SPY, XLF: Dangerous Deposit Withdrawals Signal Unstable Financial Environment

Summary

- Fed's Bank Term Funding Program partially resolved liquidity issues. It would be a grave error to consider liquidity injection as quantitative easing.

- All loan types increased by more than $339 billion, a record amount, indicating that the situation is not under full control.

- In preparation for a potential bank run, the most recent data from commercial banks indicate a massive proportion of expensive borrowings to bolster the liquidity position.

- Detailed flow analyses demonstrate how large banks strengthen their positions as a result of regional bank-related issues.

- Profitability and EPS in the banking sector and SPY will likely take a larger hit than anticipated. Fed Funds Futures and Inflation expectations greatly lowered.

bluekite

While it has been some time since I published my most recent analysis of SPDR S&P 500 Trust ETF (NYSEARCA:SPY), in which I was concerned about macro and remained pessimistic, I will reiterate that I am still bearish. Since then, the SPY has gotten close to its break-even point, but as in the last article, I was concerned and could not be bullish into the most aggressive tightening cycle since, as history says, there are numerous indications that something broke. This time, it all began as a result of management errors made by SVB and other banks due to insufficient liquidity and inadequate hedging measures. The concern is that the financial sector, which constitutes a substantial portion of SPY, is vulnerable to significant difficulties. The majority of concerns are always associated with the withdrawal of deposits, as is the case recently. Nonetheless, the liquidity issue can be partially resolved through the Bank Term Funding Program , but the profitability of the bank will be severely impacted. There is also a hidden danger known as credit risk, which is being almost entirely overlooked. In addition, bank deposits are likely to suffer and continue their downward trajectory, as the safest Treasury securities provide preferable options with significantly higher rates than savings accounts. There would be no quiet in the banking industry till this spread significantly persists.

Bank Term Funding Program

BTFP resolved liquidity concerns caused by withdrawal requests by providing depository institutions with additional funds to meet the needs of all depositors. Banks, savings associations, credit unions, and other qualifying depository institutions can get one-year loans from the BTFP by pledging U.S. Treasuries, agency securities, or agency mortgage-backed securities, which the Federal Reserve Banks can purchase in open market operations at par value. The BTFP will offer liquidity against high-quality assets during times of crisis, eliminating the need to sell them.

In other words, if banks incur losses on their asset side due to AFS (Available-For-Sale) portfolio, caused by duration effect of Treasury and MBS securities and lack of hedge (hedge against interest rate risks via swaps), they can save their assets in the Fed's accounts and receive cash. Its loan type, however as indicated previously, the assets are valued at par, which means they are valued at the purchase price (adjusted for losses). To provide an illustration, suppose you purchased Treasury securities with long-term maturities for $100 and incurred an unrealized loss of $20. Hence, the fair value is 80 USD and not 100 USD, but the Fed views it to be at par, therefore they are only concerned with the purchase price. It is strictly regarded money. The issue is that the Fed requires a higher return on this loan, making such a strategy utterly unprofitable for banks in the medium-term.

It´s definitely not QE

Although, such a tool can be viewed as an expensive sort of loan, but it is very important for banks that have failed in their liquidity management policies or are experiencing a bank run. Hence, it is a loan-type instrument, not QE. While both QE (asset purchases) and BTFP are implemented to increase the liquidity of the financial ecosystem, they serve fundamentally distinct purposes. In order to stimulate the economy, quantitative easing focuses on decreasing interest rates through asset purchases and targeting long-term rates, whereas credit facilities aim to resolve short- or medium-term liquidity concerns linked to outflow of deposits. In the past, QE and more credit facilities were used together. However, right now, we only see a rise in BTFP (a liquid injection) and ongoing rate hikes (a liquid contraction).

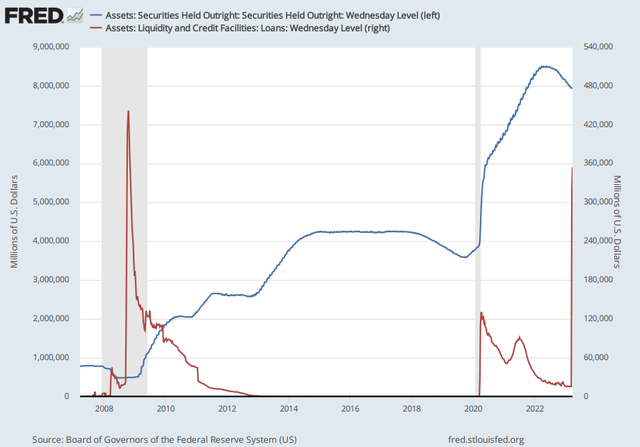

Fed Balance Sheet Changes (FRED)

You can compare the evolution of QE (securities held outright) to that of Liquidity and Credit Facilities in the graph below (loans). While both occurred in the most recent two tail episodes, it does not appear that the Fed intends to do the same. Fed intends to maintain tightening while adding additional liquidity to financial institutions due to liquidity concerns. I believe QE might occur if a credit crisis occurs, but not earlier.

