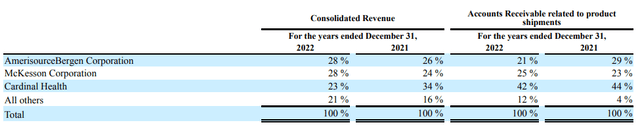

The company runs all of its business operations within one segment, and the majority of its revenue is generated from product sales in the United States, as stated in the latest 10-K filing [March 8, 2023]. The vast majority of the company's net product sales come from 3 large, national wholesale distributors:

As we can see, ASRT was able to blur its dependence a bit - the share of "All others" increased from 16% to 21% within a year thanks to a change in the product mix.

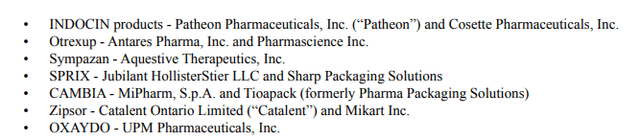

The company has its products manufactured by third-party suppliers - as we can see from the 10-K, each individual drug is produced in a separate facility:

If you are interested in following the story of how the company has experienced the ups and downs of its business, my last article has a fascinating description with links to various sources. To avoid repeating myself and wasting the time of readers who do not need a historical digression, I suggest turning to recent trends in financials to understand what state the company was in at the time of its last report.

Assertio's Financials Look Decent

Thanks to the addition of 2 new drugs to its sales structure, which now account for over 8% of total sales, ASRT increased its top line by almost 42% [YoY]:

ASRT's 10-K filing [author's notes]

In FY2022, Assertio Holdings saw an increase in the cost of sales [COGS] of just 18.41% - with declining SG&A expenses [-11.1% YoY] and a slight increase in other operating expenses of just $18 million, ASRT saw an increase in EBIT figure of >318% YoY. The operating income margin improved by 16.61% [1661 basis points - that's a lot].

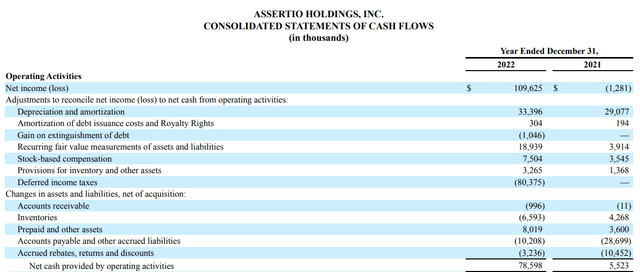

Interest expense declined 22.1% year over year and a huge income tax benefit of $78.46 million allowed the company to post a net income of $109.6 million, compared to a loss of $1.28 million a year earlier.

Operating cash flow generation looks very solid even after adjusting for deferred income taxes [>$80 million]:

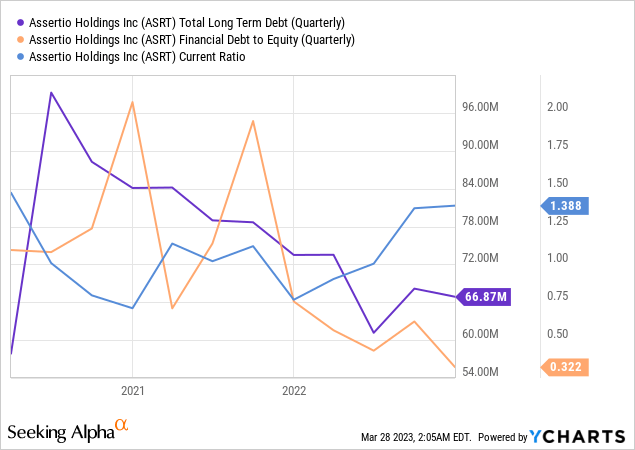

The company continued to purposefully reduce its debt burden. At the end of February 2023, ASRT entered into separate, privately negotiated exchange agreements with a limited number of holders of Assertio's currently outstanding 6.50% Convertible Senior Notes due 2027. Presumably, the transaction closed on February 27, and thanks to it, ASRT managed to reduce its overall debt by $30 million, or 42.9%, while consuming only $10.5M in cash (and issuing ~7 million shares). As one of the commenters below that news post [linked above] noted, the company eliminated $30 million of notes convertible at $4.09 and paid $10.5 million to increase the conversion price to $4.29. This reduced the number of shares outstanding by 334,000 and eliminated future interest payments of approximately $9 million. The whole transaction seems to be accretive to earnings net-net.

Therefore, I expect ASRT to show a further improvement in its already good solvency and debt indicators in the next reporting period.

Assertio's Valuation & Expectations

Despite ASRT's phenomenal growth in recent months, the stock does not appear to be overvalued at all - in fact, based on certain metrics, the company looks quite attractive.

As you'll recall, the income tax benefit in FY2022 proved to be a one-time event that drove up earnings, which is unlikely to be repeated in 2023. What was not affected by this effect is the operating profit - the growth looks quite natural and is explained by the growth in operating activities and newly acquired products.

