SoFi: Leading In A Crisis

Summary

- SoFi launched a $2 million solution to the FDIC insurance limits in a move to garner more deposits during this banking crisis.

- The digital bank affirmed Q1'23 deposits should already match the $2+ billion levels of the prior 2 quarters.

- The fintech stock remains incredibly cheap at 11x '24 adjusted EBITDA talks.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Justin Sullivan

One of the best times for a company to take market share is during a crisis. SoFi Technologies (NASDAQ:SOFI) is making this move with a plan to internally boost FDIC insurance for customer accounts in a move that shouldn't surprise investors considering how easily the lender thrived after the student debt moratorium. My investment thesis remains ultra Bullish on the fintech set to benefit from the crisis while most regional banks contract.

$2 Million Plan

While regional banks struggle to survive, SoFi not only expects deposit growth to continue at levels similar to the last couple of quarters, but also the fintech has unleashed a new product. Last week, the company announced a plan to roll out a new FDIC Insurance plan to cover up to $2 million in deposits.

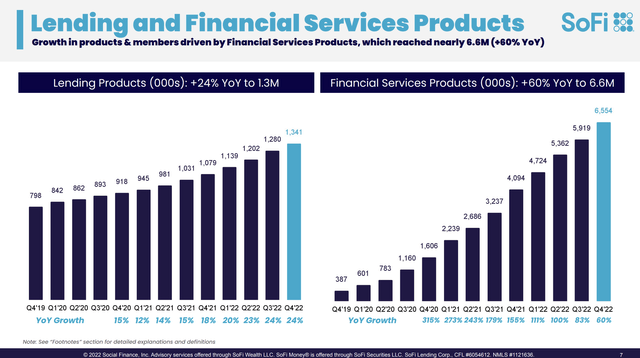

As a reminder, SoFi collected $2.3 billion worth of deposits in Q4'22 leading to a total deposit balance of $7.3 billion. The company only recently became a digital bank and the fintech targets new members with student debt and limited assets in order to help people build a financial future.

The SoFi FDIC Insurance Network works with banking partners to offer seamless coverage of multiple accounts. Since 90% of current account balances are under the $250,000 FDIC Insurance level, the digital bank is rolling out the service to new customers first.

SoFi could be pushing north of $9 billion in deposits at the end of March prior to even rolling out this new FDIC insurance. CEO Anthony Noto was very straight forward at the BoA 2023 Electronic Payments Conference that the bank had strong deposit inflows still ongoing:

Importantly, our growth in deposits remained strong. We expect our absolute increase in deposit dollars to be equal to or greater than the levels we’ve seen in the last few quarters. For those that aren’t familiar in Q4, our deposits grew $2.3 billion in absolute dollars and in Q3 also $2.3 billion. So despite all the upheaval our model, our value proposition remains really robust and strong, which is allowing us to match or beat that level of deposit growth.

Ironically, SoFi originally rolled out a $1 million FDIC Insurance plan when launching SoFi Money in 2019, but customers didn't like the product. Either way, the digital bank has worked on ways to keep client funds above $250,000 while some of the regional banks with whole business plans focused on high-net worth individuals and startup companies had no such plans.

The digital bank only had 10% of deposits uninsured, yet SoFi was still working on a plan to garner higher deposits. The company has $7.3 billion in deposits leaving an average of only $1,400 per member in a checking or savings deposit account. SoFi only has members on 1.5 financial products per member highlighting the upside potential as members move from borrowers into full-fledged banking services.

Source: SoFi Q4'22 presentation

Leadership

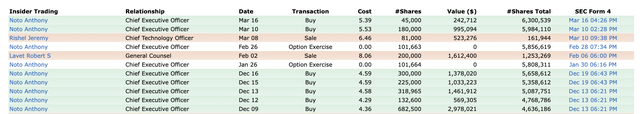

While the financial sector is in crisis mode, SoFi CEO Anthony Noto was leading during the crisis via immediate stock purchases. The executive bought a total of 225,000 shares for over $1.2 million while other bank CEOs were still figuring out how to survive the crisis.

Not only was SoFi not caught off guard with a large amount of uninsured deposits, but also the company has a plan to capture deposits from other banks not prepared for the current market. The CEO knew this and Noto loaded up on the stock again in the lows $5s.

Back at the BoA conference, Noto confirmed that Q1'23 results were in line with the strong guidance the company provided along with the Q4'22 results:

We remain comfortable with our guidance and the overall trends of our key metrics. Obviously, we gave that guidance back in the beginning of the year, but we’ve continued to execute and see the positive trends that were implied by our guidance with all the assumptions that Chris laid out for the economy, as well as the student loan moratorium as caveats as part of our guidance, but overall, comfortable with our guidance and the overall trends in both the financial and nonfinancial metrics.

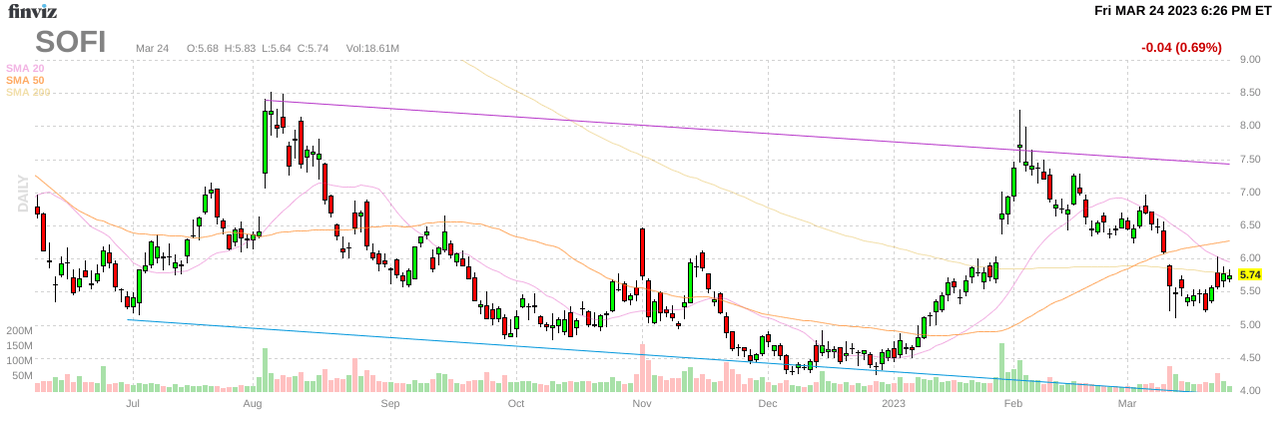

SOFI stock only trades at 11x 2024 EBITDA targets of nearly $500 million. As highlighted in prior research, these adjusted EBITDA targets are very similar to adjusted profits.

Takeaway

The key investor takeaway is that the market spent the last year trying to convince investors that SoFi wasn't a future leader in the digital banking space, yet the company handling another crisis with hardly an impact. Investors should use the weakness to buy the fintech near the lows alongside the CEO. The key is to not allow the market to convince one that adjusted profits aren't the way to value SoFi.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SOFI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.