Deposits outflow continue and has not stabilized yet

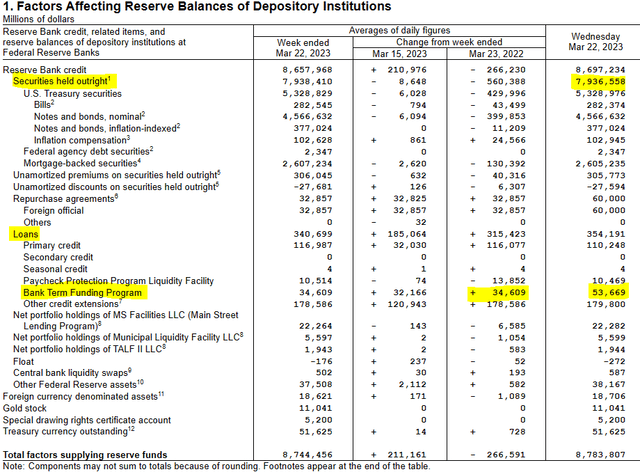

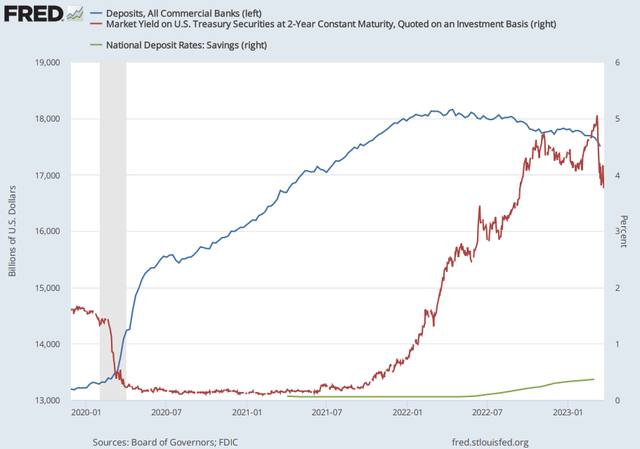

Fed statistics allow for direct monitoring of deposits in commercial banks. Unfortunately, we only have access to the dataset until March 15th. In general, deposits are being withdrawn due to the high yield on Treasury securities, which is far more appealing (US02Y yields near 4%) than national deposit savings rates, which are well below 1 percent. Several options may be utilized to deal with the issue:

- It could be problematic for banks to boost the rate of savings, given the need to generate interest on the additional money. Overall, the profitability may decline. But, it could attract customers back and improve liquidity concerns,

- BTFP - high quality liquid assets with unrealized losses (HQLA), such as treasuries and mortgage-backed securities (MBS), might be used as collateral for loans, i.e., for Fed-provided liquidity; however, this would considerably erode the P&L of banks, as it is an expensive tool. This is not a long-term solution,

- Alternatively, if the Fed were to reduce its FFR, the disparity between treasury yields and savings rates would narrow, reducing the pressure on banks and deposit outflows. However, enormous inflation concerns would return.

Outflow of deposits from commercial banks, Treasury yield and saving rates (FRED)

In terms of effectiveness and the formation of a new fund, which is expensive for banks but can alleviate their temporary problems, I believe the Federal Reserve did an excellent job. Moreover, it aimed to raise rates by 25 basis points, thereby signaling to markets that the fight against inflation is not done, which is their principal objective for the time being. The major issue is that the Fed is also responsible for the withdrawal of deposits since it is withdrawing liquidity from the markets and the tightening cycle is reducing disposal income and destroying savings. If the trend of bank savings rates does not alter, deposits will continue to drop. Yet, I believe that pausing or reducing interest rates is the most effective method for resolving this issue, but it would spark inflation.

