PacWest Bancorp: Transparency Created The Kind Of Stability Investors Needed

Summary

- PacWest Bancorp has not been immune to the carnage seen in the banking industry, and understandably so.

- The management team at the company has provided a good deal of transparency and clarity into the firm's financial condition.

- Overall, the company looks to be stabilizing and its cash position is robust enough to warrant optimism.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Hero Images Inc

From my experience in life, something good can come from almost anything bad, just as something bad can almost always come from anything good. Take, for instance, a crisis. During these times, investors experience a tremendous amount of pain and employees may lose their livelihoods. As awful as this is, a crisis creates panic-like behavior that can cause some companies to see their stock pushed down unjustifiably. Such a move lower is awful from the perspective of investors who already own shares. But the good side of this is that it can lead to situations where other investors can come in at a good discount and existing investors can increase their exposure to the firm in question.

The difficulty though is in determining which companies are being pushed down unjustifiably, and which ones warrant a decline. One firm that fits in the former category, in my opinion, is PacWest Bancorp (NASDAQ:PACW), a bank holding company that owns Pacific Western Bank, a fairly small community bank that began operations in 1999. The stock has taken quite a tumble over the past few weeks. Although it has recovered a sizable portion of that loss, the firm still is trading at levels well below what it was previously. But based on the data provided by management, the worst does seem to have played out and the company's financial footing is in much better shape than investors feared it might be. Due to this, I believe that the company warrants a solid ‘buy’ rating at this time, a rating that reflects my view that the stock should outperform the broader market moving forward.

A look at PacWest Bancorp

The carnage seen in the banking industry began earlier this month when news broke that the parent of Silicon Valley Bank, SVB Financial Group (SIVB), was collapsing as depositors rapidly withdrew their balances. This was nothing less than a bank run that caused a domino effect that, in turn, resulted in the collapse of Signature Bank (SBNY) and Silvergate Capital Corporation (SI), and caused concerns to mount about Charles Schwab (SCHW), First Republic Bank (FRC), and other institutions. One of the casualties of this, at least from a share price perspective, was PacWest Bancorp. Shares of the business started the month of March at $27.99. They bottomed out on March 13th at only $5. Fortunately for investors, they recovered some of those losses rather rapidly, hitting as high as $17.25 on March 14th before pulling back again some to the $9.55 that they are trading at as of this writing.

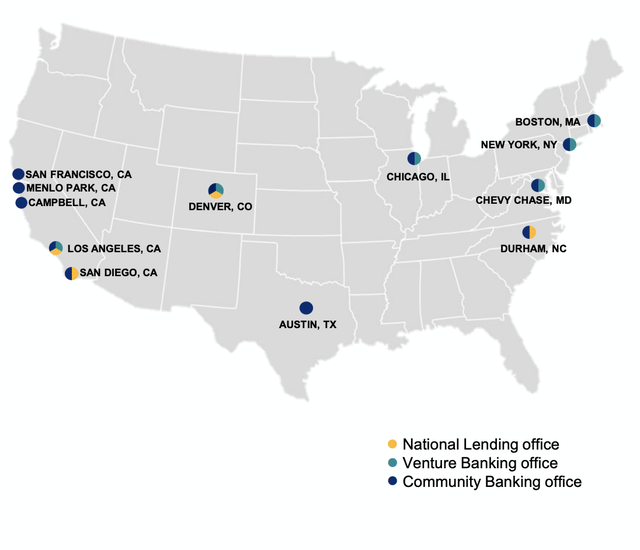

Some background about PacWest Bancorp is most definitely warranted. As I mentioned already, the firm operates as a holding company for a community bank. Through the 71 branches that the company operates throughout California, Colorado, Texas, Illinois, Massachusetts, New York, Maryland, and North Carolina, the company provides a wide range of services to its clients. In total, the company ended its 2022 fiscal year with $28.6 billion of loans and leases held for investment. Of this amount, about 13% was in the form of commercial real estate mortgages. Multifamily real estate accounted for another 20%, while other residential mortgages made up 10%. In total, residential real estate mortgages comprised 40% of these loans.

