IWD: Low Growth Is Not Necessarily Value - Also For Large Caps

Summary

- There are countless methods and nuances of (systematic) value investing, but the general idea remains "cheap beats expensive". Not always, but on average over the long run.

- The iShares Russell 1000 Value ETF tracks the Russell 1000 Value Index and offers a simple, transparent, and cheap implementation of the value premium for US large caps.

- The Russell value process unfortunately equates "low sales growth" with "value" which contradicts with the best practices discussed in the literature on the value factor.

- Despite decent performance when compared to an investable value peer-group, IWD is therefore not my preferred value implementation.

Darren415

This article examines the next ETF of the peer-group that I introduced in an earlier article on (systematic) value investing and QVAL. More specifically, this one is a follow-up to my article on the iShares Russell 2000 Value ETF (IWN). For those who haven't read that one: I criticized Russell's methodology for equating "value" with "low sales growth" which is not in-line with well-known results of the academic and practitioner literature on the value factor. Quite unsurprisingly, the iShares Russell 1000 Value ETF (NYSEARCA:IWD) suffers from the same problem, just for its large-cap universe...

For a deeper introduction to (systematic) value investing, I kindly refer you to the "Value Investing - Idea and Evidence" section of my first article or to this post on my website. To get everyone on the same page, however, here is a brief summary. The general idea of value investing is that fundamentally cheap securities outperform expensive ones. Not always, but on average over the long-term. Systematic value investors implement this idea by being long/overweight stocks with low valuation multiples and short/underweight stocks with high valuation ratios. Nowadays, there are of course countless nuances and methodological innovations. But the underlying idea always remains (and should remain) a simple "cheap beats expensive".

IWD's Implementation of Value

Quite unsurprisingly, IWD tracks the Russell 1000 Value Index. Given that the Russell Value Indices are always derived from the parent index, IWD is a dedicated large-cap value strategy. This is not necessarily a problem (investors must decide if they want small-cap risk or not), but there is evidence that value investing historically worked better among small caps. Note that this is in-line with the fact that the Russell 1000 Value Index (IWD) underperformed the "small" Russell 2000 Value Index (IWN) by about 1.7%-points per year since inception in May 2000.

But let's go back to the methodology of the Russell 1000 Value Index. As always, the latest factsheet provides a first summary:

The Russell 1000® Value Index measures the performance of the large-cap value segment of the US equity universe. It includes those Russell 1000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics

Source: Russell 1000 Value Index Factsheet, accessed March 26, 2023. Annotations by the author.

As one would have expected, this is the exact same methodology as for the Russell 2000 Value Index just applied to another universe. I will therefore not re-cover all of the further methodological details at this point. As I explained in my article on IWN, Russell employs some more sophisticated methodology under the hood. The overall mechanics, however, are rather simple to understand. The Russell 1000 Value Index overweights "value" stocks (according to the definition above) with respect to the standard Russell 1000 Index. Therefore, it is essentially a broadly diversified large-cap value portfolio of stocks with low Price/Book ratios and low sales growth. At the time of writing this, IWD currently holds 852 stocks.

Before I turn to the historical performance, let me again highlight the two (in my opinion) key problems of Russell's methodology.

First, the value signals. Price/Book is the classic value signal and has been studied extensively. This is fine. To the best of my knowledge, however, there is no consensus in the literature for sales growth as a signal for the value factor. It is of course possible that fundamentally cheap value stocks are cheap because of low sales growth. So you may find cheap value stocks with low sales growth but low growth itself has nothing to do with value. It is just low growth. Flipping the argument around, the consensus among systematic value investors (again to the best of my knowledge) is to measure value with multiple valuation multiples and within industries. We can debate endlessly about the right valuation ratios and industry classifications. But no matter how we look at it, the Russell methodology is far off from this consensus.

Second, there is the long rebalancing interval. This is not a giant problem as value is a much "slower" strategy than for example momentum and requires less turnover. However, it should be easily possible to rebalance a portfolio of US large caps quarterly or at least semi-annually. Given that companies release quarterly fundamentals, that would make more sense (in my opinion).

To sum up: The methodology of IWD is (unsurprisingly) identical to that of IWN, it is just applied to the Russell 1000 instead of the Russell 2000 universe. But enough with stating the obvious, let's see how this value strategy performed against various benchmarks.

