Helen of Troy: Looks Like A Value Trap

Summary

- HELE is facing a number of issues, from too much inventory in the channel to higher interest expense from its variable debt.

- The company, meanwhile, is embarking on a restructuring plan to reduce costs.

- However, a Hydro Flask competitor is now all the rage, limiting the likelihood of a quick turnaround.

Astri Kurniawati/iStock via Getty Images

Helen of Troy (NASDAQ:HELE) is dealing with multiple issues as it embarks on a restructuring program. It's looking for a Hydro Flask refresh to help drive some growth, but there is a new, popular tumbler on the market taking share.

Company Profile

HELE is a consumer products company that sells a variety of products in the Home & Outdoor, Health & Wellness, and Beauty categories.

In the Home & Outdoor segment, its brands include OXO, Good Grips, Softworks, Osprey, and Hydro Flask. It sells products such as food storage containers, coffee makers, household cleaning products, infant care products, backpacks, and insulated cooler bottles (Hydro Flasks).

In the Health & Wellness segment it owns the PUR brands, and also has the licenses for Honeywell, Braun, and Vicks. Its products include thermometers, oximeters, blood pressure devices, humidifiers, fans, heaters, water filtration systems , and air purifiers, among other items.

In the Beauty segment, it owns the Drybar and Hot Tools brands, and has licenses for the Revlon and Bed Head brands. It offers such things as hair dryers and other hair appliances, brushes, hair accessories, prestige market shampoos, conditioners, and liquid hair styling products.

From an operational standpoint, the company will be consolidating its Health & Wellness and Beauty segments, and now calls it Beauty & Wellness.

Amazon (AMZN) is its largest customer, representing nearly 20% of sales, while Walmart (WMT) and Target (TGT) represent just over 10% each. Nearly 80% of its sales are in the U.S.

Opportunities & Risks

HELE has had a difficult fiscal 2023 thus far, hit by the destocking issues that quite a few companies have seen over the past year. With supply chain disruptions stemming from Covid, retailers over-ordered, which then led to too much inventory in the channel. This was particularly true before the 2021 holiday season, which is why HELE's FQ3 results were really ugly.

For Q3, HELE saw its organic sales tumble -18.5% to $558.6 million. Home & Outdoor organic sales plunged -23.3% to $228.9 million, while Beauty revenue sank -20.7% to $149.2 million. Health & Wellness organic revenue fell -10.8% to $180.5 million.

The hair appliance category has been weak all year following a very strong period coming out of Covid. The company also said it has lost share as consumers have traded down in the mass merchandise category.

The Health & Wellness category, meanwhile, is likely still experiencing a bit of a Covid hangover, as sales of things like thermometers and oximeters were very strong during that period. That likely pulled forward a lot of potential sales.

In addition to its operational issues, HELE also has over a $1 billion in variable debt. Current covenants also currently limit it to be able to take out "$262.2 million of additional debt from all source" as of the end of November, according to its last 10-Q. The greater its net leverage ratio, the higher its interest rate as well.

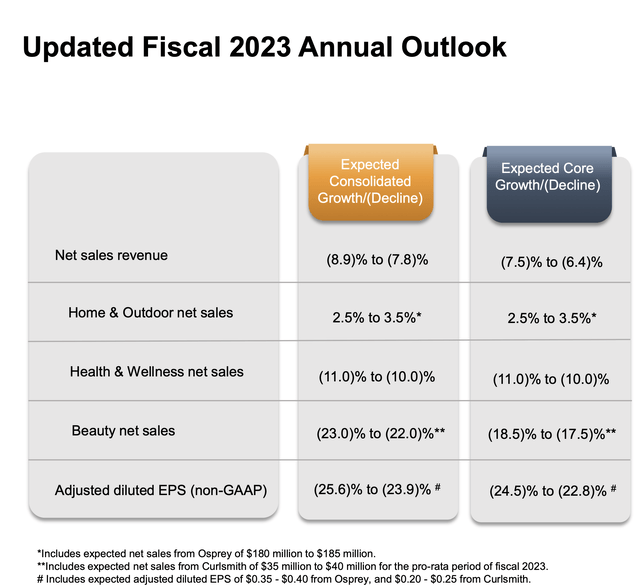

The company isn't expecting a big turnaround in calendar year 2023, with CEO Matthew Osberg saying on its fiscal Q3 call:

"Looking ahead to fiscal '24, there remains considerable uncertainty in the near-term macroeconomic and consumer outlook. We expect that many of the same macroeconomic factors that made calendar '22 so challenging may persist into calendar '23 as well as the compounding effect of the uncertainty of a potential recession and whether or not the Fed can execute a soft landing. These factors continue to make the ability to forecast consumer behavior patterns difficult.

