BCX: Inflation Protection And Long-Term Growth Potential At A Discount

Summary

- Commodities can be a good way to get inflation protection, and this was borne out by how well they did in 2022.

- BCX invests in a portfolio of commodities and natural resources companies to provide its investors with a high level of income.

- The largest positions in the fund have pretty good fundamentals that should provide them with some solid long-term growth potential.

- The fund yields 6.79% at the current price and it appears to be able to sustain its distribution barring a major recession.

- The fund is trading at an enormous discount to the net asset value today, so the price looks right.

- This idea was discussed in more depth with members of my private investing community, Energy Profits in Dividends. Learn More »

poco_bw

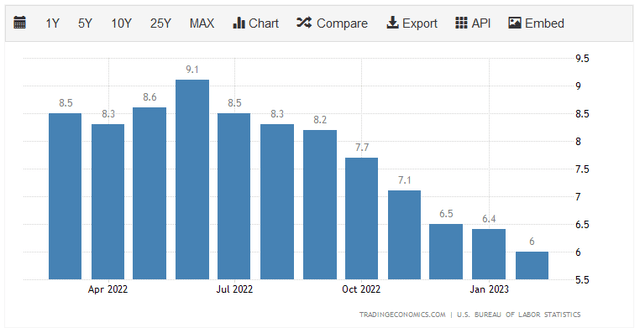

It is no surprise to anyone reading this that the biggest challenge that has been facing Americans for the past eighteen months has been the incredibly high inflation that is dominating all levels of the economy. We can see this by looking at the consumer price index, which has not seen a single month in the past year in which it was not at least 6% higher than in the prior-year period:

As this inflation has been heavily focused on food and energy, which are necessities for modern life, it has had a very devastating effect on those of lesser means. Fortunately, this creates a potential investment opportunity for us. That opportunity is in owning the things that have been appreciating in value. For example, commodities have generally delivered a very good performance in 2022, which is in stark contrast to most other things in the market. While the shine has been tarnished somewhat over the past few months, there is still the case to be made for long-term investment as the Federal Reserve will likely soon be forced to choose between saving the banking system and fighting inflation.

One of the biggest problems with commodities is that they do not inherently produce any income. This problem can be solved by purchasing shares of a closed-end fund that invests in commodity producers. The investment media does not typically follow these funds and, admittedly, neither do many investors. That is a shame because they do offer a pretty good proposition for income-focused investors. This comes from the fact that these funds provide easy access to a portfolio of assets that can usually deliver higher yields than just about anything else in the market.

In this article, we will discuss the BlackRock Resources & Commodities Strategy Trust (NYSE:BCX), which is one fund that investors can purchase in order to generate a high level of income and gain exposure to commodities. As of the time of writing, this fund yields 6.79%, which is admittedly not quite as good as we usually like to see here at Energy Profits in Dividends, but it is pretty close and certainly can provide a respectable level of income for a portfolio. As long-time readers may recall, I have discussed this fund before, but that was back in 2021 so obviously, a great many things have changed since that time. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund's finances.

About The Fund

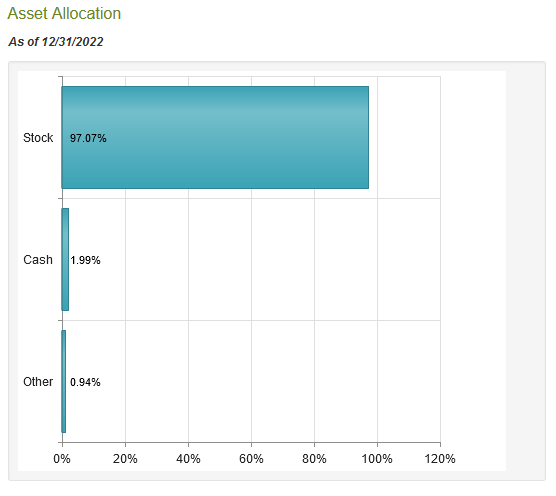

According to the fund's webpage, the BlackRock Resources & Commodities Strategy Trust has the stated objective of providing investors with a high level of current income and current gains. This is, admittedly, a bit unusual as an objective for an equity fund. As we can see here, fully 97.07% of the fund is invested in common equity, with the rest mostly in cash:

CEF Connect

The reason why this objective is unusual is that common equities are generally not thought of as an income vehicle. After all, the S&P 500 Index (SPY) only has a yield of 1.63% as of the time of writing. That is significantly less than even a safe money market account has today. However, the commodities sector does tend to have somewhat higher yields. For example, several of the shale energy companies like Devon Energy (DVN), Pioneer Natural Resources (PXD), and Diamondback Energy (FANG) have yields that are very close to 10%. However, for the most part, common equity is a total return vehicle since it is purchased both for generating dividend income and for long-term capital gains. This fund does have long-term capital gains as a secondary objective, but its primary objective implies that it is going after dividend income and short-term gains. Usually, we see that as an objective for a fixed-income fund, not an equity fund.