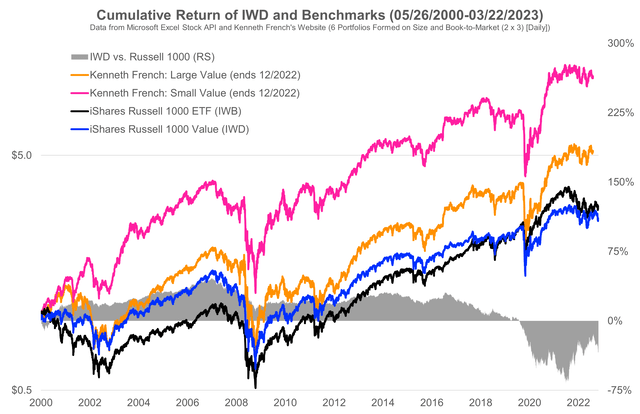

Own illustration of data from Kenneth French's website and market data. (Tuck School of Business and Microsoft Excel Stock API)

The good news first. Since inception in May 2000 (such a long history deserves credit for itself), IWD was ahead of the overall Russell 1000 Index until the beginning of the most recent painful value drawdown around 2017/18. Since then, IWD massively underperformed the market (as almost all value strategies did) but strongly recovered over the last two years. At the time of writing this, however, it is still behind the Russell 1000 for the full period.

The (in my opinion) more interesting and more appropriate comparisons are the Kenneth French value portfolios. Interestingly, "Large Value" (orange line) massively outperformed both the Russell 1000 and the Russell 1000 Value Index (note the log scale...). This is very interesting as this simple academic benchmark is solely based on the Price/Book multiple and strictly market-cap weighted. An investable index of course requires some more practical constraints but in my opinion, it is still astonishing that the simple and well-known academic benchmark delivered such strong performance. I regard this as further evidence against the "low growth" value definition of Russell.

Finally, the chart also shows how empirically what I mentioned earlier. "Small Value" did much better than "Large Value", IWD, and the general Russell 1000.

IWD and Value-Peers

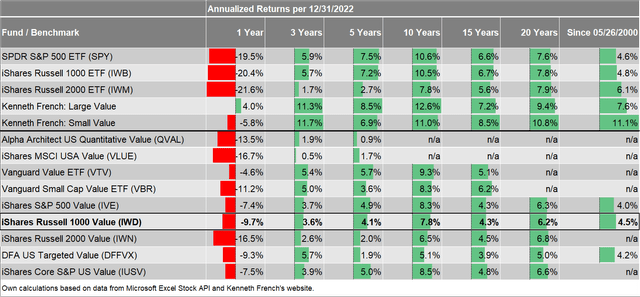

To further examine the performance of IWD, I next look at the performance of IWD compared to my (arguably somewhat arbitrary) value peer-group. The following table includes returns of VLUE, VTV, VBR, IVE, IWN, QVAL, DFFVX, IUSV, and various benchmarks.

Tuck School of Business and Microsoft Excel Stock API

I don't want to comment too much on specific numbers. The overall pattern is (in my opinion) much more interesting. IWD kept up decently with the value-peers for virtually all time periods. When compared to the market benchmarks and the Kenneth French benchmarks, however, the performance is rather disappointing. IWD underperformed the academic "Large Value" portfolio by more than 3%-points per year since inception. It also underperformed both the large-cap (Russell 1000 / S&P 500) and small-cap (Russell 2000) segment of the US market.

As strange as it may sound, being a value strategy and underperforming the overall market is "okay" as the value factor simply didn't work over many of the last 15 years. The consistent underperformance against the academic benchmark, however, is reason for concern. But to be fair, none of the investable value ETFs managed to hold pace with the theoretical value benchmarks of Kenneth French. Some of that is certainly due to real-world frictions (trading costs, management fees, etc.), but some of it is probably also attributable to the "low growth = value" problem of IWD (and IWN).

Conclusion

From reading this article, you may get the impression that I am overly skeptical and tedious. That may be true, but I think it is important to mention that except for the "low growth = value" argument, I don't have a problem with IWD's (and IWN's) value process. The idea of creating a transparent value version of a well-known index is great and improves the efficiency of markets. From this perspective, IWN has definitely a raison d'être. It is one of the most common value proxies, everyone knows it, and (according to the thoughtful comment of a reader under my IWN post) there are reasonably liquid derivative markets for the Russell Value indices.

All of this is great, but it would be even greater if Russell moves towards the "value-consensus" of the literature and drops the sales growth signals from the process. Until that happens, I assign a "Hold" rating as the ETF could still benefit from the value premium but doesn't incorporate the best-practice from research on the value factor.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This content is for educational and informational purposes only and no substitute for professional or financial advice. The use of any information on this website is solely on your own risk and I do not take responsibility or liability for any damages that may occur. The views expressed in this article are solely my own and do not necessarily reflect the views of any organisation I am associated with.

Given that I am based in Germany, I have no access to the mentioned securities for regulatory reasons. However, I do have beneficial long-positions in comparable securities.