Paychex Q3 2023 Earnings Preview: A Profit Beat Looks Likely

Summary

- The management team at Paychex is expected to announce financial results covering the third quarter of the company's 2023 fiscal year on March 29th.

- Revenue growth is likely to slow, but I believe there's a decent chance of an earnings beat.

- The firm is a quality operator, but shares are not cheap enough to warrant attractive upside.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

hapabapa

The economy is always in a state of flux, but typically speaking the picture is not as uncertain as it is today. This uncertainty creates risk for investors. But this doesn't mean that opportunities don't exist. Sometimes, the best opportunities can be found during times of great uncertainty. But of course, it's important to keep in mind that the uncertainty we are experiencing needs to be assessed in the context of the impact that it has on the companies we are analyzing. And because of how rapidly the picture can change, it's important to keep a close eye on data as it comes in each quarter. One firm that definitely warrants the attention of investors during this time is Paychex (NASDAQ:PAYX), a human resource software and services company that provides payroll functions, human resource activities, benefits activities, insurance services, and more.

Previously, management came out with a relatively bullish outlook for the business for the 2023 fiscal year. But because of how pricey PAYX stock is, there is a risk of underperformance if things don't go according to plan. That's why investors should keep it very close eye on what the company reports when it announces financial results covering the third quarter of the 2023 fiscal year. This data is supposed to be released in the coming days and it could have a big impact on how shares perform over the next few months.

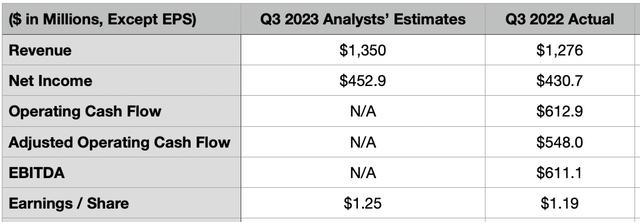

Setting expectations

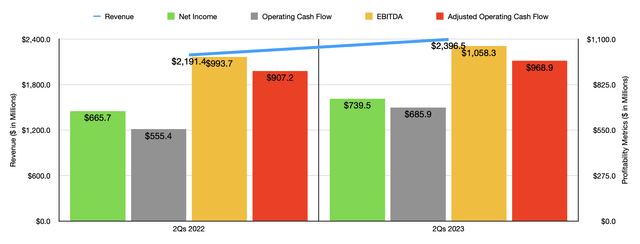

Before the market opens on March 29th, the management team at Paychex is supposed to announce financial results covering the third quarter of the company's 2023 fiscal year. At top of mind for investors will be the revenue the company reports. During the third quarter, analysts believe that revenue came in at $1.35 billion. If this is indeed what transpired, it would translate to a roughly 5.8% increase over the $1.28 billion the business reported the same quarter one year earlier. To me, such a reading would not be all that surprising. I say this because, for the 2023 fiscal year, management is anticipating revenue growth of about 8%. That would take sales up to $4.92 billion. In the first half of 2023, sales for the firm came in at just under $2.40 billion. That would translate to a 9.4% rise over the $2.19 billion reported one year earlier.

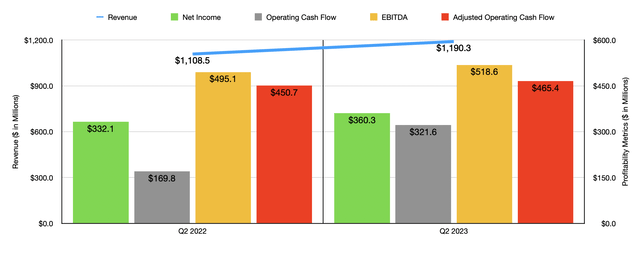

If management's guidance is to be accurate, then sales growth must be slower in the second half of the year than it was in the first half. This would also continue the trend experienced throughout the first half of the year. You see, the second quarter of the year was slower than the first. During that time, revenue grew only 7.4%, climbing from $1.11 billion to $1.19 billion. More likely than not, the growth in sales for the company should be driven in large part by the Management Solutions activities of the firm. This is the portion of the company that engages in payroll processing services, payroll tax administration services, employee payment services, and other related activities like regulatory compliance, retirement solutions administration, and more. The primary contributors to any growth in this portion of the company with largely be a rise in the number of clients and employees under those clients, as well as expanded revenue per client thanks to price increases and higher product attachment. In particular, the company has cited HR Solutions, retirement, and time and attendance solutions activities as big drivers of growth relative to the same time last year.

