KURE: Clear Skies Ahead For Chinese Healthcare

Summary

- The KraneShares MSCI All China Health Care Index ETF has been plagued by policy headwinds in recent years, but the backdrop looks set to improve.

- Backed by a near-term rebound in patient visits and long-term demographic tailwinds, the outlook for healthcare spending remains compelling.

- As a low-cost, single-sector investment vehicle, KURE offers investors a great option to invest in the Chinese healthcare theme.

Edwin Tan

With few signs of a COVID resurgence in China thus far, medical activities look to be getting back to normal. This means a cyclical recovery in patient visits and surgeries relative to last year. Alongside the reopening tailwind, policy support for biopharma and medtech-related innovation are additional positives for the structural growth potential of the healthcare industry. And with the secular rise in high-end medical services demand also intact, given the projected demographic shift toward an aging society, leading private healthcare services providers are well-positioned to capitalize. Expect more valuation repair in the coming months as the post-COVID recovery translates into earnings upside and pipeline innovation further accelerates. The KraneShares MSCI All China Health Care Index ETF (NYSEARCA:KURE) is a great low-cost vehicle for investors looking to capitalize on the theme; the fund's outsized exposure to cash-generative blue chips leaves it well-positioned to benefit from the reopening, as well as long-term growth drivers.

Fund Overview - Diversified, Low-Cost Exposure to Chinese Healthcare

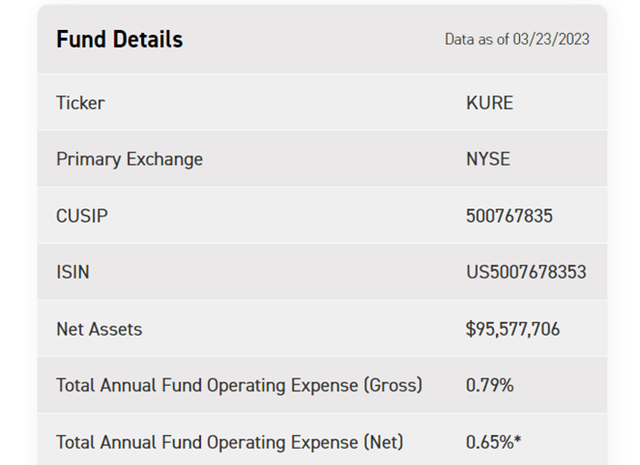

The US-listed KraneShares MSCI All China Health Care Index ETF seeks to track, before fees and expenses, the performance of the MSCI China All Shares Health Care 10/40 Index, a free float-adjusted market cap-weighted index spanning healthcare companies listed in Mainland China, Hong Kong and the United States. The ETF held ~$96m of net assets at the time of writing and charged a 0.8% gross expense ratio (0.7% net of contractual fee waivers in effect through August 2023), making it a cost-effective option for US investors looking to express a single-sector view on Chinese healthcare. A summary of key facts about the ETF is listed in the graphic below:

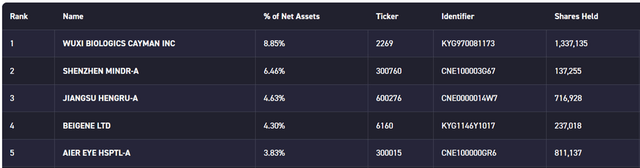

Per its latest factsheet, the fund's assets are spread out across 97 holdings, with no single-stock weighting exceeding 10%. The single-stock allocation is led by top-holding WuXi Biologics (OTCPK:WXIBF), a leading Chinese biologics technology platform, contributing 8.9% of the portfolio. Other key holdings include Shenzhen-based medical instrumentation manufacturer Mindray Medical International at 6.5%, Chinese pharmaceutical company Jiangsu Hengrui at 4.6%, biotechnology leader BeiGene (BGNE) at 4.3%, and ophthalmic medical institution Aier Eye Hospital at 3.8%. In total, the top five holdings account for ~28% of the overall portfolio.

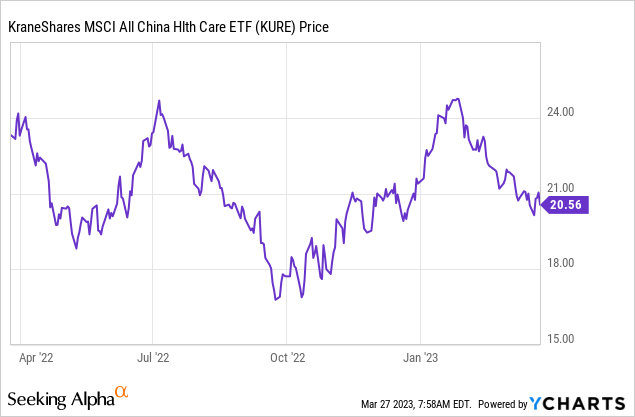

On a YTD basis, the ETF has declined by 4.8% and has compounded at a -0.1% annualized rate in market price and NAV terms since its inception in 2018. Fund performance has been volatile, with the double-digit percentage drawdown over the last two years being a case in point. The overall distribution runs on an annual basis and has also been lackluster in recent years, reflecting the volatility of the sector's capital returns in recent years.

