Ligand Pharmaceuticals: Expanding Royalty Portfolio And Strong Drug Pipeline

Summary

- Ligand’s strategy of providing development capital to high-quality assets with capable teams is paying off, as evidenced by the recent positive developments and advancements in its product pipeline.

- Ligand Pharmaceuticals has recently announced several positive developments, including the submission of an NDA by its partner Novan for the treatment of molluscum contagiosum and the accelerated approval of Filspari.

- Ligand is entitled to receive net milestone payments and royalties on future global net product sales of sparsentan, which is the first and only non-immunosuppressive therapy approved for the treatment.

Sean Anthony Eddy

Ligand Pharmaceuticals (NASDAQ:LGND) has built an impressive portfolio of drugs and technologies for the treatment of a range of medical conditions. Its sector-leading drugs like Filspari have shown significant improvement in clinical outcomes for patients, setting the company apart from its competitors. With its recent FDA approvals and regulatory milestones, Ligand has demonstrated its ability to bring innovative drugs to market and generate significant value for its shareholders.

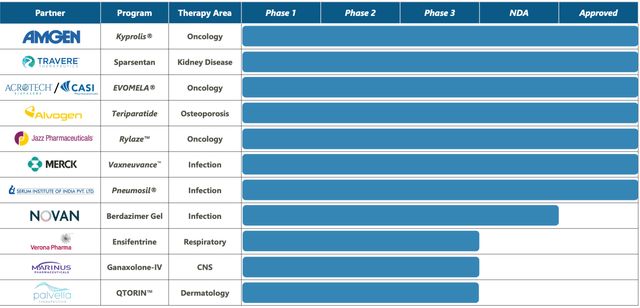

In particular, Ligand's partnerships with Novan (NASDAQ:NOVN) and Travere Therapeutics (NASDAQ: TVTX) have yielded promising results in the development of berdazimer gel and sparsentan, respectively. These drugs have the potential to be game-changers in their respective fields and could significantly improve the lives of patients suffering from skin infections and kidney diseases. Ligand's focus on building a robust royalty portfolio has been a key factor in its success, providing the company with a steady stream of revenue and allowing it to invest in the development of new drugs. The company's solid balance sheet and financials have also helped it weather market volatility and position itself for future growth.

Financial Status

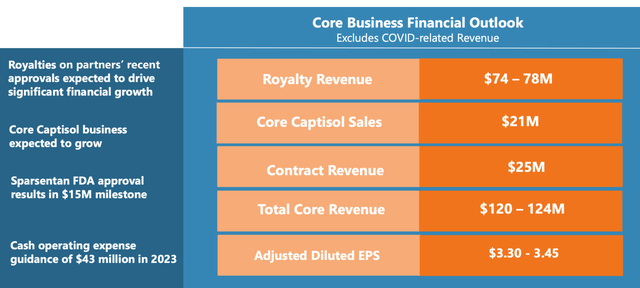

Ligand has announced total revenue of $50.4 million for Q4 2022, in contrast to $56.4 million during the same quarter in 2021. Despite a small decline, the firm's royalty performance in Q4 2022 was remarkable, reaching $22.0 million, an increase from $17.6 million in Q4 2021. This growth is primarily attributed to higher sales of medications utilizing the Pelican platform.

On the other hand, the company's primary Captisol sales reached $3.3 million in Q4 2022, a decrease from $7.1 million in Q4 2021. This reduction in sales is not a concern, however, as it resulted from a change in the timing of client purchases. Captisol sales linked to COVID-19 amounted to $23.5 million in Q4 2022, a drop from $28.3 million in Q4 2021. However, the decline in Captisol sales was counterbalanced by a rise in royalties from the Pelican platform.

The cost of Captisol for Ligand was $21.6 million in Q4 2022, an increase from $12.0 million in Q4 2021. This rise was primarily due to $9.8 million in expedited depreciation on Captisol manufacturing equipment during Q4 2022. Concurrently, research and development expenditures climbed from $8.1 million in Q4 2021 to $9.2 million in Q4 2022, mainly due to equity-based remuneration and a rise in facility-related costs.

