Nutrien: Significantly Undervalued Thanks To A Strong Bull Case And M&A Chatter

Summary

- Nutrien is one of the world's largest fertilizer companies with a large footprint in potash and phosphates.

- While shares have been under pressure, its bull case remains very strong, backed by rebounding demand, supply issues, and the company's ability to distribute cash to shareholders.

- NTR shares are trading at attractive prices, supported by M&A chatter.

Carl Banks/iStock via Getty Images

Introduction

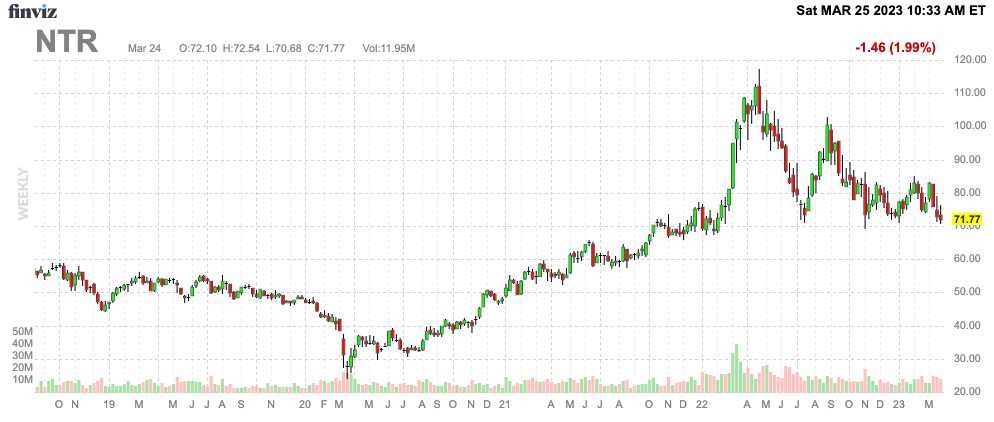

Nutrien Ltd (NYSE:NTR), one of the world's largest fertilizer producers, has faced challenges as falling energy prices, higher supply, and increasing recession fears have caused its shares to decline by roughly 40% from the 2022 peak during the Ukraine conflict. These headwinds have put pressure on basic material and energy stocks and have impacted my bull case for the company.

FINVIZ

Despite these challenges, I believe that NTR shares are now in a highly favorable risk/reward zone. The company remains optimistic about fertilizer fundamentals and is well-positioned to continue growing its dividend. Furthermore, NTR shares now yield over 3.0%, making them attractive from both an income and growth perspective.

Moreover, M&A chatter is starting to gain momentum.

In this article, I will delve into the details of NTR's situation and share my thoughts on why I see the potential for capital gains in the future. So, let's explore why NTR may be a compelling investment opportunity.

Why Nutrien Matters

Nutrien isn't just a random fertilizer producer. This Canadian-based giant is the result of a 2018 merger between PotashCorp and Agrium. The company operates in 11 nations, providing potash, nitrogen, and phosphates. While its phosphates business is very small (6% of 2022 sales), it's fair to say that NTR is responsible for all key fertilizer types: N, P, and K.

Elitech Drip

Thanks to its stellar balance sheet and consistent cash flows (we'll get to that in this article), the company pays a dividend of more than 3%, providing an income benefit for its many (long-term) investors.

Needless to say, fertilizers are as important as oil (maybe even more important), as they not only provide plants with deeper roots and bigger leaves, they are the backbone of the global food supply chain.

According to its competitor Yara (OTCPK:YARIY):

The world's population is growing, and we will be 9 billion people by 2050. By then, we need to make 60% more food in the same land area. Achieving food security requires enough nutritious food available at affordable prices, at any time - wherever people live.

