ARKK: 3 GARPs With Strong Competitive Advantage

Summary

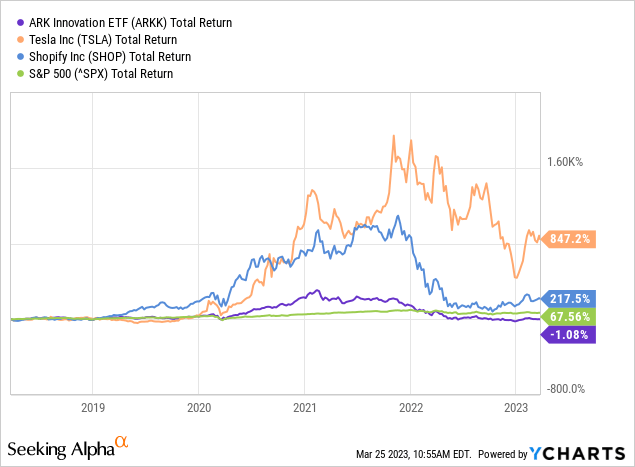

- ARK Innovation ETFs returns were huge from its inception in 2014 to its peak in 2021. Now, it lost its return completely.

- Companies that have interesting investment characteristics are companies that are growing in revenue, earnings, and free cash flow.

- They also have competitive advantages over others, are growing rapidly in an expanding market, and trade at a favorable valuation.

- Although I am not interested in growth stocks because of their risky characteristics and volatile behavior, I still find 3 stocks in the ARK Innovation ETF interesting.

We Are

Introduction

It has been a wild ride since the launch of the ARK Innovation ETF (NYSEARCA:ARKK). Led by Cathie Wood, the ARK Innovation ETF includes 28 growth stocks in the disruptive innovation industry that are displacing older technologies or creating new markets. The ETF includes several industries such as:

- Artificial Intelligence

- Energy Storage Robotics

- DNA Sequencing

- Blockchain Technology

Its returns were huge from its inception in 2014 to its peak in 2021. Now, it lost its return completely, a period of nearly 10 years without return. This was mainly due to high inflation and the risky growth stocks in ARK's holdings. These growth stocks thrive during low interest rate environments because cash is almost free to borrow.

Now that the Fed has had to raise interest rates to curb high inflation, those growth stocks have plummeted in value.

Growth stocks are companies that grow rapidly in revenue and are usually small in size. They are not profitable yet or are free cash flow positive. A rise in interest rates can be a problem for these companies because their interest expenses will increase significantly (because they usually have a lot of debt). Moreover, investors are slowing down their investment activity in these companies during a high interest rate environment. Therefore, growth stocks are considered high risk.

The ARK Innovation ETF has several growth stocks in its portfolio, but only 3 of them are of interest to me. Companies that have characteristics that interest me are growing in revenue, earnings and free cash flow. They also must trade at a favorable valuation.

In my article, I discuss 3 companies that have these favorable characteristics.

#1 Tesla

The first is Tesla (TSLA), many know Tesla for their advanced electric vehicles with strong performance, and with cool features like autopilot, caraoke, bioweapon defense mode, a touchscreen, streaming and video gaming, a web browser, easter eggs, air suspension, sentry mode, superchargers and a cool mini Tesla key.

In the ARK Innovation ETF, Tesla is 7% allocated. This gives Tesla an important position to drive up the price of the ETF.

The stock price is currently under pressure, which presents a nice buying opportunity, as I wrote about in my article on Tesla this month. In that article, I wrote about Tesla's competitive advantages:

- Tesla has the best energy storage systems on the market.

- Fast-growing company in an expanding market.

- The stock's valuation is in favorable territory.

In 2022, Tesla recorded a 51% increase in revenue from the previous year. Tesla operates in an expanding market as the EV market is expected to grow at a CAGR of 17%.

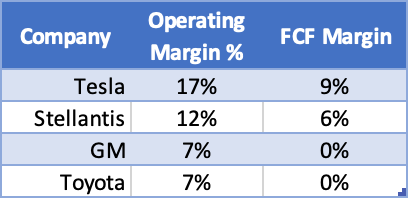

Electric vehicle manufacturing is more streamlined than that of internal combustion engine vehicles. Thus, Tesla is able to generate one of the highest free cash flow margins in the entire mass market car sector.

Free cash flow of mass market car manufacturers (SEC and author's own calculations.)

Currently, Tesla seems a bit on the expensive side. But with a PE ratio of 26 for 2025 and fast-growing earnings, I think the stock's valuation is attractive. Another positive point to note is that Moody's upgraded their credit rating and assigned a Baa3 rating. Quoted from a news article on Seeking Alpha:

Tesla will remain one of the foremost manufacturers of battery electric vehicles with an expanding global presence and very high profitability.

#2 Shopify

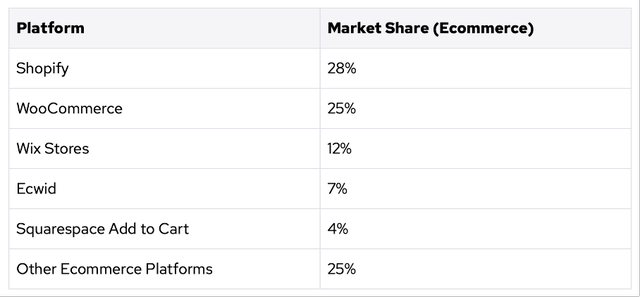

The second promising stock is Shopify (SHOP). Shopify ranks No. 7 in the ARK Innovation ETF with a 4.8% allocation. Shopify also has a high rank in the ETF which contributes strongly to returns. Shopify provides an e-commerce platform that many online stores use today. The company is popular as it has a market share of 28%. Shopify is also easy to use, therefore it is an ideal choice for starting businesses.

