Palo Alto Networks: A Smart Bet On AI-Backed Cybersecurity Business

Summary

- With its innovative AI-powered solutions, the company is well-positioned to continue delivering robust cash flow thanks to outstanding revenue growth and margins expanding.

- My valuation analysis suggests that the stock is significantly undervalued, indicating significant upside potential for investors.

- The competition is intense, but I believe the company's strong financial position, innovation, and industry-leading solutions make it a compelling investment opportunity.

hapabapa

Investment thesis

Palo Alto Networks (NASDAQ:PANW) is one of the most innovative artificial intelligence [AI] powered cybersecurity companies in the market. The company has achieved outstanding revenue growth over the past decade thanks to innovative cybersecurity solutions and high customer satisfaction. PANW has been able to build strong cash flow, which allows the company to reinvest in future growth. This is evidenced by the fact that management is providing a very positive outlook for the coming quarters. Despite the company's impressive growth and strong fundamentals, my valuation analysis indicates that the stock is currently trading at a significant discount to its intrinsic value, making it an attractive investment opportunity.

Company information

Palo Alto Networks is a cybersecurity company headquartered in Santa Clara, California, specializing in providing network security solutions to enterprises worldwide. The company's innovative platform provides automated and integrated cybersecurity solutions to prevent cyberattacks and secure digital transformation initiatives. The company's product portfolio includes firewalls, cloud security, endpoint protection, threat intelligence and security management tools. Founded in 2005, the company has grown into one of the global leaders in cybersecurity solutions with offices in more than 150 countries and a customer base that spans a variety of industries, including healthcare, finance, education, and government.

The company disaggregates its revenues by geographic theater, latest 10-Q report indicates that the company generates almost 38% of sales outside the U.S.

Apart from disaggregation by geography of sales, the company also discloses it's revenues with a product and services breakdown. Almost 80% of the company's revenues represent "subscription and support', i.e. services.

Financials

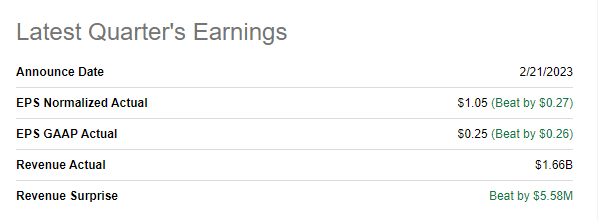

The company's latest fiscal year ended on July 31, 2022, so the latest available quarterly financials relate to Q2 of FY2023. The company announced 2Q2023 financials on February 21, delivering beat both in terms of revenue and EPS.

Seeking Alpha

PANW reported impressive quarterly results with revenue growth of 26% YoY to $1.7 billion. Current remaining performance obligation [cRPO], a key indicator of the company's future sales, rose 29% to $4.4 billion, suggesting a strong revenue pipeline. The company's Subscription and Support performed well with a growth of 29%. In contrast, Product revenue grew at a slower pace of 15%, reflecting the company's shift from hardware to a cloud-based software-as-a-service [SaaS] model. Although the company's hardware security appliance lines accounted for about 20% of revenue, management is looking to exit this segment due to supply-chain issues in the tech industry. Despite these challenges, the non-GAAP gross margin expanded by 140 basis points to 75.5%, supported by both Services and Products.

The company's non-GAAP operating income grew an impressive 55% to $377 million, and non-GAAP operating margin expanded by 430 basis points to 23% compared to the prior year, underscoring the management's focus on profitable growth. Furthermore, PANW reported its third consecutive quarter of positive GAAP earnings in 2Q2023, reporting an EPS of $0.25, compared to a loss of $0.95 per share in 2Q2022. Non-GAAP EPS rose 81% from the prior year to $1.05, with share-based compensation charges being the primary exclusions from non-GAAP EPS at $0.94 in 2Q2023 and $0.90 in 2Q2022, along with other smaller charges.

In summary, the company demonstrated strong performance across all its key metrics last quarter, signaling a positive outlook for the company's future growth.

Dipak Golechha, the CFO, also provided guidance and outlook for the next fiscal year and upcoming quarters during the last earnings call. Management expects operating margins to increase in the second half of fiscal 2023 and into fiscal 2024, resulting in faster earnings per share growth than revenue growth. In addition, management expects fiscal 2023 operating margins to be between 21.5% and 22% and earnings (excluding GAAP EPS ) to be between $3.97 and $4.03, an increase of 57% to 60%. The company also expects adjusted free cash flow margin to be between 36.5% and 37.5% and expects to be profitable in each quarter and in fiscal 2023 under GAAP.

Overall, PANW management provided a positive outlook and guidance for the next fiscal year and upcoming quarters. With expected increases in billings, revenue and non- GAAP EPS, along with improving profitability and operating margins, PANW appears well positioned to continue its growth trajectory in the cybersecurity industry.

While the most recent quarterly results together with near-term guidance provide a snapshot of the company's current financial health, it's important to take a deeper look at the financials over the past decade to fully understand the growth trajectory and potential for the future. Examining key financial metrics such as revenue, profit margins, and return on investment can provide valuable insight into the company's performance and strategy over the long term.

