Buy Delta Air Lines: Unjustified Sell-Off

Summary

- The recent decline in Delta's stock is likely unjustified.

- Delta Air Lines and the airline industry are collectively forecasting a strong travel demand for 2023.

- In times when consumers are preferring experiences over goods, consumers' sentiments are improving while oil prices are decreasing.

Sundry Photography

Introduction

Delta Air Lines (NYSE:DAL) stock has been severely punished in the past few days. From its recent highs, the stock declined by almost 30%, and I believe this is unjustified and only creates opportunities for investors. The 2023 travel demand forecast coming from Delta, other airlines, and external analysts all expect a robust demand environment despite the macroeconomic concerns. Further, with favorable consumer sentiment and an oil price environment, I strongly believe that the dip in Delta Air Lines stock creates the buy a dip opportunity.

Delta's View

Delta Air Lines, in the company's most recent earnings report and JPMorgan's Industrial Conference, have laid out an extremely positive view of the air travel environment. Delta's management team, during the conference held on March 14th, said that their "demand is getting stronger" and gave an example by saying that "in the last 30 days, we've had the 10 highest sales days in our company's history." Further, the company explained that the airline industry, historically, made up on average about 1.3-1.4% of the GDP. Still, with increasing consumer demand for travel and services over goods, the company expects to "overcorrect on that historical relationship of 1.3% to 1.4% of GDP" because "airfare and air travel continue to be right at the top of the list as a priority for consumers." The company also mentions the demand to be strong "over the course of the next several years, not just the next several quarters." Thus, I believe the narrative is clear. Delta Air Lines despite the questionable macroeconomic conditions today is seeing strong demands.

If the positive notes only came from Delta from the entire airline industry, the company's view of the industry may be questioned; however, that is not the case. American Airlines (AAL) and United Airlines (UAL) have also hinted at a strong demand environment for 2023.

Starting with American Airlines, the company during the JPMorgan conference has had a positive tone for 2023 as well pointing out that the company "continue[s] to be in a decent pricing" environment due to the "mismatch between supply and demand." For the entirety of 2023, the company said that they will be "reaffirming [the company's] guide on both the first quarter and for the year as a whole." Moving on to United Airlines, the company downgraded its first-quarter forecast; however, the company has confirmed that "the outlook looks really strong" for the entirety of 2023 maintaining their guidance. Therefore, because Delta Air Lines' claim of strong demand translated across the industry players, I believe it is reasonable to assume that the airline industry will continue to experience a strong demand environment.

Objective Data

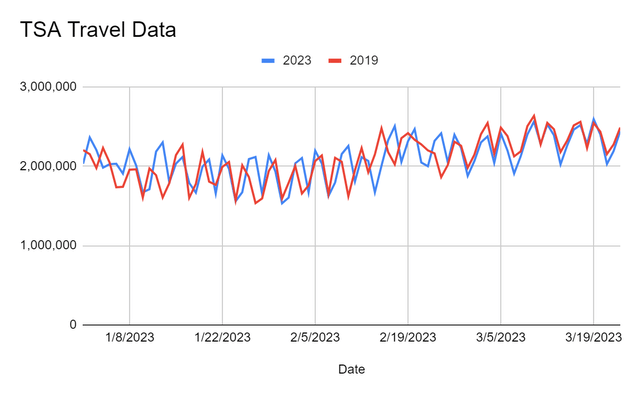

The objective data from TSA also tell a similar picture to Delta Airline's forecast. As the chart below shows, from the beginning of the year, daily travel numbers recorded by TSA in 2023 in line with pre-pandemic, 2019, levels show that there have been no signs of declining demand despite fears of slower demand from the macroeconomic conditions.

[Source]

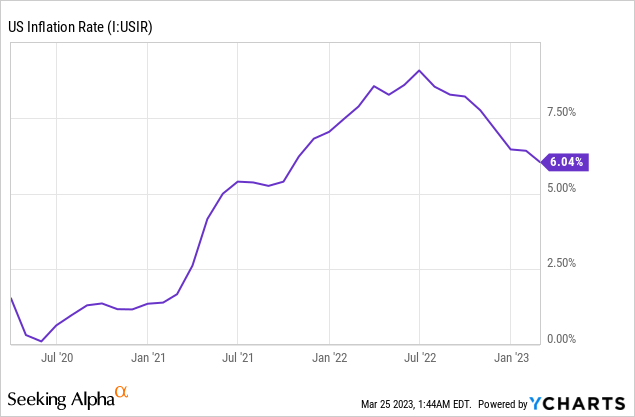

I believe this data to be strong. As the chart below shows, the United States' inflation rate has been extremely strong, which has led to consumer sentiment during this period being significantly lower than in pre-pandemic times. Yet, as the consumers' taste for travel and experiences far outpaced their preference for goods, spending has shifted in a favorable environment for Delta Air Lines. Thus, even with continued high inflation and macroeconomic concerns, I continue to believe that consumers will put traveling and experiences toward the top of their spending priority.

[Chart created by author using YCharts]

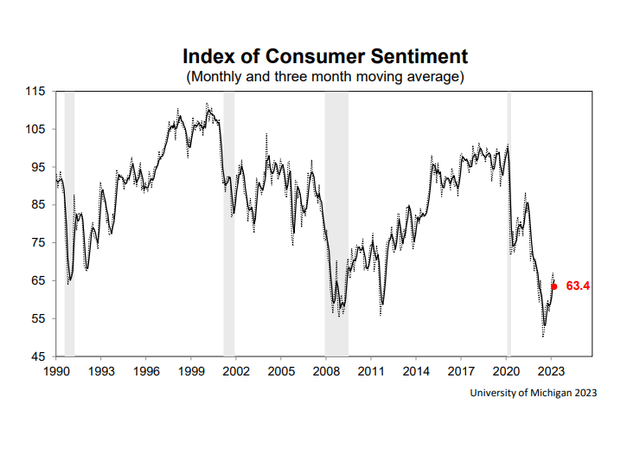

Further, as the picture below shows, consumer sentiment, in recent months, has been recovering from its trough as inflation continued its downward trend showcasing the resilience of consumers during the current economic conditions.

