Skechers U.S.A.: Highly Demanded, But Inventory Headache Still Persists (Rating Downgrade)

Summary

- Despite the management's cautious view, we believe that Skechers' demand remains robust. The company's international expansion seems to bear fruit, as seen from sales growth and Google trends.

- However, inventory stood at $1.8 billion. Despite congestion downstream having "loosen up," the management expects domestic wholesale to decline. This might suggest that inventory has not yet peaked.

- Further, the company is doing promotions, which should put pressure on margins. Incremental supply chain costs will persist, albeit moderately. In the long run, DTC has room for EBIT margin expansion.

- Finally, SKX stock is trading at 15x forward P/E. Shares will be attractive at least $39 per share. Investment risks include prolonged elevated inventory levels and possible recessions.

David Becker

Recap

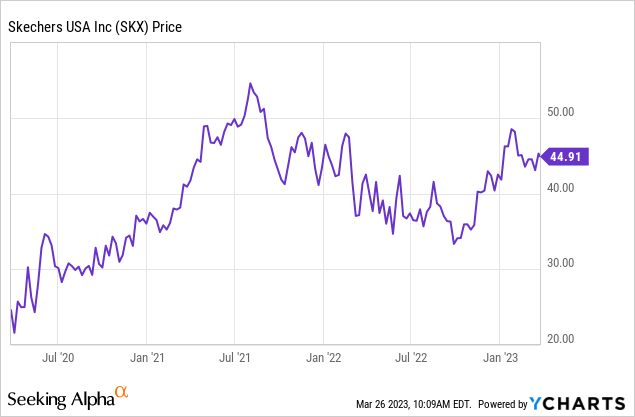

Last year, we wrote an article on Skechers (NYSE:SKX), citing the company's promising growth trajectory, competitive margins, positive cash flows, and a reasonable valuation at 13 times of its earnings. Since then, the stock has gone up 25%.

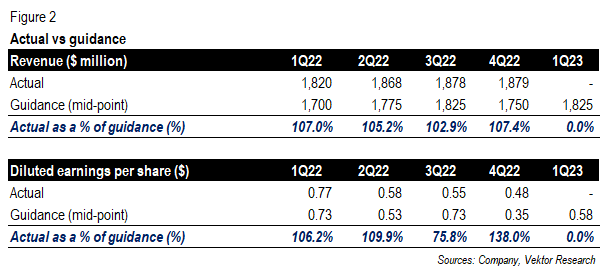

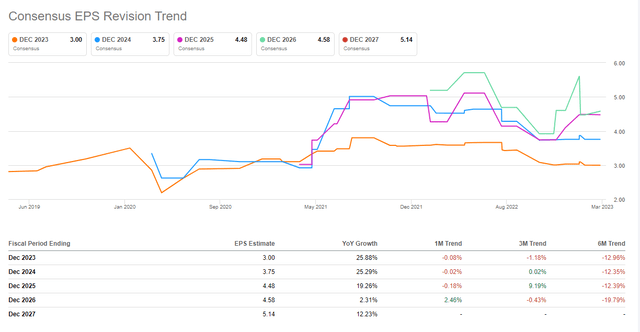

The company initially expected last year's revenue to be between $7 billion and $7.2 billion before revising the guidance upward to $7.2 billion-$7.4 billion. On the contrary, the management slashed its bottom-line guidance from $2.7-$2.9 per share to $2.6-$2.7 per share. As a result, the market changed its expectations.

Actual results vs guidance (Company, Vektor Research) Consensus EPS revision trend (Seeking Alpha)

The $10 Billion Revenue Plan Is Feasible

In 4Q22, the company booked $1.9 billion in revenue, up by 13.5% (Y/Y). Domestic sales grew 22% (Y/Y), while international sales increased by 9% (Y/Y). In China, revenue dropped 23% (Y/Y), with over 35% of its stores closed at one point. However, since the zero-COVID policy was lifted in December, the market has picked up, although the company is still expressing reservations about the first half this year given "the dynamics" of the market.

During the last earnings call, CFO John Vandemore provided this year's guidance:

- Revenue in the range of $7.75 billion to $8 billion

- Net earnings per diluted share between $2.8 and $3 per share

- Effective tax rate between 19% and 20%

- Capital expenditures in the range of $300 million to $350 million

The numbers imply that revenue is expected to grow modestly at 6% next year (mid-point), lower than the five-year CAGR of 12%. Indeed, John Vandemore said the company anticipated "a meaningful degree of uncertainty ahead" and "many recessionary signals in the marketplace." Thus, questions remain about whether the company can achieve its $10 billion sales target by 2026.

