ZIM Integrated: 12% Discount To Cash Value

Summary

- ZIM’s key operating metrics have deteriorated amid a slump in container spot rates.

- The container company, however, has no debt, substantial cash, and is growing its business.

- The valuation makes no sense whatsoever.

Shutter2U/iStock via Getty Images

The stock of ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is grossly overpriced. The shipping company reported quarterly earnings for 4Q-22 a while ago, and despite the fact that spot rates and realized average freight rates have declined significantly in 2022, there is little doubt in my mind that the stock is significantly undervalued.

The market has had plenty of time to factor cyclical EBITDA adjustments into ZIM Integrated Shipping's valuation. With that said, the valuation appears to be a bad joke to me, as ZIM Integrated Shipping is growing, has very low leverage, and more than $27 cash per share, implying that investors purchasing ZIM stock today receive all of the company's customer relationships, operating systems, and other assets for free.

ZIM Is Seeing Headwinds In The Industry, But Is Still Interesting From A Valuation Point Of View

The shipping market experienced a severe correction in 2022, as pandemic-driven gains in the container industry were eroded and demand effects weighed heavily on the industry's spot rates. ZIM Integrated Shipping's financial and operating metrics have fully reflected the general deterioration in fundamentals.

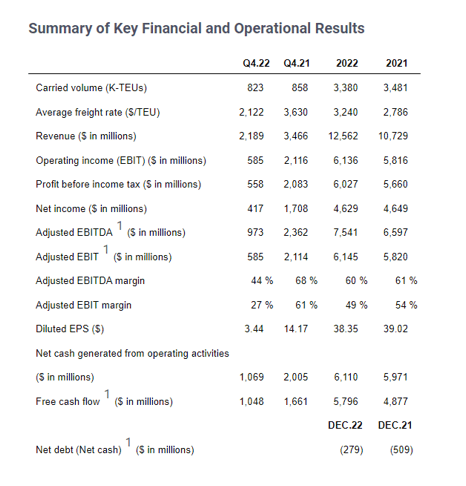

For one thing, ZIM Integrated Shipping's profit potential has been severely harmed. In 4Q-22, the container company generated $2.2 billion in sales, a 37% decrease YoY.

More importantly, the average price ZIM Integrated Shipping charged its customers for container shipping fell 42% YoY to $2,122 in the fourth quarter.

Other metrics, such as free cash flow, EBITDA, and diluted earnings per share, have also plummeted. Having said that, despite a clear deterioration in operating fundamentals, there are still compelling reasons to buy ZIM Integrated Shipping stock.

Key Financial And Operational Results (ZIM Integrated Shipping)

Debt And Cash Value

If I had to pick just one reason to invest in ZIM Integrated Shipping, it would be the company's substantial cash value per share, which translates into a very high margin of safety for investors even if the economy fell deeper into a recession in 2023.

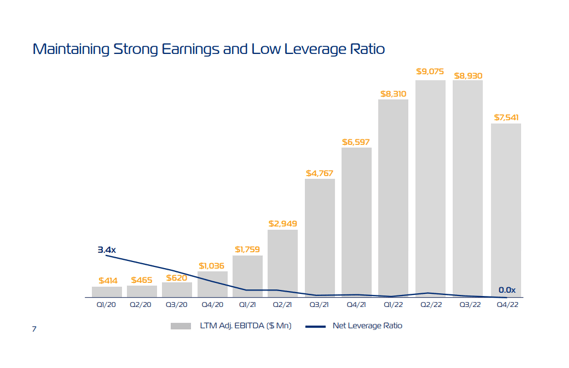

ZIM Integrated Shipping had a net cash position of $279 million at the end of 4Q-22, down from a net cash position of $509 million the previous year.

Since ZIM Integrated Shipping has a net cash position, the leverage ratio is 0.0x.

Strong Earnings And Low Leverage Ratio (ZIM Integrated Shipping)

ZIM's current valuation implies that investors receive a discount to cash value, which is likely the most conservative valuation assumption anyone could ever make. Typically, companies are valued based on their earnings or cash flow potential.

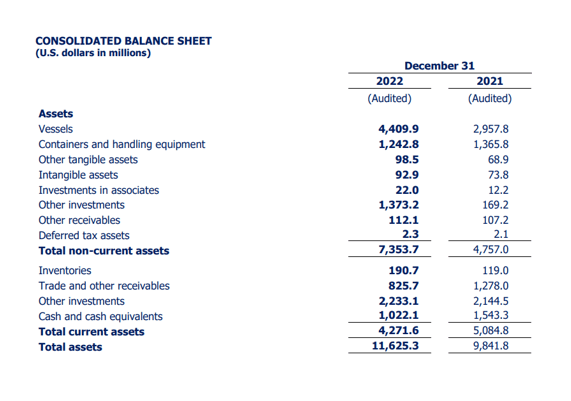

As of December 31, 2022, the shipping company had $1.02 billion in cash and $2.23 billion in (cash-like) investments on its balance sheet.

ZIM Integrated Shipping has $27.12 per share in cash on its balance sheet, with approximately 120 million shares outstanding.

The stock price is currently $23.95, implying that bargain hunters are getting a real steal here.

ZIM is valued at 88% of the company's cash, implying that investors not only get a discount to the cash ZIM has on its balance sheet, but they also get a growing business with no net debt and significant earnings potential for free.

According to ZIM's guidance, the company expects to earn between $100 and $500 million in adjusted EBIT in 2023.

Consolidated Balance Sheet (ZIM Integrated Shipping)

ZIM Is Priced For A Recession

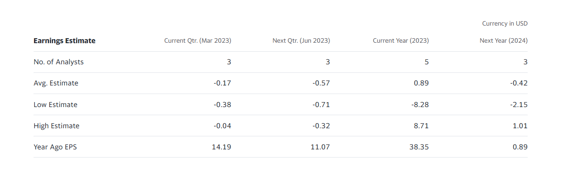

According to Yahoo Finance, the market expects ZIM Integrated Shipping to continue losing money. Profits are currently projected to be $0.89 per share in 2023, representing a 98% drop YoY.

In 2022, ZIM earned $38.35 per share on a diluted basis. Things could get worse in 2024, with the market expecting $(0.42) per share on average.

Analysts are rarely correct in their two-year projections, and things may turn out better or worse in the next two years than projections currently suggest.

However, ZIM Integrated Shipping is still a growing business, and the company's cash value, in my opinion, effectively establishes a floor beneath ZIM's stock price.

Earnings Estimate (Yahoo Finance)

Why ZIM Could See A Lower Valuation

If spot rates completely collapse and the container industry is decimated, ZIM may trade at a higher discount to cash value.

Because ZIM offers a discount to its cash value, which is a very conservative valuation approach, I believe the valuation already makes no sense. In my opinion, a complete annihilation of the container industry is also unlikely, which translates into a very high margin of safety for investors right now.

My Conclusion

You don't often come across a business opportunity that stipulates that you can purchase a company's operating assets for less than the value of the cash that the company currently has on its books. But this is precisely the investment opportunity that ZIM Integrated Shipping is currently providing to investors.

While it is true that key operating metrics have suffered greatly as a result of the decline in spot rates and slowing demand in consumer markets in 2022, the fact remains that ZIM Integrated Shipping has a solid $27 per share in hard, cold cash on its balance sheet, and with the stock trading just below that, investors are essentially getting the company's operating assets for free.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ZIM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.