Bank Of America: Busted Preferreds Stand Out For Their Yield

Summary

- Bank Of America has gotten crushed alongside many bank stocks.

- The financial giant has rarely been this cheap.

- Yield seekers though could gravitate to its quality preferreds, particularly one that offers more than the rest.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Brandon Bell/Getty Images News

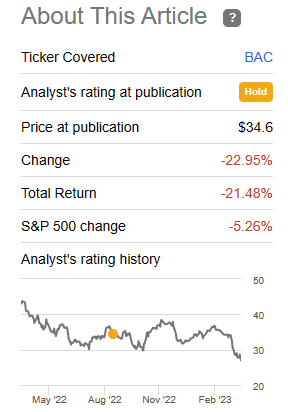

On our last coverage of Bank Of America Corporation (NYSE:BAC.PK), we were pleased with the company results and rated the common shares as a hold/neutral. We felt that yield seeking investors would be better served using options or using one of its preferred shares rather than the common. Specifically we said,

BAC wins full marks for their longer term performance and we believe even in the upcoming turbulent times, it will show its mettle. The common shares are poor yield plays though and hence we have outlined two interesting choices for those looking for income. We have our financial sector quota full for now, but we are keeping an eye on both these choices for our subscribers.

Source: Bank Of America, Now Offering Good Income Choices

BAC stock has really underperformed the market since then. We review our suggested trade and update our outlook.

The Trade

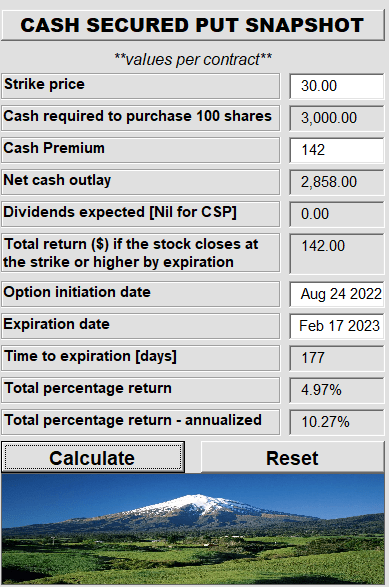

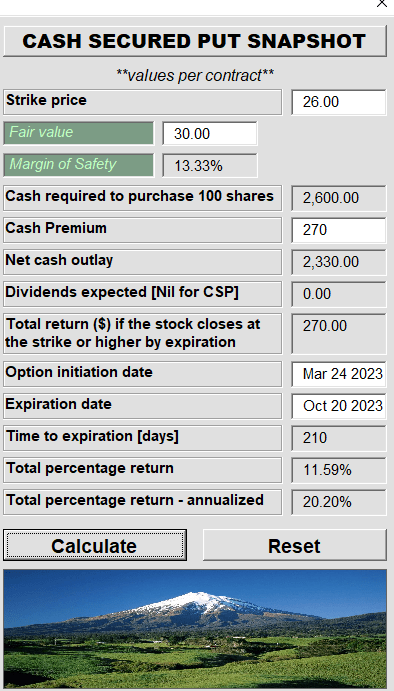

While BAC's valuation was modestly attractive we did not see the urge the pile in as we were deep in the economic cycle. The $30 cash secured puts balanced the positive outlook with a solid buffer and yield.

Screenshot From Previous Article

BAC prices ended on February expiration (Feb 17, 2023) slightly higher than where we wrote the article. The full premium was captured and the options outperformed the common shares. Of course the real bludgeoning came after.