The dataset is, as indicated, restricted until March 15th. Yet, there are also indirect evidence that deposits are dropping at a very rapid rate, which is quite adverse for banks and the financial sector as a whole with implication on SPY. The first is a large increase in the value of Money Market Fund assets. It is directly trackable on ICI, however Jim Bianco produced the chart below.

Assets in Money Market Funds (ICI. Chart from Jim Bianco)

As suggested by the graph, the addition of 238 billion USD in the last two weeks will almost surely have a negative effect on bank deposits. In particular, the following indirect tracker of deposits withdrawal is precisely BTFP. In the table above, you can see that this week has also witnessed a significant growth. As considerable deposits are being removed, it is evident that I do not fully believe such claims about the robustness and strength of the banking market (mainly in relation to regional banks). In my judgment, deposits will continue to decline until banks raise their savings rates or the Federal Reserve makes a policy shift. The failure of another bank, even a tiny one, would be catastrophic due to psychological effect.

At a press conference led by Mr. Powell this week, he stated:

In the past two weeks, serious difficulties at a small number of banks have emerged. With the support of the Treasury, the Federal Reserve Board created the Bank Term Funding Program to ensure that banks that hold safe and liquid assets can, if needed, borrow reserves against those assets at par. This program, along with our long-standing discount window, is effectively meeting the unusual funding needs that some banks have faced and makes clear that ample liquidity in the system is available. Our banking system is sound and resilient, with strong capital and liquidity.

Underline the final phrase of the quotation. Why did financial institutions receive record liquidity and credit facilities when, according to numerous politicians, everything is fine and sound? Nonetheless, the additional "loans" from March 8 totalling 339 billion USD may be a factor in the withdrawal requests for deposits. While all of these loans are suitable for those in need of short-term liquidity, primary credit is reserved for institutions with a verifiable financial institution, whereas secondary credit is intended for institutions that do not qualify for primary credit and has stricter requirements.

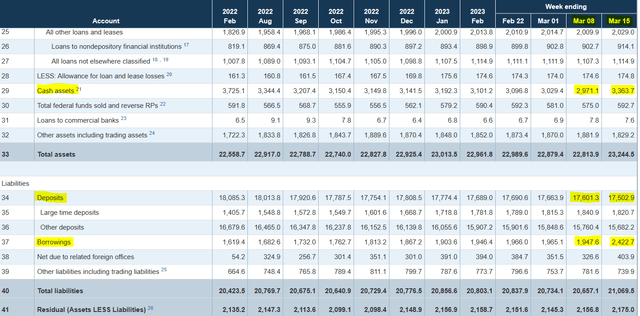

In addition, all of these borrowings from the Fed's balance sheet correlate with slightly lagging commercial banking data. While we dispose of data from the Fed's balance sheet that is quite current - as of March 23 - in the case of banks, we dispose of a week-old information (15th March). However, there is one major certainty. As shown in the table below, a sizeable portion of the bank's Fed loans were used to improve its cash position. While deposits decreased slightly week-over-week, look at the massive increase of 475 billions of dollars in borrowings (WoW). Now compare this to the increased cash position (asset side) WoW, which adds up to 392 billions of dollars and it is nearly equivalent. Moreover, the deposit outflows amounted to -99 billions of dollars.

Changes in Balance Sheet of Commercial Banks (FRED.)

As a result, we can conclude that, from the banks' perspective, they were preparing for a massive bank run in the week beginning 15 March, as their liquidity improved dramatically due to quite expensive loans from the Federal Reserve. As stated previously, it is a combination of bank tools, with only a small portion of the BTFP program being utilized.

Deposits will inflow into large banks

If the situation isn't fixed soon, I'm sure that regional banks, even though they have less strict rules, will continue to lose deposits, which will go to the big banks. I believe so for two material explanations. The potential weakened position of regional banks in general is the initial factor. Based on my research from the most recent 4Q2022 for the banks listed above, it appears that regional banks are or could be under the most pressure if the bank run materializes. It is merely an inference from its balance sheet.

I analyzed the cash position as a percentage of the balance sheet, and did the same with tangible book value. I am well aware that it is necessary to compare LCR, Common Equity Tier 1, and numerous other crucial metrics for a more complex perspective and a clearer conclusion. To unfreeze the deposits, however, the amount of cash and the velocity of cash conversion (as from BTFP from collateral) are crucial. This is also the reason why banks increased their cash position so significantly and quickly through borrowing. In addition to stricter regulation, larger banks have a tendency to hold more cash on their balance sheets, as shown in the chart below.