Market share of well-known e-commerce platforms. (MobiLoud)

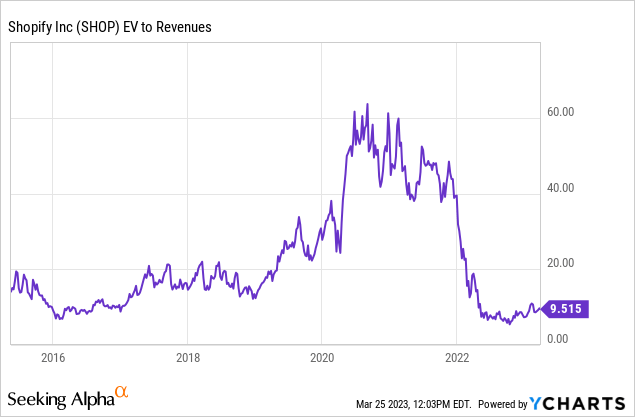

In October 2022, I wrote an article on Shopify in which I described being overly cautious about buying the stock because of fears that Fed policy is affecting consumer behavior. I described that the stock was favorably valued with a price to sales ratio at its lowest level since years. Therefore, I gave the stock a hold rating. It was a wrong choice because the stock increased in value by 65% since then.

There are several things I like about Shopify. The first is their customer loyalty and the ease of use of the platform compared to Woocommerce, Magento and other e-commerce platforms. The second thing I like is that the e-commerce market is expected to grow strongly with a CAGR of 14%.

However, some analysts have a mixed outlook for Shopify, as 17 analysts have revised their earnings estimates upward, while 15 have revised it downward. They expect revenue to grow 18% this year and earnings per share to break even. My expectation in October 2022 was that consumer confidence would decline during the Fed's interest rate hikes, yet Shopify continues to grow strongly.

The valuation is still at a favorable level as shown in the chart below. Therefore, the stock is worth buying for the long term.

#3 Roblox

The third and final interesting choice is Roblox (RBLX). Roblox is a popular gaming platform where users can create their own games and also play games created by other users. Users can customize their own avatar that can communicate and chat with other users in a virtual world. Roblox and its games are free to use, and users can make in-game purchases with Roblox's virtual currency called Robux.

Roblox is extremely popular and has grown significantly especially during the corona crisis, when many users had to sit at home due to corona measures. Roblox has several competitive advantages over other game developers.

The first competitive advantage is that Roblox is not a game developer, but a platform where users can develop and play games. Many games gain and lose popularity, and because Roblox users develop their own games, the Roblox platform is less sensitive to the varying popularity of the games. As a result, Roblox' revenue will be more steady than those of Tencent (OTCPK:TCEHY), for example.

The second advantage is their social media feature. This feature allows users to chat and interact with each other, making it more likely that users will stick to the platform. The third advantage is that Roblox is accessible to many consoles such as desktops, mobile devices and many game consoles.

The last competitive advantage is that it offers several concerts on the platform where many well-known artists perform, such as Mariah Carey, Elton John, Lauv, George Ezra, Charli XCX, Tate McRae, Lizzo, Boris Brejcha, 24kGoldn, David Guetta, Twenty One Pilots and many more. These artists are popular among the youth.

Roblox's competitive advantages are a good way to keep users attached to their platform. This stickiness can also be seen in their revenue growth. While their revenues grew only 16% in 2022, many analysts expect them to grow 55% this year. The increased popularity and competitive advantages will benefit Roblox for further growth.

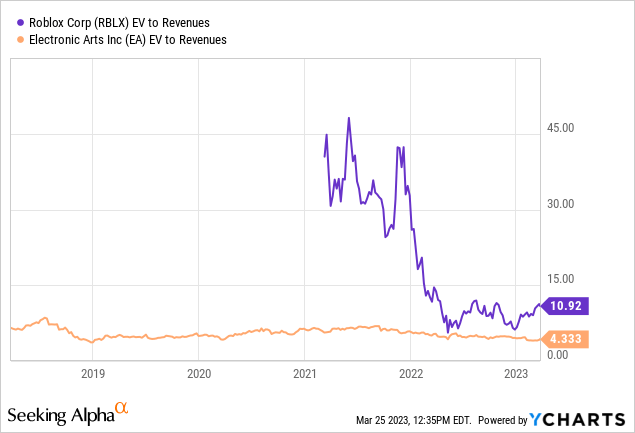

So what about its stock valuation? To get insight into the stock's valuation, we look at the enterprise value to revenue ratio, because it includes cash and debt into the valuation equation. The EV to Revenue ratio currently stands at 10.9, which is close to its all-time low. The next question is what a favorable EV to Revenue ratio is. To answer this question, I look at other companies in the gaming industry with gross margins about equal to Roblox'.

I found Electronic Arts (EA) as a good comparison because it has gross margins nearly equal to Roblox's. Its EV to revenue ratio is only 4.3. However, EA is not growing as fast as Roblox. Roblox's revenues are expected to increase 50% this year, while EA's revenues are expected to remain flat. At this price level, Roblox's projected EV to Revenue ratio is about 7, making it an interesting stock to own. Because of its competitive advantages and favorable forward valuation, Roblox is worth buying.

Conclusion

Although I am not interested in growth stocks because of their risky characteristics and volatile behavior, I still find 3 stocks in the ARK Innovation ETF interesting. These 3 companies are common names in the sectors in which they operate, and the recent price correction provides an interesting opportunity to buy the stocks cheaply. They also have competitive advantages over others, are growing rapidly in an expanding market and trade at a favorable valuation. They are (or were) also cash flow positive, which (in my opinion) makes the shares less risky. Therefore, I think they are good bargains.

I am also interested in your thoughts, please leave your thoughts in the comment section below.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SHOP, RBLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.