Better Buy: Black Stone Minerals Or Kimbell Royalty

Summary

- In this head-to-head, I am going to see which royalty play - Black Stone Minerals or Kimbell Royalty Partners - is competing for the hardest for our investment dollars.

- Each company will be evaluated on Dividends, Debt & Dollars, and Dirt (yes, DIRT!).

- The winner will be considered the King of Royalties.

Yurii Kifor

Thesis

The energy markets have been smacked around lately due to a warmer than normal winter and strife in the financial sector of the economy. Compounding the issue, inflation and lower DUC inventory pressures are driving up capital expenses for producers. In contrast, royalty based companies benefit from next to zero capital expenses and profits are extracted from wells already in operation. For income oriented investors, this segment provides a diverse income stream in the energy sector that allows to exposure to multiple operators and basins.

In this article I will compare, head-to-head, two mineral and royalty based companies. The winner will be based on the following metrics for both Black Stone Minerals (NYSE:BSM) and Kimbell Royalty Partners (NYSE:KRP).

- Dividends - which company has the best shareholder return model.

- Debt & Dollars - a measure of overall management performance and forward flexibility.

- Dirt - a measure of the physical asset we are investing in. Whoever has the best acreage should (over the long haul) provide the best returns.

A Quick Look

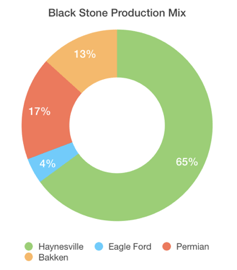

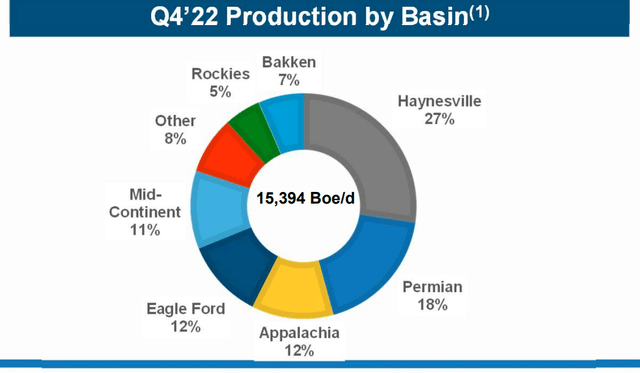

Before we get started, let's take a look at each company. Both BSM and KRP have similar business models as royalty based operators. Black Stone derives most of its royalties (61%) via production from the Haynesville and Eagle Ford basins in eastern Texas, while Kimbell is slightly more diverse. Kimbell produces a more even spread, with the Permian basin coming in as the largest contributor at 23%. That is followed by the Haynesville and Eagle Ford Basins coming at 20% and 14% respectively. The rest of its production is sprinkled amongst the Appalachia, Mid-Content, and several other US basins.

Both companies cash flows are derived from commodity prices, although some of this volatility is mitigated through hedging. In spite of operating in the same business environment, the companies differ in their shareholder return models. BSM operates under the traditional fixed distribution model, while KRP uses a variable distribution that fluctuates with the cash flow the company generates. Due to the volatility this can create, we will explore which company is best suited to reward its shareholders over the long term.

DIRT

Ultimately when investing in an oil/gas producing entity, we must remember that the quality of property they own will be the limitation to their success. Poor quality acreage will produce poor financial returns, and thus not attract companies to drill and produce on the land. The main focus of this discussion will compare and contrast the differences in production spread (oil vs natural gas), while also looking at what the differences in basin focus could mean for investors. Below are images to show each companies respective production profile.

BSM Production Profile (Black Stone Minerals 10-K) KRP Production Profile (Kimbell Royalty Partners)

Permian and Eagle Ford Basins

Both companies operate leases in the Permian and Eagle Ford Basin. These basins are traditionally oil heavy basins, producing in the range of 50%-60% oil, with the remainder being a mix of natural gas and NGLs. Black Stone gets roughly 14.3% of its total volumes from these two basins, while Kimbell comes in significantly higher at a combined 30%. These basins are also the "headline" basins for future growth from many of the large oil producers like Exxon, Occidental, or Pioneer.

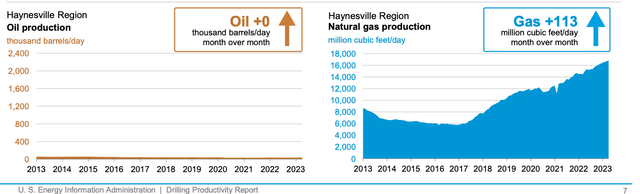

Haynesville Basin

The Haynesville shale basin is the next door neighbor to the Eagle Ford but is a different animal entirely. The Haynesville shale is a dry natural gas dominated play with limited liquids production. This basin is Black Stone's bread and butter. 65% of the company's production comes from this basin. In contrast Kimbell generates 27% from this Basin.

