VFH: Targeted QE To Balance High Inflation And Financial Stress

Summary

- The Fed's recent hike may appear contradictory given the stress level in the banking sector.

- Looking closer, the U.S. central bank appears to have more of a two-pronged approach, which I term "targeted quantitative easing" or "Targeted QE".

- This approach is a positive for Vanguard's VFH ETF, which not only holds large and regional banks but is also diversified into other sectors.

- There are surely risks as evidenced by the latest German Deutsche Bank-related volatility that has also been contagious to stocks in the U.S.

- The Fed has other tools to address bank liquidity issues, but, bear in mind that there are risks that current liquidity issues could impact economic growth.

Wipada Wipawin/iStock via Getty Images

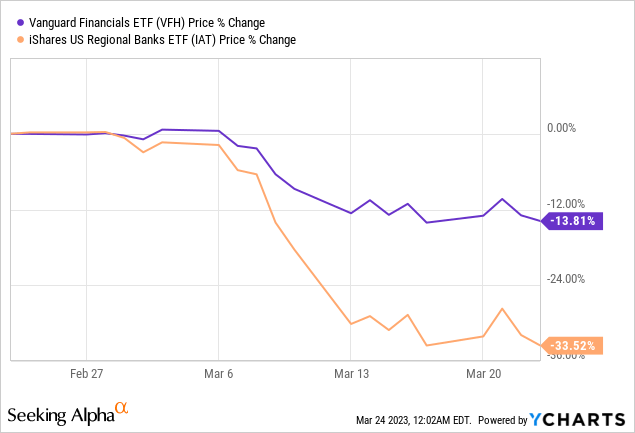

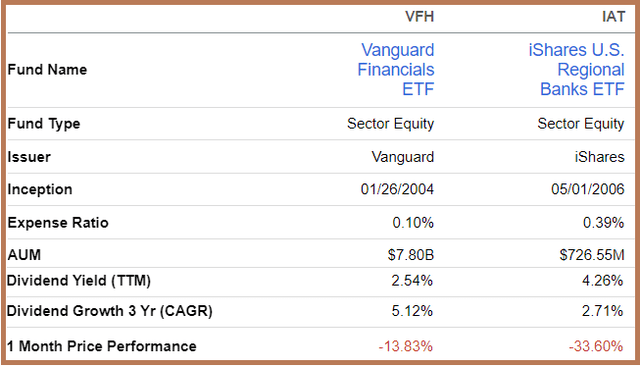

Only last month, things were looking good for the banks forming part of the Vanguard Financials ETF (NYSEARCA:VFH) which had broken the $88 resistance level. However, the second week of March changed it all with a drop to the $75-$76 level with a flurry of events happening within a short span of time. However, comparing its performance with the iShares U.S. Regional Banks ETF (IAT) which is down by 33.5% as shown by the orange chart below during the last month reveals that the Vanguard fund has been much less impacted by the banking turmoil.

Now, in light of the latest Federal Reserve interest rate hikes, the aim of this thesis is to assess whether VHF can fully recoup its losses and post gains for the rest of 2023. For this purpose, it is useful to learn from the recent events which have induced a lot of volatility in banking stocks, especially the one by the U.S. central bank concerning monetary policy.

The Events

The Federal Reserve Monetary Committee or FOMC, which met on Tuesday and Wednesday, saw itself pressured between, on the one hand, the task of stabilizing a banking sector in difficulty and, on the other hand, the need to continue interest rate hikes to stem persistent inflation. Between price stability and sustaining the financial system, the Fed's Chairman appeared to have chosen both, as the "ongoing increases in the target range" statement made in February appears to have been replaced by a more dovish stance of "some additional policy firming may be appropriate" to reach the 2% target.

Pursuing further, acknowledging that inflation "remains elevated" to be replaced by "has eased somewhat" in the February meeting denotes hawkishness as it entails more rate hikes. More important, the fact that Mr. Powell mentioned interest rates are already restrictive and on top, banks will be forced to further tighten lending in view of the recent turmoil implies a more dovish stance in the future. However, this position was somewhat moderated by the mention that there may be no rate cut in 2023.

Now, due to the Fed raising rates by 25 basis points in the middle of a banking crisis which is unprecedented, some view this as prioritizing the fight against inflation. However, learning from the European Central Bank (ECB) last Thursday, it is possible to do both at the same time. Hence, there was a 50 basis point hike to fight inflation while ensuring financial stability with a different set of tools. Hence, by rising by 25 basis points, instead of 50, the Fed ensures that it tightens at a less aggressive pace, but, at the same time, it also has in mind financial stability.

