Nordea Bank: Robust, Profitable And Undervalued

Summary

- Nordea is a Finnish bank which serves personal and business clients across Finland, Sweden, Denmark and Norway.

- The bank is the largest in Northern Europe with a strong reputation and diversified set of income streams driving a wide economic moat.

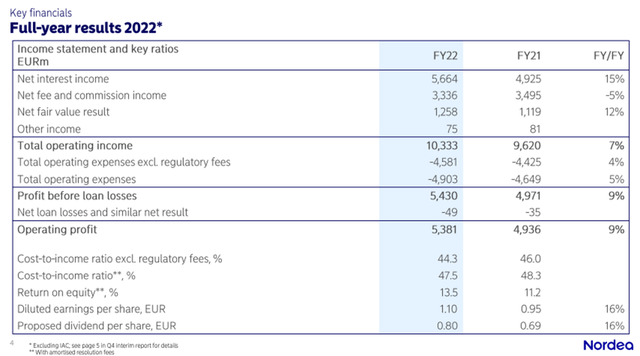

- Increasing interest rates means Nordea is set to generate an additional €1B in NII throughout FY23.

- Current valuation provides just enough room for potential value-oriented investment thesis.

- Potential for further price drops towards $9/share would warrant Buy rating being changed to Strong Buy.

Lev Karavanov/iStock via Getty Images

Investment Thesis

Nordea Bank Abp (OTCPK:NRDBY) is a Finnish bank which provides customers across the Scandinavian and Northern European countries with a market-leading banking experience.

A healthy and diversified set of income streams combined with a client-oriented business model has allowed Nordea to become the biggest banking provider in northern Europe.

The high interest rate environment present in Europe due to ECB interest rate hikes has left the company with huge NII growth and a very healthy looking FY23/24.

Even amidst the current banking turmoil, Nordea looks like a solid bank which is set to benefit from the current macroeconomic environment. Shareholder value generation looks like a real possibility throughout 2023.

Company Background

Nordea Bank is a European financial services group operating in northern Europe across the Scandinavian countries and based in Helsinki, Finland. The bank has been formed through a multitude of mergers between Finnish, Swedish, Danish and Norwegian banks which culminated in 2001 to form Nordea.

The bank serves approximately 10 million household customers and 600,000 corporate customers across 320 branches and call centers. Nordea has the largest distribution network in the Nordic region and is a market leader in online and mobile banking platform solutions.

Nordea is a refreshingly transparent bank who is devoted to ensuring customers and shareholders can enjoy a superior experience with the bank. Clear and conservative fiscal objectives combined with a strong shareholder base means Nordea stands out in the European banking scene.

A fundamental company analysis and intrinsic valuation must be completed to fully understand what sort of investment opportunity may lie in this unique Nordic bank for value-oriented investors.

Economic Moat – In Depth Analysis

Nordea has a wide economic moat in the Nordic banking environment thanks to their large scale and diversified operations and through the provision of a consistently high-quality service to clients resulting in a robust Nordic franchise.

Fundamentally, Nordea is the largest and most established provider of consumer and enterprise-oriented banking solutions in Northern Europe, particularly across the Scandinavian and Finnish markets.

With over €570B in AUM, the bank is still a hefty €50B ahead of their main rivals Danske Bank. Nordea’s consistent AUM growth rates suggest this market-leading position is unlikely to change in the short- to mid-term.

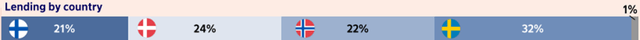

Furthermore, Nordea is well diversified across the Northern European countries with most of their lending being relatively evenly spread across Sweden, Denmark, Norway and Finland. When compared proportionally to the total populations in these nations, Finland has the highest concentration of Nordea customers.

I believe this geographically diverse consumer base creates for some economic moatiness due to the increased potential for market penetration the company holds in these markets. A similar small source of moatiness arises from Nordea being the largest bank, as it no doubt will act as a further draw for many consumers, particularly in our current times of banking system instability.

