DiamondRock Hospitality: I'm Not Worried About The 8.4% Yielding Preferreds

Summary

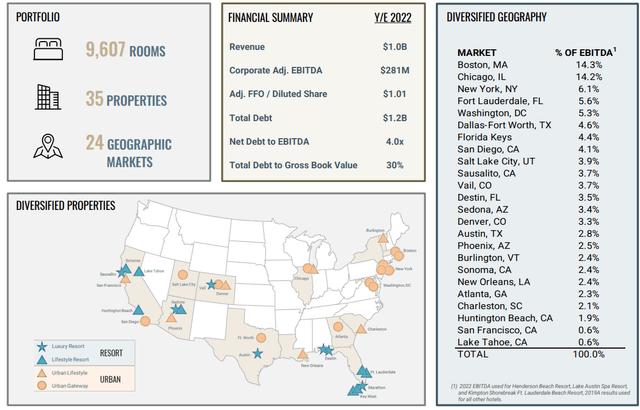

- DiamondRock Hospitality focuses on luxury resorts. It has an enviable track record of being able to take advantage of opportunities when they arise.

- The REIT pays a very low dividend; most of the cash is retained on the balance sheet.

- That's good news for the investors in the preferred shares as the REIT continues to add common equity to the balance sheet.

- The preferred dividends are very well covered while there is also a strong margin of safety from an asset coverage level perspective.

- I continue to buy preferred shares below the $25 principal value as I think the odds of a call at $25 in 2025 are increasing.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Nelosa/iStock via Getty Images

Introduction

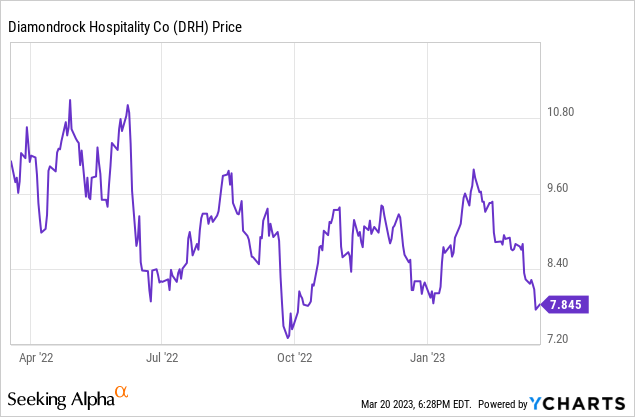

Sometimes a smaller issue of preferred shares in a lesser-followed name could provide an excellent risk/reward ratio. I initiated a long position in DiamondRock Hospitality's (NYSE:DRH) preferred shares, which are trading with (NYSE:DRH.PA) as ticker symbol. When I published the previous article on DiamondRock, the preferred shares were trading at a 1.5% premium to the principal value of $25 per preferred shares but are currently available at a discount again. I wanted to follow up on the REIT's Q4 results and outlook for 2023 to see if I should continue to add to my position.

The fourth quarter was in line with the expectations

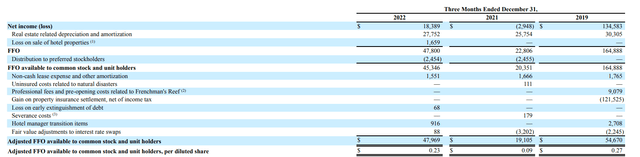

I will mainly focus on the REIT's FFO and AFFO performance versus the total cash outflow related to the preferred dividend payments as the safety of the preferred shares is the focus point of this article.

As you can see below, the REIT generated an AFFO of $0.23 per diluted share.

DiamondRock Investor Relations

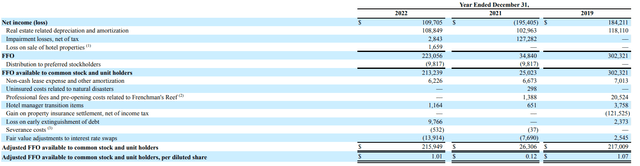

The full-year AFFO came in at $216M which, divided over the current share count of less than 210M shares results in an AFFO/share of $1.03. The $1.01 shown below is based on the weighted average share count throughout the year while my $1.03 is based on the current share count.

DiamondRock Investor Relations

The Q4 and FY 2022 results are very important information. We know the preferred dividends are costing the REIT just under $10M per year. And that's important because this means the preferred dividends are exceptionally well-covered by the AFFO profile of the REIT. Adjusted for the $9.8M in preferred dividend payments, the AFFO exceeds $225M on a pre-dividend basis which means the REIT needs less than 5% of its pre-dividend AFFO to effectively cover the preferred dividend payments. That is very encouraging, and as DiamondRock pays a quarterly dividend of just $0.03 per share on its common units, the majority of its AFFO is added to the balance sheet thereby making the balance sheet stronger by the quarter.

DiamondRock Investor Relations

I added a little bit to my preferred share position

As explained in my previous article, the series A preferred shares (NYSE: DRH.PA) are cumulative issue, offering an annual preferred dividend of $2.0625 per preferred share paid in four quarterly installments. The securities can be called from Aug. 31, 2025 on.