In absolute terms, EV/EBITDA multiples [both TTM and FWD] are many times lower than in the Healthcare sector even as the stock price rose, according to data from Seeking Alpha:

YCharts, Seeking Alpha data [author's notes]![YCharts, Seeking Alpha data [author's notes]](https://static.seekingalpha.com/uploads/2023/3/28/49513514-16799862631010613.png)

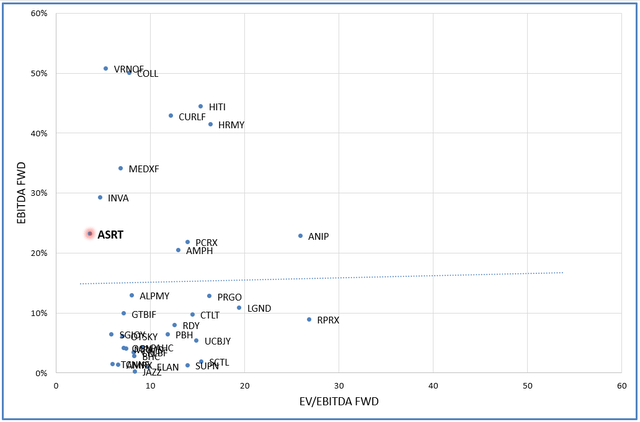

Looking at the pharmaceutical sector, which includes 222 companies [based on Seeking Alpha], ASRT appears to be the cheapest company of all in terms of forward EBITDA growth:

Author's calculations, Seeking Alpha data

Note: I removed many outliers from the sample so as not to shift the chart to the right.

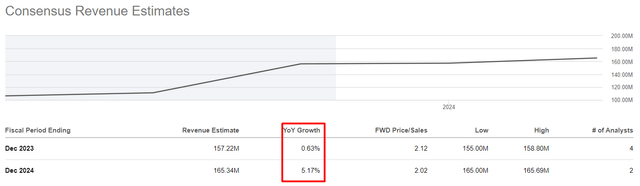

As I wrote above, Assertio will not have the same positive tax effect in FY2023 as it did in FY2022, but this moment seems to be already priced in by the Street:

Seeking Alpha data, ASRT, Earnings Estimates

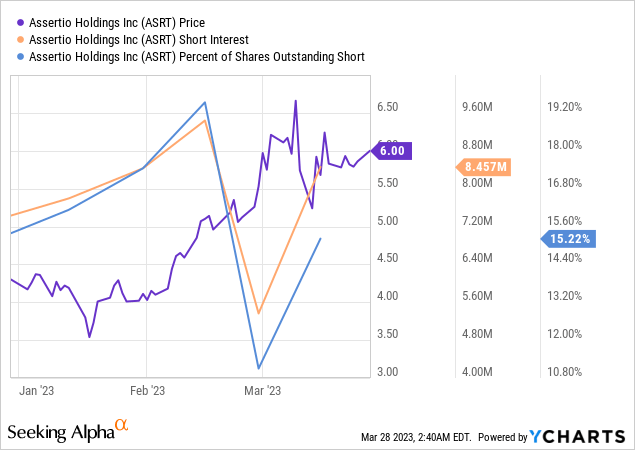

What seems to be underestimated to me is the revenue growth forecast - how ASRT will fall from a growth rate of over 40% to just 0.63% this year and 5.17% in FY2024 is completely unclear to me.

Seeking Alpha data, ASRT, Earnings Estimates [author's notes]

Yes, last year's growth is a thing of the past, but we saw from the momentum of sales that the growth was not just from new products. I expect further earnings beats going forward - the short sellers who are most likely rebuilding their positions as the stock keeps going higher may get very painfully burned if my hunch comes true.

Risks & Bottom Line

Of course, the risks currently surrounding Assertio Holdings cannot be ignored. The business is negatively impacted by generic competition for Cambia and Zipsor, as well as a 503B compounder for INDOCIN suppositories. In addition, generic approval for other products, including INDOCIN products that are not patent protected, would adversely affect the business.

Also, the pharmaceutical industry faces various risks, including changes in laws and regulations; potential failure to comply with regulations; increased liability for promoting off-label drug use; the potential impact of healthcare reform; risks to intellectual property; and the potential for significant damage awards from litigation settlements.

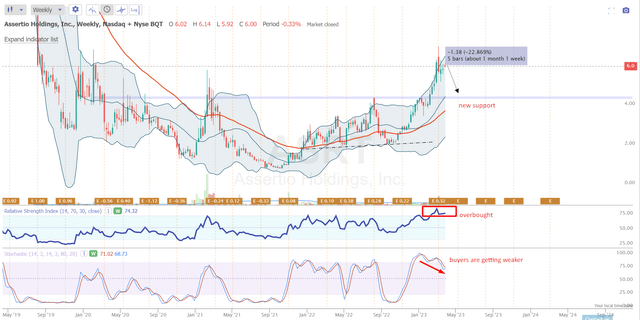

Furthermore, there is a risk of a mean-reversion - ASRT stock might have risen too much and has approached the upper Bollinger Band on the weekly chart. And this is with decreasing strength of buyers [indicated by the stochastic] and RSI in the overvalued area:

TrendSpider Software, ASRT, author's notes

Despite all of these risks, Assertio Holdings stock looks very, very attractive at current levels based on the company's valuation, modest priced-in revenue projections, and management's desire to [financially] deleverage and keep on growing the business.

I expect that once Assertio reports its next quarterly results, we will see a growing discrepancy between valuation and actual growth - short sellers will likely rush to cover their positions, and unfair "cheapness" will begin to dissipate. In the medium to long run, I estimate ASRT stock growth to be 100% [doubling] - along the lines of Morningstar Premium's system fair value estimates:

Morningstar Premium, ASRT [author's notes]![Morningstar Premium, ASRT [author's notes]](https://static.seekingalpha.com/uploads/2023/3/28/49513514-16799888574771533.png)

As always, your comments are welcome! Thanks for reading!

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don't bury our heads in the sand when the market is down - we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% - hurry up!

This article was written by

Chief investment analyst at a small Singapore-registered family office. A generalist in nature. Mainly focused on special situations, IPOs, and undercovered/hidden stocks. Ranked in the top 4% of financial bloggers by Tipranks (as of June 17, 2022, compared to the S&P 500 Index over 1 year).

BS in Finance. The thesis description can be found in this article.

DM me in case you're interested in investment consulting services.

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ASRT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.