BAC Performance Since Last Article

The Fundamentals

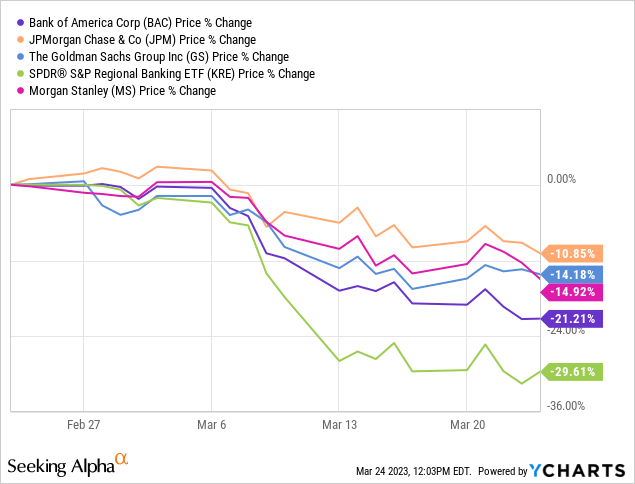

There are two sides to the story here. The first being that BAC is being crushed (many will argue unfairly) with the regional banks. There is some truth to that. While BAC has long been one of the biggest of the "too big to fail", its recent price performance has strayed a bit from the likes of JPMorgan Chase & Company (JPM), The Goldman Sachs Group Inc. (GS) and Morgan Stanley (MS). In fact, It has been the closest to the SPDR S&P regional banking ETF (KRE).

So this is certainly strange behavior on the surface. This gets even stranger when you take into account that some regional bank capital flight has made it into BAC.

Bank of America Corp. mopped up more than $15 billion in new deposits in a matter of days, emerging as one of the big winners after the collapse of three smaller banks dented confidence in the safety of regional lenders.

The inflows offer a first glimpse into the deluge of deposits that made its way to the country’s largest banks as customers fearful of a spreading crisis sought refuge in the firms seen as too big to fail. The money flowing into the second-largest US bank was described by people with direct knowledge of the matter, who asked not to be identified as the information isn’t public.

Source: Bloomberg

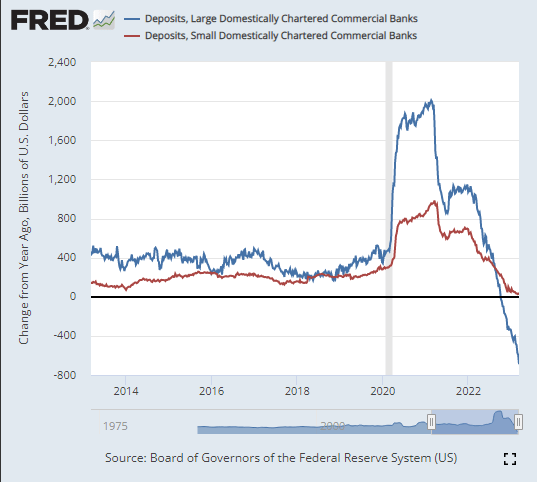

The other side is that BAC will eventually have to pay a lot more on its deposits. There is a generalized capital flight out of banks into money market funds and that will only accelerate as time goes on. Here, the larger banks, which pay next to nothing on deposits have actually got hit harder than the smaller banks.

FRED, Bob Elliott-Twitter

So, the way we see it is that the earnings estimates for 2023 and beyond, are extremely optimistic.

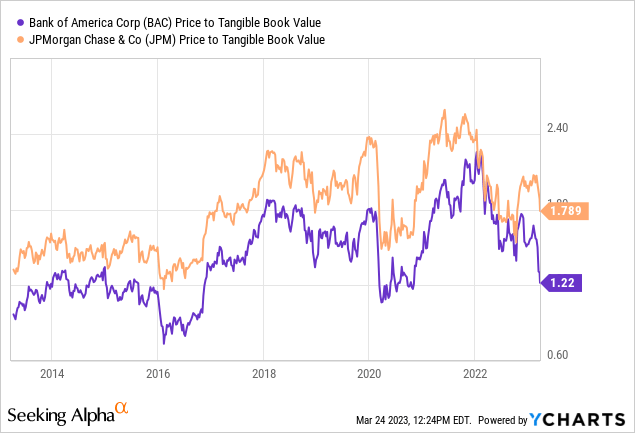

Valuation Relatively Attractive

Even using the low end of 2023 and 2024 estimates, BAC stands out as cheap. BAC also is extremely cheap relative to JPM on a price to tangible book value basis. The chart below shows that the two did trade at a similar multiple for most of 2022, something we believe is warranted.