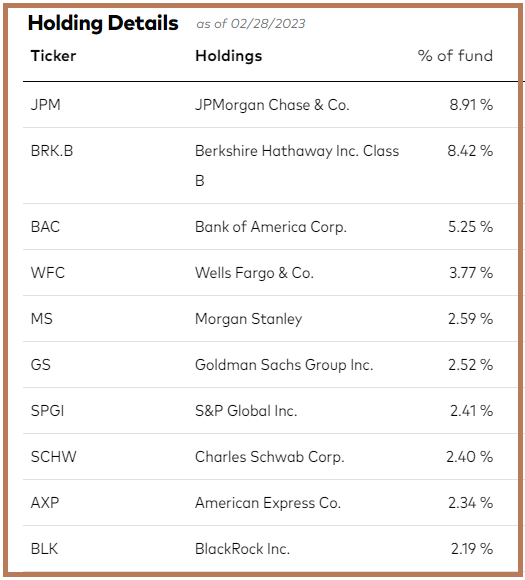

For this matter, the Fed's emergency loans to banks reached a record of $153 billion in just one week, higher than the previous highs reached in 2008 during the Great financial crisis. Therefore, while individual liquidity issues may crop up at the regional banks, regulators can be relied upon to take extraordinary steps to contain risks, so that these do not spread to the banking sector. This in turn means that such stressful events can induce a significant degree of volatility in ETFs like IAT, but, there should be less damage to those holding the shares of larger banks like VHF whose top holdings are pictured below.

Portfolio Composition (investor.vanguard.com)

Going deeper, one will notice that this list includes behemoths like Bank of America (BAC), JPMorgan Chase (JPM), Wells Fargo (WFC), Morgan Stanley (MS), and Goldman Sachs (GS) which are the so-called "too big to fail" banks, but, mind you, these diversified banks only constitute 21.5% of VFH's assets.

Diversification, Regional Banks, and Risks

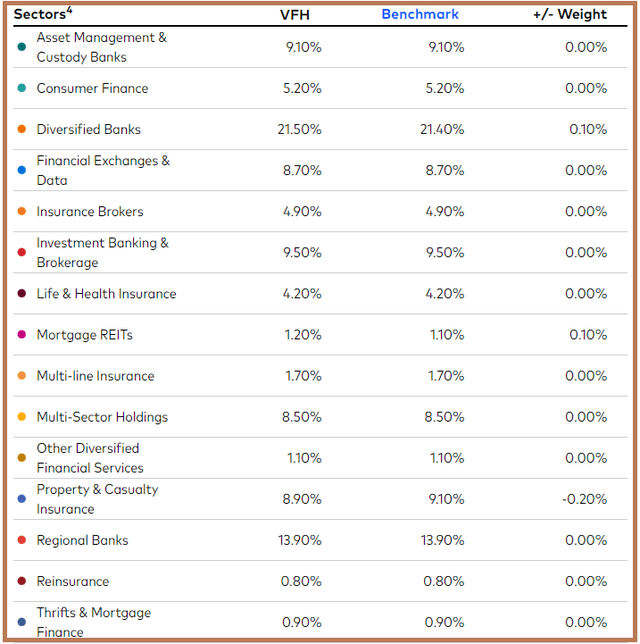

The word "diversified" takes all its importance, especially in the current context, where in addition to just taking deposits and issuing loans, VFH's holdings provide asset and wealth management, as well as other financial advisory services like M&As. For this matter, 9.1% and 9.5% of the ETF's overall weight are dedicated to "Asset Management and Custody" and "Investment Banking and Brokerage" respectively as seen below.

Sector Coverage (investor.vanguard.com)

Also, as illustrated with Berkshire Hathaway (BRK.B), the fund's assets are skewed towards insurance, sectors which are less susceptible to be impacted during periods of banking stress, but rather at times of wider systemic issues.

Thus, diversification has imparted VFH with lower volatility, which is evident by a comparison of the performances last week when credit ratings and benchmarks analytics provider S&P Global (SPGI) and credit payment card processor American Express (AXP) produced upsides.

However, the ETF has exposure to regional banks, at 13.9% of its overall weight. Here, the problem is that after ten rate hikes by the Fed since 2022, monetary conditions are tight. One area where this has caused havoc is long-dated and fixed-rated treasuries whose value has gone significantly down as a result of interest rates going up, as exemplified by the more than 25% downside for the Vanguard Extended Duration Treasury ETF (EDV).