Nordea has an equally diverse portfolio of assets with the majority of their incomes being derived from mortgages and corporate clients. Nordea also assures us that only around 8% of their income is negatively impacted by the higher energy costs, inflation and lower disposable incomes caused by the current difficult macroeconomic situations facing most of the world’s countries.

The bank has created a business model which focuses on deriving an almost equal portion of incomes from Net Interest Income (NII) and from Net Fee and Commission Income (NFCI). This allows the bank to distance themselves from being solely reliant on NII and increases the stability of their revenue streams during times of fiscal uncertainty or economic decline.

The bank’s fundamentally strong and fiscally diversified business model creates for a small economic moat thanks to the stability and robustness these factors offer Nordea’s consumers.

Nordea also derives a not-inconsequential economic moat from their customer-oriented approach to business which focuses on creating the best omnichannel customer experience in the Nordics.

In FY21, Nordea’s drive towards increased customer satisfaction led to a reduction in customer complaints by 9%, down 41% compared to FY17. The increased levels of customer activity in their digital and in-person product delivery metrics suggests the banks omnichannel model is creating the desired effect of more customer satisfaction.

A push towards a more comprehensive digital services platform should allow Nordea to remain ahead of their rivals when it comes to mobile banking solutions. This could allow the bank to increase the appeal of their services to a more youthful market segment thus further driving the growth of their customer base in the future.

Overall, it is clear that Nordea boasts a varied and robust product portfolio which targets multiple different sets of consumers, enterprise clients and market demographics. I believe Nordea holds a wide economic moat (in the context of the Nordic banking environment) which provides the company with multiple tangible competitive advantages when analyzed on a 10 year timeframe.

It is important to note that on an absolute scale, Nordea has a narrow economic moat due to the bank’s relatively localized nature and globally miniscule scale of operations. This of course does not reduce their influence in the Nordics, but is worth keeping in mind when considering investment opportunities as a whole.

Nordea offers a good exposure to the European localized banking environment and should naturally be considered on this scale primarily.

Financial Situation

Nordea has been a largely profitable bank for the last two decades. Consistent 5Y net margins of 30.42% combined with a very low financial leverage ratio of 4.8% (Jan 2022 - Dec 2022) means the bank significantly outperforms many of its much larger, EU and U.S. counterparts.

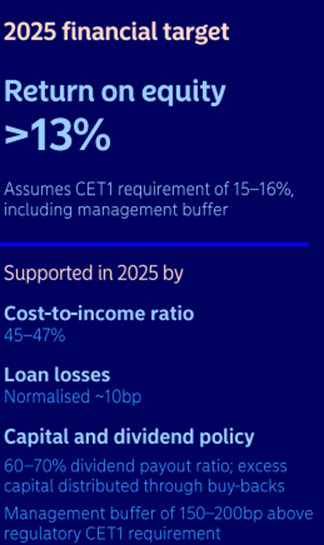

The bank has outlined four primary fiscal targets to be achieved and maintained through to 2025 which should allow Nordea to remain fiscally competitive.

Nordea Full-Year 2022 Report

A 15.9% ROE for full-year 2022 combined with EPS being up 31% illustrates how profitable the last year has been for the Nordic bank. This ROE performance greatly exceeds their planned >13% target for 2025 which most likely will lead to an even more optimistic outlook for the future.

Nordea’s management has indicated that ROEs of over 13% could be on the horizon for the bank during the FY23 year.

The bank’s cost-to-income ratio has improved hugely over the past four years rising to 47.5% in FY22, just shy of their desired 45-47% target.

Similar positive movement towards these ambitious FY25 targets has also been seen in the normalized loan losses which have dropped to a new low of 59M (7bp) compared to their 10bp target.

The final objective to see a 60-70% dividend payout ratio with excess capital being distributed through buy-backs is incredibly welcomed news to investors. This represents a buffer of 150-200bp above the ECB’s supranational regulatory CET1 requirements.

This high dividend payout ratio has left Nordea yielding shareholders an outstanding current TTM dividend yield of 14.40% with an equally impressive 4 year average of 10.90%. While 2023’s dividend is expected to drop to around 7-8%, this is still outstanding and a fantastic return for investors.