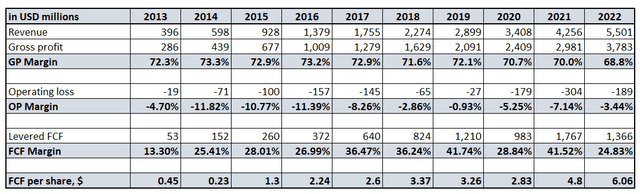

Compiled by author based on historical information

As we can see the revenue has grown consistently year over year demonstrating a 30% CAGR, which I consider impressive on such a long term horizon. Gross profit grew in absolute terms in line with the topline but gross margin declined from 72.3% to 68.8% over the last decade. Operating margin has been negative over the decade but the trend has improved in the last year with an operating margin of -3.44% compared to -7.14% in the previous fiscal year.

For me as an investor it is important that PANW has consistently generated positive levered free cash flow [FCF] throughout the decade, reaching $1.4 billion in the last fiscal year. FCF margin has been volatile but generally increasing and FCF per share has also been on an upward trajectory.

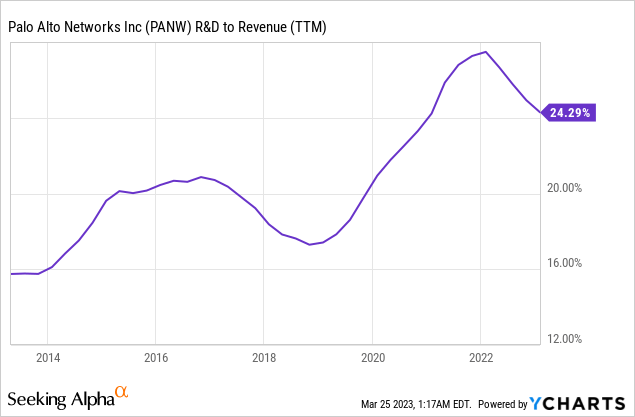

To fuel growth, the company has been consistently investing in research and development [R&D] with R&D to revenue ratio steadily increasing from 16% in 2013 to 26% in 2022, indicating that the company is investing a significant portion of its revenue in R&D.

In terms of one of my favorite metrics for growth companies, revenue per employee, PANW has been improving steadily. This indicates that the company has been able to maintain a consistent level of productivity from its employees.

To summarize the company's financial performance over the last decade, I believe that PANW's financials show a positive trend with strong revenue growth and consistently positive FCF.

The stock is massively undervalued

If we look at PANW's Seeking Alpha Quant valuation grade, we would probably never invest in this stock.

However, for a growth company like PANW traditional valuation methods based on multiples is highly likely to be inappropriate to accurately determine the company's fair value. Thus, to measure PANW stock intrinsic value I performed a discounted cash flow [DCF] analysis using conservative assumptions. For revenue projection I use consensus estimates which are available up to FY 2027. For fiscal years 2028 to 2032 I implement a 12% CAGR which is rounded down to even percentage forecast for cybersecurity market size growth up to 2030 provided by Grand View Research. To calculate future FCFs I implement TTM levered FCF margin of 34.92%. FCF are discounted using WACC of 10% which is a rounded up estimation of Gurufocus.

Incorporating all assumptions gives me a fair value of PANW business at $112.75 billion which is significantly higher than the current market cap of $58.67 billion. This indicates a massive 92% upside potential.

It would be fair if readers challenge my assumptions, so I decided to perform a sensitivity test using much worse conditions with a topline growing at just 5% CAGR for years beyond FY 2027 and FCF margin deteriorating significantly to 25%. Even under this tough conditions the model suggests stock is fairly valued with a margin of safety of 6%.

Based on the calculations above I think the market is significantly undervaluing the company if compared to the company's FCF growth prospects.

Risks to consider

Investing in the company's stock is not without risks. As a rapidly growing company, management must effectively address future growth by improving systems, processes, and controls. Failure to do so could negatively impact operational efficiency and put pressure on profit margins. In addition, PANW's operating results can fluctuate significantly from period to period and be unpredictable, which could lead to short-term volatility in the share price. Although the Company's recent growth rate has been impressive, this is no guarantee of the Company's future performance. Another risk to the company is the intense competition it faces. The cybersecurity industry is highly competitive, with many large and established companies operating in the field. PANW competes with companies such as Cisco (CSCO), Check Point (CHKP) and Fortinet (FTNT), among others. As a cybersecurity company, PANW's success is closely tied to its ability to protect its customers from cyber threats. However, ever-evolving cyber threats mean that PANW may be exposed to new and unpredictable risks in the future. Defects, errors or vulnerabilities in PANW's products, subscriptions or support offerings could damage its reputation and negatively impact its operating results. The incorrect detection of applications, viruses, spyware, vulnerabilities, data patterns or URL categories could also have an adverse effect on PANW's business.

In summary, investing in PANW stock involves risks, but I believe the massive upside potential outweighs those risks.

Bottom line

In summary, investing in PANW stock offers an attractive opportunity to benefit from the growth of the cybersecurity industry. Moreover, under my baseline scenario with conservative assumptions, I estimate a potential upside of 92% over the current market price. Even under extremely pessimistic assumptions, DCF analysis shows an upside potential of 6%. Analysis provides strong evidence that PANW is an attractive investment opportunity for investors seeking exposure to the cybersecurity industry. I believe PANW stock is a strong buy since it has the potential to deliver strong long-term returns for investors.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PANW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.