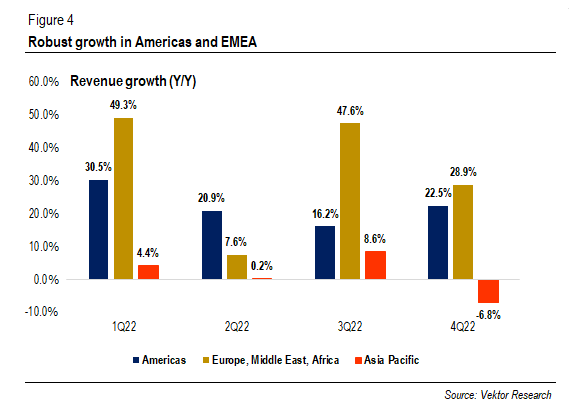

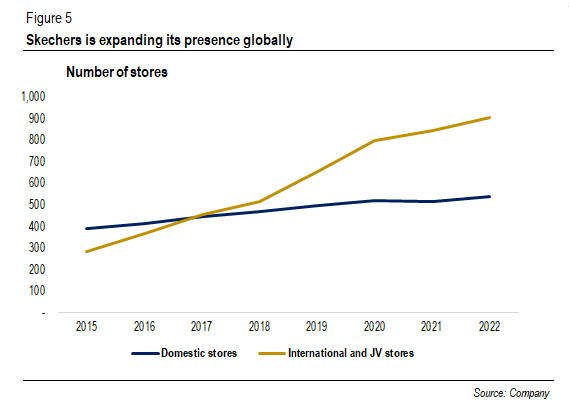

We still believe that demand for Skechers products remains robust. First, while some think that China is the only growth story for Skechers, this is not the case. Last year, revenue in the EMEA market grew 32% (Y/Y). APAC revenue growth was flat. Excluding revenue from China (-15% Y/Y), APAC revenue would have increased 32% (Y/Y). The company continues to expand its presence in Europe-it recently opened a flagship store in Dublin, Ireland-and sees South America and India as "huge opportunities," regarding the latter as "one of our fast-growing markets." Since 2017, the company has added over 500 international and joint venture stores.

Robust growth in Americas and EMEA (Company, Vektor Research) Skechers' store count (Company)

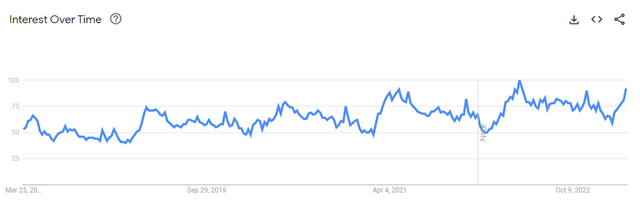

Further, Google trends (last five years) on the term "Skechers" suggest that the company is gaining popularity worldwide.

Google trends on "Skechers" worldwide (Google)

Second, through its proprietary survey, Cowen said that Skechers "looks to have taken preference" from NIKE (NYSE:NKE) and Adidas (OTCQX:ADDYY) domestically, as consumers are looking for more affordable footwear amid high inflationary environment, as cited in Business Insider. Lastly, Skechers' wholesale gains traction as retailers are shifting to DTC. Thus, we still believe that Skechers can reach the $10 billion mark a year earlier than expected.

How Skechers Is Dealing with Its Inventory and What We Can Expect

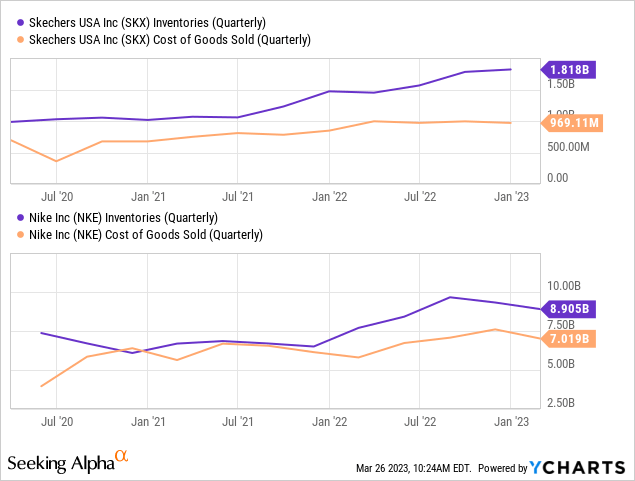

Nevertheless, in the last few quarters, all eyes are turning on retailers' inventories, which have built up because of numerous supply chain issues, such as longer transit time. As a result, some retailers rely on markdowns and promotions to liquidate excess inventories. For example, NIKE saw a 330 basis point gross margin deterioration in 3Q23. Under Armour (NYSE:UAA) also reported a higher-than-expected gross margin decline.