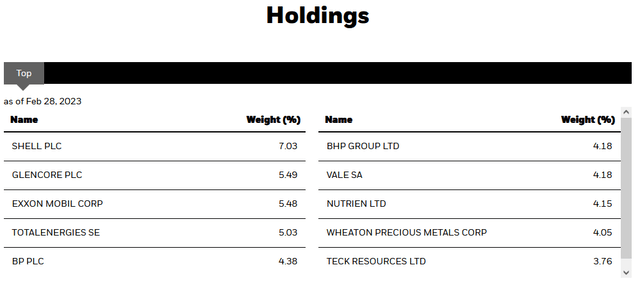

As the name of the fund implies, the BlackRock Resources & Commodities Strategy Trust aims to achieve its objective by investing in securities issued by commodity or natural resources companies. However, this does not necessarily mean what many people might think it means. For example, we can see a few energy companies listed among the fund's largest positions. Here they are:

Shell (SHEL), Exxon Mobil (XOM), TotalEnergies (TTE), and BP (BP) are all energy companies and are, as such, probably not what most people will picture when we state that a fund is investing in natural resources companies. However, as I pointed out in my last article on this fund, crude oil and natural gas are natural resources by definition so they still deserve a place in the fund. The remainder of these companies is generally connected to the mining industry in some way, with the exception of Nutrien (NTR). Nutrien is a fertilizer company, which is both surprising and also nice to see. As mentioned earlier in this article, food prices have been one of the biggest drivers of today's inflation, so the presence of this company provides some exposure to the agricultural industry.

Nutrien has a particularly good outlook going forward due to the fact that the global supply of farmland per capita is likely to decline in the coming decades. I pointed this out in a previous article. According to the World Bank, there will only be 0.38 arable acres available to feed each person worldwide by 2040, down from 0.44 arable acres per capita today:

Gladstone Land/Data from World Bank

That means that each acre of farmland must see increasing productivity in order to maintain the security of the global food supply. Fertilizers will be essential to accomplish this productivity increase, which positions Nutrien quite well as one of the largest producers of fertilizer in the world.

There can be similar cases made for most of the other companies in this list. For example, Glencore (OTCPK:GLNCY) is by far the largest producer of cobalt in the world, which is an essential mineral in the production of batteries for electric vehicles and energy storage at wind and solar power plants. Wheaton Precious Metals (WPM) is very well-positioned to capitalize on an increase in silver prices which, as I pointed out in a recent blog post, is very likely to accompany any increase in solar energy production. I should not have to mention that the global demand for crude oil and natural gas is also likely to increase over the coming decades as I have been discussing the fundamentals of these products in dozens of articles published on this site and elsewhere over the past several years. Overall, then, this portfolio looks pretty well-designed to capitalize on many of the current trends affecting the natural resources sector, and, of course, the energy companies in the fund will benefit from any increase in crude oil and natural gas prices, which has been a major driver of the inflation that we have seen over the past eighteen months.

There have been a number of changes to the fund's top ten positions list since we last reviewed it. These changes are summarized here:

Removed Companies | Added Companies |

Chevron (CVX) | BP |

Anglo-American (OTCQX:NGLOY) | Vale (VALE) |

CF Industries (CF) | Wheaton Precious Metals |

Bunge (BG) | Teck Resources (TECK) |

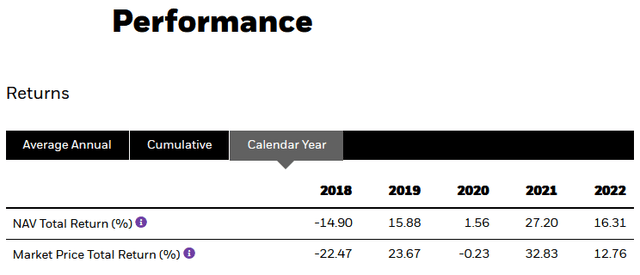

In addition to this, the weightings of the remaining companies on the list have all changed significantly, but this may be at least partially explained by one company outperforming another in the market. Overall, we might be able to conclude that this fund has a fairly high annual turnover. That is confirmed by the fact that the fund had a turnover of 92.00% in 2022, which is on the high side for an equity fund. However, it does make some sense considering the fund's objective of providing its investors with current gains, as that would necessitate selling stock and realizing capital gains. The reason that this is important is that it costs money to trade stocks or other assets and these expenses are billed directly to the shareholders of the fund. This makes management's job more difficult as it will need to generate sufficient returns to cover these expenses as well as have enough left over to satisfy the shareholders. This is a very difficult task to accomplish over extended periods of time, which is one reason why actively-managed funds usually fail to beat their benchmark indices. The BlackRock Resources & Commodities Trust does not specifically provide a benchmark index and I cannot think of a good one to compare this fund against. However, the fund did beat the S&P 500 Index in 2022, by quite a lot:

The S&P 500 Index was down in 2022 but this fund delivered a very strong 16.31% total return over the year. Unfortunately, the fund's market price did not do so well as the fund's shares only delivered a 12.76% total return over the year. This is a characteristic of closed-end funds that is not possessed by other types of funds. In short, a closed-end fund's market price performance can be very different from the performance of the portfolio itself. This is evident in 2022 but also in 2020, as the fund's shares actually delivered a total loss over the course of that year, although the fund's portfolio actually had a positive total return. This can result in opportunities in which investors can purchase the fund's assets for less than they are actually worth. We will discuss this later in this article.

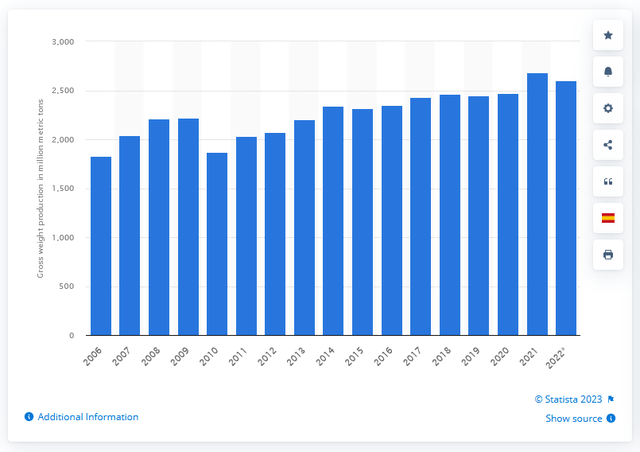

The fact that the fund delivered a positive total return in 2022 in direct defiance to the rest of the market is a sign that our thesis of inflation protection is playing out. The reason for this was outlined in my previous article on this fund, but in short, it is that inflation is caused by the money supply growing faster than the production of goods and services in the economy. However, natural resources cannot be created out of thin air like fiat currency. Rather, they require actual human and mechanical effort to produce so they are limited supply relative to fiat currency, which causes the price to be bid up. In addition, natural resources are essential for the functioning of just about every other sector of the economy, so the demand for them increases during periods of economic growth. However, their production does not necessarily increase. We can see this in the fact that America's production of crude oil is currently lower than in 2019 and there are several major shale oil producers planning to hold production steady this year instead of increasing it. The total production of iron ore globally in 2022 was lower than it was in 2021:

As natural resources are involved in everything, their prices tend to play a pretty big role in the price of everything else but since production does not necessarily grow as fast as demand, which happened in a big way in 2021 and 2022 due to the COVID-19 lockdowns ending, they tend to be a major driver of inflation. An investor that has exposure to natural resource production will therefore have some inherent protection against the negative impacts of inflation on their purchasing power. This fund is a reasonable way to gain that exposure.

Distribution Analysis

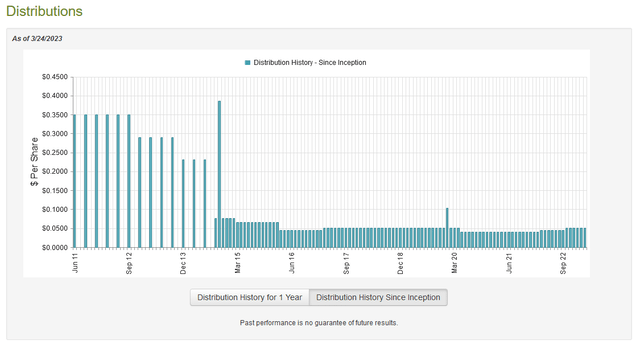

As mentioned earlier in this article, the primary objective of the BlackRock Resources & Commodities Strategy Trust is to provide investors with a high level of current income and current gains. As is frequently the case with closed-end funds, the fund will pay these out to investors via distributions rather than relying on its own share price appreciating in the market to deliver its investment return. Thus, we can guess that this fund will likely have a very high yield. That is certainly the case as it currently pays out a monthly distribution of $0.0518 per share ($0.6216 per share annually), which gives it a 6.79% yield at the current price. Unfortunately, the fund has not been particularly consistent with its distribution over time, and it has varied quite a bit over the years:

This is not exactly surprising for a commodities fund. After all, commodities are well-known for their price volatility. We do see the inflation hedge playing out in the past few years though as the fund has increased its distribution twice since early 2021. However, the overall volatility will likely reduce the fund's appeal to those investors that are looking for a stable and consistent source of income to use to pay their bills. As I have illustrated though, the primary reason to buy this fund is to hedge your wealth against the loss of purchasing power that comes with inflation and not as a pure source of income. With that said, we are still concerned with the fund's ability to maintain its current distribution since anyone purchasing the fund today will receive the current distribution and the current yield and we want to ensure that the distribution and the yield will not be immediately reduced.

Fortunately, we have a very recent document that we can consult for this purpose. The fund's most recent financial report corresponds to the full-year period that ended on December 31, 2022. This is nice because it will give us a pretty good idea of how well the fund handled the somewhat challenging market conditions over the course of the year, although as mentioned a few times in this article, they were not particularly challenging for most natural resources. We can still get a good idea of how profitable the fund was over the year, though. Over the full-year period, the BlackRock Resources & Commodities Strategy Trust received a total of $38,356,164 in dividends and $32,648 in interest from the assets in its portfolio. As some of the portfolio is invested abroad, we have to net out foreign withholding taxes, which leaves us with a total income of $36,176,351 over the course of the year. The fund paid its expenses out of this amount, which left it with $26,122,375 available for the shareholders. As might be expected from the size of this fund, that was not enough to cover the $48,556,774 million that the fund paid out in distributions, but it did manage to cover more of the distributions out of net investment income than I expected it to. Still, the fact that the fund's net investment income was insufficient to cover the distribution may be concerning at first glance.

However, the fund does have other methods through which it can obtain the money that it needs to cover the distribution. In particular, it could have capital gains, and indeed the fund's objective states that it does aim to obtain short-term capital gains. As we can probably expect considering how well commodities have done over the past two years, the fund enjoyed a great deal of success at this task. During the full-year period that ended on December 31, 2022, the BlackRock Resources & Commodities Strategy Trust reported net realized gains of $164,961,884, but this was partially offset by $53,573,504 net unrealized losses. However, the fund's assets still increased by $81,399,151 over the course of the year accounting for all inflows and outflows. As that is more than enough to cover the same distributions for more than a year, the fund should be in reasonably good shape for a while. It does not appear that we have to worry about a distribution cut unless a recession occurs that pushes down commodity prices.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Resources & Commodities Strategy Trust, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all of the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are obtaining the fund's assets for less than they are actually worth. Fortunately, this is the case with this fund today. As of March 23, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Resources & Commodities Strategy Trust had a net asset value of $10.60 per share but the shares currently trade at $9.15 per share. That gives the shares a 13.68% discount to the net asset value at the current price. This is a significant discount that is better than the 10.63% discount that the shares have traded at on average over the past month. Thus, the price certainly seems to be reasonable right now.

Conclusion

In conclusion, natural resources and other commodities serve a useful place in the portfolios of most investors because they provide a significant hedge against inflation. That is something that is very important today. The BlackRock Resources & Commodities Strategy Trust appears to be a very reasonable way to gain exposure to the sector and also obtain a very high yield at the same time. The long-term fundamentals for many of the companies that comprise this fund's portfolio certainly appear very good, especially as population growth and a growing global need for both traditional and renewable energy will drive demand growth for their products. The fact that this fund appears to have a sustainable yield and an incredibly attractive valuation only adds to its appeal. Overall, this one may be worth buying today.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long various energy-focused funds that may hold certain stocks mentioned in this article. I exercise no control over these funds and their positions may change at a moment's notice without my knowledge.

This article was originally published to Energy Profits in Dividends on Sunday, March 26, 2023. Subscribers to the service have had since that time to act upon it.