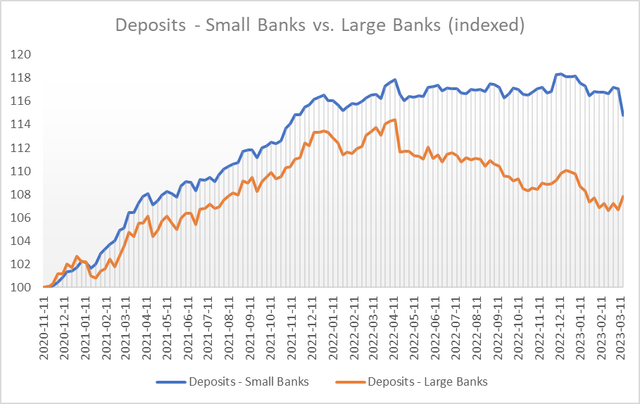

The graph below displays the deposit with indexed values for both small and large banks. Beginning in early 2022, the negative trend became more noticeable for larger institutions. The Fed's dataset for commercial banks indicates that smaller banks performed better in terms of deposits.

Bank deposits - Small and Large banks (Author´s calculations. FRED)

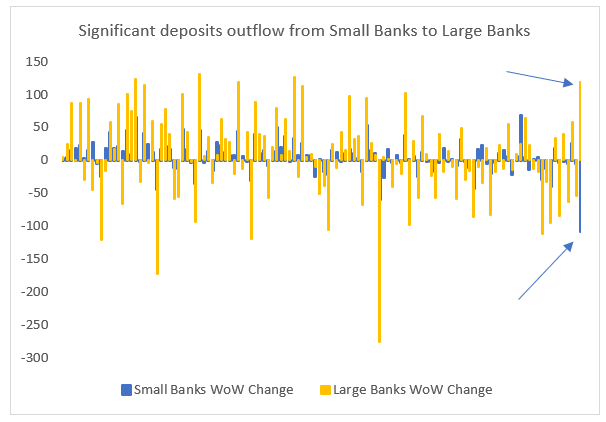

However, consider the most recent data, which captures the inflow/outflow of deposits for March 15th (week). Observe the WoW changes and you will notice the following pattern. There is a substantial outflow of deposits from small banks and a substantial inflow of deposits into large banks.

Significant deposits outflow from Small Banks to Large Banks (Author´s calculation. FRED)

Final thoughts on profitability, macro and SPY

Nevertheless, I do not know how long this trend will last, but we do know something from the Fed's balance sheet. The loans increased by an additional 36 billions of dollars since March 15 (as seen in the chart above), which indicates to me that the crisis has not been resolved and a cautious approach has been maintained. As a result, deposits are often still being withdrawn. It could also imply that such borrowings will have a negative influence on the profitability of the bank, given borrowings are costly and banks are not producing new loans and receiving income, but rather boosting their cash position.

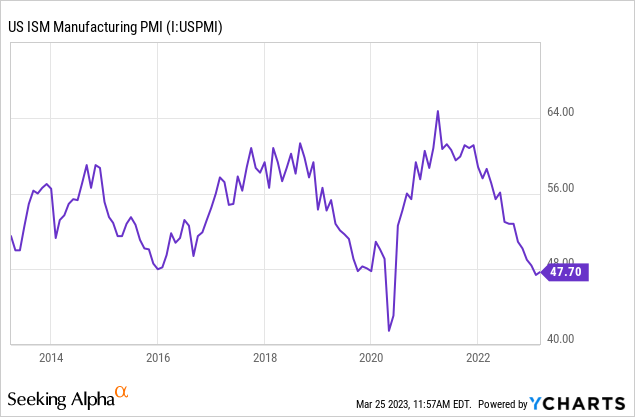

In addition, practically every time in history, such macroeconomic repercussions have resulted in reduced inflation expectations, decreased consumption, higher unemployment, and other negative outcomes in the medium run.

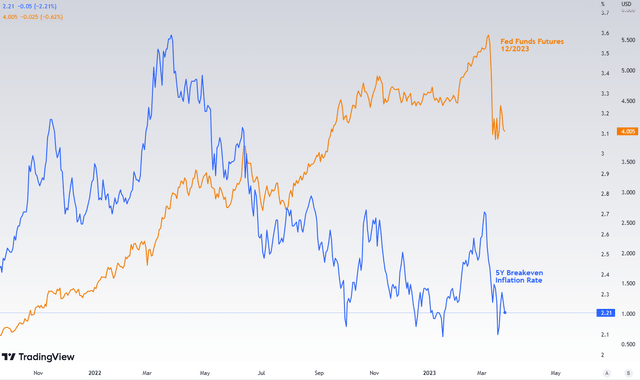

FFFR, 5Y Breakeven Inflation Rate (Author´s calculation. Tradingview.)