"We believe that fiscal '24 sales growth will be challenged and highly dependent on the health of the consumer and that the variability of these factors could drive a wide range of potential outcomes which would be impacted by the depth and length of any potential recession. As previously discussed, we also expect to face a number of cost headwinds in fiscal '24, which include higher interest expense as we annualize the increase in interest rates in fiscal '23, incremental depreciation related to our new $225 million distribution center which we expect to put in service at the beginning of fiscal '24 and higher annual incentive compensation expense as we reinstate expense associated with our estimates to achieve fiscal '24 compensation targets."

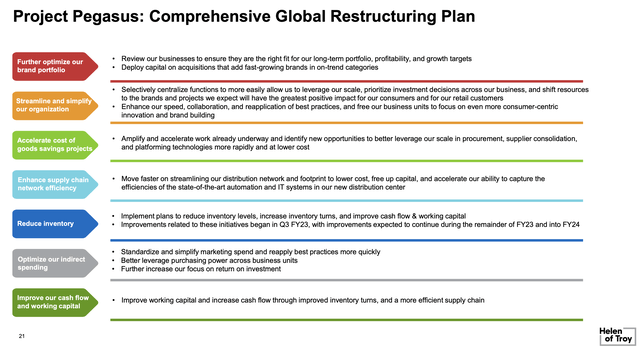

Given its struggles, HELE announced a big restructuring plan to lower inventory, increase inventory turns, and improve cash flow and working capital. Among its initiatives will be to reduce its SKU count, renegotiate rates with packaging suppliers, improve sourcing and procurement, centralize shared service, and consolidate marketing spend across business units.

HELE is targeting $75-85 million in annual pre-tax operating improvements by the end of fiscal 2026. About 60% will be through reduced COGS and 40% through lower SG&A. It expects to achieve 25% of the savings in FY24, and additional 50% in FY25, and the remaining 25% in FY26.

HELE CFO notably won't be sticking around to oversee this plan, deciding to resign after the company files its 10-K towards the end of April.

The company also plans to launch a number of new products this year to help try to drive growth. This will be done across categories, although there does appear to be some emphasis on Hydro Flask. It will be introducing new colors, designs, and expanding customization.

However, the Hydro Flask brand is now facing increased competition from the popular Stanley Cup Tumbler (not to be confuse with the NHL Stanley Cup). The drinkware brand has become all the rage on social media, and its tumblers are being sold at mark-ups on the secondary market they are so popular.

Valuation

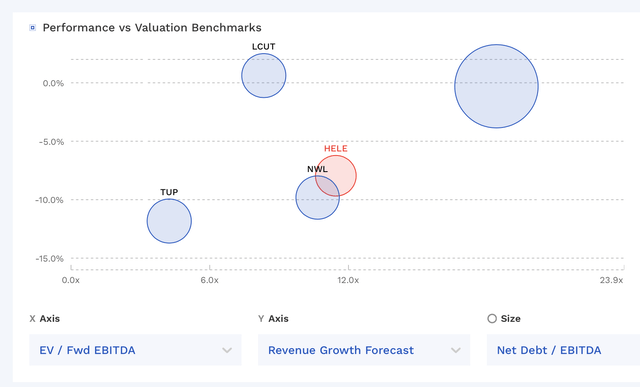

HELE currently trades around 10x the FY2024 consensus EBITDA of $339.4 million and 9x the 2024 consensus of $375.1 million.

It trades at a forward PE of 11x the FY24 consensus of $8.85.

Revenue growth is expected to be flat in FY24.

The company trades at a bit higher valuation than most household durable names.

HELE Vs Peer Valuations (FinBox (Note ticker to the right is SPB))

Conclusion

HELE was a popular stock when its Hydro Flask brand took off and became part of the VSCO girl trend a few years back. The Hydro Flask Brand is still solid, but it hasn't grown much since, and I'm not sure how popular it will stay. With the Stanley Cup Tumbler now the "it" brand being pumped on social media, HELE's Hydro Flask has an uphill climb to post strong growth.

At the same time, the company is dealing with a lot of issues from too much inventory in the retail channel, to prior pull-forward sales, to high interest expense.

The restructuring program is nice, but not something that is overly exciting given its issues. The company likes M&A, but given its issues and leverage, that should be off the table for a while. I think the stock looks a bit like a value trap and would stay away.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.