Administrative and general expenses also increased, from $12.6 million in Q4 2021 to $31.1 million in Q4 2022. This surge was attributed to a one-time equity compensation cost related to the retirement of Ligand's former CEO and legal fees associated with the OmniAb spin-off.

Although the net loss from ongoing operations in Q4 2022 was $14.5 million, or $0.86 per share, compared to $3.2 million, or $0.19 per share, in Q4 2021, Ligand maintains a solid financial outlook; Ligand had $211.9 million in cash, cash equivalents, and short-term investments as of December 31, 2022. With a sturdy financial foundation, Ligand Pharmaceuticals is well-equipped to continue the development and distribution of specialized drugs that enhance patient outcomes.

Though there is a slight decrease in sales and a rise in expenses, the company's royalty growth and robust financial status ensure that the company will not have financing issues for the foreseeable future.

Product Overview

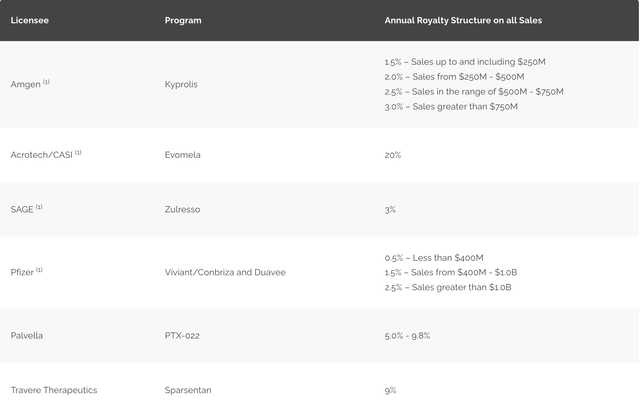

Ligand has a royalty based revenue structure for multiple drugs, including Kyprolis and Baxdela. Kyprolis, a proteasome inhibitor, addresses multiple myeloma by hindering proteasome activity. Baxdela, a fluoroquinolone antibiotic, addresses acute bacterial skin and skin structure infections by impeding critical enzymes necessary for bacterial DNA replication and transcription.

Several products are in advanced stages of development or awaiting regulatory approval within Ligand Pharmaceuticals. Sparsentan, a combined endothelin receptor and angiotensin receptor blocker, is being developed to treat focal segmental glomerulosclerosis and IgA nephropathy, both rare kidney diseases (this has just been approved; more on that later). Lasofoxifene, a selective estrogen receptor modulator, is being developed to manage postmenopausal women with osteoporosis and vulvovaginal atrophy. LGD-6972, a glucagon receptor antagonist, is being developed to address type 2 diabetes mellitus by obstructing glucagon's action, a hormone responsible for increasing blood glucose levels.

Novan Collaboration Yields Results

Ligand Pharmaceuticals has revealed that its collaborator, Novan, has filed a New Drug Application (NDA) with the FDA, seeking authorization to market berdazimer gel, 10.3%, as a topical solution for molluscum contagiosum. This NDA submission marks a significant achievement for Novan and validates Ligand's approach of broadening its royalty portfolio through providing developmental funding. If granted approval, berdazimer gel, 10.3%, would become the first topical molluscum contagiosum treatment, allowing patients to apply it themselves.

Under a development financing and royalty arrangement with Novan, Ligand may receive up to $20 million in milestone payments and tiered royalties ranging from 7% to 10% on future global sales of berdazimer gel. This news brings Novan one step closer to potentially introducing a crucial medication. The Phase 3 clinical trial evaluating berdazimer gel displayed a highly statistically significant improvement in the primary clinical endpoint, and the gel was deemed well-tolerated with only mild side effects.

Berdazimer gel has the potential to significantly alter clinical practices, as many molluscum patients currently go untreated due to a lack of FDA-approved treatment options. The ability for patients to apply the gel themselves also offers a considerable advantage over in-office procedures, making it a more appealing choice for caregivers and molluscum patients.

Filspari Receives Fast Track Approval

Ligand also announced the fast-tracked approval of Filspari, co-developed with Travere Therapeutics, aimed at treating primary IgAN, a rare kidney disorder. This accelerated approval, granted based on proteinuria reduction, marks a notable achievement for Ligand, as it could potentially enhance the lives of approximately 50,000 patients afflicted with this condition in the U.S. Ligand will receive a net $15.3 million milestone and a net royalty of 9% on future global net product sales of sparsentan as a result of the approval. While it remains uncertain whether Filspari slows kidney function decline in IgAN patients, the ongoing Phase 3 PROTECT Study should confirm clinical benefits within the next two years.

