Fastly: On The Upswing

Summary

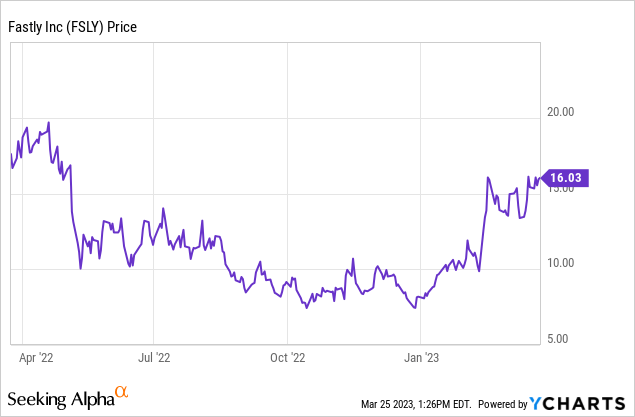

- Shares of Fastly have doubled this year as investors have regained confidence in the company's growth story.

- Even amid macro pressure, Fastly is achieving double-digit revenue growth with high 120%+ dollar-based net retention rates.

- It is also optimizing its network and consolidating hardware spend in order to achieve meaningful gains to gross margin.

- Still trading at just over 4x forward revenue, Fastly still has plenty of room to drive higher.

ko_orn

I've said it time and again: amid this volatile market, it's a great time for investors to take on a stock-picking mindset. Particularly in the tech sector, where performance has varied widely among individual stocks, it's a great time to pick up "growth at a reasonable price" names that have substantial room to rally further.

Fastly (NYSE:FSLY) is one such play. Since I last wrote on the stock toward the tail end of 2022, Fastly has appreciated tremendously - year to date, the stock is up approximately 2x. Investors have been emboldened by the company's sturdy growth rates alongside consistent margin performance. And at the end of the day, seeing as Fastly is a content delivery network that powers the internet, as long as we believe in the long term future of the web, we also believe in Fastly's capacity to grow.

In spite of sharp recent gains in Fastly, it's not time to sell out of this stock just yet. I remain bullish on Fastly and am retaining the name in my portfolio. As we look ahead to 2023, I continue to see Fastly achieving sizable revenue growth from expanding within current customers alone. Its recent efforts to optimize hardware spend are achieving gains in gross margin, while the company is also noting that opex growth will lag revenue growth in FY23.

For investors who are newer to this stock, here are my key long-term bullish drivers for Fastly:

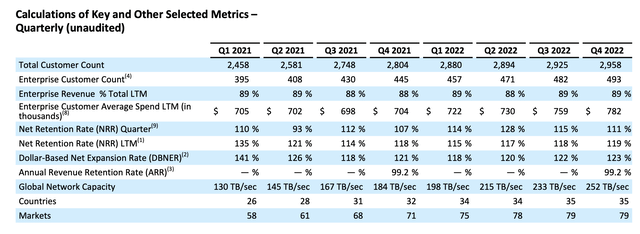

- Fastly's usage-based business model opens the door to tremendous growth. Fastly, alongside other software/technology peers like Twilio (TWLO), were among the companies that could fully take advantage of the pandemic and the increase in internet traffic that came with it. Because Fastly's pricing is based on volumes of content delivered, as the underlying customers continue to grow their websites and traffic, Fastly's revenue will also grow proportionally. Fastly's dollar-based revenue retention rates recently clocked in at 123%, indicating that the average Fastly customer increases their usage by 23% in the following year.

- Greater customer diversification. 2020 caused a big disruption for Fastly when it lost its biggest customer, TikTok. Since then, however, Fastly has proven its "horizontal" nature by landing customers of various industries, and the fact that it is still growing revenue in the mid-20s proves that it has reduced its reliance on single large customers. The company now has a base of approximately 3,000 total customers, with about ~500 enterprise customers between them.

- Best of breed. Though CDN is not a new technology category, with companies like Cloudflare (NET) and Akamai (AKAM) preceding Fastly by several years (and in Akamai's case, decades), Fastly is one of the most highly regarded CDN vendors. Fastly's addition of Signal Sciences and its web application firewall (WAF) tools also flesh out Fastly's offering. The company was also recently recognized as a Challenger by the influential Gartner Magic Quadrant reviewers.

- Economies of scale. As Fastly grows, it achieves economies of scale on its CDN network. It has already started to pare down hardware spend in the effort to improve gross margins. Capex spend as a percentage of revenue is also expected to continue trending downward. As Fastly's existing customer base continues to boost usage, margins will continue to expand.