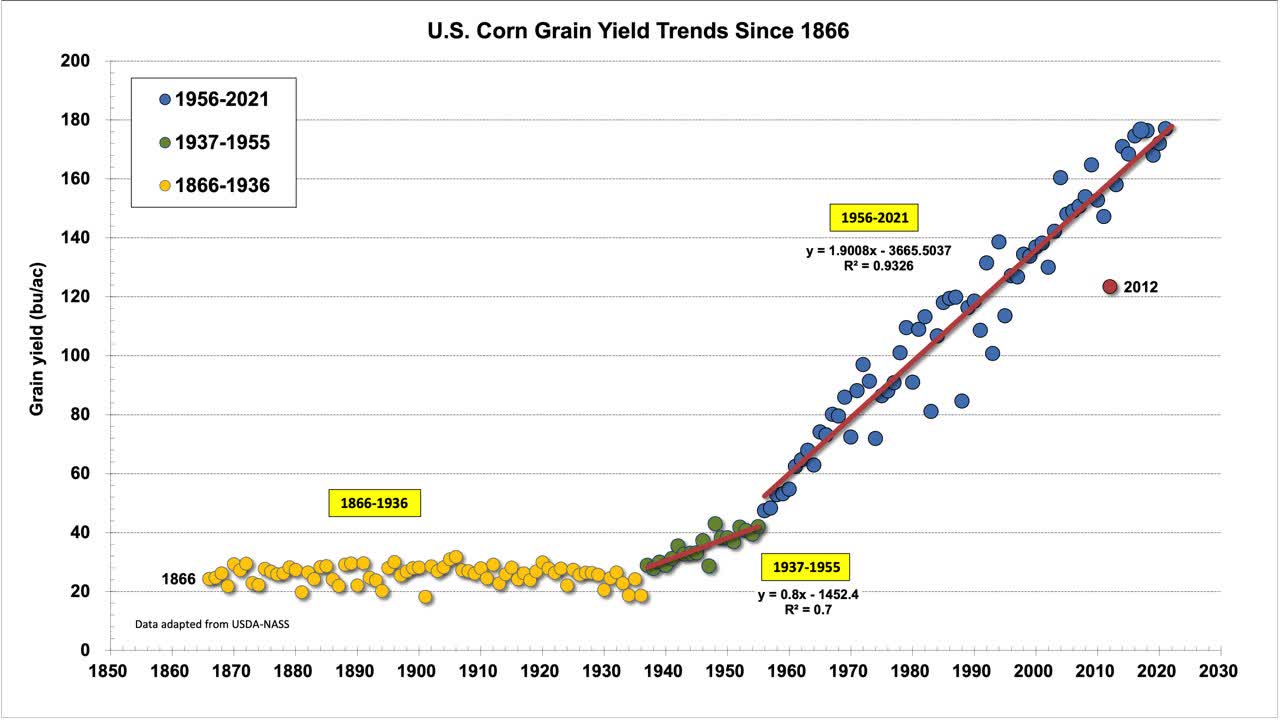

In an article last year, I highlighted that the massive adoption of fertilizers after the Second World War provided the world with the ability to boost crop yields. The chart below displays this using corn as an example. Needless to say, better farming equipment and GMOs also contributed to this.

Purdue University

So, based on that context, let's dive into what drives the NTR stock price.

