DocuSign: Massive Uphill Battle

Summary

- DocuSign's becoming a post-growth company. Investors now adopt a ''show me'' investment approach.

- The most telling aspect of its growth prospects fizzling out is that billings for the year ahead point to just 2% y/y growth.

- The company will need to pivot its growth strategy and start to seriously focus on its GAAP profitability.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Devrimb/iStock via Getty Images

Investment Thesis

DocuSign (NASDAQ:DOCU) has become a very challenging investment. There are so many hurdles that this business has to cross to once again get investors to consider backing this stock.

Here I discuss its 2% billings growth rates for the year ahead, its lack of GAAP profitability, its top competitor Adobe (ADBE), plus its more than $700 million of convertible notes maturing in the next twelve months.

I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over. (Warren Buffett)

What Happened to DOCU?

The main problem with investing in an interesting and disruptive company is when the company's growth rates slow down. At that point, the company becomes ''post-growth'' and most investors that were allured by its sizzling growth rates and compelling narrative will exit the name.

And in most instances, the company's profitability hasn't sufficiently matured to get ''value'' investors involved. The company trades around in ''no man's land'', without a firm shareholder base.

Going forward, DocuSign will do everything in its power to improve its profitability and get a new shareholder base enticed by prospects.

DOCU's Vision to Move Beyond E-Signatures

Even before Allan Thygesen became CEO of DocuSign, the company had been attempting to solve a key value proposition. How to expand its prospects beyond e-signatures? How to get more value out of holding onto the document?

During the recent earnings call, Thygesen articulated DocuSign's future prospects as such,

Our goal is to turn flat agreements into structured data that can be used to make intelligent decisions. Value of an agreement is in the data. Every step of an agreement can deliver more value when it's automated, intelligent and seamlessly integrated into core business systems.

Beyond the narrative of its future prospects, the problem with DocuSign ends up being two-fold.

Firstly, its core offering can only expand alongside an expanding market. Meaning that, when the market was rapidly expanding, DocuSign was able to increase its pricing. And that was terrific. Recall, one of the most significant verticals for DocuSign is the real estate market. With the real estate market on its knees, this suppresses DocuSign's prospects.

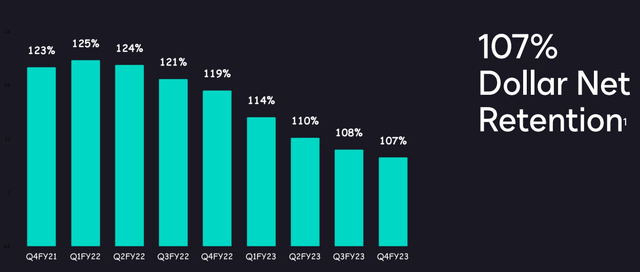

Furthermore, when the macro environment tightens up, its customers' inclination to pay higher prices slows down significantly, which leads to DocuSign's dollar net retention figures compressing.

The next consideration is that DocuSign has a formidable competitor, Adobe's (ADBE) Adobe Sign. Adobe has a very strong brand. But most crucially, Adobe's distribution of its products provides Adobe with a massive advantage. Nearly every computer, from students to professionals has Adobe software already installed.

Simply put, Adobe Sign is just such a seamless experience for users, that it becomes a hassle to consider an alternative e-signature product.

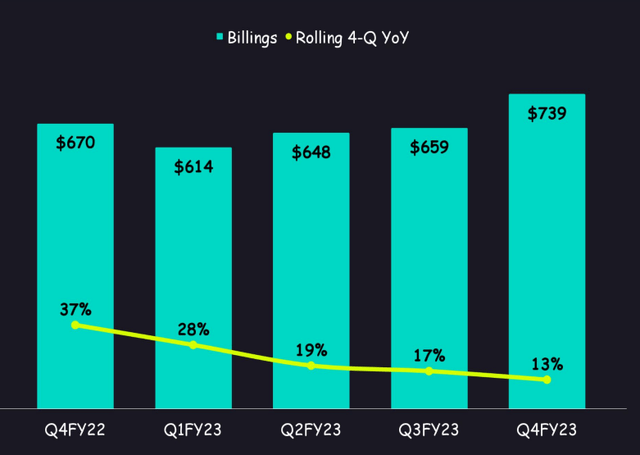

These two considerations can be seen in DocuSign's billings. Billings for fiscal 2024 (the year ahead) point to approximately 2% y/y growth rates.

In my experience, any time that a ''growth company'' starts embracing rolling 4-quarter periods, the yellow line above, that's normally a sign that the company is no longer a growth company.

Indeed, as we know, fiscal 2023 ended with billings coming in at 13% y/y, while fiscal Q4 2023 was up 10% y/y, and the guidance for fiscal 2024 points to less than 3% y/y.

The Focus Will Need to be GAAP Profitability

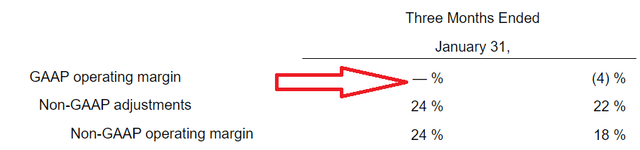

As you can see above, DocuSign's GAAP operating profits are essentially breakeven. So the underlying business is not quite profitable. Then, on top of that, DocuSign's guidance for the year ahead points to non-GAAP operating profits of 23% at the high end. That means that if we believe that DocuSign is lowballing estimates to allow for a beat down the road, in the best case, the business is unlikely to post any progress in profitability in the coming year.

Next, DocuSign has more than $720 million of convertible notes due in the next twelve months. This will eat away at any cash DocuSign has left on its balance sheet.

The Bottom Line

DocuSign has a lot of hurdles to cross to get investors to reconsider the appeal of backing a company with a lot of competition, no growth, and barely breakeven profitability.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.