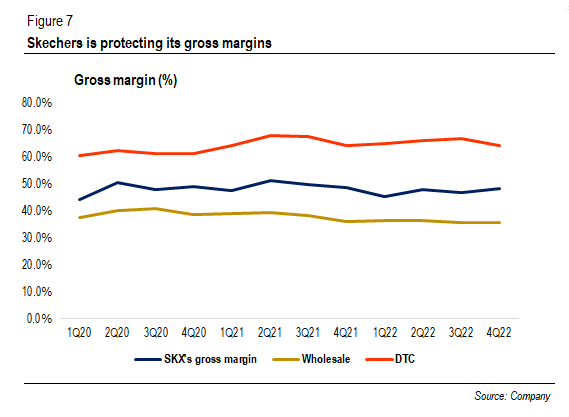

Nevertheless, not all retailers follow the herd. Lululemon (NASDAQ:LULU) is relatively more conservative in its promotional play, noting that about 45% of its inventories were core seasonless products. Skechers is likely to have followed a similar path, being more prudent by offering promotions "in a targeted way." As a result, wholesale average selling price rose 5% (Y/Y), and DTC saw a 3% increase last year. This helps Skechers protect its margins.

Skechers' gross margin (Company)

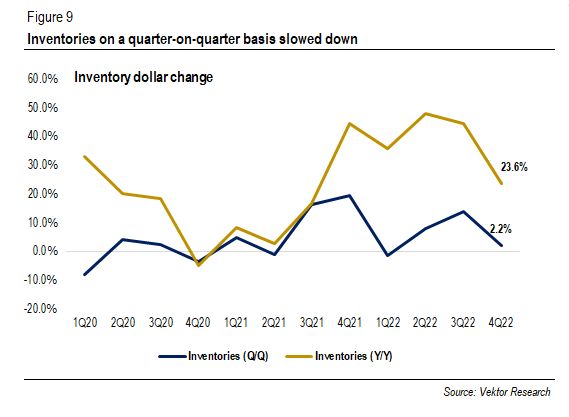

However, Skechers' inventory dollars stood at $1.8 billion, up by 24% (Y/Y) but slowed to 2% (Q/Q). This is a stark contrast to NIKE's inventory position, which has declined from its peak thanks to aggressive efforts to liquidate excess inventories. Skechers said that the issue was related to the congestion in downstream, while inventory in its domestic distribution center was down 12% (Q/Q).

Skechers' inventory change (Y/Y) and (Q/Q) (Company, Vektor Research)

The management said that such congestion has "loosen up" but expects domestic wholesale to be down in the first half this year. This suggests that inventory balance might not have yet reached its peak, in our view. Promotions should help Skechers reduce its inventory, although those are likely to erode gross margins. According to John Vandemore (transcript by Koyfin):

Well, the first thing, I mean, it's definitely a DTC phenomenon. We're not seeing as much push yet in wholesale. Customers are asking, but for us, it's still the right equation from a margin perspective. Look, I mean, I'm the CFO, so I would just assume sit here and talk about full price sell-through every day of the year. A, it's not realistic, b, It's not always the right answer. And I think in this instance, what we're seeing is where we put promotions back into place, they are having the right effect.

What Will Drive Operating Margin?

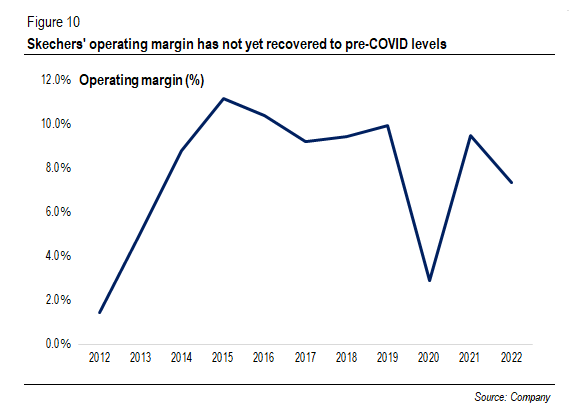

Speaking of margins, many hope Skechers' operating margin to recover to 10%. In 2022, Skechers' margin was 7%. Last quarter, it was slightly below 5%. Besides high freight costs that have steadily declined, the company incurred about $90 million incremental "warehousing and distribution-related costs," equal to more than 1% of full-year revenue. The company expects these costs to moderate this year.

