Datadog: Solid Business In A Difficult Macro Environment

Summary

- Cost optimization amongst Datadog's largest customers continued in the quarter as their focus shifts from growth to profitability.

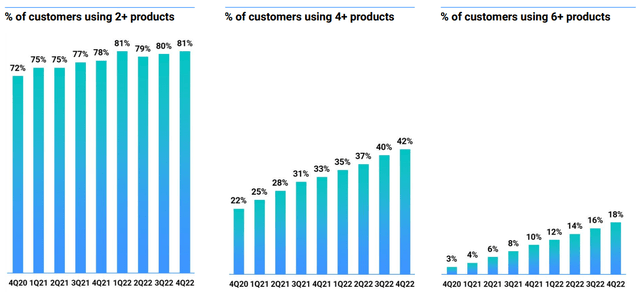

- Datadog continued to see traction in its multi-product strategy, with a record-high number of customers using more than six products.

- Lowered guidance was a matter of time given the weakness in hyperscalers and cost optimization we have seen in the past few quarters.

- The company highlighted significant go-to-market wins, which continue to show strong customer demand and value add.

- My one-year target price for Datadog is $106. This implies a 61% upside potential from the current stock price.

- This idea was discussed in more depth with members of my private investing community, Outperforming the Market. Learn More »

NicoElNino

Datadog, Inc. (NASDAQ:DDOG) stock is down 15% since its results release. I looked into its Q4 earnings report and listened to the management call to highlight the key points from the results.

I have previously written an earlier article on Datadog, which can be found here. For members of Outperforming the Market, I have also elaborated my views on why I'll be adding to Datadog when the Buy alert trigger is met. I continue to see Datadog as an attractive long-term holding and look to enter DDOG stock at a more reasonable valuation.

Here are some of the key takeaways from Datadog's recent quarter that you need to know about.

Cost optimization

The most significant takeaway from the fourth quarter 2022 results of Datadog is the cost optimization efforts in its installed base increasing.

Cost optimization in Datadog's business comes in two ways. The first is when customers turn off workloads in hyperscaler environments. This leads to fewer instances for Datadog to monitor and thus monetize. The second is direct cost optimization with Datadog as customers reduce the volume of data they send or reduce the length of storage. This will then directly impact the volume-based parts of the portfolio. For Datadog, its business has seen more of the latter, as customers look to directly optimize cost with Datadog.

As noted by the management team, in October and November 2022, the usage levels of the existing base grew at levels similar to that seen in the second quarter and third quarter of 2022. However, in December 2022, management saw a significant deceleration compared to prior years, which more than offset the growth seen in October and November 2022.

This deceleration in usage levels of the existing installed base is largely driven by Datadog's large customers. The slowdown that Datadog saw in the large customer usage in the second and third quarters of 2022 continued in the fourth quarter. In terms of sectors, the consumer discretionary verticals faced more weakness. Its smaller customers, on the other hand, continued to show resilience. These are typically large companies with a small cloud spend. As a result of its early stage of cloud migration, its smaller spend base means that there is less scope for cost optimizations in the first place and thus, this group is likely to continue to be more resilient going forward.

The other aspect of cost optimization has to do with Datadog's correlation to hyperscalers. Although it's certainly not a perfect correlation, the weakness we have seen from the hyperscalers end implies a similar trend to Datadog's business.

Strong multi-product traction

I think that one positive takeaway from the quarter was the continued traction in its multi-product strategy. The percentage of customers using more than four products grew two percentage points, and the percentage of customers using more than six products also grew by two percentage points.

This strong momentum in Datadog's multi-product strategy helped to maintain Datadog's more than 130% NRR momentum, its 22nd consecutive quarter.

Datadog multi-product platform (Datadog 4Q22 presentation)

Interpretation of the lowered guidance

Datadog's full year guidance for the fiscal year 2023 was definitely disappointing to the street as they guided for 24% to 25% revenue growth with operating profit margins expected to be at 15%.

This was 8 percentage points and 2 percentage points below the street's expectations for revenue and operating profit margin for 2023 respectively.

Although this was undoubtedly a disappointment and painful for Datadog's investors to bear, this was a necessary guide down to manage expectations, in my view. With hyperscaler weakness, slowing cloud adoption across the board, and reductions in spend and usage of the installed base, I think that this was also unsurprising in a way as it was inevitable that Datadog would need to guide down and manage expectations. Furthermore, I like that management stated that the guidance provided incorporates the assumption of cost optimization in all areas of the business. This means that while management is seeing more weakness in the consumer discretionary sector than in other sectors, the forward guidance assume that all sectors will see cost optimization.

However, I think that the guide down is not a doomsday story for the stock and, in my view, a transient macro issue that is affecting the Datadog business.

The question then remains to be whether or not the lowered guidance leads to de-risked estimates going forward or will there be more downside in forward guidance to come. This uncertainty will remain in the near term, in my view, as investors need to be able to see that the spend and usage optimization situation has at least stabilized before becoming more constructive on the stock.

I reiterate that this lower guidance is a result of transient macro issues. In my view, I think that Datadog's technology moat and platform vision do look solid for the longer-term prospects of the company. Management also highlighted that the issues seen today are not structural in nature, but merely because customers are looking to protect themselves from macro uncertainties, shifting focus from growing rapidly to profitability.

Cost drivers

Despite revenue beating by 6 percentage points for the fourth quarter of 2022, operating profit margin also beat but at a lower magnitude of about 5 percentage points.

