A Fundamental Regime Shift Is Underway

Summary

- Following the collapse of Silicon Valley Bank on March 10, 2023, markets have undergone a fundamental regime shift.

- Investors' performance in 2023 will depend on how they position their portfolios in response.

- The commodity trade is likely over for the time being. The inflation trade is over as well.

- The Federal Reserve is likely to become accommodative much sooner than expected.

- Strong balance sheet companies with long-dated cash flows and non-USD investments are likely beneficiaries.

wildpixel/iStock via Getty Images

It Started with Silicon Valley Bank

The failure of Silicon Valley Bank (SIVB) is having profound knock-on effects throughout global financial markets. First, I should admit my surprise at the wide-ranging impacts of SVB's failure. That banks owned longer-dated Treasuries and that these fell in price as rates rose in 2022 was well known to market participants. The uniqueness of SVB - both in terms of its duration exposure and its highly concentrated investor base - was well known as well. One may have thought that the failure of SVB would have been shrugged off by markets and investors as a case of what-else-is-new. But that is not what happened.

I, and others, have written in the past that SVB's failure is unlikely to lead to a systemic banking crisis, and I think this is still true. Nevertheless, the impacts from SVB's failure have been extraordinary. First, of course, there was the takeover of Credit Suisse by UBS. While Credit Suisse's management issues were well known, the stunning collapse of this one-time pillar of the global banking community has been highly surprising. Second, there is a full-scale credit contraction underway in the banking system.

Credit Contraction

Bank stocks have fallen dramatically over the last few weeks. The SPDR S&P Bank ETF (KBE) is down close to 30% from its recent high. The most benign interpretation of this move is that banks will have to start paying more for their deposits which will eat into their earnings. Depositors, who once may have thought that putting money into their bank savings account was a zero-risk undertaking, are learning that this is only true up to the $250,000 FDIC insurance limit. For money above this amount, depositors are now looking at investing in money market funds or in Treasuries, and banks will have to pay up to keep their depositors from leaving.

Bloomberg

That's the benign interpretation. The less benign interpretation is that banks are going to have problems accessing capital in public markets. The AT1 (Additional Tier 1) write down at Credit Suisse is certainly not helping matters as this disruption in capital structure priority has caught investors off guard. Looking at banks' credit default swaps (CDS, which pay out if banks default on their senior unsecured debt), it is not comforting to see what's happening to UBS, and especially to Deutsche Bank. That JP Morgan CDS is hanging in pretty well is certainly comforting. But moves like this bring back uncomfortable memories of the Global Financial Crisis of 2008-2009.

Bloomberg

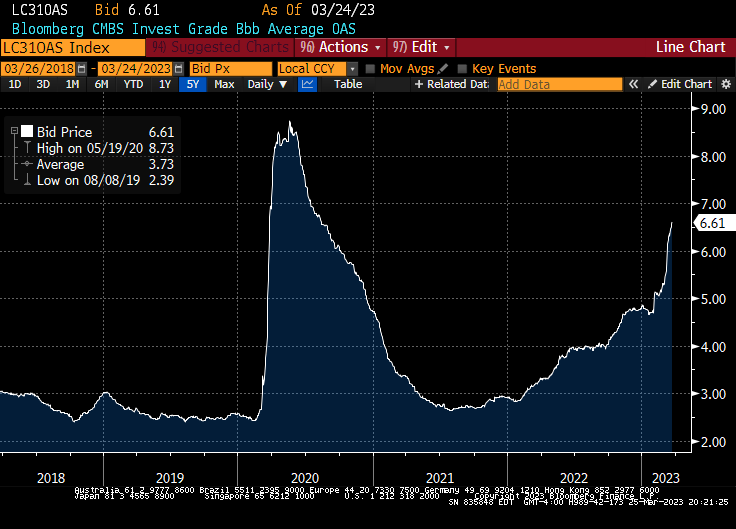

The knock-on effects of tightening in credit conditions are already starting to be felt. It is estimated that close to 70% of commercial real-estate loans in the U.S. come from small, regional banks. If these banks are facing depositor angst, and if credit conditions are tightening for the likes of JP Morgan, it is safe to assume that the credit contraction for regional banks is even more severe, and that credit provision to commercial real estate will become yet more constrained. We are now seeing CMBS BBB spreads blow out to levels last seen during the 2020 COVID-19 crisis.