Anyone who pays attention to natural gas prices may call me crazy for discussing Black Stone any further and declare Kimbell the winner on this premise alone, but BSM there is more than meets the eye.

Growth Strategy

Another diverging aspect between the two companies is their growth strategy. Kimbell has been on an acquisition spree since 2020. It most recently acquired Hatch Resources for $271 million to increase its foot print in the Permian Basin. This acquisition marks its sixth acquisition since its IPO in 2017. Management has indicated that at the moment, it is satisfied with its current structure and will be looking to pay down debt. Management feels that this is a good return on dollars invested based on today's interest rates and the possibility of rates continuing to rise.

Black Stone is looking internally for its answers for growth. Management has very creatively structured deals with producers to foster growth starting back in 2020. Blackstone has partnered with natural gas producer Aethon Energy to ensure gas flows out of its Haynesville acreage.

In 2020 it signed agreements to give Aethon Energy exclusive access to its Angelina County acreage and reduced royalties in exchange for contracted well development. In 2021, a follow up agreement was signed for BSM's San Augustine County acreage. Both of these footprints are in the Haynesville Basin.

To ensure the acreage is developed and the wells are tapped to become productive, BSM structured a deal Aethon Energy can't refuse. Black Stone partners with 3rd parties to foot the development costs for Aethon. In exchange for this upfront capital expense, the 3rd party gets a fraction of the working interests in the wells productivity. Blackstone is willing to share a portion of its royalty income in exchange for contracted development on its acreage.

| Acreage Position | Year 1 | Year 2 | Year 3 | Year 4 | Continuation |

San Augustine County | 5 wells | 10 wells | 10 wells | 12 wells | 12 wells per year |

| Angelina County | 4 wells | 10 wells | 10 wells | 15 wells | 15 wells per year |

With all of these positives being developed on the BSM property, it is hard to not give them the point for this one, even in spite of their gassier profile. They are optimizing their acreage to the maximum extent possible, while setting up to capitalize on the project LNG export boom.

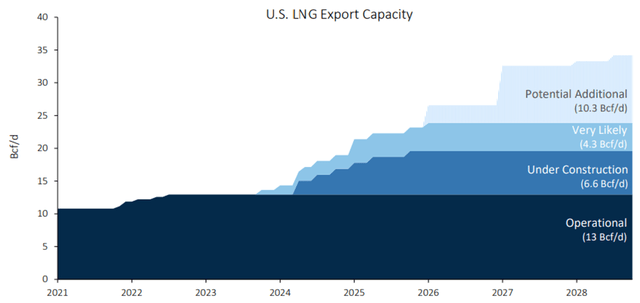

There are significant projects under development for the exportation of LNGs that could potentially double to export volumes in just a few years. These projects are expected to go into operation starting in 2024 through 2027 and will meaningfully increase demand for US LNGs. Additionally, being located near the gulf coast, the Haynesville basin is uniquely positioned to benefit from these projects. The score is 1-0 BSM.

LNG Exports (Enterprise Products)

Dividends

Another diverging category is the shareholder return model. KRP uses a variable distribution method. 75% of DCF is returned to shareholders in cash payments, while the remaining 25% is kept internal to the partnership for debt repayments, buybacks, and acquisitions. At the moment management is focused on debt repayment and was reinforced during Q4's conference call by CFO, Davis Ravnaas.

For the time being, we intend to continue that same policy, which would be to allocate 75% of cash flow to distributions and 25% to debt paydown.

This policy will result in the dividend fluctuating with commodity prices (with the exception of hedging, which we will get into later). Since current energy prices are more similar to what they were in 2021 than 2022, its fair to say the dividend will contract in 2023. The payout in 2021 was $1.14/share, so a repeat performance would still yield 7.86% at current prices which is solid, but not as fantastic as 2022.

Black Stone takes a more traditional approach, yielding a steady fixed rate dividend. In February, BSM raised its quarterly dividend to $0.475/share or 12.7% yield at today's prices. The obvious question is, is this yield sustainable?

I have modeled $75 oil and $3 natural gas at 2022 production rates to determine if the dividend is safe in the current energy environment. In the absence of hedging, I calculate a 20% decrease in oil revenues and a 28% decrease in natural gas revenues for 2023. The current dividend payout costs the partnership $402 million annually. If operating expenses remain unchanged, I calculate Operating Net Cash Flow to be approximately $447 million.

There is not a lot of wiggle room in this scenario, with a projected coverage ratio of 1.1x. It is also worth pointing out that my calculations are somewhat conservative by holding tax levels flat on decreased revenue and not factoring the benefits from hedging (more on that later). Overall, BSM faces some risk of being cash flow negative at the current payout levels and natural gas underperforming the $3 mark for most of 2023 thus far.

Management projected a more optimistic tone in the Q4 conference call.

