AltaGas: An Unloved Energy Infrastructure Company Offering A 5.2% Yield

Summary

- AltaGas offers a 5.2% dividend with expected CAGR of 5-7% through 2026.

- The company’s 60/40% regulated utility and midstream EBITDA mix offer a relatively low-risk business model.

- The company is approaching its leverage targets with continued non-core asset dispositions.

- Operating in two business segments, AltaGas lacks the defensiveness of a pure-play utility or the scale of a large midstream operator.

- Trading at a discount based on the sum of its parts, AltaGas has the potential for capital appreciation as it surfaces value.

Vladimir Zapletin/iStock via Getty Images

Investor Thesis

AltaGas Ltd. (TSX:ALA:CA) (OTCPK:ATGFF) is five years into its turnaround as a company. The company has made progress on streamlining the business and deleveraging its balance sheet through asset dispositions. Following a dividend cut in 2018, the company has restored its dividend profile with an attractive 5.2% yield anticipated to grow at 5-7% annually through 2026.

AltaGas has a low risk business mix that includes regulated utilities and midstream assets. While there is still work to be done on optimizing its asset mix, the company has improved its EBITDA quality through longer-term contracts. AltaGas is expected to announce a replacement of its retiring CEO in the first half of 2023. Clarity on this appointment and a clear path to continued deleveraging and business mix rationalization could be catalysts for this undervalued energy infrastructure company.

Company Profile

Headquartered in Calgary, Canada, AltaGas owns and operates a $24B portfolio of midstream natural gas and regulated utility assets. The firm's revenue mix is approximately 60% utilities and 40% midstream. Approximately 75% of EBITDA is underpinned by medium to long-term contracts.

The company's midstream assets are centered around the Montney play in northern British Columbia. The company owns natural gas pipelines as well as interest in liquefied propane export terminals on the West coast in British Columbia and Washington state. The company's network of extraction, gathering and processing facilities has 1.5 Bcf/d of capacity.

AltaGas Company Profile (AltaGas )

AltaGas's utility portfolio includes regulated gas distribution networks and storage assets in Maryland, Virginia, Michigan, and Washington, D.C. where the company serves 1.7 million customers. AltaGas also owns a small portfolio of legacy power generating assets across 11 jurisdictions in Canada and the U.S. with 695 MW of generation capacity.

AltaGas trades on the Toronto Stock Exchange under the ticker "ALA" with daily average volume of approximately 1.0 million shares. The company has a market cap of $6.3B and enterprise value of $17.2B

Business Mix

For the FY 2022, AltaGas delivered results in the upper half of its guidance range, including EPS growth of 10% year-over-year and EBITDA growth of 5%. AltaGas has reaffirmed 2023 guidance of $1.5-1.6B EBITDA and EPS of $1.85-2.05. The company anticipates an EBITDA mix comprised of 57-61% coming from utilities and 39-43% of its 2023 EBITDA generated by its midstream segment. The 2023 capital plan does not reflect this dynamic however, with approximately 75% of Capex being allocated in the utility side for 2023. Part of this capital mix is attributable to the capital intensive and urgency of the utility segment. The current US$4.9B regulated rate base is expected to increase 8-10% CAGR through to 2026, with allowed ROE of between 9.2-9.9%.

Typically, firms operating across multiple sectors use the stable earnings from one segment to grow a higher margin or faster growth segment. In the case of AltaGas regulated earnings from the gas utility could be used to invest in higher return midstream assets. Growth biased towards the utility segment speaks to attractive allowable returns from utility regulators and the increasing regulatory hurdles associated with developing export facilities on the West coast linked with the company's midstream network.

Prize LPG Assets

The Ridley Island Propane Export Terminal is a world class asset that can be considered irreplaceable. The liquified propane gas export facility located at the end of the Canadian National Railway (CNR:CA) line in Prince Rupert, British Columbia on Canada's northwest coast is a core strategic asset for a few reasons. This export terminal provides much needed egress from the Montney play for propane and provides access to lucrative Asian markets. This facility is capable of unloading 50-60 rail cars a day and storing 600,000 Bbls of propane or 1.2 million tonnes per year.

AltaGas LPG Facilities (AltaGas )

Prince Rupert's northern location makes it the closest North American port to key Asian markets. This provides a shipping advantage of several days over Washington and Oregon ports and cuts off more than two weeks of travel from U.S Gulf Coast. As I noted in my previous analysis of Canadian National Railway, Prince Rupert is one of North America's most important ports:

Prince Rupert is the closest North American port to Asia and is the deepest harbor on the North American continent. As the gateway to the shortest shipping route across the Pacific, the opportunity that Prince Rupert presents to CN cannot be overstated. The Port of Prince Rupert is North America's closest port to Asia by up to three days sailing - it's 36 hours closer to Shanghai than Vancouver and over 68 hours closer than Los Angeles. A 400 meter (1,300 ft.) long cargo ship crossing the Pacific at 24 knots would burn approximately $130,560/day in fuel.