The operating profit margin beat came from the beat in revenue and cloud cost efficiencies, but operating expenses in the quarter outpaced revenue growth. Operating expenses grew 54% year on year while revenue grew 44%. This was driven by higher spend in the hiring for R&D and go-to-market teams.

As highlighted, the main driver for the increase in operating expenses was a result of spending to hire for roles for its R&D and go-to-market teams. Management continues to see holes to fill in these roles. With a growth in its headcount in S&M, Datadog has seen decent return on investment on its new sales hire, which landed new logos and brought traction in new products. Despite the increase in S&M headcount, this does not directly correlate to higher revenue growth as Datadog's business depends on usage increases.

Go-to-market wins

Datadog's go-to-market team has executed well in the fourth quarter of 2022, especially with new logo lands.

In the quarter, Datadog signed a 7-figure land with a Fortune 500 industrial group, with the customer using an impressive 13 products. Another signing that Datadog did was a 7-figure land with a Fortune 500 financial services company, and this customer is expected to save about $1 million in the first year of using Datadog.

Next, Datadog also signed a 7-figure land deal with a major federal government agency, which is among a number of new government customers in 2022. In addition, the company signed a 7-figure land deal with a leading Japanese system integrator, with the plan to add up 15 of Datadog's products. Lastly, Datadog signed a multimillion-dollar expansion with one of the world's leading insurance companies, which saw about 115% return on investment within a year of using Datadog and currently uses 12 products.

Customer growth decelerated to 23% growth year-on-year, with 23,200 customers at the end of 2022. Of note, the customer group with more than $100,000 ARR or more grew 38% year-on-year to 2,780. These customers made up 85% of Datadog's total ARR. The customer group with more than $1 million ARR or more grew 47% year-on-year to 317.

Valuation

Datadog is currently trading at 7.5x 2024 EV/Sales and 47x 2024 P/E. For the fiscal year of 2022, based on the revenue growth of 63% and free cash flow margin of 21%, the company is running at more than the rule of 80. That said, management expects near-term revenue to decelerate amidst the more difficult environment and thus, it could operate at a lower growth rate in the near term. As a reference, based on the guidance for 2023 of 24% to 25% revenue growth, this implies a significant deterioration in operation above the rule of 80.

I think that we could see the company accelerate top and bottom-line growth in the longer term, as I expect that the challenging macro environment will pass and Datadog will continue to be able to expand profitability, maintain the quality of its competitive positioning and sales execution and thus operate above the rule of 50.

For my valuation of the Datadog stock, I am lowering my EV/Sales terminal multiple to 13x EV/Sales. This is to reflect the near-term risks involving cost optimization, a potential further downside to guidance, and macroeconomic environment risks. Also, this takes into account the transient lower revenue growth at which Datadog is operating at today.

To determine the valuation of Datadog's stock, I utilize an EV/Sales method. I apply a 15x EV/Sales terminal multiple on Datadog's FY2025 revenue and discount that back by 10% to derive the company's target price. As the company has been seeing a strong growth rate of more than 30% and operating at a solid "rule of 80" for a software company, I think that the higher EV/Sales is justified.

As such, my one-year target price for Datadog is $106. This implies a 61% upside potential from the current stock price.

Risks

The hyperscaler effect

We have seen that the slowdown in growth in hyperscalers is rather apparent today. The weak cloud environment has resulted in deceleration in the cloud industry as customers prioritize profitability over growth in the current macroeconomic environment. This slowdown in hyperscalers brings weakness to Datadog's business, as highlighted in the article. As such, the slowing cloud adoption and cost optimization efforts could bring added downside risks in my view.

Macroeconomic environment

As Datadog's weak guidance was a result of cost optimization, this has to do with its customers looking to cut costs where possible to improve their profitability. As a result, any increased uncertainty in the macro environment will bring downside revisions to Datadog's forward guidance, in my view.

Competitive pressures

I think Datadog has a strong technology moat and platform vision that will continue to drive its outperformance. However, there are other competitors in the observability market like Dynatrace, Inc. (DT) and Splunk Inc. (SPLK). Datadog will need to continue to invest in the necessary teams to grow and bring the needed innovation to the table through continued research and development efforts.

Conclusion

All in all, I think it's clear that Datadog, Inc.'s business is hurting at the moment. The uncertainty as to whether we have seen the worst of the cost optimization is causing investors to stay at the sidelines.

That said, I think that the current weakness in Datadog is transient and a result of macro issues instead of structural issues with the business.

At the end of the day, the company continues to execute well in go-to-market wins, gaining traction in its multi-product strategy, and continues to invest in go-to-market and R&D teams.

My one-year target price for Datadog, Inc. is $106. This implies a 61% upside potential from the current stock price.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 41% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!

This article was written by

I am a portfolio manager with experience working for a hedge fund and a long-only equity fund with more than $1 billion in assets under management and I have a track record for outperformance in my portfolio. I have been writing consistently, with an article published each day on Seeking Alpha and on my Marketplace service.

Focused on long term investing, I believe in a barbell strategy in a portfolio, where there are both growth and value elements, which will be reflected in my articles.

I will be running a Marketplace service, Outperforming the Market, where I will share with you The Barbell Portfolio, which consists of high conviction growth and value stocks to help you outperform in the long-term, as well as The Price Target Report, which tells subscribers how much discount the stock is trading to intrinsic value and the upside potential. Lastly, subscribers will be able to get direct access to me and can ask me anything about the investment process or stock picks.

CFA charter holder and graduated with degrees in Finance and Accounting.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.