CMBS BBB spreads. (Bloomberg)

And REIT stocks are tanking.

Bloomberg

This isn't to mention that 30-year mortgage rates have now increased from roughly 3% in 2021 to close to 7% today. Commercial and residential real estate are certainly among the most interest rate sensitive sectors in the economy, and the early signs in these sectors are concerning.

The Fed's Tightening Cycle

All this, of course, has not gone unnoticed by markets. When credit tightens, economies slow, and the market is revising down its beliefs about future growth. After their 2022 Ukraine-war induced spike, commodity prices have been trending down, and that downward trend has accelerated recently.

The S&P Goldman Sachs commodity index. (Bloomberg)

In a stunning turnaround, the Fed Funds futures market is now anticipating rate cuts later in 2023. U.S. Treasuries have had massive rallies, and the 2s-10s curve has dramatically steepened. 2-year Treasury yields have fallen by over 125 basis points, and 10-year rates have fallen by close to 70 basis points. Treasury markets are now anticipating a much more benign path of U.S. monetary policy.

2- and 10-year Treasury yields. (Bloomberg)

What's Next?

It is safe to say that March 2023 represents a dramatic change in the narrative that has been prevalent in markets for most of 2022 and, thus far, 2023. Commodity prices are falling. Inflation fears are abating. Concerns over a large credit contraction are growing. And expectations of Fed monetary policy are being revised down.

Despite all this, the regulatory response to this mini banking crisis has been very robust. Regulators have reassured depositors and we are not seeing system-wide bank runs. The U.S. job market is very healthy. And there are generational changes in technology (e.g., generative AI or mRNA vaccines) which look to improve our productivity and health in never-before-seen ways. The point is, it's not all bad.

So what comes next?

First, any part of the economy that is heavily reliant on bank credit provision is likely to be under pressure, at least until the SVB shock fully works its way through the economy and financial markets. Unless Congress decides to backstop all deposits at U.S. banks by extending the size of the FDIC insurance limit, this process is likely to take several months.

Second, all of the above trends seem to favor companies that: (1) have fortress balance sheets, (2) have long-dated cash flows whose value is appreciating due to dropping interest rates, and (3) give investors exposure to the amazing technological innovations that are currently under way. Of course, this all describes the composition of the Nasdaq, and, indeed, these stocks have been huge winners over the last few weeks.

Nasdaq 100 stock. (Bloomberg)

As impressive as the rally in QQQ (Nasdaq 100) has been, I don't think it reflects the entirety of the institutional asset reallocation that will happen in response to the events of March 2023. Hedge funds move quickly while large institutions move slowly. And I think there is a lot of price impact that remains to be incorporated into security prices from upcoming institutional portfolio flows.

Finally, I've written before that the Federal Reserve is several months or quarters ahead of other central banks in its tightening cycle. Given the ECB's relatively hawkish tone at its recent rate decision, and the Fed's more conciliatory one this past week, it is likely that the Fed will start to ease monetary conditions well ahead of its international central bank peers. This will likely be bad for the U.S. dollar but good for U.S. corporate earnings, so the impact on U.S. stocks relative to international stocks is unclear. But falling U.S. rates suggest that an allocation to high-quality international bonds may do well if the dynamics that I discussed play out.

Conclusion

To summarize:

The impacts of the SVB failure are likely to be far-reaching.

Companies and market sectors that rely on bank funding will be under pressure.

Thing aren't all bad as the regulatory response to the SVB crisis has been strong and as incredible technological innovation is underway.

These dynamics are likely to favor cash-rich companies with longer-dated cash flows that are positively exposed to technological innovation.

Nasdaq companies are the beneficiaries of all these trends. They have rallied a lot and this is likely to continue as large institutions reposition their portfolios in response to these trends.

An additional consideration is that, as U.S. rates fall relative to other developed market economies because of the Fed's lead in the current monetary policy cycle, U.S. dollar denominated assets may face headwinds relative to those denominated in stable foreign currencies.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VOO, IGOV, VXUS, QQQ, VGIT, VTV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.