In July 2022, AltaGas doubled down on its LPG strategy by purchasing the remaining 25.97% equity ownership of Petrogas Energy Corp for $285M. Funded by the disposition of a non-core, non-operating Aitken Creek gas processing facility, this acquisition consolidated the company's ownership of the Ferndale export terminal and expanded on its strategic positioning as a critical infrastructure operator.

As of Q4 2022, AltaGas exported 63,000 bpd from Ridley Island and 34,000 bpd of propane and butane from Ferndale, Washington. Spread over 16 Very Large Gas Carriers or VLGCs, the LPG exported at the Ridley Island and Ferndale sites together account for almost 16% of Japan's and 14% of South Korea's total LPG imports. Asia-Pacific LPG demand is projected to grow from $129.17B in 2021 to $211.96B in 2028 at a CAGR of 7.3%. This demand growth leaves AltaGas well positioned to add incremental capacity at these two sites. Management expects that capacity expansion at the Ridley Island terminal to 80,000 bpd is achievable over the next several years with incremental capital expenditures.

Deleveraging

On March 1, 2023 AltaGas closed the sale of its Alaskan Utilities asset for proceeds of approximately USD $800M. The company plans to use these funds to reduce debt and improve its balance sheet. This disposition moves AltaGas closer to its near term debt/EBITDA target of 5.0X with a meaningful 0.4X net debt/EBITDA reduction. Additional asset sales are likely required to see the company achieve its long-term debt/EBITDA target of 4.5X. The Mountain Valley Pipeline project led by Equitrans Midstream Corp (ETRN) is in the federal permitting process. While an in-service timeline can be hard to predict, AltaGas will receive a better disposition value for its 10% stake when there is more clarity on an operational timeline.

Dividend

In December 2018, the company slashed its dividend 56% from $0.1825 to $0.08 quarterly. At this time, AltaGas's dividend payout ratio was over 250% and needed to be cut. This action was coupled with nearly $4B in non-core asset sales including the disposition of a troubled hydroelectric project. AltaGas has spent the past four years rebuilding investor trust and deleveraging its balance sheet.

AltaGas Dividend History (Seeking Alpha)

AltaGas resumed dividend increases in 2020 with a 4.9% increase. The company's most recent dividend increased announced in December 2022 was 6%, bringing the cash payment to $0.28 quarterly or $1.12 annually per share for 2023. The current AFFO payout ratio of 56% has improved from 58% in 2021 and is well within the target range of 50-70%. AltaGas expects to achieve normalized EPS of $1.85 - $2.05, a level that should allow the company to maintain its target payout ratio while supporting the 5-7% targeted dividend growth plan.

AltaGas Dividend Profile (AltaGas )

Contract Quality

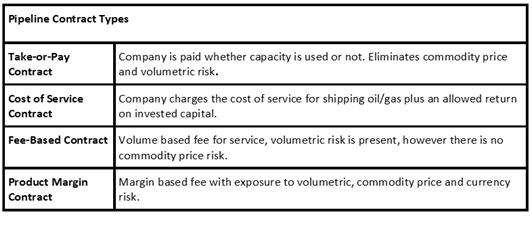

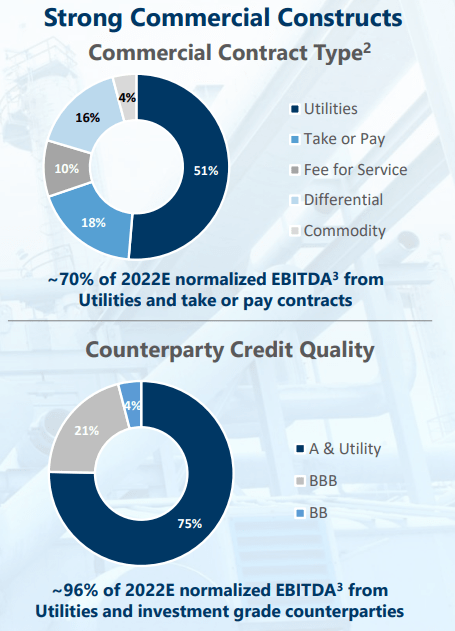

AltaGas earns approximately 80% of EBITDA from its regulated utilities and fee-for-service and take-or-pay contracts. This compares to 95% for Enbridge Inc. (ENB) for cost-of-service or contracted, 94% for TC Energy (TRP) and approximately 80-90% for Pembina Pipeline Corp. (PBA).