[Source]

External Factors

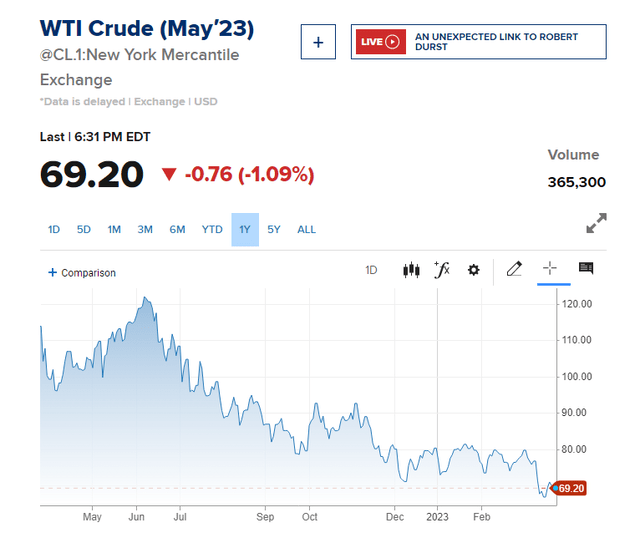

While Delta Air Lines is forecasting a strong 2023 and consumer sentiments are recovering from their record lows, the global oil price had been trending downward. In the International Energy Agency's March 2023 Oil Market Report, the agency says that the price movement is due to "cross-currents of supply outstripping still-lacklustre demand," and as a result, stocks have been "building to levels not seen in 18 months." The agency estimates that this trend will continue throughout the first half of 2023 creating a favorable environment for Delta Air Lines. However, with China's reopening expected to come in full swing by the second half of 2023, the agency estimates that the oil price may start to tick back up toward the end of 2023.

[Source]

Delta Air Lines

With a strong demand environment, increasing consumer sentiment, and declining oil prices, I believe it is reasonable to be bullish on the airline industry. But, within the industry, as I believe Delta Air Lines is the strongest player, I believe Delta Air Lines is a buy.

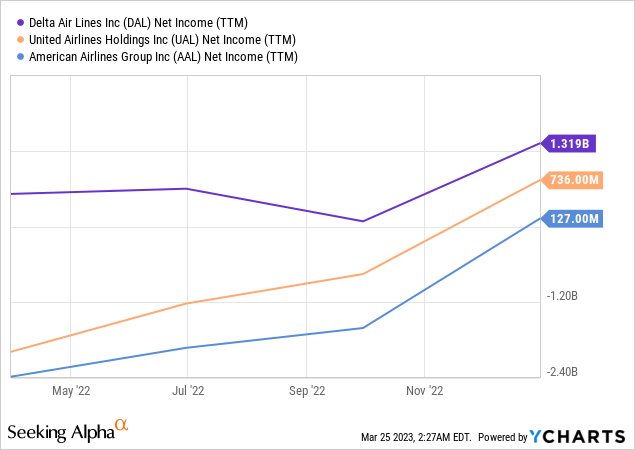

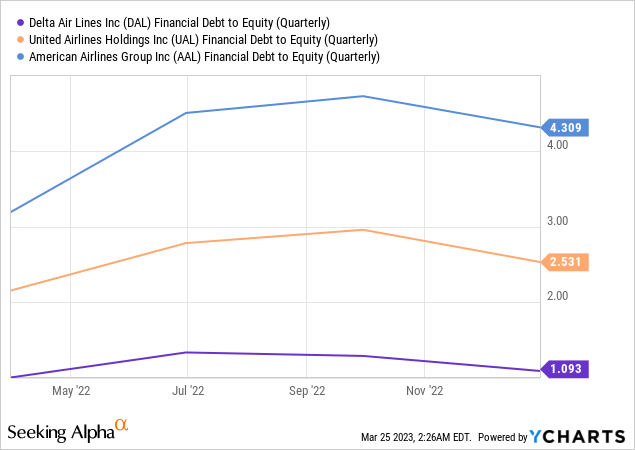

In terms of both operational strength and balance sheet, Delta Air Lines far exceeds its competitors. Looking at the chart below, Delta Air Lines, by far, has the lowest debt-to-equity ratio showcasing its balance sheet strength. Even in operational excellence, the chart below shows that Delta's net income far exceeds its competitors. In fact, Delta's net income is nearly double that of United Airlines and about 10 times bigger than American's net income.

[Charts created by author using YCharts]

Risk to Thesis

With the Federal Reserve's effort to tame inflation while keeping the economy afloat, the macroeconomic conditions can deteriorate greatly pressuring the economy into some magnitude of a recession. In this scenario, it may be likely that consumers cut the majority of their discretionary spending including travel to cut costs and shore up their financials.

Summary

I believe the current demand environment for Delta Air Lines is strong, and the recent fall in the company's stock price, therefore, is unwarranted. All major airlines are forecasting a strong 2023 as TSA numbers, to date, support these forecasts. What's more, consumer sentiment, in times when consumers are shifting priority to experiences over goods, is starting to see an increase from its lows potentially justifying the airlines' bright future outlooks. Thus, as the oil price is showing a decline while travel demand is strong, I strongly believe that Delta Air Lines stock is a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DAL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.