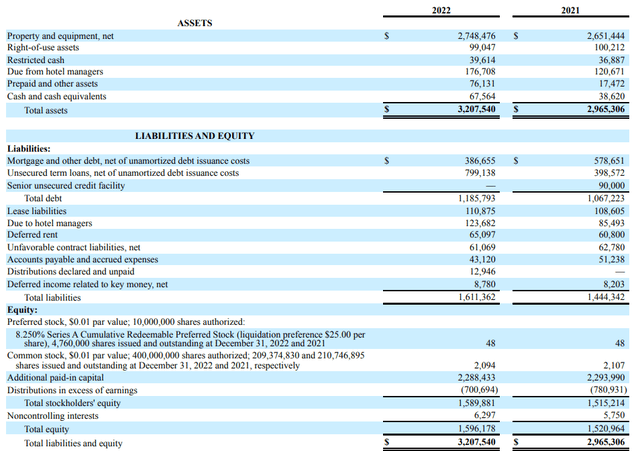

Earlier in this article I already established, the preferred dividends are very well-covered, but I also like to keep an eye on the asset coverage ratio. The balance sheet provides an excellent look under the hood. We see the total amount of assets as of the end of FY 2022 was approximately $3.2B, of which $2.75B were real estate assets.

As you can see below, the REIT had about $67.6M in cash as of the end of last year while the balance sheet also carried $1.19B in debt (other than normal liabilities that arise in the course of doing business) resulting in net financial debt of just over $1.1B. This represents approximately 40% of the book value of the assets.

DiamondRock Investor Relations

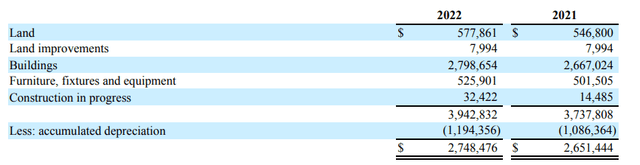

While the book value of a REIT is always interesting, I also like to have a look at the acquisition cost of the real estate assets. And as you can see below, the $2.75B in book value includes an accumulated depreciation of approximately $1.2B, so the current market value of the assets is likely substantially higher than the book value.

DiamondRock Investor Relations

That's important because it allows investors to try to get a better understanding of how 'safe' the preferred shares are from a balance sheet perspective.

There are currently 4.76M preferred shares outstanding which means about $119M of the equity on the balance sheet is attributable to the preferred shareholders. This has two important implications. First of all, based on the almost $1.6B in equity on the balance sheet, there is almost $1.5B in equity ranked junior to the preferred shares. That's a very solid 'margin of error' in case DiamondRock would run into balance sheet issues.

Secondly, if we would assume the fair value of the assets is somewhere halfway in between the book value of $2.75B and the acquisition cost of $3.94B (so roughly $3.35B), this would indicate there's about $600M in 'hidden value' on the balance sheet, which makes the balance sheet (and thus the preferred shares) even safer.

So from an asset coverage perspective, I'm not worried at all about the preferred shares. And as the total amount of equity ranked junior to the preferred shares increased without seeing a more substantial increase in the net indebtedness, I would argue the balance sheet has gotten safer.

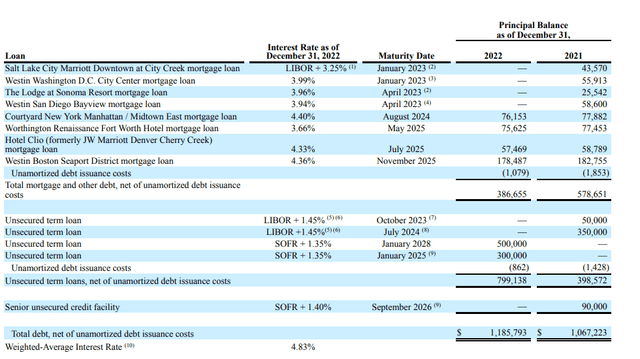

Of course, the one element I will have to keep an eye on is the evolution of the debt. Most of the debt has a floating interest rate, so there will for sure be pressure on the FFO and AFFO generated by DiamondRock Hospitality. But as I already explained in the first part of this article, the preferred dividends are actually very well covered by the incoming earnings.

DiamondRock Investor Relations

And with an average interest rate of 4.83%, the worst of the interest rate increases should be behind us. If I would for instance apply a 6% interest rate on the entire $1.19B in gross debt, the total interest expenses would increase to just $72M. And while that is a substantial increase, it is a very manageable $34M bump versus the FY 2022 net interest expenses of $38M. The official guidance for 2023 calls for an interest expense of $61M this year.

Also important: the majority of the debt is unsecured and DiamondRock could always look at issuing secured debt upon refinancing some of the unsecured debt.

Investment thesis

DiamondRock ended 2022 on a strong note. The preferred dividends are very well covered while the balance sheet looks very robust as well. DiamondRock can call the preferred shares from mid-2025 on, and I think the odds of the REIT calling the preferreds are increasing as the balance sheet is continuously improving thanks to DiamondRock's focus on retaining earnings. This should make it relatively easy to just repay the $119M in preferred equity which will subsequently lift the AFFO per common share by more than 4 cents per share. The yield to call is approximately 8.95%. The current yield is 8.4% based on the current share price of $24.60.

I will continue to add to my position on weakness (read: below the $25 principal value).

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DRH.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I continue to add to my position but I'm in no rush.