Twilio: Finally Showing Some Improvements

Summary

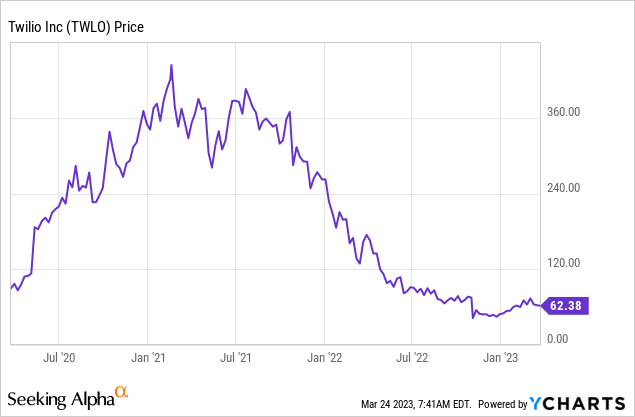

- Twilio is down nearly 30% since my last coverage in July.

- The company's latest earnings finally showed some improvement in the bottom line as the pace of spending slowed.

- The valuation has also compressed significantly and is now much more reasonable and in line with peers.

- I rate the company as a hold.

Tom Werner

Investment Thesis

Twilio (NYSE:TWLO) has dropped nearly 30% since my sell coverage last July, as the macro environment further weakened. It is now trading over 80% below its all-time high in 2021. I believe the downside potential should be limited and I am upgrading the company from a sell to a hold.

In the past few months, the company has shifted its focus to the bottom line, as the market is starting to emphasize more on profitability rather than revenue growth. Its latest earnings finally showed some progress with losses contracting thanks to cost-cutting initiatives. After the drop, its current valuation is also much more in-line with peers. I believe the improving financials and compressed valuation should provide a solid floor for its downside. Although the upside remains uncertain as it vastly depends on its future progress and macroeconomic development.

Improved Financials

Twilio announced its fourth-quarter earnings last month and it finally demonstrated solid improvement in the bottom line.

The company reported revenue of $1.02 billion, up 22% YoY (year over year) compared to $842.7 million. The growth is mostly driven by the increase in customers, which grew 13.3% YoY from 256,000 to 290,000. Existing customers also spent more, dollar-based net expansion rate coming in at 110%. This is a slowdown compared to 126% in the prior year, as its usage-based model resulted in greater macro exposure. Gross profit was in-line with revenue, up 21.3% from $396.5 million to $481.1 million. The gross profit margin was 46.9% compared to 47.1%, down 20 basis points.

The bottom line was the highlight of the quarter, as the company implemented multiple cost-cutting initiatives and slowed down on spending. While revenue increased 22%, operating expenses were only up 2.9% YoY from $680.2 million to $699.7 million. Most of the increase is attributed to R&D (research and development) expenses, which grew 22.8% YoY from $223.2 million to $274.1 million. This was offset by the decline in S&M (sales and marketing) expenses, which dropped 10.6% YoY from $331.4 million to $296.3 million. G&A (general and administrative) was flat at $125 million but should start to drop as the company announced a 17% reduction in headcount. The improved discipline in spending resulted in the net loss reducing 21.3% YoY from $(291.4) million to $(229.4) million, with a net loss margin of (22.4)%. Net loss per share was $(1.24) compared to $(1.63).

Khozema Shipchandler, COO, on cost-cutting initiatives:

We're continuing to rationalize all discretionary spend across the business and as a result, we cut back on a number of employee perks, including the sabbatical program that we announced last year. We also plan to further reduce our global real estate footprint over the next few months. We're focused on running a more effective and efficient company, where we prioritize our spend on the areas most critical to achieving our long-term strategic goals.

The company's balance sheet remains extremely strong with $4.16 billion in cash and only $1.24 billion in debt, which provides ample financial flexibility. It also initiated guidance for Q1 FY23, which continues to reflect management team's emphasis on the bottom line. Revenue growth is expected to be 14% to 15% which indicates a meaningful slowdown from 48%. However, non-GAAP EPS expects to be $0.18 to $0.22, which represents a significant improvement from $(0.00) in the prior year.

A More Reasonable Valuation

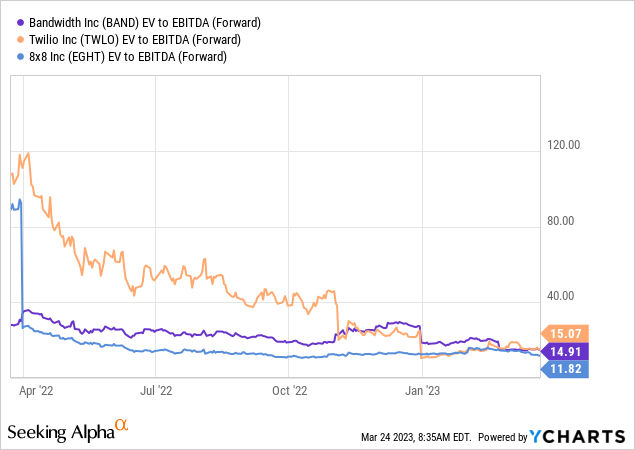

After the drop in share price, Twilio's valuation is much more reasonable now. The company is currently trading an fwd EV/EBITDA ratio of 15.1x, which is pretty compelling for a company that expects to grow revenue in the mid-teens (I am using EV/EBITDA as it can take the company's cash into account). As shown in the chart below, this is also in line with other CPaaS peers such as Bandwidth (BAND) and 8x8 (EGHT), which have an fwd EV/EBITDA of 14.9x and 11.8x respectively. Its multiple is still slightly higher but the gap is much smaller now, and I believe a small premium should be justified considering its higher growth rates and leadership position in the industry.

Investor Takeaway

I think Twilio is in a better place right now compared to July last year. The management team has finally realized the importance of profitability and started to implement different cost-cutting initiatives to reduce spending. The improvement is demonstrated in its latest earnings, as the bottom line contracted meaningfully while top-line growth remains solid. There is still work to do but this is a good start in the right direction. The company's valuation has also come down significantly and is now pretty much trading in-line with peers. A lot of pessimism regarding the macro environment is now known and should be priced in. This alongside the improved fundamentals should limit its downside moving forward. However, the upside will also likely be muted until the company shows further progress, therefore I rate the company as a hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.