Pipeline Contract Types (Sell Side Handbook)

The company has continued to improve the quality of its earnings through longer-term contracts with investment grade counter parties. AltaGas recently entered into a new tolling arrangement at the Ridley Island site and extended a tolling structure to 2033 at Ferndale. In February 2023, AltaGas reached an agreement with Southern California Edison for its Blythe power plant in California from January 2024 to December 2027.

AltaGas Contract Type (AltaGas)

Valuation

Based on its assets and EBITDA, AltaGas looks inexpensive at current levels. However, there are a few things working against the company garnering a higher multiple. In November 2022 the current CEO, Randy Crawford announced he would retire in H1/23. The uncertainty about the CEO transition continues to be an overhang. While this is a transient issue, the fundamental business mix is a perpetual drag. Investors seem unclear whether AltaGas is a midstream or a utility.

The company's 2023 guidance described a roughly 60/40 EBITDA mix between U.S. regulated gas distribution utilities and midstream assets. This dynamic makes the overall business less defensive relative to other regulated utilities. Midstream investors are spoiled for choice among pure play midstream players with more scale, commodity tailwinds, revenue diversification and higher contract quality. From the utility perspective, concerns about costs associated with energy transition and electrification have resulted in electric utilities commanding a premium over gas distribution utilities.

One of the overhangs with AltaGas is that it is not straightforward to value. Midstream companies are best valued on EV/EBITDA, while utilities trade on earnings. Midstream companies operating in the WCSB trade around 10-11X EV/EBITDA. While regulated utilities may trade around 17-18X earnings. Breaking out these two segments, consensus estimates from 15 analysts peg AltaGas worth approximately $30.

Risk Analysis

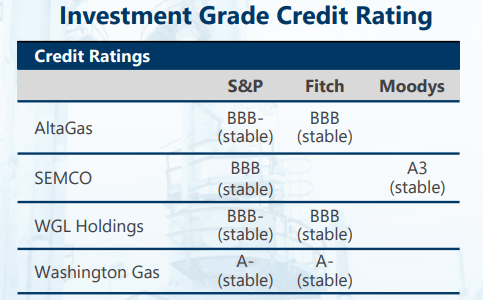

AltaGas's core business segments are both low risk. The utility business is regulated with constructive approved returns on equity. The midstream business continues to be improved by long-term contracts with investment grade counter parties.

Capital expenditures within the utility business are relatively uncontroversial pipe replacement projects that improve safety. The company's operating jurisdictions are generally considered to be constructive rate setting and regulatory environments that include cost recovery provisions for pipe replacement. There are risks of regulatory lag and negative outcomes in individual rate case decisions, however the EBITDA delivered from the utility business can be considered very stable.

Within the midstream segment, AltaGas has helped control shipping costs and timing by chartering its own VLGCs. While this has helped to mitigate export disruption, chartering VLGCs expands the operational scope to other maritime risks. AltaGas hedges approximately 75% of its export volume for the first three quarters of 2023. This should help smooth out earnings around peak and shoulder seasons.

The company has been actively deleveraging its balance sheet with a medium-term target of <5X net debt/EBITDA and long-term target of approximately 4.5X net debt/EBITDA. A failure to successfully market further non-core assets could be a drag on the company. Specifically, a failure to divest the 10% stake in the Mountain Valley project due to regulatory or in-service delays would be an overhang.

AltaGas Credit Rating (AltaGas)

AltaGas has gotten itself in trouble with poor acquisitions in the past. While the company intends to use its capital primarily on investments in its regulated gas utility business, it runs the risk of overpaying for an asset should it choose to go shopping in the future.

Investor Takeaways

AltaGas is inexpensive at current levels. The company is in the midst of a turnaround, however there are still a number of issues that could limit the company experiencing a rerating. This 60/40 business mix of regulated utilities and midstream assets is not particularly strategic as the mix is not countercyclical nor does it provide operational synergies or scale. There are some great assets here, particularly its LNG export facilities; it's just not a cohesive business mix.

A new CEO who can surface value from asset sales, continue to streamline the business and deleverage the balance sheet would support improvements in the company's multiple. AltaGas has been improving the quality of its earnings with longer term contracts and growing demand on its midstream segment. With a current dividend yield of 5.2% expected to grow 5-7% annually, investors can anticipate attractive dividend growth covered by a reasonable payout ratio as well as the potential for capital appreciation.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ENB, TRP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.