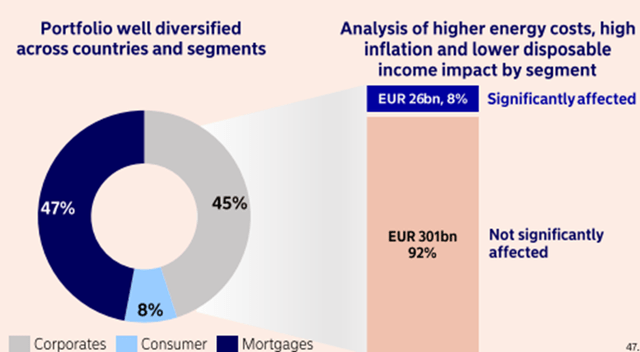

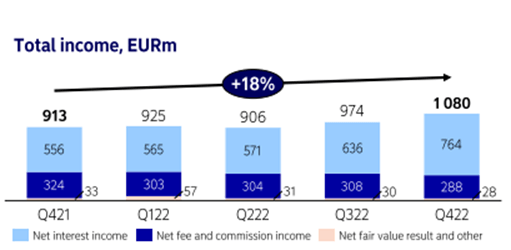

Nordea had a very strong FY22 thanks to the increasingly tight interest rate environment present in Europe due to the ECB’s continued rate hikes. These factors have seen Nordea’s NII increase 15% compared to FY21 with total operating income having increased 7%.

Lending volume growth was primarily driven by corporate lending (up 9%) with mortgages also up 3% compared to FY21.

Operating profits also grew 9% in FY22 with diluted EPS increased a whopping 16% to €1.10/share.

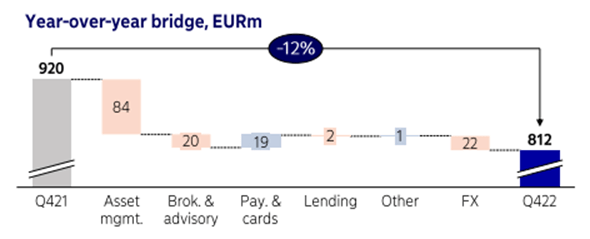

The bank saw a small decline in their NFCI due to a contraction in asset management, brokerage and advisory incomes. These were primarily driven by customer activity being negatively impacted by unfavorable macroeconomic market conditions.

However, to better support their customers, Nordea has pivoted to offering more holistic expert advice to help customers manage the rising inters rates and high inflation. The increase provision of such services should see some positive impact on the bank’s NFCI during 2023.

Nordea Full-Year 2022 Report

Savings fees represented the biggest component of the 5% NFCI decrease due to total AUM decreasing by 13%. Nonetheless, the company recorded strong 19bp growths in payment and card incomes illustrating their net inflows from internal revenue channels.

Unfavorable FX environments also resulted in a further 22bp impact on NFCI for FY22.

While this decrease in NFCI is not exactly what investors would like to see, it’s limited nature (particularly when considering the incredibly pessimistic and negative macroeconomic market environment) compared to the increase in NII means overall business operations remain strong.

The growth seen within their internal channels also suggests Nordea’s fundamental approach to doing business is sound and illustrates the exceptional abilities of its management to tackle tricky external factors.

Nordea Full-Year 2022 Report

The banks Personal Banking segment saw higher NII driven by increased deposit income and higher lending volumes. Total income was up 18% for the market with along with a 2% increase in mortgage market share growing amid a muted Nordic market environment.

A whopping 42% YoY increase in personal banking income was seen in the Finnish markets thanks to a 98% NII increase driven by mortgage and deposit volume growth as well as improved deposit margins.

This illustrates the aforementioned draw of Nordea’s customer-centric franchise for consumers thus buttressing the hypothesis that their reputation creates an economic moat for the firm.

The personal banking segment also saw cost-to-income ratios improve down to 47% compared to 51% in Q1 FY21.

