ZIM Integrated: The Great Dividend Reset Could Be Here

Summary

- Anyone looking for hyper-pandemic era dividend yields may be sorely disappointed in our view, since those were likely one-off events.

- While ZIM may have rallied post-FQ4'22 earnings call, it may retest the $17s in the intermediate term, due to the normalized forward guidance and consequent impact on dividend payouts.

- We believe investors that understand the inherent cyclical nature of the shipping stock may still add at those levels, attributed to its more than decent FY2023 estimated payout of up to $0.82.

devke

ZIM Is Still A Compelling Buy After The Great Reset

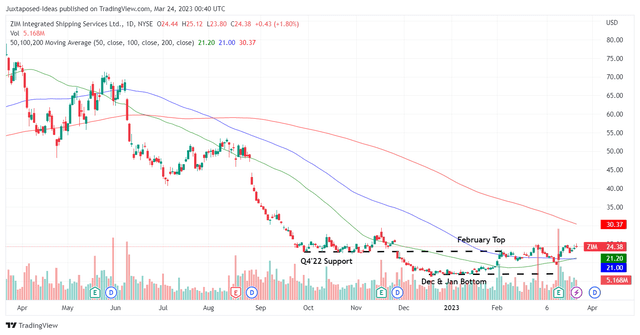

ZIM 1Y Stock Price

While the ZIM Integrated Shipping Services Ltd. (NYSE:NYSE:ZIM) stock has recorded a tremendous +49.66% recovery from the December 2022 bottom, we reckon the optimism from its FQ4'22 dividends may soon be digested, especially after its ex-dividend date of April 4, 2023. This is attributed to its guidance of "significantly lower FY2023 freight rates," due to the easing of global supply chains and the potential contraction in economy.

The shipping company historically did not report the contracted TEU rates, with a vague commentary in the recent earnings call that "freight rates were close to bottom and [we] expect some improvement in 2023." However, we might seek hints from Vincent Clerc, CEO of Maersk (OTCPK:AMKBY), a fellow container shipping company:

Naturally, the effect of the drop in the spot rate is having a profound effect across the industry during the annual contract negotiations and we expect our average 2023 contract rates to eventually move towards prevailing spot rates. (Seeking Alpha)

Drewry World Container Index

Drewry

Assuming that ZIM experiences a similar phenomenon, we may see the company record an average TEU rate of ~$1.8K in FQ1'23 (as reported by Drewry World Container Index [WCI] on March 23, 2023), suggesting another moderation of -15%/ -$0.32K from the company's rates in FQ4'22.

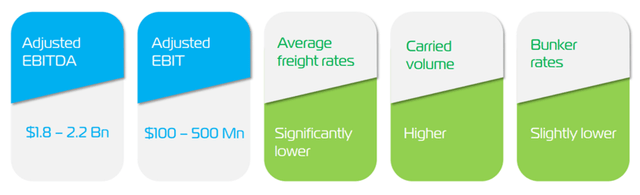

ZIM 2023 Guidance

ZIM's guidance of an adj EBITDA of up to $2.2B and adj EBIT of up to $0.5B also suggests a notable headwind of up to -70.6% and -91.8% YoY, respectively.

On one hand, these numbers are notably improved from FY2019 levels of $0.38B/$0.14B and FY2020 levels of $1.03B/$0.72B, respectively, against FY2019 TEU rates of $1K and FY2020 rates of $1.22K, suggesting a new normal from 2023 onwards.

On the other hand, the company's impacted financial performance may naturally affect its variable dividend payout. This is attributed to the company's policy for payouts comprising 30% of its quarterly net incomes, with an additional "catch-up" of up to 50% in the annual net incomes for Q4 dividends.

Therefore, we have estimated ZIM's future dividend payouts based on its 2023 guidance, as we did in our September 2022 article. Its projected EBIT of up to $500M suggests a lower net income of approximately $264M, based on three key assumptions.

Firstly, we reckon that its FY2023 interest expenses may be similar to FY2022 levels of $221M, attributed to its long-term debts of $4.33B at a fixed interest. Secondly, based on adj EBIT of $0.5B, we may see the company pay up to $15M in income taxes, as it did in FY2020.

Thirdly, ZIM expects to see improved results in H2'23. We will be prudently assuming a 60% weighting for its profitability in the second half, with FQ1'23 notably lower based on $1.8K TEU rates.

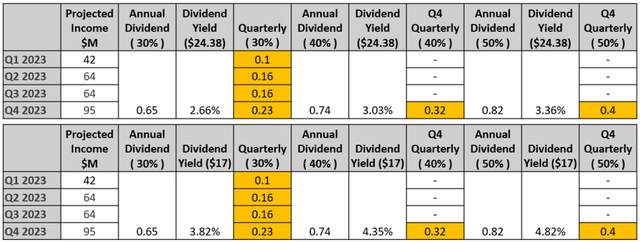

ZIM Dividend Payout In 2023

Note: The two scenarios are based on ZIM's 120.43M diluted shares outstanding in FQ4'22, its stock price of $24.38 at the time of writing, and a potential retest to the $17s. It is on top of our projected net income of $264M in FY2023, barring any one-time items. Therefore, depending on the fluctuation in freight rates, actual earnings, share count, and differing applications in company policy ahead, these projected numbers may vary from the actual results. Investors must also note that the calculation is based on FY2023's best-case scenario of $500M in adj EBIT.

While the projected yields of between 2.66% and 4.82% may look abysmal compared to ZIM's average of 61.81% in 2022, we must highlight that these are already massively improved compared to its average of 1.74% in 2021. Furthermore, AMKBY similarly recorded an average yield of 3.22% in 2021 and 1.65% in 2018. Therefore, anyone looking for hyper-pandemic era yields may need to drastically reset their expectations.

Particularly, we remain confident about ZIM's long-term prospects for many reasons. The shipping industry has always been cyclical, with freight rates fluctuating according to global supply and demand. Particularly, its company's dividend policy has been highly transparent as well, providing investors with a clear insight into its future payouts.

Furthermore, ZIM has a robust balance sheet with $4.61B of cash/investments by the latest quarter, with an approximate balance of $3.84B once FQ4'22 dividends are paid on April 3, 2023. Combined with well-laddered long-term debts through 2032, we reckon the company has more than enough liquidity to service its down payments of $495M for new-build vessels through FY2024.

In addition, it has excellent prospects for intermediate-term recovery, attributed to the robust demand for car cargo being exported within Asia and out of Asia to the EU. The company had hinted that the business was a highly profitable opportunity due to the strong demand and tight supply, contributing significantly to its top and bottom line thus far.

As an interesting fact, ZIM's promotional video on the website featured MG, a British automotive marque owned by the automotive parent company, SAIC Motor.

With 1.01M of MG vehicles (+44.9% YoY) in overseas sales for 2022, comprising over 100K in the EU, it made sense that ZIM had grown its car carrier business aggressively. This was from 2 vessels in early 2021 to 12 vessels by March 2023, with plans to expand up to 16 vessels by mid-2023.

Therefore, we cautiously rate the ZIM stock as a buy here, attributed to the decent dividend yield of 3.03% projected in 2023 (based on a 40% payout in Q4 and current stock prices) and robust prospects for outperformance in the long term. Anyone looking for an improved yield of 4.82% may consider adding at the $17s level.

It is important to note that the downturn will likely not last forever. We reckon that the market demand and TEU rates may recover moderately once the macroeconomic outlook improves. It pays to have a long-term view of cyclical stocks such as ZIM, in our opinion.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.