And in spite of this year's rally, Fastly still remains a value stock in my eyes. At current share prices near $16, Fastly trades at a market cap of $2.01 billion. After we net off the $683.1 million of cash and $704.7 million of debt on Fastly's most recent balance sheet, the company's resulting enterprise value is $2.03 billion.

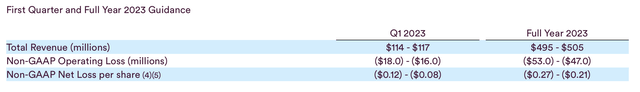

Meanwhile, for the current fiscal year, Fastly has guided to $495-$505 million in revenue, representing a growth range of 14-17% y/y.

Fastly FY23 outlook (Fastly Q4 earnings release)

Considering Fastly exited Q4 at a 22% y/y growth rate, Fastly's outlook may prove a few points too light. Nevertheless, taking Fastly's guidance at face value, the stock trades at just 4.1x EV/FY23 revenue - which to me represents a great entry point for a company that is still growing revenue double digits while starting to make strides on profitability.

My year-end price target on Fastly is $22, representing a 5.5x forward revenue multiple and ~38% upside from current levels. Stay long here and keep riding the upward momentum higher.

Q4 download

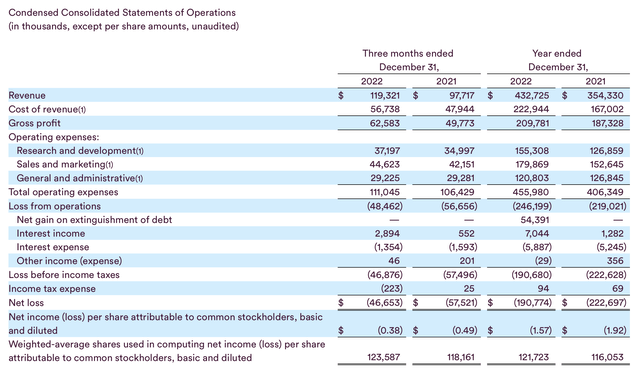

Let's now parse through Fastly's latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Fastly Q4 results (Fastly Q4 earnings release)

Fastly grew revenue at 22% y/y to $119.3 million, beating Wall Street's expectations of $114.5 million (+17% y/y) by a sizable five-point margin. The company saw minor deceleration from 25% y/y growth in Q3, driven in part by sharper macro headwinds and FX pressures.

Still, this did not impede Fastly's ability to land new customers. The company noted specific strength in the travel and healthcare sectors, where Fastly managed to land six and four new logos, respectively, within the fourth quarter.

The company brought up its total customer count to 2,958 at the end of the quarter, up 5% y/y. It added eleven new enterprise customers in the quarter, and enterprise contribution to total revenue remained steady at 89%.

Fastly key metrics (Fastly Q4 earnings release)

As seen in the chart above, dollar-based net retention rates also ticked up to 123% (up from 122% in the prior quarter), while average enterprise spend boosted 11% y/y to $782k.

Perhaps even more uplifting, however, is Fastly's growth in gross margins to 57.0% this quarter on a pro forma basis, rising 120bps y/y driven by optimized network spend. Per CEO Todd Nightingale's remarks on the Q4 earnings call:

Our gross margin was 57% for the fourth quarter representing a 340 basis point improvement quarter-over-quarter. I am very pleased with this outcome and I believe it underscores our new cost control rigor and discipline. We found savings with continued increases in peering and improvements in network optimization, coupled with improved hardware maintenance costs.

We will continue to be focused on margin improvement through 2023. In the quarter, we were also able to reduce our hardware purchase commitments by over $10 million, reflecting our increased platform efficiency at a cost of $2 million. This $2 million cancellation charge impacted our cost of revenue this quarter, but we believe it will support our margin improvement trajectory moving forward and reduce our cash spent. Excluding the impact of this $2 million payment and the take or pay true-up payment I discussed earlier, our gross margin would have been 57.5% in Q4, increasing 390 basis points from 53.6% in Q3."

These gross margin improvements brought Fastly's Q4 adjusted EBITDA to virtually breakeven in Q4, versus a -$2.6 million (-3% margin) loss in the year-ago Q4.

Fastly adjusted EBITDA (Fastly Q4 earnings release)

Looking ahead to FY23, Fastly's CFO noted that the company expects to show "meaningful improvement in our operating losses" versus FY22, driven by continued margin gains and opex cost discipline. Capex spend as a percentage of revenue is also expected to moderate to 6-8%, down from 10% in FY22.

Key takeaways

Stay long on Fastly as it continues to enjoy upward momentum. After years of underperformance driven by unsteady execution, Fastly stock is now primed to take advantage of its low valuation coupled with strong fundamental performance.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FSLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.