Midstream Energy Stocks Ranked By Quality

Summary

- Given current uncertainty, I believe high-quality, favorably valued, and low-risk investments warrant increased attention.

- Some midstream energy companies boast durable revenue, profitability, and well-supported high dividend yields.

- 35 midstreams were evaluated using a quality matrix with factors including Price/Sales, Net Income Margin, Free Cash Flow Margin, Total Debt/Market Cap, Forward Yield, and Payout Ratio.

- Based on this analysis, I recommend those who are interested in midstream energy first consider MMP, WES, MPLX, EPD, and HEP.

- I further recommend that investors who own GEL, MMLP, TRP, ETRN, or KEYUF carefully review their positions.

anilakkus

Why Midstream Energy

An exhaustive discussion of current economic conditions or stock market expectations is beyond the scope of this analysis. However, Jerome Powell of The Federal Reserve has clearly and repeatedly stated that it is his intention to tame inflation by tightening monetary policy even at the risk of reduced employment and even recession. I think investors and portfolio managers should be listening.

Recently, I have focused my work on identifying high quality, favorably valued, and low risk investments. I feel like the midstream energy sub-sector is likely to include some quality businesses at favorable valuations with durable demand, dependable revenue, and reduced risk.

Although the broader energy sector is highly subject to the volatility of oil and gas prices, midstream stocks can be more stable. Many midstream companies' revenues are stable and fee-based with long term contracts. Therefore, midstream energy might include some potential value with low risk.

Initial Screen & Relative Quality Matrix

Seeking Alpha's stock screening tool was used to assemble a list of 91 midstream companies with a market cap of at least $500M and share price over $1.00. Next, those companies whose primary business is seaborne transportation of crude, liquid neutral gas companies, and companies with insufficient data were eliminated. The remaining 35 midstream companies are roughly similar businesses with operations focused on pipelines and storage facilities.

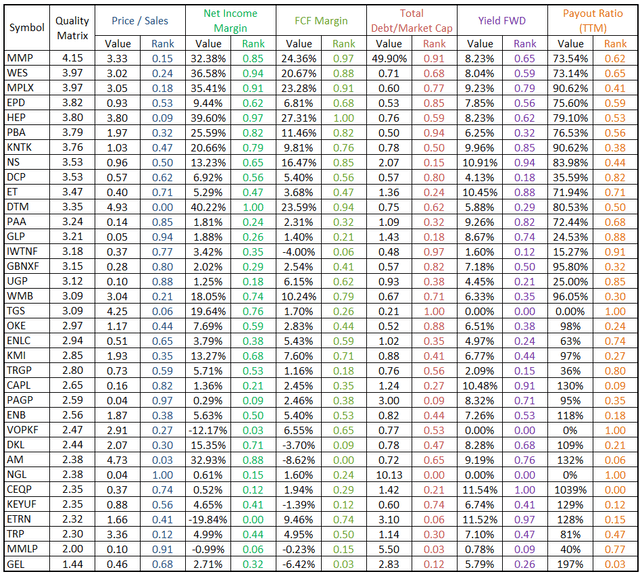

These 35 midstreams were evaluated using a quality matrix with factors including Price/Sales, Net Income Margin, Free Cash Flow Margin, Total Debt/Market Cap, Forward Yield, and Payout Ratio. The values for each midstream's factors were normalized by means of statistical percent ranking with relation to the group. The quality matrix was calculated as the sum of the percent ranks of the factors.

Midstream Quality Matrix Chart

Author, SA Data

The above chart is sorted in descending order of the best quality (highest matrix score) to the poorest quality (lowest matrix score).

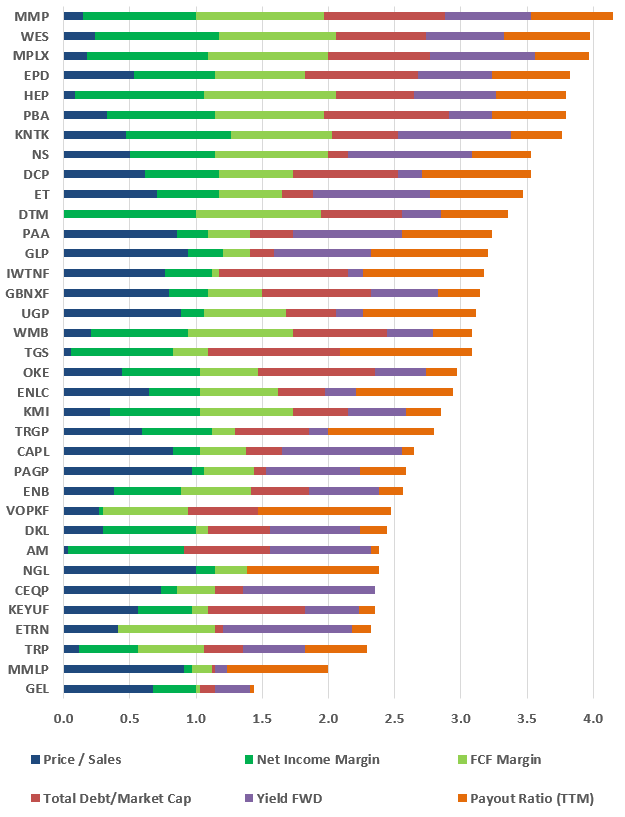

Midstream Quality Matrix Plot

Author, SA data

The quality matrix is presented graphically in the stacked bar chart above with cumulative inputs for each factor. Based on this analysis, the top-5 highest quality midstreams are:

- Magellan Midstream Partners, L.P. (MMP)

- Western Midstream Partners, L.P. (WES)

- MPLX LP (MPLX)

- Enterprise Products Partners, L.P. (EPD)

- Holly Energy Partners, L.P. (HEP)

Based on this analysis, the poorest quality midstreams are:

- Genesis Energy, L.P. (GEL)

- Martin Midstream Partners L.P. (MMLP)

- TC Energy Corporation (TRP)

- Equitrans Midstream Corporation (ETRN)

- Keyera Corp. (OTCPK:KEYUF)

Based on high payout ratios, (CEQP), (GEL), (AM), (CAPL), (OTCPK:KEYUF), (ETRN), and (ENB) could pose unique risk. High yield stocks are risky when dividends are not supported by revenue. If the payout ratio is consistently high over time, the dividend is unsupported by earnings and is at high risk of a cut with a resulting price decline.

Screening and Quality Matrix Limitations

Investors should consider the quality matrix a screen only. The matrix and its factors, normalization method, and weights could all be adjusted and yield different results. Further, the matrix is based on the most readily available and common metrics. These metrics can change rapidly with share price or as new company reports are released. It does not include company-specific data available in quarterly reports and presentations. Every investment decision regarding an individual equity should be based on comprehensive analysis of that equity.

Conclusions and Recommendations

Although risk appears elevated in the stock market, I believe current uncertainty presents an opportunity to buy great future returns at a discount. Further, risk can be managed by selecting companies with favorable valuations, solid profits, and durable demand. The midstream energy sub-sector appears very promising on these factors with the added bonus of considerable dividend yields supported by low payout ratios.

Based on this analysis, I recommend those who are interested in midstream energy first consider MMP, WES, MPLX, EPD, HEP. I further recommend that investors who own GEL, MMLP, TRP, ETRN, or KEYUF carefully review their positions.

Information is a source of learning. But unless it is organized, processed, and available to the right people in a format for decision making, it is a burden, not a benefit. - William Pollard (Physicist and Theologian)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.