UiPath: It Has The Potential To Have A Very Deep Moat

Summary

- The fall in UiPath's share price suggests that the company is reasonably valued in terms of its potential.

- Despite a challenging environment in 2022, they still made good progress in their business.

- As they have limited downside but huge upside potential, I think this could be an interesting long-term play.

Funtap

Thesis

I believe UiPath (NYSE:PATH) has the potential to build a strong competitive advantage in its market, which would lead to market-beating returns over a 10-year period. The sharp fall in PATH stock price over the past year has resulted in a more reasonable share price. If you are comfortable with a risky investment that could deliver market-beating results, this could be of interest to you.

Analysis

FY 2023 Presentation

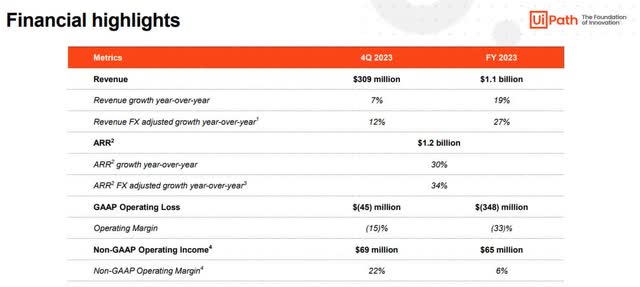

UiPath has released its Q4 and FY2023 results and they were quite good. Even without the FX adjustments, they grew revenue by 19% and ARR by 30% in a tough macroeconomic environment. One very positive thing was the non-GAAP margin improvement in Q4, which shows that they are on a good path to profitability. Guidance for FY2024 is for an improvement of 350 basis points to an operating margin of 9.5%. The long-term target is an operating margin of ~20%.

FY 2023 Presentation

Their normally conservative guidance also said that the already strong gross margins would improve further and that all quarters would be adj FCF positive. Gross margins of 83% in 2023, a 2% improvement on 2022, are expected to rise to 84% next year. The reduction in the operating loss is very likely to continue, so there is a good chance that the company will be able to make a profit in the near future.

FY 2023 Presentation

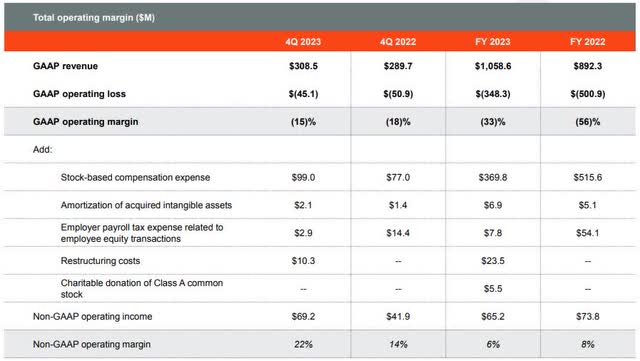

A big criticism was the heavy use of SBC in the past and as you can see they are reducing that as well and they said they want to manage it so that the dilution will be 'only' 3-4% yoy.

FY 2023 Presentation

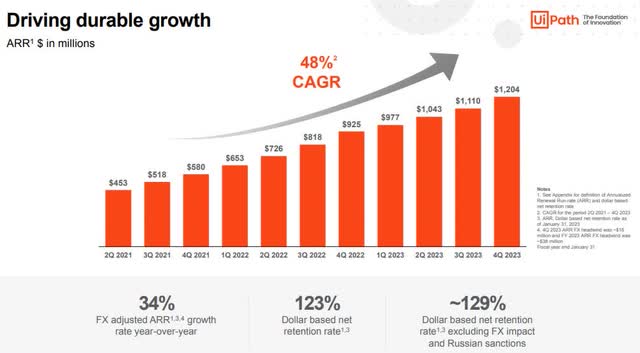

Dollar net retention and ARR look really good and hopefully will continue to grow as they have in the past. In the last earnings call, management said they are very optimistic about the future as they believe they are well positioned, particularly in the AI segment.

FY 2023 Presentation

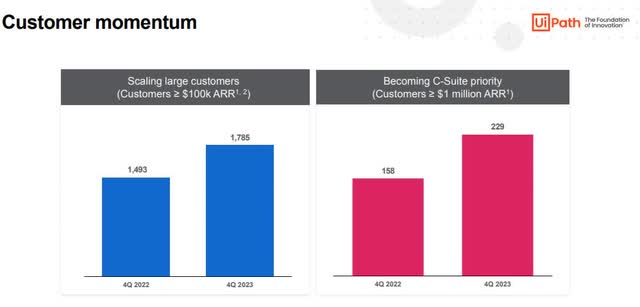

Customer momentum with large and C-suite customers is also very positive. All in all, it has been a good year for UiPath, despite the challenging situation.

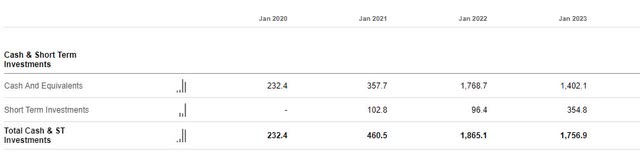

Seeking Alpha Financials Tab

A big downside protection is the total cash position of ~1.8bn combined with no debt, which is nice, especially with rising interest rates. This, combined with the potential to be FCF positive in the near future, should really help even in tough times. The current market cap is only 5 times the cash position. And despite other companies with similar market caps and growth potential, they are not burning cash as fast.

Market and Competition

UiPath has a long-term focus and they stress that they want to build a generational business. As a result, they have moved from being an RPA company to being more of a business automation platform.

Despite this, they have been named a leader in the RPA space by Forrester Research. Their advantage over the competition is that they can serve a broader market with their platform, as they plan to discover through mining, then automate and finally operate. All this in one platform as opposed to using several different vendors for all the tasks.

At the 25th Needham Growth Conference, they said that the TAM was 93 billion and that they only had a tiny fraction of that at the moment and saw a lot of growth potential. As they do a lot of AI and machine learning, they see a big opportunity because they have a lot of data that they can use because they know how people use things and what they want to do with the information.

A big question now is how OpenAI and other language models will develop and how they will be used. UiPath's valuation also raises the possibility that some larger companies will buy it. An interesting company in an area that UiPath may disrupt is WNS (WNS), which operates in the BPO market. But they are also investing in AI / ML and could be a competitor in the future.

Conclusion

By focusing on SaaS and cloud, there is potential for cost savings which, combined with increased revenues, could lead to significant future profits. But they are operating in a market that could change quickly. Nevertheless, they have a very strong potential to deliver real value to their customers with their product. There is a big opportunity to create a big competitive advantage by being mission critical, because their technology could be so much better than the competition's, and customers could really become dependent on it after using it for a while.

So I think UiPath is one of those companies that has downside protection because of its strong balance sheet, but also has the potential to deliver really strong returns over the next 10 years. Their upside potential is huge. There is no way of predicting that they will be 100% successful, but if they achieve what their potential is, they could be a 10x over the next 10 years.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PATH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.