Now, banks in general have a large part of their assets constituted of these fixed-rated securities like 28% for BAC and 56% for Silicon Valley Bank Financial (SIVB). The problem crops up when depositors withdraw large amounts of money in panic mode with banks being forced to sell securities at a market value that is less than at par (or originally purchased), in order to obtain liquidity. This results in unrealized losses.

In addition to bond portfolios losing value and deposits flying away, another issue facing regional banks is commercial property loans where higher rates have beefed up borrowing costs, while adversely impacting property valuations. Now, many of these banks account for about 80% of commercial real estate loans.

In these circumstances, businesses may simply be more inclined to hoard money instead of depositing it in the aftermath of the recent bank runs, or, financial institutions becoming more cautious about to whom they loan money. Consequently, there are risks of strains starting to appear in the trillion-dollar-worth commercial real estate loans market, signifying that risks of a credit crunch may now have overtaken high inflation concerns.

Thus, the Fed's priorities have changed.

Targeted QE as a Workaround Amid Volatility

One of these is prioritizing the stability of the financial system, with the creation of the new credit facility as I mentioned earlier. Created on March 12 by the Federal Reserve and called the Bank Term Funding Program (BTFP), this new facility can provide banks with loans for up to one year against treasuries, mortgage-backed securities, and other assets as collateral. These are valued at par, avoiding institutions in difficulty to have to liquidate them at the market rate and incurring losses.

Furthermore, the BTFP together with the Federal Reserve's Discount Window which aims to ease pressures in reserve markets by extending credit to help alleviate liquidity strains in the banking system, constitute two supportive actions that are synonymous with "targeted QE (Quantitative Easing)", in contrast to Quantitative Tightening which has been in place since early 2022.

Pursuing on a positive note, while stress around liquidity remains high, there are signs that things are stabilizing as there had been a reduction, by $1 billion, of the amount banks had borrowed from the Discount Window and BTFP in the week ended March 23. In these circumstances, one can expect VFH which has lost 13.8% to recoup losses as confidence returns in the banking system. Just assuming a 10% upside, I have a target of $82.4 (74.95 x 1.1).

Comparing VFH and IAT (seekingalpha.com)

However, volatility reigns.

In this respect, investors will note that contagion risks remain, as seen by the troubles of Deutsche Bank (NYSE:DB) on Friday impacting U.S. large banks like Morgan Stanley and Wells Fargo which fell by 4.2% and -2.8% respectively at one point. VFH was also down by 0.7%.

However, the German bank's stock eventually rebounded driving others on both sides of the Atlantic Ocean in its wake. This recovery may have been triggered by confidence-building measures like Treasury Secretary Janet Yellen calling a meeting of the Financial Stability Oversight Council and the ECB maintaining that the banks in the euro area remain strong.

On a cautionary note, normally big banks should benefit from the reduced cost of capital as deposits flee from smaller regional ones, but, the fact that America's second-largest bank BAC has fallen by over 6% in a short period as shown in the above chart shows that the market thinks otherwise. One of the reasons could be that the bank will ultimately have to disburse more by offering higher-yield deposits to avoid seeing a flight of capital toward money market funds. Therefore, this can have some dent in its profitability.

Calm Down, It Is Not Looking that Bad, for Now

However, we are far from a "Lehman moment" where the level of stress was considerably higher due to the highly opaque securitized products and bank regulations not being as ring-fenced as today. Also, with a substantial part of banks' assets constituted of treasuries, things are not as bad.

Furthermore, these same government bonds whose value has gone down as a result of aggressive interest rate hiking are the cause of the problem as I explained earlier. Then, logically, the solution would have been to shift to reverse gear for monetary tightening, but, with targeted QE and existing FDIC protection for deposits not exceeding $250K, there are sufficient tools to contain contagion risks. Banks can also tap into the Federal Home Loan Bank funding.

Along the same lines, with 65% of exposure to non-bank sectors, VFH's holdings are still benefiting from growth in the U.S. economy which expanded by 2.9% (annualized basis) in Q4- 2022. Also, with the latest job numbers still growing, there are ingredients for the ETF could recoup its losses.

Finally, the only caveat which could taint this rosy picture is a reduction in corporate borrowing as CFOs become keener to hoard deposits. In case such an action becomes widespread, then there are real dangers to economic growth.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.