On the bottom line, analysts are also optimistic. Earnings per share are forecasted to be $1.25. That compares to the $1.19 reported for the third quarter of the 2022 fiscal year. Although this may not seem like much of a difference, it would translate to net income for the business climbing from $430.7 million in the third quarter last year to $452.9 million the same time this year. Just as was the case with revenue, this rise in profits would translate to a slowing down for the company. The year-over-year increase in earnings per share would come out to roughly 5%. By comparison, for the first half of the 2023 fiscal year, earnings per share came in about 11% higher than they did the same time of 2022. On this though, I do believe that there is a chance that the company could outperform expectations. I say this because, in its latest earnings release, management said that adjusted earnings per share this year should be between 12% and 14% higher than what it was last year. If this is the case, it would mean that profits must actually pick up instead of slow down.

Analysts have not provided any guidance when it comes to other profitability metrics. But investors would definitely be wise to keep an eye on a couple of these. In the first half of the 2023, the company reported operating cash flow of $685.9 million. That was actually 23.5% higher than the $555.4 million reported the same time one year earlier. Even if we adjust for changes in working capital, growth still came in at a reasonable 6.8%, with cash flow rising from $907.2 million to $968.9 million. Meanwhile, EBITDA of $1.06 billion was 6.5% above the $993.7 million reported the same time of the 2022 fiscal year. Investors should also pay attention to the net leverage situation of the company. As of the end of the latest quarter, the company actually boasted cash exceeding debt totaling $522.3 million. This means that there is no real risk from a liquidity perspective or a solvency perspective for the foreseeable future. But with cash flow slated to grow, it will be interesting to see if the firm's cash balance relative to the amount of debt outstanding continues to grow as well.

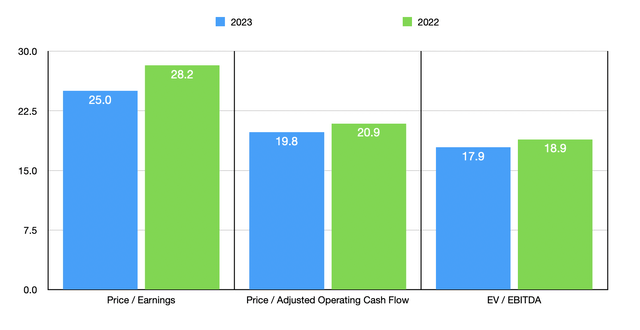

Investors would also be wise to evaluate the company from a valuation perspective. More likely than not, the firm will have grown year over year. But it's important to know what kind of price is being paid for that growth. Current estimates provided by management call for net income to be about $1.57 billion for 2023. Meanwhile, EBITDA should come in at around $2.16 billion. No estimates were provided when it came to adjusted operating cash flow. But a good approximation for that would be around $1.98 billion. Based on these figures, the company is trading at a forward price-to-earnings multiple of 25. The forward price to adjusted operating cash flow multiple should be 19.8. And the forward EV to EBITDA multiple should come in at around 17.9. All of these numbers show that the company is cheaper on a forward basis than it is using data from 2022.

As part of my analysis, I also compared Paychex to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 28.4 to a high of 223.7. In this particular instance, Paychex was the cheapest of the group. Using the price to operating cash flow approach, however, we get a range of between 7.6 and 25.6. Meanwhile, the EV to EBITDA approach gives us a range of between 10.5 and 19. In both of these instances, four of the five companies ended up being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Paychex | 25.0 | 19.8 | 17.9 |

| Global Payments (GPN) | 223.7 | 12.1 | 16.4 |

| Fidelity National Information Services (FIS) | 44.4 | 7.6 | 10.5 |

| Fiserv (FISV) | 28.7 | 15.8 | 13.2 |

| PayPal (PYPL) | 35.3 | 14.7 | 16.4 |

| Automatic Data Processing (ADP) | 28.4 | 25.6 | 19.0 |

Takeaway

From what I can see, Paychex remains a growing enterprise with an attractive amount of cash flow under its belt. Long term, I expect this trend to continue, and both management and analysts expect the trend to continue for at least the near term. I do think that earnings will probably come in higher than what analysts anticipated. If they don't, I have to imagine management would lower expectations for the year. Regardless, the company is in solid financial health, and I believe that the future for it will be bright. But given how shares are priced, both on an absolute basis and relative to similar firms, I believe that a ‘hold’ rating makes the most sense at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.