Vital Energy's Vitality

Summary

- Vital Energy is a $724 million market cap oil and gas company in the Midland sub-basin of the Texas Permian. Net long-term debt of $1.1 billion exceeds its equity value.

- Vital Energy does not pay a dividend but has a share repurchase program and has been successfully repaying debt.

- The company’s redirected and tightly focused oil-weighting of its reserves and production make its stock interesting for capital appreciation or as an acquisition candidate.

- Looking for a portfolio of ideas like this one? Members of Econ-Based Energy Investing get exclusive access to our subscriber-only portfolios. Learn More »

Jasmin Pawlowicz

Vital Energy (NYSE:VTLE) is a small-to-medium-sized oil and gas company with operations solely in the Midland sub-basin of the vast Permian field. Formerly named Laredo Petroleum, last year it benefited from higher oil and gas prices and laser-focused operations and paid off some of its debt. This year oil prices are lower and gas prices much lower; debt of $1.1 billion outweighs the company’s market capitalization of $724 million.

Vital does not pay a dividend and is servicing high-cost debt. However, it has a share repurchase program, has acquired more oil-weighted production and assets in the liquids-rich Midland sub-basin and has paid off some of its debt from free cash flow.

The 2022 environment was good for the company: its trailing price/earnings ratio is a shocking bargain 1.1 and even the forward ratios for 2023 and 2024 don’t exceed 2.0. Yet a stock price fall coupled with a short position of over 20% suggests many investors are still skeptical, likely due to the debt load.

I own shares in VTLE and recently bought more. I recommend Vital Energy as a speculative buy to those seeking capital appreciation based on expectations of solid oil prices. Vital Energy has become more profitable during the past few precisely because of a reorientation toward oil production.

Macro

Russia’s redirection of its oil, gas, and distillate away from Europe—because of sanctions stemming from Russia’s invasion of Ukraine—has resulted in readier availability and cheaper costs for customers in India and China. Overall, the friction in energy flows—especially in Europe—is resolving for the spring.

In the US, excessive government spending led to high inflation, which led to the Federal Reserve raising interest rates, which has led to bank failures. As the US federal government signals its willingness to backstop depositors, financial anxiety has eased.

In the energy sector, there has been no change since early 2021 in US energy policy: anti-hydrocarbon and pro-renewables. The Permian basin continues to provide the best results. Companies large enough to explore internationally are doing so.

Full Year 2022 Results and Guidance

In 2022, Vital Energy reported net income of $631.5 million or $37.88/share and cash flows from operations of $830 million. Consolidated EBITDAX was $914 million.

Production averaged 35,900 barrels per day (BPD) of oil and 77,900 barrels of oil equivalent per day (BOE/D), which includes natural gas liquids and natural gas.

The company repurchased $285 million face value of term debt and $37.3 million of common stock. It divested non-operated properties for about $110 million.

For 2023, Vital Energy expects total production of about 74,000 BOE/D, of which about 35,500 BPD would be oil. It also expects to make capital expenditures of about $650 million. The company is building out its water and electrical infrastructure to support development in Howard County.

Hedges cover 61% of its full-year 2023 natural gas production and 62% of 1H23 oil production, but only 25% of 2H23 oil production.

Driftwood Acquisition

On February 14, 2023, Vital Energy announced the acquisition of oil-weighted production and inventory from Driftwood Energy for consideration of 1.58 million shares of Vital Energy common stock and $127.6 million in cash. The acquisition is set to close in early April 2023, but VTLE expects no change to its activity levels or capital budget.

Most of these assets are in Upton County. They include 11,200 net acres, mainly held by production, and 5400 BOE/D of production (63% oil). However, the annual decline rate is reported to be 50%, so the prospective value is in the acreage.

