Beyond Meat: These Are Unsustainable Losses

Summary

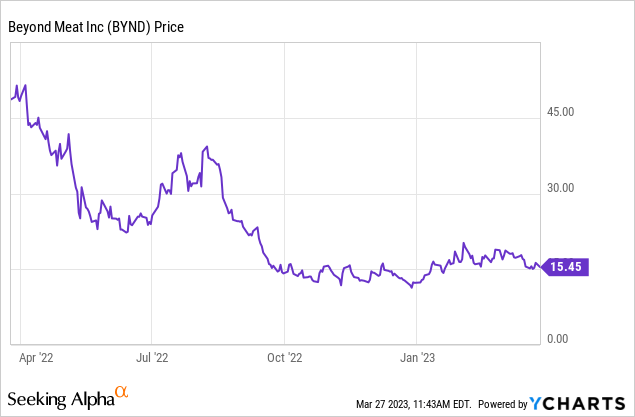

- Shares of Beyond Meat are up 25% year to date, with investors banking on the company's promise to be cash flow positive by the second half of 2023.

- That target seems like a far-off goal, with revenue declining double digits and gross margins still negative.

- The company is experiencing weakness across all sales channels, particularly U.S. foodservice.

- Amid inflationary pressures, Beyond Meat is hard-pressed to make its higher-priced protein alternatives appealing.

Joe Raedle/Getty Images News

Recessions have a way of putting pressure on and flushing out struggling businesses. We'd call it a natural part of the economic cycle. And in the case of Beyond Meat (NASDAQ:BYND), I think the plant-based food vendor's time in the spotlight has long since come and gone.

Beyond Meat certainly had a defensible niche and a solid mission: Reduce meat consumption and promote both personal health and environmental wellness. In boom times, when consumers were more willing to try new things and spend their wallets freely, Beyond Meat soared. But in this current pinch with mass layoffs, high interest rates, and unchecked inflation, Beyond Meat's more expensive plant alternatives are looking more and more unappealing.

Year to date, shares of Beyond Meat have recovered 25% - in sympathy with the recovery in other growth stocks. The stock achieved additional lift after reporting Q4 results and issuing a favorable (though bold) outlook of becoming cash flow positive in the second half of 2023.

The target that CEO, Ethan Brown, set on the Q4 earnings call, that inspired confidence in the stock, is this:

Against this backdrop, we took decisive actions to set our business on a course to achieve cash flow positive operations in the second half of 2023, a target that we stand behind today. In order to accomplish this important milestone, as I shared in our last quarterly call, we are transitioning our business from an operating model that prioritize growth above all to one that prioritizes cash flow and sustainable long-term growth, and we are executing well against this goal. While there is still much meaningful work to do, we are pleased to report net revenues toward the high end of our guidance range, along with 14 percentage points of sequential gross margin improvement in the fourth quarter and over $12 million of OpEx reduction versus the third quarter."

Beyond Meat's cash position is critical because its balance sheet is already so strained with limited cash and huge losses (more on that in the next section). But beyond aggressive cost reduction, Beyond Meat also relies on economies of scale for its production - and right now, the business is declining double digits. Slicing down inventory and focusing its channel sales efforts on a smaller amount of targets may have a "vicious cycle" effect on Beyond Meat's margin profile in the end.

I continue to have a bearish viewpoint on Beyond Meat. On a personal note, I see Beyond products less and less frequently on menus. Making a macro observation, I think inflationary pressures and general consumer malaise will continue to sink demand for Beyond Meat. The company did already cut prices last year - but even cutting prices was not able to return Beyond Meat to revenue growth and only had the effect of dampening margins into negative territory (there isn't much room left to play with pricing here, given where margins are sitting today). With a mound of debt on its balance sheet and a long path to go toward profitability, Beyond Meat remains an extremely risky bet that I'm perfectly fine not making.

Q4 download

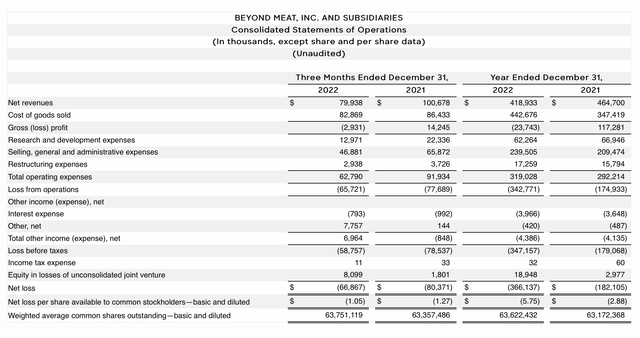

Let's now highlight the red flags in Beyond Meat's most recent Q4 results in greater detail. The Q4 earnings summary is shown below:

Beyond Meat Q4 results (Beyond Meat Q4 earnings release)

Beyond Meat's revenue declined -20% y/y to $79.9 million in the quarter. The good news is that this beat Wall Street's more pessimistic expectations of $75.8 million (-25% y/y); the bad news is that Beyond Meat barely improved over a -22% y/y decline in Q3.

