Nikon Corporation: Outlook Good Despite Precision Equipment Pressures

Summary

- Nikon Corporation has continued to see double-digit revenue growth.

- Precision Equipment has seen short-term pressures on revenue.

- However, I take a bullish view on the basis of an attractive P/E ratio and strong performance overall.

AdrianHancu/iStock Editorial via Getty Images

Investment Thesis: Nikon Corporation could see further upside from here on the basis of an attractive P/E ratio and continued revenue growth.

Nikon Corporation (OTCPK:NINOY) is a leading corporation specialising in the optics and imaging products market.

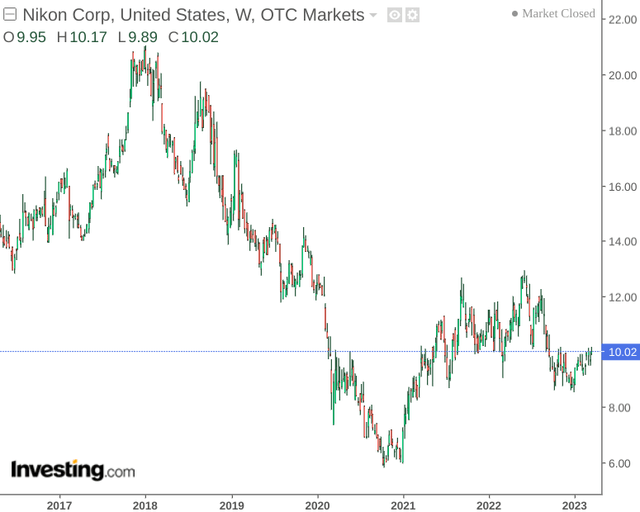

While NINOY stock has been on a generally upward trend since the beginning of 2021, we can see that the stock is still significantly below highs seen during 2017:

The purpose of this article is to assess whether Nikon Corporation could have the scope to regain further long-term upside from here.

Performance

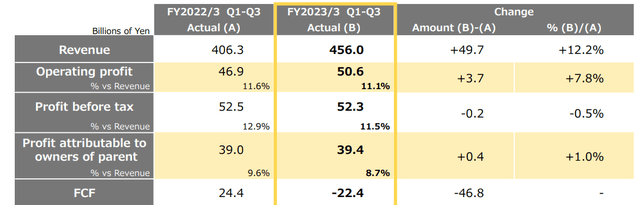

When looking at financial performance for the third quarter ending March 2023, we can see that while revenue is up by double-digits and operating profit has also seen significant growth - that of profit before tax and free cash flow is down:

Nikon Corporation: Financial Results for the 3rd quarter of the year ending March 31, 2023

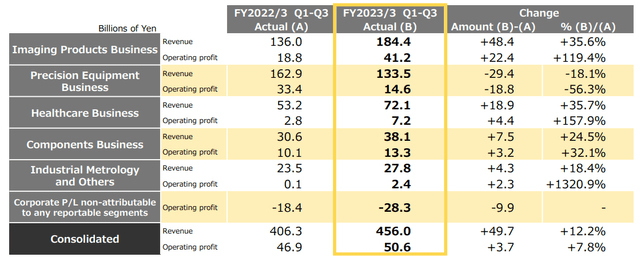

When looking at revenue breakdown by segment - we can see that while the Imaging Products Business (the second-largest by revenue) saw strong growth of 35.6% as compared to the previous period - that of Precision Equipment (the largest segment by revenue) saw a decline of 18.1% over the same period.

Nikon Corporation: Financial Results for the 3rd quarter of the year ending March 31, 2023

Within this segment, sales of FPD Lithography Systems (which enable higher definition imagery across flat-panel displays) were down significantly - from 37 billion yen in FY2022/3 Q1-Q3 to 19 billion yen for FY2023/3 Q1-Q3.

From a balance sheet standpoint, we can see that while Nikon's quick ratio has decreased since March, the ratio still remains significantly above 1 - indicating that Nikon has sufficient liquid assets to meet its current liabilities. Note that the quick ratio was calculated as total current assets less inventories all over total current liabilities.

| March 2022 | December 2022 | |

| Total current assets | 714214 | 711434 |

| Inventories | 238950 | 280066 |

| Total current liabilities | 313921 | 309380 |

| Quick ratio | 1.51 | 1.39 |

Source: Figures sourced from Nikon Corporation: Consolidated Financial Results of the Third Quarter Ended December 31, 2022 (IFRS). Figures provided in millions of yen, except the quick ratio. Quick ratio calculated by author.

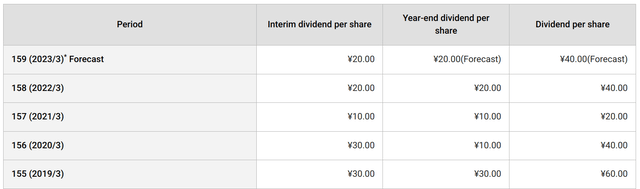

When looking at dividend performance, we can see that dividends per share decreased through to 2021 before rising back to 40 yen per share in 2022.

Nikon Corporation: Dividend Information

I deem it likely that investors will pay particular attention as to whether Nikon can continue to grow its dividend payment this year - particularly in light of the significant fall in free cash flow that we have seen.