The Agriculture/Fertilize Bull Case

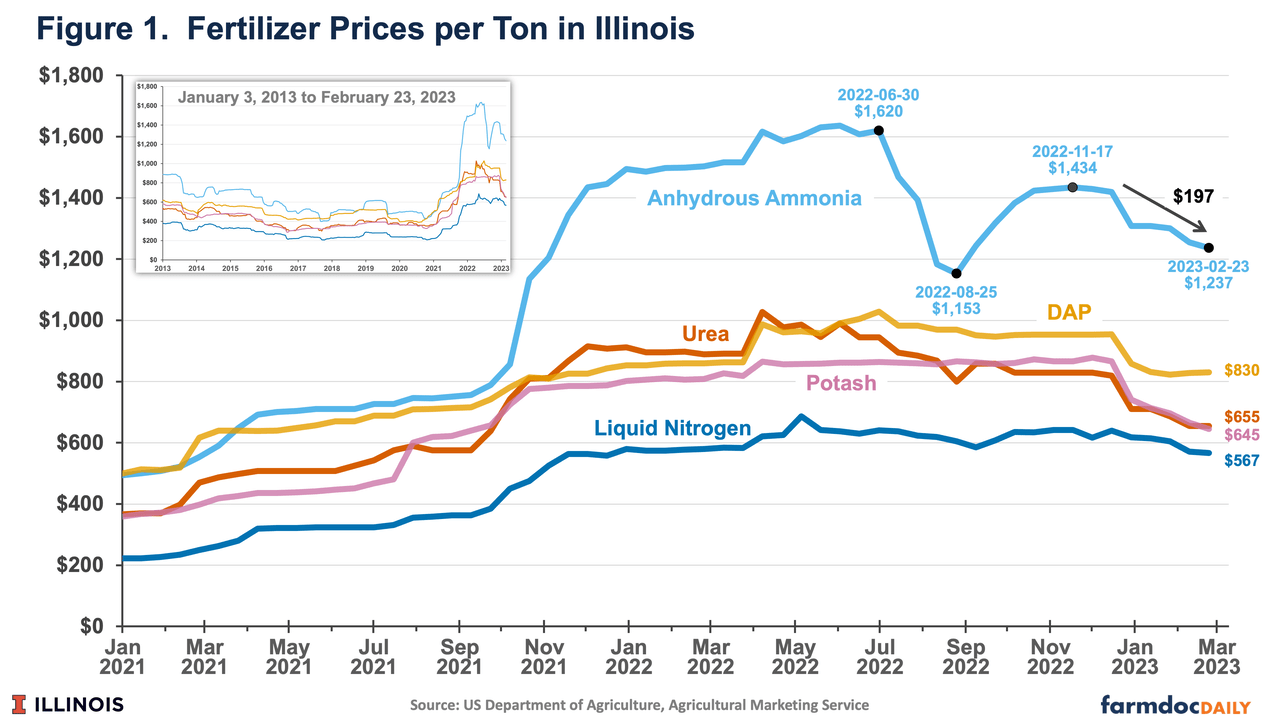

Fertilizer prices are in a downtrend, but not in a steep one, as displayed by the University of Illinois chart below.

However, it's worth noting that even though fertilizer prices have decreased, they are still high when compared to historical averages. For example, from 2016 to 2020, anhydrous ammonia prices averaged $518 per ton, which is $719 lower than the current price of $1,237 on February 23rd. The average DAP price during the same period was $454 per ton, which is $376 lower than the current price of $830. The average potash price was $350 from 2016 to 2020, which is $295 lower than the current price of $645 per ton. For corn, these prices are consistent with a doubling of fertilizer costs in 2023 compared to the 2016-2020 averages. Soybean fertilizer costs will also be nearly double.