About the Midland Sub-Basin

The Spraberry formation in the six core counties of the Midland sub-basin is considered by many to be the “original West Texas oil.” Indeed, these acres are still quite oil-rich as EIA maps show. The six core counties—like ABCs for petroleum geologists—are Martin, Howard, Midland, Glasscock, Upton, and Reagan. They are illustrated below.

texascourthousetrail.com

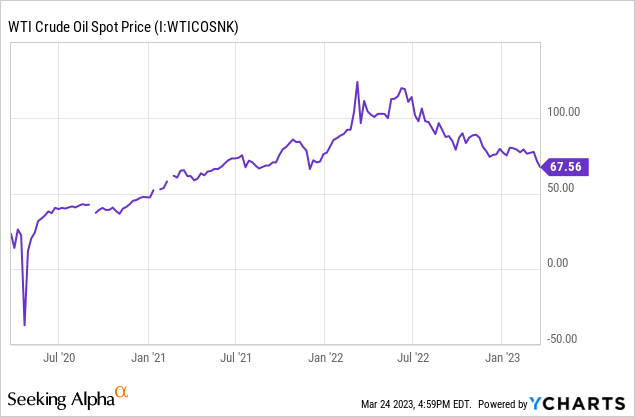

West Texas Intermediate, $/BBL

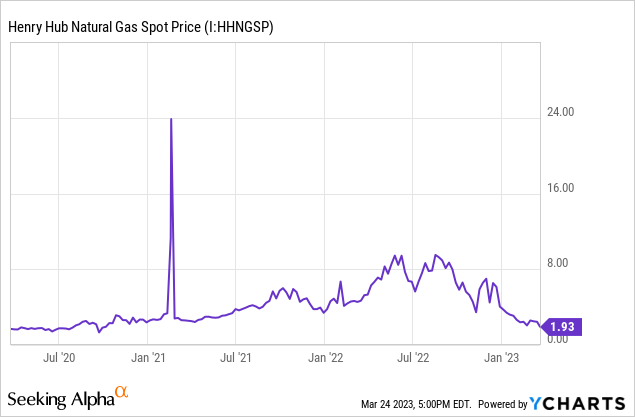

Henry Hub Gas, $/MMBTU

US Oil and Natural Gas Prices

The March 24, 2023, West Texas Intermediate oil futures price (for May 2023 delivery) is $69.27/barrel. The Henry Hub natural gas futures price for April 2023 delivery is $2.18/MMBTU.

NYMEX strip prices in future months are similar for oil but rising seasonally (summer demand, storage fill, winter) for natural gas. In general, the oil supply-demand balance is considered moderate to tightening in the second half of the year, while natural gas balance is expected to remain fairly loose well into 2024.

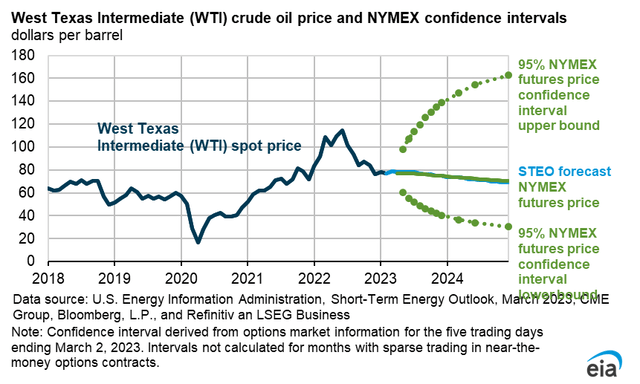

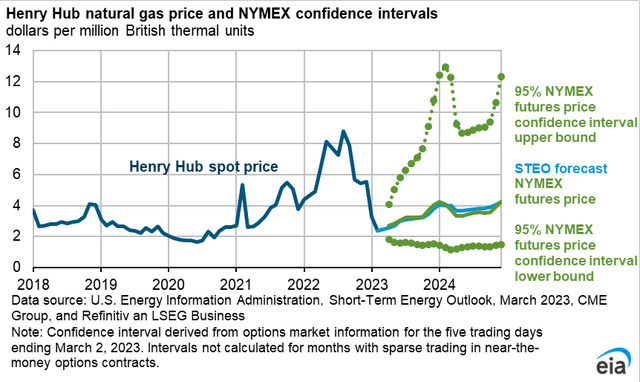

The graphs below show the EIA's 5-95 confidence intervals around future oil and gas prices.