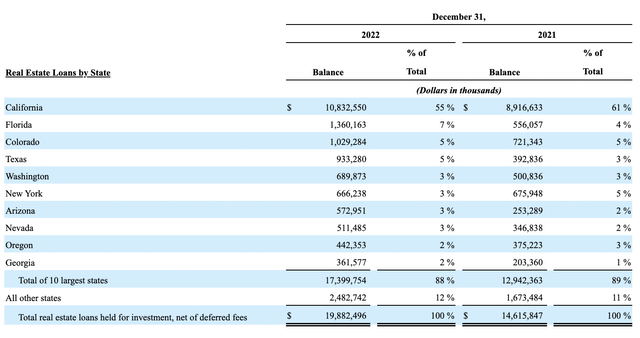

Outside of this, the company also had real estate construction and land loans that collectively made up about 16% of the company's loan portfolio. Miscellaneous consumer loans comprised 2% of its portfolio, while commercial loans accounted for an impressive 29%. The breakdown here is rather interesting, with the largest portion, accounting for 11% of loans, associated with lender finance activities. But his portfolio also includes those that fall under equipment financing, venture lending, and more. Geographically speaking, 88% of the company's real estate loans came from the 10 states its most exposed to. However, California is by far the most significant state for the business, accounting for 55% of all such loans.

The diversification geographically could be worse, but it's certainly not great. In terms of the range of activities that the loans touch on, I like what I'm seeing. However, of the $23.2 billion worth of loans that are due after one year out from the end of last year, only 39.8% are fixed rate. This means that while the company does benefit from rising interest rates, the risk of borrowers defaulting should technically rise as interest rates climb. Despite climbing interest rates, the company saw net charge-offs in 2022 of only $4.8 million.

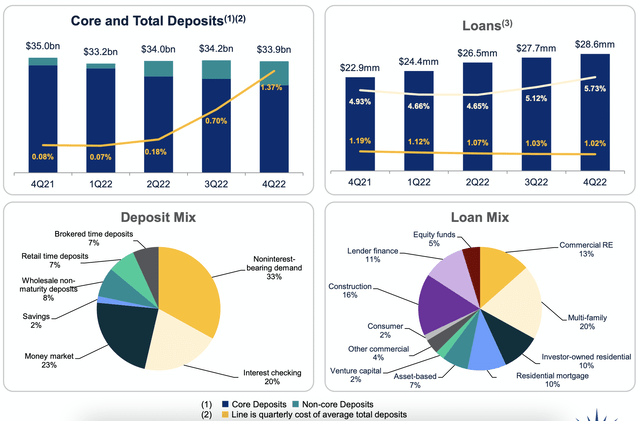

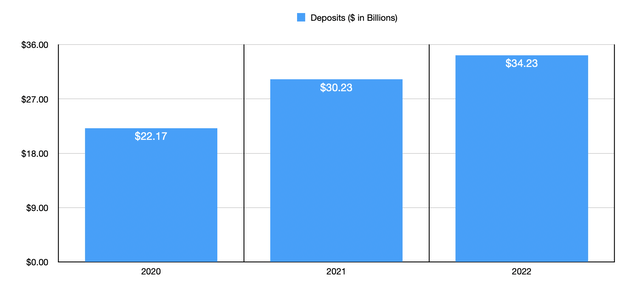

Loan composition is incredibly important when it comes to evaluating a bank, particularly in the present environment. However, we also need to pay attention to deposit data. After all, it's an outflow of deposits that creates a bank run. As of the end of 2022, the company had $34.2 billion worth of deposits. Other than the $13.6 billion that were noninterest-bearing demand deposits, The greatest exposure the company had involved $10.6 billion that was allocated to money market accounts. Another $6.9 billion involved interest checking accounts, with the rest split between time-guaranteed accounts and savings accounts. Though not included in the deposit data, it is worth noting that the company had available-for-sale securities of $4.8 billion, held-to-maturity securities of $2.3 billion, and cash and cash equivalents of $2.2 billion. Although any form of held-to-maturity securities would likely involve an unplanned loss if sold prior to maturity, the cash and cash equivalents, as well as available-for-sale securities, can be made available or liquidated (the latter in the case of the securities) without too much problem in order to fund deposit withdrawals.

The importance of transparency

There were a couple of things in the overall structure of PacWest Bancorp that made the company a target during this crisis. Some of these factors include the fact that the bank is fairly small and has a significant amount of exposure to California where, in some parts of the state, property values have taken a beating over the past year and where the same venture capital firms, private equity firms, and early-stage companies that all started the run are located. Of the deposit base that PacWest Bancorp boasted at the end of 2022, for instance, $11.3 billion fell under the venture banking category. Although this is an exciting segment of the banking market, it's also one of the most volatile and can make any bank susceptible to concerns over liquidity and solvency.