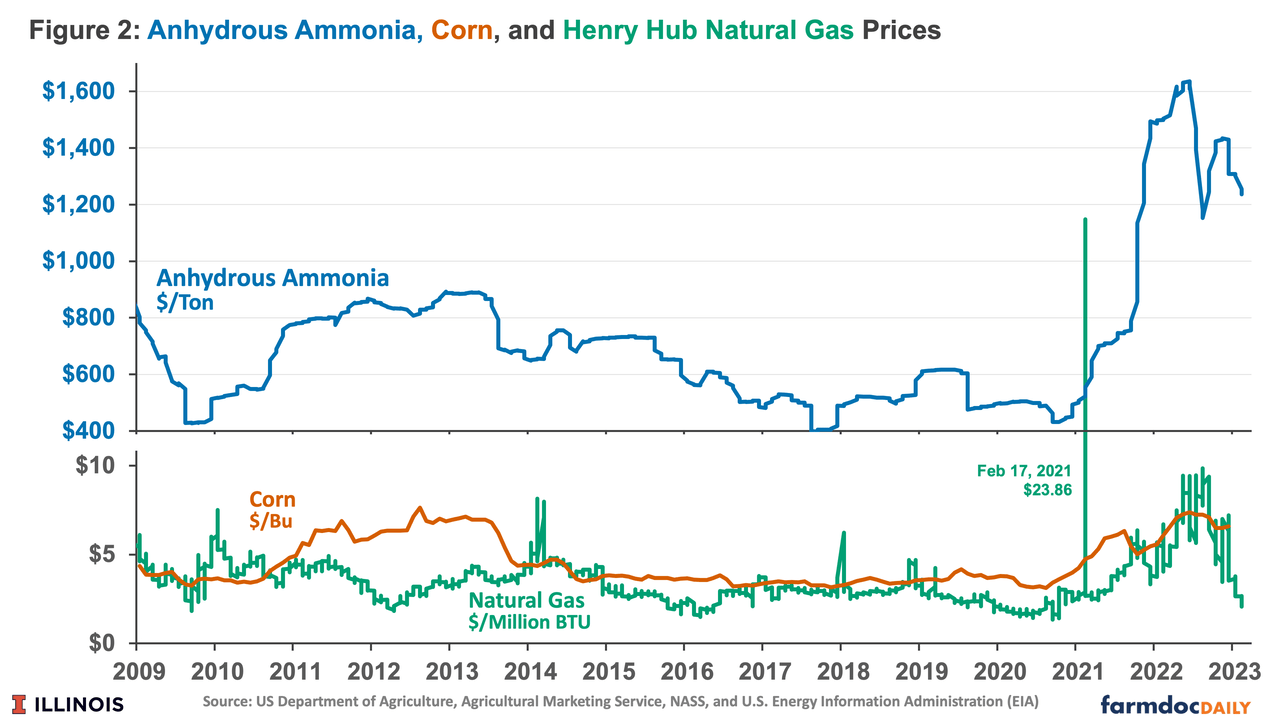

One major driver of lower prices is lower natural gas prices. Prices were down due to warm weather, which massively reduced demand, especially in Europe.

The graph below shows the relationship between natural gas prices, ammonia fertilizer, and corn.

Related to this, the Ukraine war has been priced into markets, according to the University of Illinois.

Overall, the Ukraine-Russia conflict seems to have been built into market expectations. Given current expectations, anhydrous ammonia prices near $1,000 per ton into spring are consistent with usual historical relationships with corn and natural gas prices. Furthermore, any escalation in Ukraine-Russia tensions or other supply disruptions could lead to upward swings in prices.

In other words, we now have a massive normalization in input costs, driven by warm weather and demand destruction due to increasing global recession odds. This has caused a decline in fertilizer prices, yet at above-average prices.

Now, there's more good news (at least for fertilizer producers). Earlier this month, Nutrien presented at the BMO Global Metals, Mining, and Critical Minerals Conference.

The company noted a number of things.

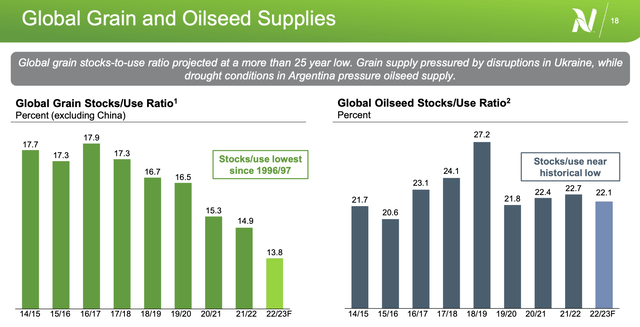

- The global grain stocks-to-use ratio is at a 25-year low, meaning demand is outpacing supply. It will take multiple cropping cycles (from seeding to harvesting) to replenish those inventories.

