AMD: Next $100

Summary

- AMD has finally rallied back to $100, but the market should really be focusing on the next $100.

- The chip company is still set to take substantial additional server market share from Intel before even focusing on AI demand.

- The stock trades at a steep discount to the forward P/S multiple of NVIDIA allowing for an easy double.

- AMD should generate substantial EPS growth to warrant another $100 gain over the next few years.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Anna Kim

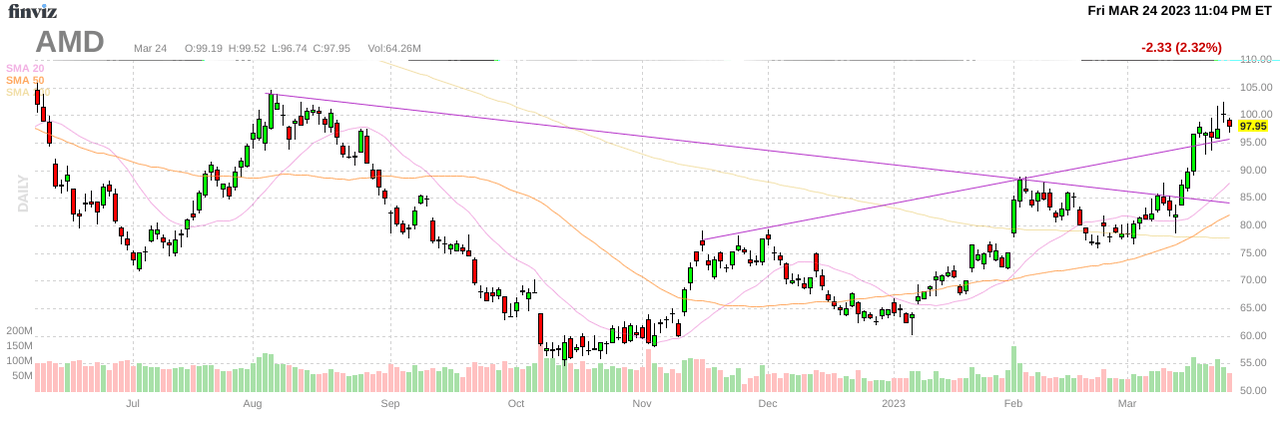

With competitor NVIDIA (NVDA) already headed back towards all-time highs, now is a good time to remind investors that Advanced Micro Devices (NASDAQ:AMD) hit an all-time high of $161 in November 2021. As chip inventory corrections end, chip demand should return into growth mode. My investment thesis is ultra Bullish on the stock only back to $100 now with years of growth ahead.

Only The Start

Amazingly, AMD fell all the way to a low below $55 despite the market still very bullish on the opportunity in data center servers. The chip company still has nowhere close to a market share lead with Intel (INTC).

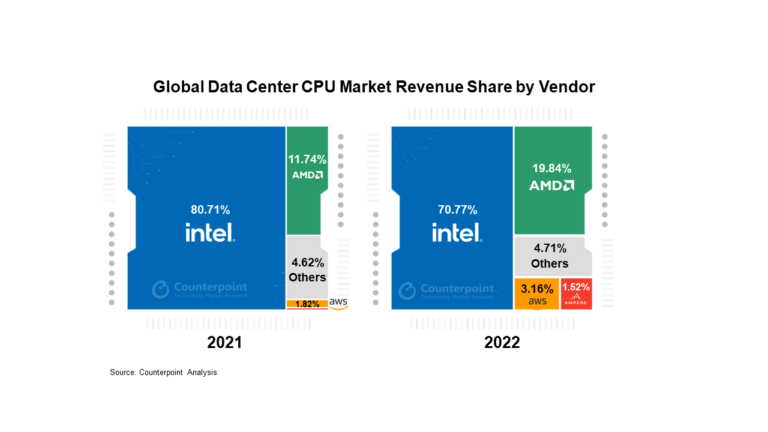

Counterpoint Research estimates that AMD had just under 20% data center CPU market share in 2022, up from nearly 12% in 2021. More importantly, Intel still controls 70% of the market offering AMD with an easy path to grow revenues.