Energy Information Administration Energy Information Administration

Reserves

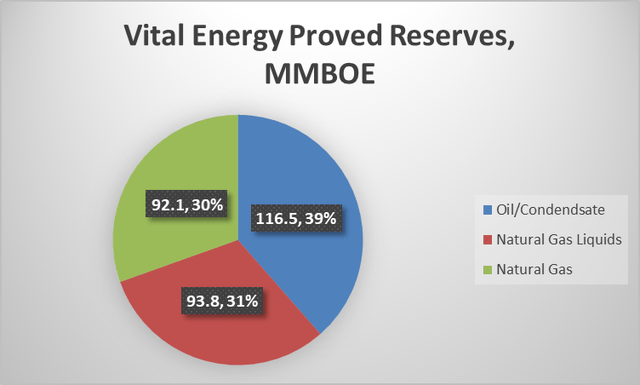

According to Vital Energy’s 10-K, on December 31, 2022, it had an estimated 302.3 million BOE of proved reserves, of which 74% were proved developed, with an oil percentage of 39%.

Vital Energy and its reserve estimation firm calculate reserve value both before- and after-tax. The pre-tax PV-10 value of proved reserves at December 31, 2022 was $5.5 billion, using SEC benchmark prices of $90.15/barrel for oil and $5.20/MMBTU for natural gas, both higher than current prices. Using the same benchmark prices, the after-tax “standardized” value of discounted future net cash flows was $4.8 billion.

Starks Energy Economics, LLC and Vital Energy

Competitors

Vital Energy is headquartered in Tulsa, Oklahoma. As a Midland sub-basin producer, it competes with all Texas and New Mexico Permian producers, e.g. most US shale companies. A few competitors in the Midland sub-basin are Earthstone Energy (ESTE), Diamondback Energy (FANG), and Occidental (OXY). VTLE also has significant competition from private companies.

Competition extends from hiring executives and professionals, to competing for service contractors, equipment, and takeaway capacity, to selling oil, NGLs, and natural gas.

Investors should consider whether a company with Midland, Texas operations and a Tulsa, Oklahoma headquarters is at an operational disadvantage compared to in-basin competitors whose headquarters are in Houston or Midland.

Governance

At March 1, 2023, Institutional Shareholder Services ranks Vital Energy’s overall governance as 4, with sub-scores of audit (3), board (2), shareholder rights (5), and compensation (5). In this measurement, a score of 1 represents lower governance risk and a score of 10 represents higher governance risk.

Insiders own 6.7% of the stock. At February 28, 2023, a high 20.6% of the floated stock was shorted.

Beta (stock volatility relative to the market) is a very high 3.36.

At December 30, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were BlackRock (15.6%), State Street (14.3%), Vanguard (6.7%), Dimensional Fund Advisors (3.4%), and Invesco (2.8%).

BlackRock, State Street, and Invesco are signatories to the Net Zero Asset Managers, a group that as of December 31, 2022, manages $59 trillion in assets in assets worldwide and which (despite constrained energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Countering this, the US state of Texas has developed a blacklist of companies and funds prohibited from doing business with the state, its state pension funds, and local governments. Other than BlackRock, most companies on the list are European. However, the list of funds (350) is lengthier, and includes, for example, funds managed by US companies Goldman Sachs and JP Morgan.

Financial and Stock Highlights

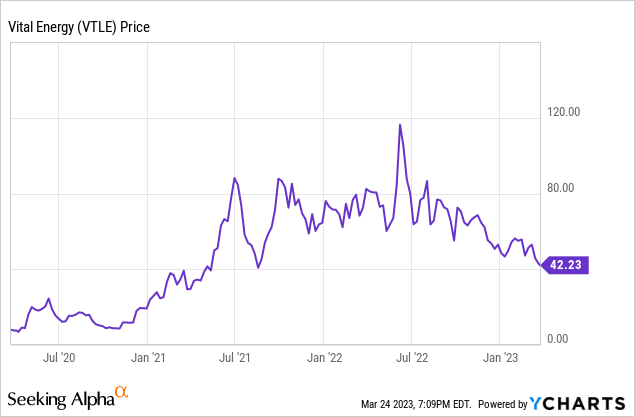

Vital Energy’s market capitalization is $724 million at a March 24, 2023, stock closing price of $42.24/share. This is down considerably from the $1.32 billion market cap of my last review, when the company was still called Laredo Petroleum.