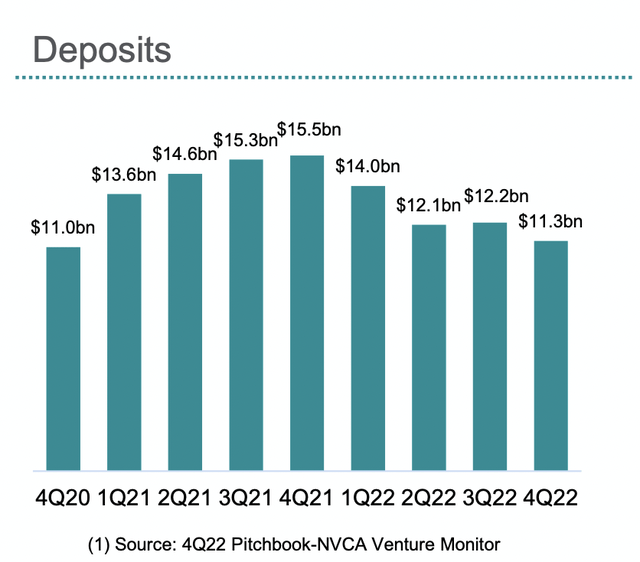

Cracks began to show in PacWest Bancorp’s financial condition last year. At the end of 2021, total venture banking deposits came out to $15.5 billion. By the end of the year, they had fallen by $4.2 billion. This was driven by the scarcity of capital caused by rising interest rates, the effects of which can be seen by the fact that, in 2022 alone, venture capital deal values dropped 31% compared to what they were one year earlier. But you can imagine that, when the crisis really began to ramp up earlier this year, a company that was already showing declining deposits would certainly experience at least some scrutiny from the investment community.

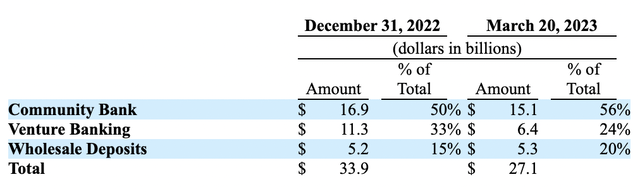

The great thing for investors, however, is that management has been incredibly transparent during this time. In fact, while there are some things I would do differently, such as provide daily updates regarding financial condition, the company’s actions have served as a model for what other banks should be doing at this time. For instance, on March 22nd, management provided an update that is rather extensive and that covers data through March 20th of this year. They revealed in this update that total deposits ended March 20th at $27.1 billion. That's down roughly 20% compared to what it was at the end of 2022. The biggest decline came from the venture banking category, with deposits plunging from $11.3 billion to $6.4 billion. However, even the community bank side saw a decline from $16.9 billion to $15.1 billion.

Included in the update was the fact that the company now has $11.4 billion in cash on hand. That exceeds the $9.5 billion in uninsured deposits. It's only the uninsured deposits that cause a significant risk of a bank run. As an interesting side note, I need to mention that 82% of the venture-specific deposits the company currently has are FDIC insured. What this means is that, very likely, much of the capital that could realistically be withdrawn from venture banking clients has already been withdrawn. This bolstering of the company’s cash position can be chalked up to a number of actions taken by management. For instance, the company received $3.7 billion from the Federal Home Loan Bank, $10.5 billion from the Federal Reserve Discount Window, and $2.1 billion from the Bank Term Funding Program that the Federal Reserve launched. It also secured $1.4 billion from a new senior asset-backed financing facility courtesy of ATLAS SP Partners. And despite worries about the company's financial condition, since March 9th of this year, the company has opened 130 new accounts under the venture banking line of business. This shows at least some confidence from depositors, some of which are likely coming from the other affected institutions.

This is not to say that everything with the company is fantastic. Fundamentally, the picture for the firm has been a bit lumpy in recent years. Tangible book value, for instance, dropped from $21.31 per share to $17.00 per share from 2021 to 2022. This came even as deposits grew from $22.2 billion in 2020 to $34.2 billion last year. Net income has been all over the map as the table above illustrates, though if we look at operating cash flow, we see a much better trend. In this case, cash flow went from $483.9 million to $702 million.

Takeaway

I definitely understand why market participants panicked when it came to PacWest Bancorp during this time. Having said that, management has gone above and beyond what other institutions have in terms of offering a tremendous amount of transparency. The financial condition of the company now looks stable and I anticipate confidence in its financial health to build moving forward. Prior to this crisis, the company had some lopsided financial performance. But what matters most, cash flows, has grown over time. Add on top of this a diverse loan portfolio and a tangible book value (using year-end figures for 2022) that is meaningfully higher than where shares are today, and I would make the case that the stock definitely warrants serious consideration from long term investors who like this space.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have a beneficial long position in the shares of SCHW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.