Leatt: 52-Week Low Provides Attractive Entry Opportunity

Summary

- Leatt Corporation was a COVID darling stock that now trades near 52-week lows due to revenue growth deceleration and fears Leatt’s high growth days are over.

- We think Leatt can generate 5-15% revenue growth in the long term due to market share gains, new products, and industry growth.

- Leatt trades at 6.5x TTM PE and 4.4x EV/EBITDA, which is cheap compared to a recent acquisition of a competitor and the overall market.

- We rate LEAT stock a BUY with a target price of $19.3, representing 15% upside from current prices and a 16% IRR.

Artur Didyk/iStock via Getty Images

Investment Thesis

As socially distanced activities, motorcycle racing and mountain biking saw a surge during COVID and Leatt Corporation (OTCQB:LEAT), a designer and distributor of “head-to-toe” gear for these markets, saw its stock run-up +700% before revenue growth deceleration led to a 50% drop to today’s $16.75. While 2022 and 2023 may see negative revenue growth due to difficult YoY comparisons, Leatt should return to growth in 2024 due to overall industry growth, current market share gains and expansion into new markets. The stock price should rebound accordingly.

Company Overview

Leatt Corporation is a designer and distributor of protective gear and apparel targeted to motorcycle racers and mountain bikers. Founded in 2005 by the eponymous Dr. Chris Leatt after witnessing a fellow rider’s death, Leatt’s first product was protective neck braces. Over the years Leatt expanded into other gear for motorcyclists and mountain bikers and now covers “head-to-toe protection” products such as helmets, goggles, chest protectors, gloves, knee braces and knee pads as well as accessories like hydration systems, etc. Leatt’s brand is best known for safety due to its flagship protective neck braces. Leatt outsources all its manufacturing to Chinese manufacturers. Leatt manages its own distribution in the United States and South Africa and relies on a network of 58 distributors to distribute in other countries.

Market Share Gains

Leatt is taking market share in many new categories while holding on to its share in more mature categories such as neck braces and chest protectors. In Leatt’s Q3 2022 Report, CEO Sean MacDonald mentions:

Again, importantly, many of our innovative products are still in their infancy in terms of market share, with significant opportunity for future gains. We believe that we are well positioned to deliver long-term growth and shareholder value with solid fundamentals in place.

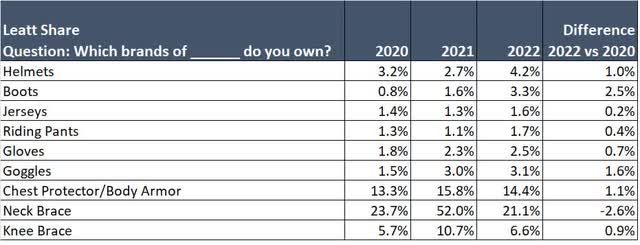

RacerX surveys from 2020, 2021 and 2022 confirm that Leatt is taking market share in many of Leatt’s newer product categories. While we question the reliability of some answers (e.g. 2021 neck brace shares) the overall picture is very positive and in many categories the number of respondents owning Leatt products has increased by 50-100%.

Table 1: RacerX Surveys on Ownership of Leatt Products

RacerX Surveys on Ownership of Leatt Products (RacerX Surveys)

New Products and Markets

Leatt has a long history of developing new products and entering new markets. Initially starting as neck brace provider for motocross riders, Leatt now encompasses full “head-to-toe” gear. Leatt has also entered new markets as well. Most recently in March 2023, Leatt struck a partnership with the newly named Orbea Leatt Speed Company Racing Team to enter the mountain bike endurance market. Leatt will develop a variety of products specifically catered to this new market.

In the long term, Leatt could develop into a mass casual brand, thus massively increasing its Total Addressable Market (TAM). Many apparel brands, such as Nike and Lululemon focused on a specific niche (running shoes for athletes and yoga pants respectively) before leveraging their brand strength and goodwill among loyal, diehard customers to expand into the mass market. Leatt is very innovative and constantly developing new products for new markets. While Leatt has long-term plans to eventually targeting all motorcycle riders and cyclists (as opposed to just motorcycle racing enthusiasts and mountain/endurance bikers), an ultra-bullish scenario goes even further and sees them become an attractive general brand for non-motorcyclists/bikers too. Leatt has a very long runway ahead.

Industry Growth

The overall market for motorcycle gear and mountain biking equipment is still growing. This Straits Research report forecasts a 7.1% CAGR for the global motorcycle gear market from 2023-2031.This Technavio report forecasts a 4.6% CAGR for the mountain biking equipment market from 2022-2026. While 2022 saw difficult YoY comps for most industry players due to post-COVID revenue normalization, these reports indicate the longer term industry growth story is still intact.

Financials and Valuation

DCF Valuation

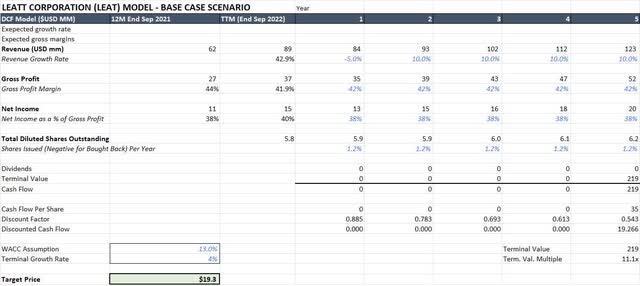

Using a 5-year DCF approach, our target price is $19.3 or a 16.2% IRR from today’s price of $16.75. We assume:

- 42% gross margins, unchanged from TTM gross margins. Ongoing shipping cost reductions benefit Leatt’s gross margin, but Leatt may also need to reduce prices on slow-moving product categories, which would hurt gross margins.