Nordea Full-Year 2022 Report

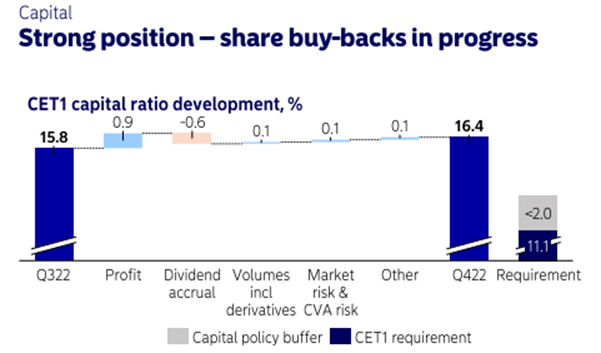

Nordea’s capital position remains strong with their third share buy-back programme having only just been completed on the 17.03.2023. This concluded a scheme repurchasing 150,069,276 of its own shares (FI4000297767) at an average price per share of €9.99.

The ECB has also just approved a further €1.0B buy-back programme which is expected to be initiated after the 2023 Annual General Meeting.

The expected interest rate hikes in 2023 should increase NII by another €1.1-1.5B. However, the actual pass-through will vary between account types and countries as well as throughout the entire rate hike cycle.

Nordea Full-Year 2022 Report

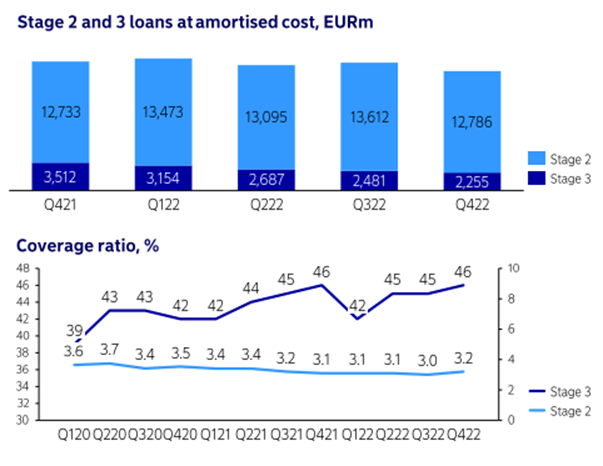

Nordea also saw stage 2 loans decrease 6% quarter-on-quarter with stage 3 impaired loans further reduced to just 0.81%. The coverage ratio of the remaining Stage 3 portfolio increased to 46% while overall credit quality remained stable and strong. These rates are incredibly low compared to many competitors including that of Danske Bank’s 2.8%.

Seeking Alpha | NRDBY | Profitability

The solid profit generating ability held by Nordea earns the company an A+ Profitability rating according to Seeking Alpha’s Quant. I believe this is a relatively representative snapshot depiction.

Nordea’s fundamentally low leverage combined with an overall conservative management style means the bank faces little liquidity risk even in today’s uncertain banking environment. Fitch affirms an AA- Long-term IDR for Nordea; the outlook is stable.

Overall, it is clear to see that Nordea is a very well organization with a key focus on profitability, stability and customer service. These three business drivers have resulted in great results since the pandemic which have further been spurred by the high interest rate environment being pursued by the ECB.

Valuation

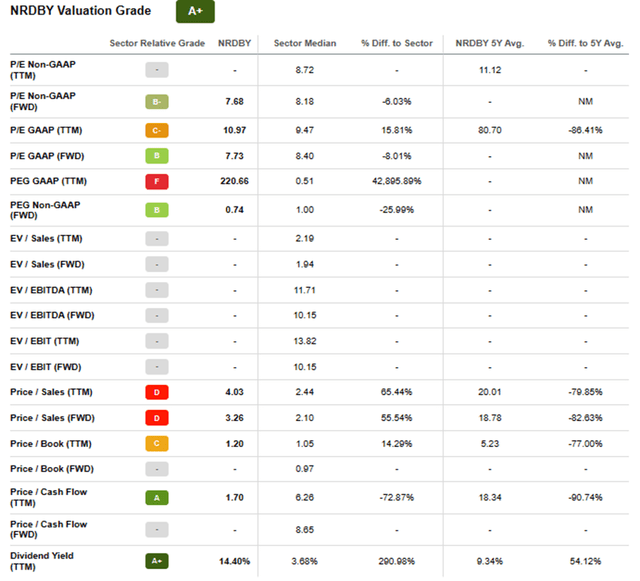

Seeking Alpha | NRDBY | Valuation

Seeking Alpha’s Quant has assigned Nordea with an A+ Valuation rating. While the outlook for 2023 is positive, it may be difficult to argue such an undervaluation from an absolute perspective.