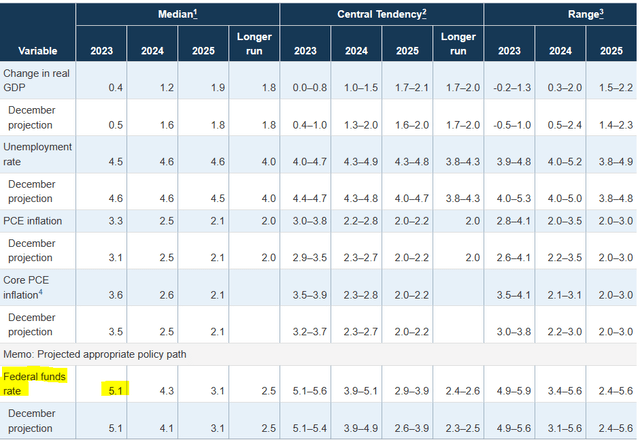

The heightened likelihood of a tail-event (if this is not the beginning of one) has dramatically reduced market expectations for future Fed rate hikes. As a result, the market anticipates rates of 4% by the end of 2023, a huge drop from the peak of 5.5% just a few weeks ago. Similar to the 5y breakeven inflation rate, which declined following the bank run. The FOMC, however, disagrees and projects the FFR to be 5.1% by the end of 2023 in contrast to the market.

FOMC projections (03/2023) (FRED)

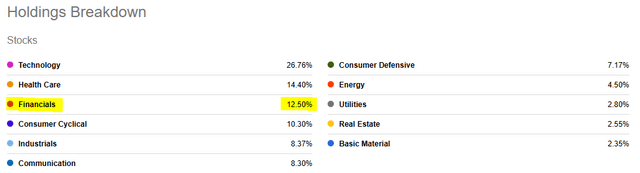

I firmly believe that it will have a major influence on the profitability of the Financial Select Sector SPDR ETF (NYSEARCA:XLF) and on SPY as a whole, given that Financials has a fairly solid 12.5% weight in SPY. In addition, liquidity issues can be resolved with the Fed's instruments, but keep in mind that this is not quantitative easing, these tools are loans, and banks must pay for it. This is not about pumping liquidity in order to stimulate the economy and reduce long-term yields. As deposits continue to be withdrawn, resolving the liquidity situation as quickly as possible is crucial. In the near future, the mere tightening of policy could have a significant impact on savings and loan delinquency.

SPY Holdings Breakdown (Seeking Alpha)

Given the current macroeconomic environment, I cannot be optimistic. The banking sector will likely stay robust, particularly large banks that are subject to more stringent regulatory frameworks. Currently, it is primarily a psychological issue, as even the greatest banks might experience significant difficulties in the event of a bank run. It is because of its business model. In addition, this event combined with additional tightening can be the cause of higher credit risk, which would have a significant impact on the SPY and other sectors. It could be affected by the continuously deteriorating position of businesses sensitive to interest rates.

I assume this situation could be resolved, but it is far too early to say with certain. We will be wiser in two to four weeks, but I see a lot more risks in the next few weeks that are in my opinion not fully priced in. There may be more pain in the medium term, but these prices are fantastic for investors in the long run. Currently, in the banking industry, stock picking and independent research play a significant role.

While there is no sign of an easing, but rather the reverse, even if we are talking about the peak rate for FY 2023, I have mentioned in prior articles that margin and EPS contractions are on the horizon, and forward EPS did not reflect this at the time. Currently, it appears that EPS are stabilizing, but I do not believe this to be the end of the EPS slide. The delayed impact of monetary policy is evident, and even if the banking industry seems to be less profitable than anticipated (despite higher interest rates), I believe we will see another decline in EPS.

S&P 500 2023 Fwd EPS (The Daily Shot. Chart from Rob Hager.)

I fervently hope that the issue will be brought under control, but the Fed and government's first responsibility is to convince the people that there is no threat. If another percentage of regional banks were to fail, the psychological impact on the financial system would be far more damaging than the risk of contagion (since small banks do not have such large exposures). From this perspective, I am bearish; nonetheless, there are and will be a multitude of ripe opportunities for further research.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.