The 52-week price range is $39.88-$120.86 per share, so the closing price is 35% of the high and 54% of the average one-year target price of $78.88/share. Put another way, there is over 85% upside from the current price to the one-year target.

Trailing twelve months’ (TTM) returns on assets and equity were an excellent 25.4% and 77.8% respectively.

Vital Energy’s TTM earnings per share (EPS) is $36.93, giving it a trailing price-earnings ratio of an astonishing 1.1. The average of analysts predicted full-year 2023 and 2024 EPS are $22.87 and $21.98, respectively, for truly bargain price/earnings ratio of 1.85-1.92.

TTM operating cash flow and levered free cash flow are $830 million and $216 million, respectively.

Vital Energy does not pay a dividend, but it has implemented a share repurchase program.

At December 31, 2022, the company had $1.62 billion in liabilities, including $1.11 billion of net long-term debt, and $2.73 billion in assets. This gives VTLE a liability-to-asset ratio of 59% (down from 84%) but a nosebleed long-term debt to market capitalization ratio of 157%.

Per the company’s 10-K, debt includes the following:

*$456 million of 9.5% notes maturing January 2025

*$300 million of 10.125% notes maturing January 2028

*$298 million of 7.75% notes maturing January 2029

*$70 million of 6.9% senior secured credit line.

Average analyst rating for is 2.7, or “hold,” leaning somewhat toward “buy” from nine analysts. At least one analyst considers the stock to be significantly undervalued.

Notes on Valuation

VTLE’s book value per share of $67.73 is about 50% over its market price, implying negative investor sentiment.

The company’s enterprise value is $1.8 billion and the pre-tax PV-10 value of its reserves is $5.5 billion; the after-tax PV-10 value is $4.8 billion. Market cap is $724 million.

The ratio of enterprise value to EBITDA is an extreme bargain 1.3 (far less than maximum 10.0) and the ratio of net long-term debt to EBITDA is a decent 0.8.

Market capitalization to production is cheap at $9,300/flowing BOE and $20,200/flowing barrel of oil.

Positive and Negative Risks

Vital Energy’s biggest positive and negative risk is simply future oil and gas prices. It could face limits on oil and gas takeaway capacity. Most especially, due to significant nearby earthquakes, it could face limits on drilling, water disposal, and higher costs. And, since oil is a global commodity, Midland sub-basin oil competes with that from every other basin.

Inflation has increased operating and financing costs.

Other risks are political and regulatory—particularly with the Biden administration, banks, and several states taking a no-hydrocarbons posture, keen to increase production costs in the near term and eliminate US oil and gas production in the long term.

Recommendations

I do not recommend Vital Energy stock to dividend hunters.

I do recommend the company to speculative investors interested in potential capital appreciation from a focused Midland oil and gas producer and I have added to my share position.

Upside to the one-year target from the current price is +85%.

The low (cheap) current and forward price/earnings ratios are remarkable; however, capital appreciation is the only avenue for payback, and even there, investors may be stymied due to the sizable short interest.

Vital Energy’s strategy of adding oil production is reflected in its now-larger $4.8 billion after-tax PV-10 reserve value.

Equity investors should obviously be aware debt is always paid first, and Vital Energy has over a billion dollars in long-term, relatively costly debt, $400 million more than its market capitalization. Of necessity, this is ameliorated by the required hedge program.

Ironically, the company is better off having gotten the debt months and years earlier when it was less expensive than it would be now.

While the $4.8 billion of reserve value was calculated at higher-than-current prices, assuming the Driftwood acquisition closes, it will be accretive to value.

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.

This article was written by

Do you want to understand and invest in volatile energy markets? We bring fundamentals-based insights to oil, gas, utilities, renewables, and gasoline companies for real-world investors.

Disclosure: I/we have a beneficial long position in the shares of VTLE, ESTE, FANG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.