Near-Term Patient Rebound Adds to Long-Term Demographic Tailwinds

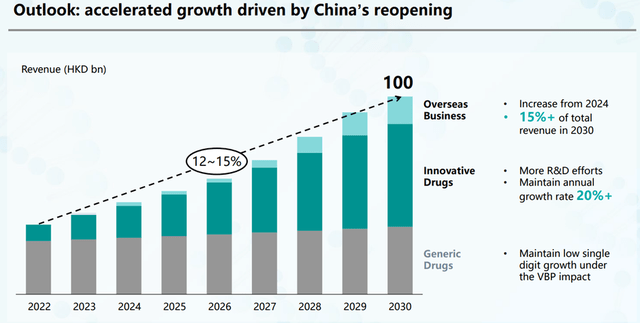

China's healthcare policies in recent years haven't been business-friendly, but even with a backdrop of medical insurance cost controls, growth opportunities are aplenty, particularly for the private hospital space, where KURE maintains a sizable presence. As Chinese private healthcare providers like Aier Eye Hospital (a 3.8% holding) tend to have a differentiated market positioning in terms of regional operations or specialization (ophthalmology for Aier), they tend to have a more 'sticky' base of customers. In the near term, all eyes will be on the revenue benefit from a normalization of patient visits post-COVID - as public hospitals have a limited capacity, the increased operational burden should allow for private hospitals to grow into the market gap.

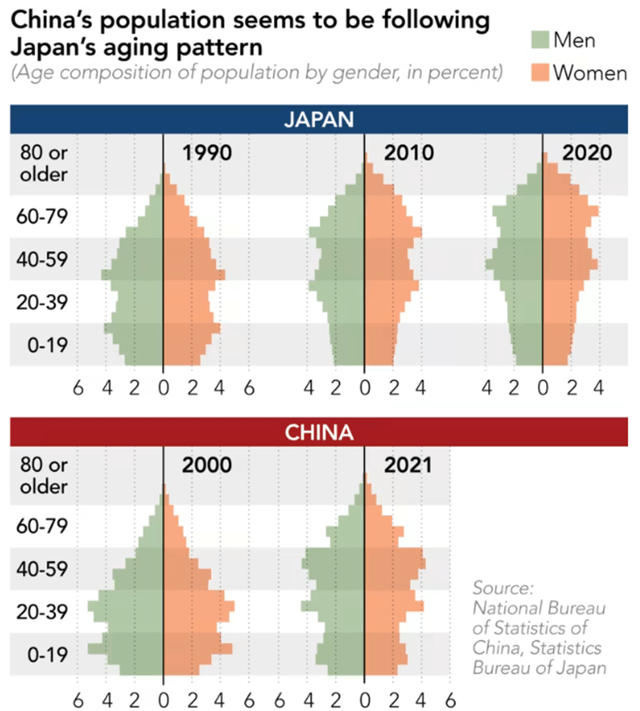

In the mid to long term, there are two key trends - China's aging demographic and growing middle-class population. The former entails rising demand for basic healthcare services and hospitalizations, but also traditional Chinese medicine and oncology services. This will coincide with consumption upgrades alongside the increased spending power. Expect younger buyers to step up their health and beauty spending, while high-end medical services should also see increased demand from a richer aging society. Given KURE's portfolio of established private hospitals and equipment providers with market leadership and strong management teams, the ETF is poised to benefit.

Negative Policies Priced In; Future Policymaking Increasingly Supportive

KURE has significantly underperformed over the last two years, partly because of China's COVID restrictions but also due to policymaking. Specifically, the extension of volume-based procurement (VBP) from pharmaceuticals to high-value medical devices has been a major pricing headwind for manufacturers. Through 2022, multiple rounds of VBP have already been implemented, with price cuts averaging >50%, moving the industry closer to the government's target. So VBP-related pressures should gradually ease over time - key KURE holdings like Sino Biopharm (OTCPK:SBMFF), having already seen most of its generics impacted in previous years, will likely see less earnings pressure vs. their peers.

On a more positive note, there are policy tailwinds in the pipeline to boost biopharma and medtech innovation going forward. The rollout of the National Reimbursement Drug List (NRDL), for instance, will result in lower prices, but will also speed up the commercialization of innovative drugs via clinical trials and drug approval processes. At the company level, biotech companies are increasingly exploring new ways to further offset the moderate price cuts, including via increased pipeline collaboration between pharma companies; case in point - CSPC's (OTCPK:CSPCY) mRNA and Hansoh's (OTCPK:HNSPF) siRNA platforms.

Clear Skies Ahead for Chinese Healthcare

The Chinese healthcare sector looks poised for clear skies this year, as COVID looks to have finally faded, allowing for the growth of clinical visits and surgeries to normalize higher YoY. Unfavorable policies have held back the sector in recent years, but most of the negative impact has been priced in by now. On the other hand, innovation-friendly policies in biopharma and medtech, including for clinical trials and drug approvals, should result in upside over the mid to long term, adding to the structural demand growth from an aging demographic. With the China healthcare sector down YTD, the risk/reward skews favorably heading into the upcoming earnings season. KURE presents investors with an opportunity to capitalize on a healthcare rebound via a portfolio of industry leaders with established track records and strong cash positions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.