Skechers' operating margin (Company)

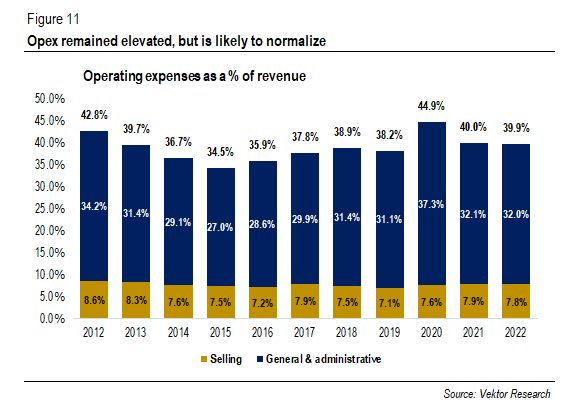

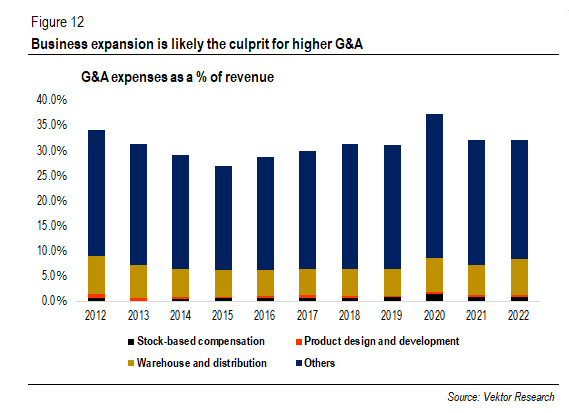

Freight rates and incremental supply chain costs are going down but are likely to be in part offset by promotions. Therefore, how can the company reach its long-term target of 11%-13%? For years, stock-based compensation, R&D expenses, and warehouse and distribution costs pre-COVID as a percentage of revenue were flat. Thus, while the company does not provide further details on G&A expenses, it might be increasing salaries and operational costs related to domestic and international expansions that pushed G&A expenses up.

Operating expenses as a % of revenue (Vektor Research) G&A expenses as a % of revenue (Vektor Research)

Further, we notice that DTC sales contribution rose to ~40% from ~30% pre-COVID. But operating margins remain tight even though DTC has an average 2,000 basis-point higher gross margin than wholesale channels. A study from BMO Capital Markets suggests that DTC EBIT margin is "meaningfully below" wholesale EBIT margin, as cited in SGB Media. As confirmed by John Vandemore (transcript by Koyfin):

And are geared to increasing it over time, part of our longer-term growth strategy going forward is we'll continue to grow international, which is gross margin accretive. We'll continue to grow direct-to-consumer, which is gross margin accretive. The only caveat I'll give to that though is we don't chase gross margin falsely in the sense that one of our most profitable operating margin categories is actually our least generous gross margin, our distributors.

So there are markets out there where we don't operate directly. We still work through distributors. And while those do carry lower gross margins, we don't bear any operating expense to support them. And so even in that instance, that's a lower gross margin business but a very high operating margin contribution. So we also want to make sure we're being thoughtful about how we target gross margins so that we don't inadvertently cut our nose off to supply it at our face.

However, there is likely room for EBIT margin expansion in DTC channels, including e-commerce. Just as NIKE's management spoke about ways to improve the profitability of its digital channel during the latest earnings call:

One, we talked specifically in EMEA about some of the efforts that the team is making to lower our fulfillment cost from a digital perspective through O2O, through reducing split shipments and adding pickup points. And then on the membership and marketing side, the idea that if we've got more members coming in through the top of the funnel who are more engaged and buying more frequently, we should start to see an improvement in our ROAS or return on ad spend from a digital perspective and give us a lot of confidence that we're building a moat to be able to continue to serve and grow our digital business.

Skechers still puts emphasis on scaling-up, describing the "urgency to continue to grow in markets like China and India and Malaysia and all the rest out there." Expansion means more headcounts and operational costs, which will erode margins. However, in the long-run DTC still has room for operating margin expansion.