Source: Counterpoint Research

AMD generated $5.75 billion in 2022 revenues from data centers CPUs. If the company just doubled market share to 40%, revenues would jump to $11.5 billion while still leaving Intel with a market share lead of 50%. The chip giant struggled releasing Sapphire Rapids CPUs while AMD released the Genoa server chip update to the EPYC line at the end of 2022 to solidify a performance lead in the server market.

The stock rallied all the way back to $100 on hopes that some chip sectors like PCs are starting to recover. Investing in AMD has never been about the PC sector, yet the market sold off the stock anyway.

As mentioned in previous research, the chip company is poised to benefit from huge generative AI demand with the launch of new chips targeted at this market. The TAM for AMD is forecast to surge from just $79 billion back in 2020 to $300 billion by 2027 due to AI growth providing a massive opportunity as the global economy eventually comes out of this funk caused by coordinated interest rate hikes to combat high inflation.

Next $100

With AMD back at $100, investors need to focus on the big picture described above. The stock is only back to where the floor should've been over the last year.

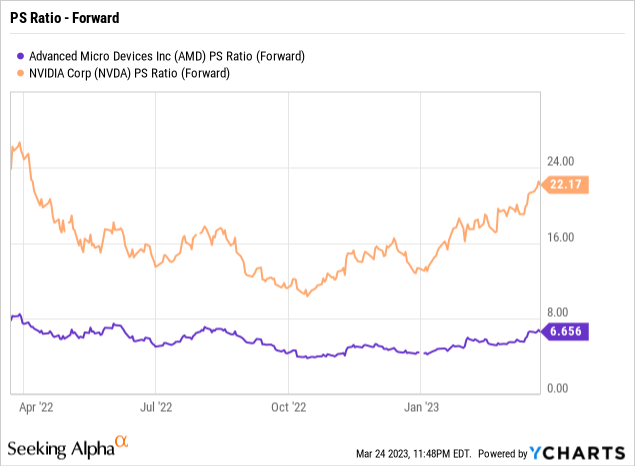

The real opportunity is for AMD to gain another $100 in the next few years. One can even argue, the stock could arguably double tomorrow considering AMD would still trade at half the forward PS multiple of chip peer NVIDIA.

The base case isn't to value AMD based on sales and honestly NVIDIA has a higher gross margin to warrant the higher multiple. The issue is the difference in the multiples likely due in part to AMD still focused on a market segment where Intel has the largest market share by far. NVIDIA dominates the GPU sector allowing for higher margins, but AMD has a new chip to aggressively compete in the GPU segment.

Prior to the PC inventory correction, AMD was headed towards mid-50% gross margins. The higher margins along with higher revenue totals were leading to massive EPS growth for the chip company.

Analysts have cut EPS targets due to the weakening demand environment, but targets for 2024 and 2025 are now up above $4 and $5, respectively. The opportunity is for these numbers to rise considering the backbone of these estimates is limited revenue growth.

Either way, AMD only trades at 23x the 2024 EPS targets. The chip company isn't even forecast to grow this year while revenue growth only hits 17% in 2024 amounting to just $4 billion in additional revenues during this 2-year period.

The data center CPU opportunity alone is upwards of $6 billion during this period. The company has a much bigger catalyst in just taking CPU server market share from Intel than the targeted sales growth rates.

Our previous research had highlighted AMD with a nearly $6 EPS opportunity with revenues at only $32 billion. Our projections are that the chip company reaches those levels much sooner than forecast by analysts due to a rebound in end market demand and AMD taking more market share from Intel in the server market.

Takeaway

The key investor takeaway is that AMD returning to $100 is only the start of the recovery. The stock could easily reach new all-time highs with the opportunities ahead and investors should expect AMD to follow NVIDIA back to previous highs due to surging generative AI demand.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.