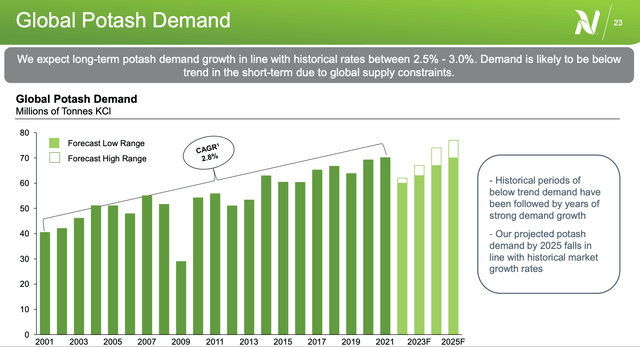

- Demand is reflecting that, with long-term annual potash demand growth at 2.5%.

Moreover, supply continues to be volatile.

During its presentation, the company discussed the challenges on the supply side of the equation, particularly the conflict in Eastern Europe, which has resulted in significant drops in Russian and Belarussian volumes by 28% and 52%, respectively. This has had a major impact on the supply of globally traded potash. Although there was volatility in inventory builds in 2022, prices began to soften as farmers started to de-inventory, leading to cautious buying behaviors among farmers.

Despite this, Nutrien expects a strong 2023 spring planting season, as farmers have strong balance sheets and the fundamentals remain favorable. Inventory levels are also at or below historical levels in most markets, including North America and Brazil, where destocking has occurred. Brazil has also seen price stabilization at around $500 per ton.

Nutrien is also closely watching the contract markets in India and China, with the view that annual contracts being in place will create a floor for prices and lead to more engagement in spot markets.

Moreover, with regard to the aforementioned supply issues from Russia and Belarus (who supply a combined 20% of global potash), in 2023 the company expects Russian volumes to be down 15% to 30% and Belarussian volumes 40% to 60%. This is because Nutrien believes that they have exhausted all alternative markets and outlets for their volumes, given their export constraints and pricing. For example, the Lithuanians closed off access to the tidewater port of Lithuania, making seaborne exports impossible. As a result, Belarus is sending as much via rail to China as possible, which is 6,000 kilometers away, and the logistics are ten times more complicated than exporting via the port of Klaipeda in Lithuania.

In other words, supply and demand fundamentals remain highly favorable for Nutrien. Demand is rising while supply constraints remain a top issue.

Nutrien Investors Remain In A Good Place

Nutrien has turned into a cash cow. In 2023, the company expects to generate between $5.5 billion and $6.5 billion in operating cash flow. It already has plans for $5.0 billion in spending, consisting of $1.8 billion in sustaining CapEx (to keep its business running), $1.2 billion in growth CapEx, $400 million in leased assets to service customer needs, and $1.6 billion in cash distributions. $1.0 billion is dedicated to dividends.

In retail, the company's focus is to strengthen its network in Brazil, expand its proprietary product offerings, and enhance its digital capabilities. In Brazil, the company is one of the largest fertilizer producers, despite having a market share of just 2.5%. This shows how much growth potential this market still has for companies that are able to gain market share.

In potash, the company continues to progress with the ramp-up of its existing low-cost potash capacity but has adjusted the timing to optimize capital expenditures in line with the pace of the aforementioned projected demand recovery in 2023.

Nutrien will maintain a flexible approach and now expects to reach 18 million tons of annual operating capability in 2026. The company's nitrogen investments are focused on concluding in-flight, low-cost brownfield expansions, decarbonization projects, and advancing front-end engineering work for its proposed Geismar clean ammonia plant. Nutrien intends to make a final investment decision on this project in the second half of the year.

In other words, after maintenance and growth CapEx, the company is expected to generate $3 billion in free cash flow. This translates to a free cash flow yield of 8.4%. This supports its 3.0% dividend (recently hiked by 10%) and buybacks on top of debt reduction. Note that the company has a dividend payout ratio of just 14%. This is obviously very low due to the massive boost in earnings. However, even *if* earnings were to come down a lot, the dividend would unlikely be in danger.