Now in a proper recession, which we see as highly probable, cheap can become cheaper. So even though we think BAC is extremely cheap, we would still use a buffer to play it. That buffer can come with a $26 Cash Secured Put.

Author's App

The yield and returns are quite solid for a flat price. By flat price we mean that if BAC stays here or moves higher, you make the full premium.

The Other Choice

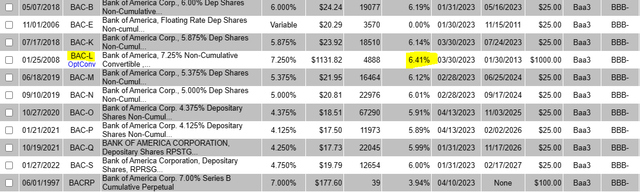

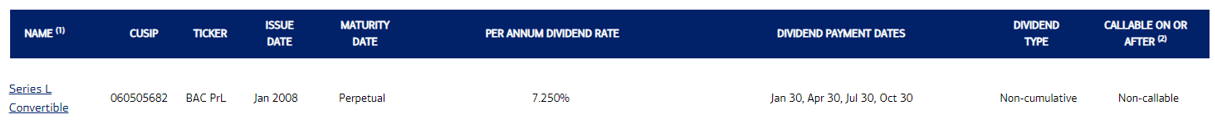

Preferred shares offer investors additional buffer during times of capital stress and the ones from BAC are no different. The one we are going to focus on today is Bank of America Corporation 7.25% Convertible Preferred L (NYSE:NYSE:BAC.PL). This comes up on our screen for a couple of reasons.

Bank Of America

The first being that currently it offers the highest yield amongst its brethren.

Bank of America Corporation 5.875 NCM PFD HH (NYSE:BAC.PK) and Bank of America Corporation 6.00 NCUM PFD SR GG (NYSE:BAC.PB) offer the next highest yields. A couple of other advantages that BAC.PL has here are notable over BAC.PK and BAC.PB. The first being that most investors are afraid of higher yielding preferreds being called during the next era of low rates. Whether we get that low-era again or not, BAC.PL has a lot of protection against that possibility.

BAC.PL is one of the rare preferred shares that cannot be redeemed by BAC i.e. it is non-callable. BAC.PL is convertible at the your option (option of the holder) into 20 shares of common stock. The yardstick for this was the $50 stock price when this was issued. Of course you will not convert it today (that would be a big loss) but this is information you need and the next part is even more relevant. BAC also has a right to force a conversion, on or after January 30, 2013. But the kicker here is that price has to exceed $65 (which was worked out as 130% of BAC common share price at issuance) for 20 trading days during any period of 30 consecutive trading days. So for practical purposes, BAC.PL is not convertible for as far as the eye can see. Also conditions which might cause redemption of the other two high yielding preferred shares, such as low interest rates, are likely not to result in BAC.PL being converted. Very low rates are likely to be deflationary conditions with poor performance of bank stocks, so BAC is extremely unlikely to reach $65 at that time.

The second advantage is that in the chance this does get converted, you do get a sweet capital gain of about 9%. This is higher than what either of BAC.PK and BAC.PB offer to their par values.

Verdict

BAC is unequivocally cheap but markets rarely follow logic when chaos strikes. We think the Federal Reserve hikes from 2022 are still working through the system and all stocks will become cheaper in 2023. Cash Secured puts offer a defensive way to play this. BAC.PL offers a great way to lock-in a 6.5% yield, one that cannot be easily called away.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC.PL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.