Looking Forward

Going forward, I take the view that further growth in Nikon Corporation's stock hinges on the degree to which the company can start to grow its free cash flow once again, as well as the extent to which Nikon can see a recovery in the Precision Equipment business.

From a macroeconomic standpoint, the 4K TV market is expected to see strong growth through to 2029 - with a forecasted CAGR of 13.92%. In this regard, there is significant scope for sales of FPD Lithography Systems to see a rebound over the longer-term.

In the short to medium-term, Nikon is anticipating a contraction in sales demand as customers reduce investment in this area due to falling panel prices. A significant reason for this has been due to excess inventory built up during the pandemic when TV demand was higher - subsequently leading to an oversupply and a fall in prices accordingly. I anticipate that as supply and demand start to re-calibrate - we should start to see price growth once again and a subsequent revival in demand for FPD Lithography Systems.

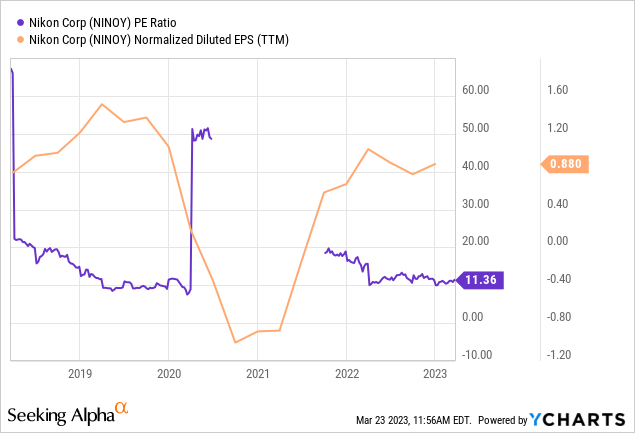

Additionally, when looking at the company's P/E ratio - we can see that the ratio is trading near a five-year low, while earnings per share is rebounding back towards the highs we saw in 2019.

ycharts.com

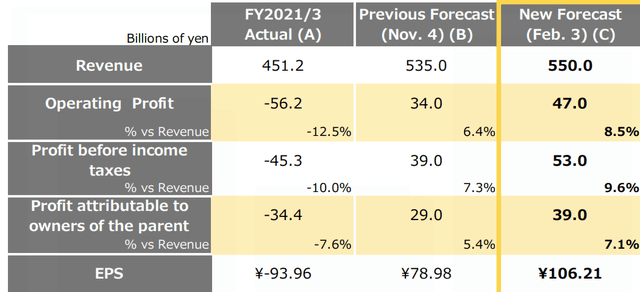

When comparing 3rd quarter 2021 earnings results to that of the 3rd quarter of 2022, we can see that EPS for the former came in at a loss of 93.96 yen per share - well below expectations of 78.98 yen per share.

Nikon Corporation: Financial Results for the 3rd quarter of the year ending March 31, 2022

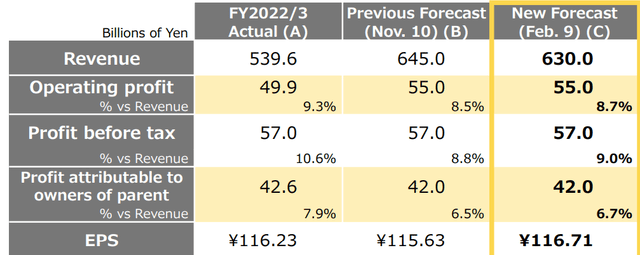

However, 3rd quarter 2022 results showed EPS rebounding strongly to 116.23 yen per share - slightly above that of the originally forecasted 115.63 yen per share.

Nikon Corporation: Financial Results for the 3rd quarter of the year ending March 31, 2023

Overall, I take the view that the stock is trading at good value - and a recovery in the Precision Equipment business could propel the stock higher from here. To put a caveat on this view - recent performance also means that investors will be expecting further evidence of earnings growth going forward. Should we see a slowdown in such growth - then this could also place further pressure on stock price growth accordingly.

In spite of strong performance across the Imaging Products business - Nikon continues to face increasing competition from the smartphone industry as phone camera quality continues to improve and is becoming an increasingly viable alternative to traditional digital cameras. With that being said, it was reported last year that Nikon will stop production of SLRs (single-lens reflex) cameras in favour of focusing on mirror-less camera models that are better suited for professional photography purposes.

In this regard, I take the view that Nikon has significant scope to further bolster its revenue across its Imaging Products business this year by focusing on this specialised segment of the market. With that being said, the company does face significant competition from Canon (OTCPK:CAJPY), FUJIFILM (OTCPK:FUJIY) and Sony (SONY), with TechRadar recently ranking certain mirrorless camera models such as Sony's A7 IV or Canon's EOS R6 Mark II ahead of Nikon's Z 6II.

From this standpoint, while Nikon is going in the right direction by refocusing its efforts on the mirrorless camera market - this year will be a significant telling point as to whether the company can compete effectively against its rivals. Should this prove to be the case, then the stock could see further upside from here. However, there is also the risk that performance could disappoint in this regard if competitor brands prove to be more popular.

Conclusion

To conclude, Nikon Corporation is showing continued revenue growth overall, with a quick ratio above 1 also indicating a strong cash position.

While a decline in revenues across the Precision Equipment business has placed short-term pressure on revenue growth - I take the view that this segment has the potential to rebound over the longer-term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.