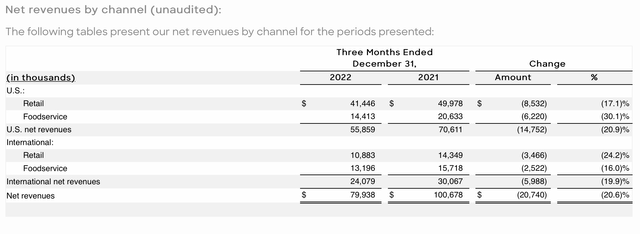

All segments showed decline, though the weakness was particularly felt in the U.S. Foodservice channel (think fast food restaurants that serve Beyond Burgers, et cetera).

Beyond Meat channel results (Beyond Meat Q4 earnings release)

Note that on a pounds sold basis, Beyond Meat's pound sales declined "only" -17% y/y. The five-point spread to a revenue decline of -22% y/y is bridged by the company's price declines, particularly in the international segment, where revenue declined -20% y/y but pounds sold only by -3% y/y. The translation here: Beyond Meat has had to implement sharp price decreases in international, and this is still producing double-digit declines.

Equally eye-popping is the continued trend of negative gross margins of -3.7% in the quarter: Driven by volume deleverage, price declines, and higher inventory reserves. Beyond Meat has an aggressive target to deliver positive FCF in the back half of 2023, but I struggle to see how this is achievable just half a year away with negative gross margins today.

Per CEO Brown's remarks on the Q4 earnings call on the company's margin-improvement strategy:

Moving now to our second pillar, aggressive management and reduction of our inventory. We can report that we reduced our inventory balance by $48 million, or 17%, from Q1 to Q4, allowing us to deliver on our 2022 objective of having inventory to be a net generator of cash for the year. We intend to accelerate this momentum in 2023. Here again, we are relying on lean value streams across beef, pork and poultry to increase visibility into and focus on optimal inventory levels and have recently invested in systems that we believe will substantially improve our ability to manage inventories across our global network of manufacturing sites and warehouses.

Big ticket items include pace and timing of our committed pea protein deliveries, resetting our WIP and finished goods stock to levels to better align with our anticipated production volumes and demand levels and exploring alternative avenues for inventory items with greater than required current stock levels among others. Increasing sales velocity, especially on our core items, is of course the most effective and cash flow accretive way to work down our inventory levels. In this regard, as we shared on our last call, we have designed certain time-bound trials and pricing programs to drive stronger velocities and we are encouraged by early results. Specifically, where we have implemented such programs, we have been pleased to see not only an acceleration in unit velocity, but importantly an increase in takeaway dollar growth as well."

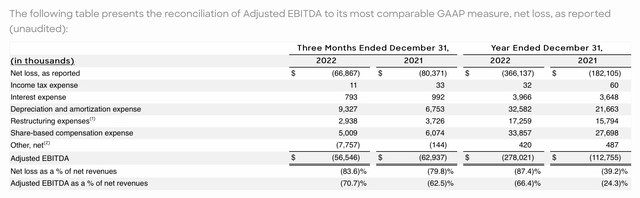

Q4 adjusted EBITDA was -$56.5 million, representing a wide -71% loss margin:

Beyond Meat adjusted EBITDA (Beyond Meat Q4 earnings release)

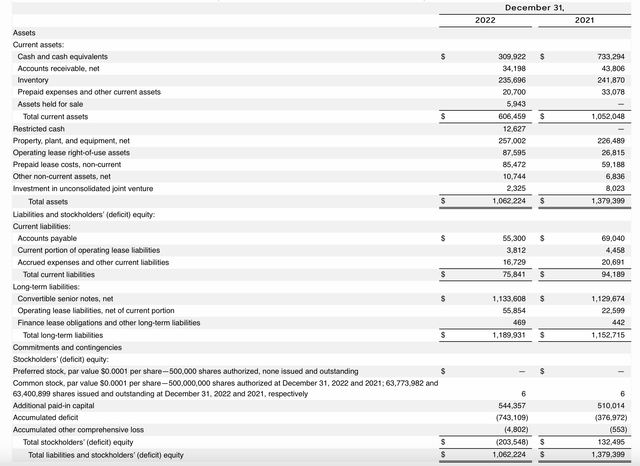

We note as well that the company has only $309 million of cash left on its balance sheet, alongside a $1.13 billion pile of convertible debt.

Beyond Meat balance sheet (Beyond Meat Q4 earnings release)

Free cash flow burn in FY22 was -$390.7 million, which included ~$70 million of capex spend. In the absence of the company's cost-reduction targets, if it continues burning at the same pace, Beyond Meat will need to raise capital at some point in 2023 - and in a very tough and expensive market to do so.

Key takeaways

A sagging brand, sharp declines in sales, price reductions that haven't lifted volumes, and negative gross margins - there are a lot of red flags here to watch out for. Even if Beyond Meat does achieve the long stride toward cash flow breakeven this year, its return path to growth is certainly not guaranteed. Steer clear here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.