Filspari is engineered to selectively target two crucial pathways in IgAN disease progression, making it the first non-immunosuppressive therapy approved for treating this condition. Filspari was made available beginning the week of February 27, 2023, accompanied by a comprehensive patient support program throughout the treatment process. This recent advancement in the field affirms Ligand's dedication to enlarging its royalty portfolio by supplying development capital for high-quality assets.

Specific Drug Risks And Concerns

Ligand Pharmaceuticals has a large portfolio of drugs; however, the nature of the mechanisms of actions of some of these drugs has been associated with certain concerning side effects. Kyprolis, a proteasome inhibitor, may lead to oxidative stress, endoplasmic reticulum stress and cause subsequent cardiac toxicity. Baxdela, a fluoroquinolone antibiotic, may cause adverse effects on tendons, muscles, and joints as have been linked to similar antibiotics. These drugs have significant benefits but require careful monitoring and management of adverse reactions.

Sparsentan, a dual endothelin receptor and angiotensin receptor blocker, has been developed for the treatment of focal segmental glomerulosclerosis (FSGS) and IgA nephropathy. That said, there are definitely some potential long-term concerns with the drug that cannot be ignored, even though short-term safety has been demonstrated through extensive clinical trials.

Endothelin receptor antagonists (ERAS) inhibit the action of endothelin-1, a potent vasoconstrictor, while angiotensin receptor blockers (ARBs) block the angiotensin II type 1 receptor, thus reducing the vasoconstrictor and aldosterone-secreting effects of angiotensin II. Both classes of drugs are used to manage conditions such as hypertension, heart failure, and chronic kidney disease. Combining these two classes of drugs may potentiate their therapeutic effects; however, there are potential risks associated with this dual therapy.

As both ERAs and ARBs are vasodilators, their combined use may lead to excessive blood pressure reduction, potentially causing symptomatic hypotension, dizziness, and fainting. This risk may be particularly pronounced in patients with pre-existing hypotension or those concurrently taking other antihypertensive medications.

Both drug classes can cause a decrease in renal function due to their effects on renal hemodynamics. The concomitant use of ERAs and ARBs may further exacerbate renal impairment, particularly in patients with pre-existing kidney disease, leading to acute kidney injury or a decline in glomerular filtration rate (GFR).

Advantages Over Current Therapies

Current treatments for IgAN involves the use of angiotensin converting-enzyme inhibitor (ACEIs) or ARBs to control hypertension and proteinuria, as well as corticosteroids and immunosuppressive drugs in more severe cases. A dual endothelin receptor and angiotensin receptor blocker offers superior treatment as it targets multiple pathophysiological mechanisms at once. This would reduce the vasoconstrictor and pro-inflammatory actions of both angiotensin II and endothelin-1, leading to increased blood pressure control, decreased proteinuria, reduced glomerular inflammation, and slower progression of renal disease.

In addition, this combination therapy mitigates the maladaptive effects of the renin-angiotensin-aldosterone and endothelin systems. However, as stated earlier, associated risks such as hypotension, renal impairment, and hyperkalemia must be taken into account. That said, clinical trials have demonstrated, to a significant extent, the safety of sparsentan.

Conclusion

Ligand Pharmaceuticals presents a promising investment opportunity for those wishing to invest in the biopharmaceutical industry. Its impressive pipeline of drugs being developed, alongside its royalty-producing assets, provide it with numerous possibilities to benefit from the rising demand for novel medicines. Despite some inherent risk associated with pharmaceutical development, the company reduces such danger and spreads out revenue sources through strategic partnerships and collaborations.

Furthermore, Ligand stands out from rivals due to its focus on providing efficacious drugs such as Filspari which may lead to fewer adverse effects. This philosophy of prioritizing quality over quantity is indicative of their dedication to favorable patient outcomes which could result in higher market share and revenue growth. Even though risks come along with drug development, Ligand's track record of achievement and solid financial condition make it an appealing option with a bullish outlook.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.