We are very well-positioned to continue this trend into 2023 and offer a compelling value proposition to new and existing investors with virtually no debt and a distribution, which we believe is sustainable in 2023 that delivers a yield of over 12% to our current unit price.

It's hard to declare a clear victor in this category after reviewing the data. KRP's dividend will almost certainly be smaller, while BSM is on the edge of being cash flow negative if energy prices degrade further. I will award the point for dividends to KRP for having a model that is more financially responsible. Using 75% DCF as a guide, they can never payout more than they generate. The score is now tied 1-1.

NOTE: KRP issues a 1099-DIV while BSM issues a K-1. Investors should be aware of the differences in tax implications.

Debt & Dollars

To measure the work of the management team, we must evaluate the financial condition the company is operating under. We will compare the debt and cash profiles of both companies as well as the cost of said debt on a per share basis.

BSMs debt levels are fantastic being essentially zero net debt. KRP's levels, while higher, are not a hindrance to operations. Rising interest rates do pose a threat to cut into DCF however.

| Total Debt | Interest Rate | Interest Cost | Cash Reserves | |

| BSM | $10 million | 6.92% | <$0.01/share/year | $4.3 million |

| KRP | $233 million | 5.28% | $0.21/share/year | $25 million |

Hedging

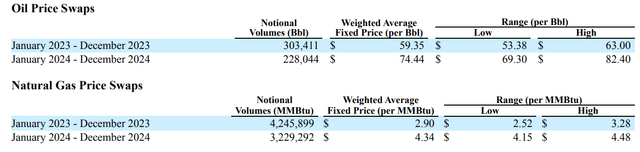

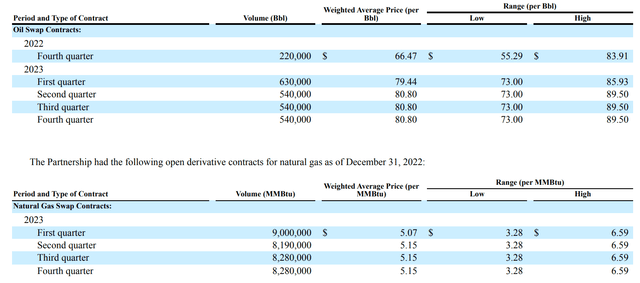

KRP has hedged 21% of its daily volumes. The oil contracts are priced too low to provide any meaningful uplift at today's prices. Conversely, their natural gas price spreads do appear to be helpful at today's prices.

If we shift our view point out further, their 2024 contracts are priced significantly higher than 2023, providing a longer-term uplift in earning potential. This will help de-risk this investment over the longer term if natural gas prices remain low.

When compared side-by-side, BSM has the better priced contracts of the two companies, and at a higher volume. Overall, this will provide BSM with a lower realized price decline in 2023 verse 2022 prices.

Using the tables above, it is a fairly straightforward conclusion that BSM is in better shape overall due to almost non-existent debt and more favorable hedging contracts. KRP's net debt position is not unfavorable but given the volatility in interest rates and the general financial markets, being debt free is an operational advantage. The score is now 2-1 BSM.

The Risks

Both companies operate in the commodities space and thus their earnings can fluctuate wildly. Unfortunately, this is largely out of their control. In one of my previous articles, I discussed the potential near term impacts that face producers like Devon. The royalty companies are in the same boat. Lower prices equate to lower royalties.

Both companies have significant exposure to natural gas with BSM generating roughly 56% of revenue from natural gas and KRP at 54%. The duration of sustained pressure on natural gas prices will ultimately determine how 2023 shapes up for both companies.

I believe there is sufficient support for oil at $70 WTI given the need to refill the Strategic Petroleum Reserve and OPEC's desire/ability to maintain a price floor. Historically, over the last 10 years, oil prices have averaged about $65/barrel. The downside risk is real however, as prices have flirted with sub $50/barrel prices in 3 out of the 10 years. That is why I stress the need to be patient, waiting for an entry point that protects against capital losses.

Summary

The score indicates the Black Stone Minerals is the winner in a head to head comparison, thanks to organic growth strategies, zero net debt, and better hedging contracts. BSM is exposed to some risk of having to cut its base dividend for cash flow concerns if natural gas does not recover to above $3 this year. This is partially mitigated by hedging contracts. However, the 2024 contracts are not as desirable as 2023, leading to increased risk 12-18 months from now.

I do believe that both of these companies will be valuable assets to own when LNG export projects start coming online as soon as H2 2024 and 2025. Both companies generate greater than 50% of revenue from royalties on natural gas sales. BSM has more to gain on this front thanks to its large percentage of Haynesville acreage.

Both companies offer a compelling return on investment if purchased below $15/share. I like the upside Black Stone Minerals has from future LNG export projects and how management is artfully developing the infrastructure to be ready when these projects come online.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.