- 16% net margins – in-line with results from the last 24 months.

- Revenue growth rate of -5% for NTM reflecting COVID-normalization and +10% revenue growth thereafter.

- Current common share count of 5.8 million shares and 1.2% share count CAGR, based on historical average share count increases from 2012-2021.

- WACC of 13% reflecting micro-cap risks and a 4% terminal growth rate reflecting a long growth runway. This leads to a terminal PE of 11.1x as compared to Leatt’s current 6.5x TTM PE.

Table 2: Leatt Valuation Model

Leatt Valuation Model (Author's Calculations)

Comparable Multiples

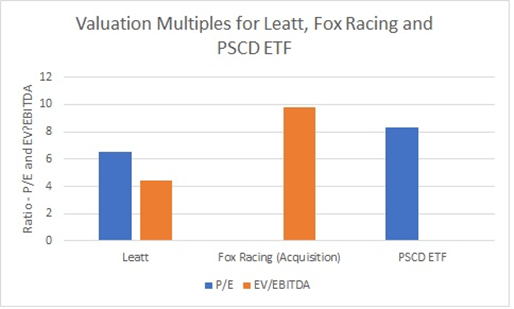

At the current price of $16.75, Leatt trades at a 6.5x TTM P/E and 4.4x TTM EV/EBITDA. Due to varying business models, privately-owned competitors, and differing products it’s difficult to find good comparable companies. Vista Outdoor (VSTO) recently acquired competitor Fox Racing for $540 million based on full year expected net sales of $350 million and adjusted EBITDA of $55 million, implying a 9.8x EV/EBITDA despite Fox Racing’s 20% revenue CAGR from 2019-2021 as compared to Leatt’s 60%. The Invesco S&P SmallCap Consumer Discretionary ETF (PSCD) trades at 8.3x TTM/PE.

Chart 1: Valuation Multiples for Leatt, Fox Racing and Invesco

Leatt Comparable Multiples (Author's Calculations)

Based on this comparison to Fox Racing and Invesco’s Small Cap Discretionary ETF, Leatt looks undervalued.

Balance Sheet and Liquidity

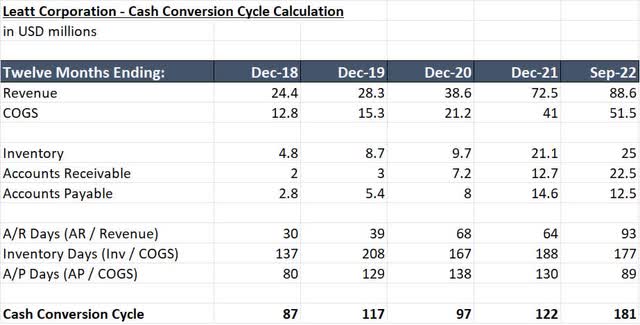

Based on its Q3 2022 Report, Leatt has $4.8 million cash and $0.35 million of debt on its balance sheet. Leatt’s market cap of just over $100 million and 30-day average daily traded volume of 4500 shares excludes many institutional investors but provides opportunities for smaller funds and retail investors. Leatt generates positive cash flow so there is little bankruptcy risk, but we are concerned about its lengthening cash conversion cycle and AR Days, as this may indicate Leatt’s downstream distributors and retailers are unable to sell Leatt’s products and are thus unable to promptly pay Leatt. This could ultimately impact revenue in 2023.

Table 3: Leatt’s Cash Conversion Cycle

Leatt Cash Conversion Cycle (Author's Calculations)

Negatives and Risks

There are several negatives worth flagging. Firstly, as mentioned in the previous section, we are concerned at the worsening cash conversion cycle and AR Days. If Leatt’s distributors are sitting on significant inventory and are unable to sell downstream, they will not buy more Leatt products, which ultimately reduces Leatt’s future revenue. We hope a seasonally strong Q4 report addresses these concerns.

Secondly, future revenue growth may be significantly lower than our projections due to 1) overoptimistic industry growth forecasts, 2) poor execution leading to market share losses or 3) a worse than expected economic recession. Leatt’s growth rate decelerated to just 5% YoY in Q3 2022 and is at risk of turning negative in 2023. Any of the above scenarios would cause worse-than-projected revenue and profitability drops, crushing the stock price.

Thirdly, Leatt Corporation has dealings with related parties that raise questions on conflicts of interest. Leatt doesn’t own the patents on its flagship neck brace – instead, Leatt pays a 4% royalty fee to Xceed Holdings, which is 100% controlled by the founder and an additional 1% to Mr. De Villiers, a former director and significant shareholder. Leatt also engages in a consulting arrangement with Innovation Services Limited, a company beneficially owned by Dr. Leatt, for $42,000 per month. While Xceed Holdings and Dr. Leatt will likely continue to exclusively support Leatt Corporation, we’d prefer if Leatt Corporation owned the patents outright and if the consulting arrangement was based on either an employer/employee relationship or share-based compensation instead of cash. This would simplify the structure and align incentives better.

Conclusion

We rate Leatt Corporation stock as a BUY with a target price of $19.3. Leatt’s strong record of developing new products that enable it to grab market share in a growing industry and low valuation outweigh concerns about decelerating revenue, a lengthening cash conversion cycle and conflicts of interest. Due to its low liquidity and other risks, Leatt stock is only appropriate for speculative individual investors and smaller fund managers. We are accumulating shares of Leatt but will be watching for signs over the coming quarters that the investment thesis remains intact.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of LEAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.