The firm is currently trading at a P/E GAAP FWD ratio of 7.73 and a P/CF TTM ratio of 1.70. Furthermore, when considered against a Price/Book ratio of 1.20, the possibility of an undervaluation being present is significant.

Seeking Alpha | NRDBY | Summary Chart

From an absolute perspective, Nordea shares are relatively pricey at their current $11.04 position. This price point is only $3 away from their historic highs of $14.00.

While this makes shares look quite pricey, I am not sure the full story is being told here either. Nordea has only been around in its current form during primarily low-interest rate times. The current high-interest rate environment combined with a solid 2023 and 2024 outlook suggests significant EPS and incomes are on the horizon for the Nordic bank.

By accomplishing a simple financial valuation based on the calculation below and using the last four quarter total average EPS of $0.86 a conservative r value of 0.04 (4%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for Nordea of $14.00.

When using this conservative CAGR value for r, Nordea appears to be under-valued by a not insignificant 22%. A slightly more optimistic CAGR value of 0.06 (6%) leaves Nordea being valued at around the $18 mark, 37% more than its current valuations.

The Value Corner

Therefore, I believe Nordea is currently sitting somewhere between undervalued and deep-value territory. While comparison to its historic share price suggests the stock is pricey, the current market environments are fundamentally different to those experienced in the past.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and the ability of the global banking systems to avoid mass contagion and negative market sentiments leading to unfairly low valuations for more stable and reputable establishments.

In the long term (2-4 years) I fully expect their position as a leader in the Nordic banking environment to become even stronger. Their unique product offerings combined with solid franchise-power and stable fiscal objectives mean Nordea is set to deliver great results for shareholders.

The current undervaluation present in the bank suggests building a position from a deep-value oriented perspective could be a real possibility. If share prices drop another $2-$3, a no-brainer fat-pitch case would be present.

Risks Facing Nordea

Nordea faces risk from a few different perspectives with the most notable threats arising from low-interest rate environments and a reducing consumer base.

Nordea relies primarily on NII to generate revenues, profits and shareholder value. While the short- to mid-term future looks to be one of continued rate hikes and a subsequent high rate plateau for at least one to two years, the threat that the ECB changes towards expansionary monetary policy (particularly in the face of a recession) is a real possibility.

The bank also faces a competitive threat from it’s Nordic counterparts who could begin to erode the banks established consumer base. While Nordea absolutely derives some of their economic moat from their reputation and customer-centric business model, it is possible that competitors begin offering a product of their own which matches or exceeds that of Nordea’s.

From an ESG perspective, Nordea faces little threats with the bank being dedicated to producing a positive impact for all entities and third-parties impacted my it’s operations. The banks dedication to sustainable finance, inclusivity and net-zero carbon emissions highlights the organizations devotion to being a positive ESG benchmark.

The firm also offers personal banking clients a host of ESG oriented investment solutions and provisions which are increasingly becoming an important factor for millennials in particular when choosing companies to invest in.

Summary

Nordea has had an up and down history from an investor returns standpoint. The company’s historically robust business model has become even stronger thanks to a pivot towards offering an improved customer service as well as reducing the banks fundamental reliance on NII for income generation.

While the current share-price is high from an absolute historic perspective, the promise of exceptional FY23/24 results means an intrinsic value calculation suggests Nordea is currently undervalued.

A further $3 share price drop would mean the firm becomes an undeniable fat-pitch for value-oriented investors. Given the instability in the global banking sectors, I believe this price drop is a very real possibility and could potentially occur over the next 3-4 weeks.

This earns Nordea a Buy rating with a strong buy occurring around the $9 price-mark. Nordea is a great bank at an attractive price, with any further decrease in valuation only further driving the argument to begin building a position in this fundamentally strong Nordic bank.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.