Valuation

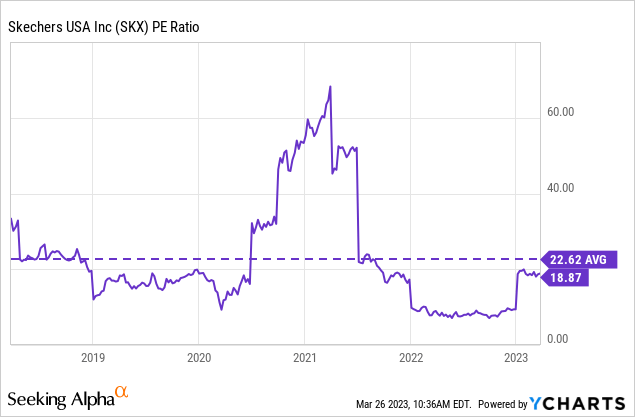

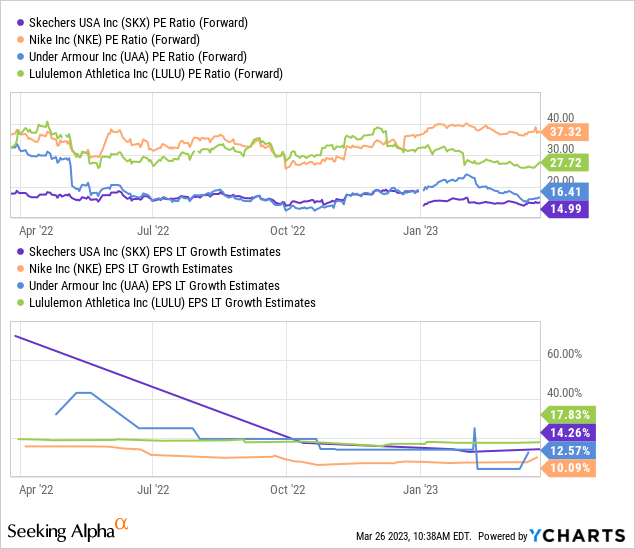

The stock is trading at 15x forward P/E (GAAP), a slight premium relative to its peers but a discount to its 5-year average. Considering Skechers' long-term earnings estimates compared to some of its peers, the current valuation still makes sense.

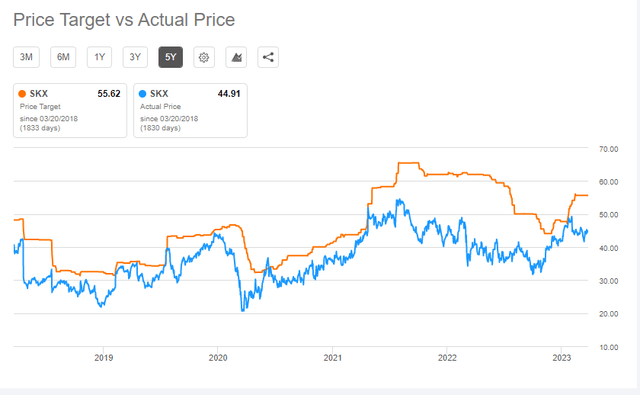

However, does the stock provide a comfortable margin of safety? We were bullish when shares traded at $36 per share and $44 per share, during which analysts' target price to be $62 per share and $58 per share, respectively. As things stand, analysts' target price is around $56 per share, implying 19x forward P/E. A 30% margin of safety suggests that the shares will provide an attractive entry point at least $39 per share (13x forward P/E).

Analysts target price (Seeking Alpha)

Conclusion

While Skechers' growth story remains, all eyes still focus on how the company will deal with its inventory. Being more conservative last year, Skechers is likely to increase its promotional activities, thus possibly putting pressures on margins. Short-term supply chain issues, such as high freight costs and downstream congestion, will persist, albeit moderately. Moreover, we view that inventory has not yet reached its peak.

Indeed, the market should have expected revenue growth and margin recovery as we are heading out the pandemic. However, we think that a factor not yet fully anticipated might be Skechers' international expansion. Moreover, consumers are likely to prefer more affordable athletic apparel products, such as Skechers, amid looming recessionary threats, although those might also slow down demand. Further, margin expansion in DTC business could help the company operate at its long-term margin target.

The stock is trading at 15x forward P/E. It still has an upside, but shares provide an attractive entry point at least $39 per share (30% margin of safety from analysts' target price). Investment risks include prolonged elevated inventory levels that will erode margins and possible recessions that could slow down demand. Therefore, we changed our "BUY" rating to "HOLD." If you have any questions, please do not hesitate to comment below.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SKX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Vektor Research is not responsible for any inaccuracy caused by human errors. But Vektor Research will make sure, with reasonable efforts, to reduce such mistakes as minimal as possible. Vektor Research is not responsible for any loss, expenses, and the reader's decision-making, as we do not force readers to act towards any securities. In other words, please do your own due diligence.