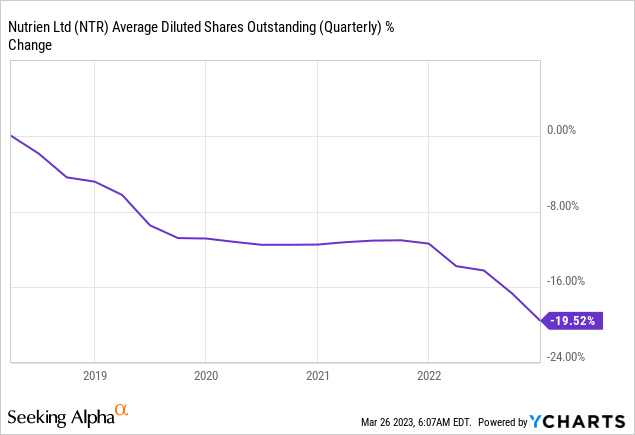

Earlier this year, the company approved a new 5% share repurchase program.

Over the past three years, the company has bought back roughly 20% of its shares.

Moreover, all of these distributions are backed by a BBB- credit rating, a leverage ratio of less than 1, and consistently high free cash flow.

So, what about the valuation?

Valuation & Takeover Chatter

NTR shares are trading at 5.1x 2023E EBITDA, based on an expected EBITDA decline from $12.2 billion in 2022 to $9.0 billion. Needless to say, this decline was expected, as 2022 was truly a one-off year. However, using 2024 numbers, the valuation still remains below 6x EBITDA, which is a good deal.

NTR shares currently trade at $72 per share in New York. The consensus price target is $99 (+38%). I agree with this consensus estimate and believe that it's where NTR should trade without being anywhere to being overvalued.

Based on this context, on March 14, Seeking Alpha reported that mining giant BHP (BHP) may be interested in a partnership or a total takeover of Nutrien. In 2010, the mining company bid $40 billion to buy Potash Corp, Nutrien's predecessor.

A takeover makes sense, as BHP is eying the sale of Australian coal mines and speeding up the work on Canadian potash. Moreover, thanks to high commodity prices, miners have high excess cash, which can be used to buy exposure in other areas.

Note that the 2010 takeover bid also came at a time of elevated commodity prices.

This is what Bloomberg reported in January 2022:

The world's top fertilizer producer could be a takeover target for BHP Group after a "peculiar" CEO change earlier this month, according to research from Gordon Haskett.

The surprise exit of Nutrien CEO Mayo Schmidt to start the year after only eight months on the job suggests the company is struggling with figuring out what it wants to do, Don Bilson, head of event-driven research at Gordon Haskett in New York, said Wednesday by phone.

Nutrien has been previously touted as a potential partner for BHP at its Jansen mine in Saskatchewan and the company is positioning itself for a return to large-scale M&A.

That said, I think a takeover is likely, especially as NTR shares are trading at a discount versus (expected) fair value.

Takeaway

The stock price of Nutrien is currently not performing well, having decreased by 40% from its 2022 highs due to lower fertilizer prices. However, the underlying agricultural and fertilizer fundamentals are still strong. There is an increasing demand for fertilizers and the profit margins are stabilizing. This trend is expected to continue because of low global grain stocks.

Nutrien is well-positioned to benefit from this situation due to its massive low-cost operations, ability to expand production, high excess free cash flow used for debt reduction, and increasing shareholder distributions. Although there is a possibility that the ongoing recession could lead to a potential stock price breakdown to $60 per share, I believe that the current situation has presented a buying opportunity for NTR shares.

There is also a chance of Nutrien being acquired by BHP, which could be a viable wild card. Although I do not own NTR shares, I am considering adding them to my portfolio due to their attractive risk/reward potential, especially if the ongoing market issues cause the stock price to drop to the low-$60 range.

However, it is important to keep in mind that fertilizer stocks are highly volatile, and one should take this into consideration when evaluating whether to invest in NTR or not. Furthermore, I already have exposure to other fertilizer producers, and I am about to increase my stake in Canadian Pacific (CP), which is the main railroad shipping NTR's products. This way, I will have less volatile exposure to Canadian fertilizers.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice