Regeneron Pharmaceuticals Boosted By COPD Data

Summary

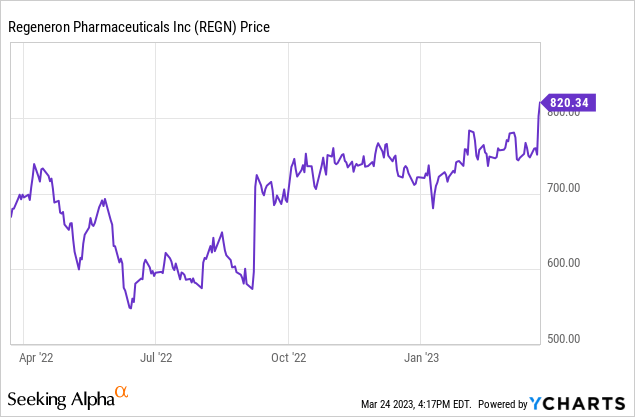

- Regeneron stock hit a record high on March 24, 2023.

- Dupixent COPD data was reported as positive.

- Concerns about Eylea competition remain, so I am neutral on REGN stock.

mi-viri

Regeneron Pharmaceuticals (NASDAQ:REGN) is a large cap pharmaceutical company best known for its eye disease therapy Eylea. The release of data on Dupixent for COPD (chronic obstructive pulmonary disease) pushed it to record highs on March 23 and March 24. That followed a recent series of other positive news for the company. This article will look at the new data and its implications for investors. The context is concerns about possible erosion of Eylea revenue and the potential of the rest of the pipeline. First, I will briefly recap Q4 2022 financial results including sales revenue for Dupixent and Eylea.

Regeneron Q4 2022 Results

Regeneron Q4 2022 results were reported on February 3, 2023. Revenue was $3.41 billion, down 31% y/y on a decline in its Regen-Cov therapy for Covid-19. GAAP net income was $1.20 billion, down 46% from $4.95 billion y/y. GAAP EPS was $10.50. On a non-GAAP basis net income was $1.45 billion, down 46% y/y. EPS was $12.56. The y/y declines sound discouraging, but they were expected as the Covid epidemic wound down. Excluding the drop in Regen-Cov, sales increased 14% y/y.

Regeneron ended the quarter with $14.3 billion in cash and equivalents with only $2 billion in long-term debt. Cash from operations was $5.0 billion and free cash flow was $4.42 billion. Clearly Regeneron could pay a substantial dividend or greatly increase its share buyback program or do major acquisitions with this level of cash.

Dupixent for COPD

On a dollar basis Dupixent (dupilumab) led sales growth in Q4, up 38% y/y to $2.45 billion. The current label for Dupixent, which is an anti-interleukin antibody, is for atopic dermatitis, asthma, eosinophilic esophagitis, and prurigo nodularis. Dupixent was developed and is sold in partnership with Sanofi (SNY). Dupixent was approved in Europe in December 2022 for prurigo nodularis, and in January 2023 for eosinophilic esophagitis. The CHMP has recommended it for children with severe atopic dermatitis. In the US in Q4 a sBLA for chronic spontaneous urticaria was submitted to the FDA. Given the rapid label expansion, and the potential for expansion outside the U.S., there is every reason to believe Dupixent sales will continue to grow at least for the next few years.

The latest news, March 23, 2023, was that results were positive in a Dupixent Phase 3 trial for COPD. COPD is the third leading cause of death worldwide, is very hard to treat, and has had no new treatments approved in more than a decade. The trial showed a 30% reduction in worsening of respiratory syndromes over 52 weeks. It also showed improved lung function from baseline compared the placebo group. Smoking is the major risk factor for COPD. The number of potential patients in the U.S. is estimated at 300,000. Regeneron will be discussing with the FDA whether the single Phase 3 trial will be sufficient for a regulatory filing. The current official price of Dupixent is $3,385 per carton.

Despite the cost compared to the corticosteroids that are currently standard of care for COPD, I believe it is highly likely that the COPD community will want to adopt Dupixent after FDA approval. This would likely add very significant revenue for Regeneron.

Eylea End of Exclusivity

Eylea (aflibercept) sales in Q4 dropped 4% y/y to $2.335 billion. While I would not call Regeneron’s stock price low, the main overhang is concerns about Eylea revenue. Before Dupixent took the lead, Eylea accounted for almost all Regeneron revenue. It is co-marketed with Bayer. It is approved for wet macular degeneration and diabetic macular edema. It was first approved by the FDA in 2011. It is also approved in the EU and other nations. In February this year the FDA added an addition indication, Eylea for preterm infants with retinopathy. It has long had competition in its indications, including from Lucentis and Avastin, which now have biosimilars available. Roche’s Vabysmo, while not a biosimilar, is a new competitive threat. Among others, Amgen (AMGN) has an Eylea biosimilar, ABP 938, which is expected to report its final Phase 3 analysis in Q2 2023.

Regeneron hopes to stave off all competition by introducing a new, 8 mg dose of Eylea that will be injected into eyes at longer intervals. That could happen by Q3 2023. Patients would like that. Regeneron hopes it will become the new standard of care. Because of the biosimilar rules, the new biosimilars cannot just bring out an 8 mg equivalent dose, though there is nothing to prevent doctors from using them off-label that way. Higher-dose Eylea biosimilars will have to go through the entire approval process again for the longer dosing interval. Despite that I would expect some price erosion for Eylea to remain competitive.

Trajectories for other Regeneron approved therapies

Beyond Eylea and Dupixent the outlook for other Regeneron approved therapies is mixed. Regen-Cov revenue will probably continue to fall quickly, which is one reason the company did not issue 2023 revenue guidance. Praluent Q4 2022 revenue was down 30% y/y to $133 million. Kevzara revenue was down 22% y/y to $81 million. It had an additional approval in February for polymyalgia rheumatica, so it could swing back up. Evkeeza, a relatively new therapy, saw y/y revenue grow 67%, but only to $15 million.

The one additional therapy that continues to show clear revenue potential is Libtayo, a PD-1 antibody cancer therapy. Revenue in Q4 was $169 million, up 40% y/y. As a PD-1 therapy and rival to Opdivo and other approved PD-1 therapies, it is in a crowded market. However, it also continues to expand its label. Most recently, in February Libtayo for NSCLC gained a positive opinion from the EU CHMP for advanced PD-L1 positive lung cancer.

Rest of Regeneron Pipeline

Regeneron spends heavily on R&D and has an extensive pipeline. That pipeline appears to be well-balanced between trials in Phase 1, Phase 2, and Phase 3, promising new therapies likely coming to market throughout this decade. Bispecific antibodies and RNAi therapies, licensed from Alnylam (ALNY), are near the cutting edge of current biotechnology, as is a CRISPR-based potential hematology therapy. We can’t predict in advance which therapies will generate data that can gain regulatory approval, but Regeneron does have a strong track record.

Analysis

At the March 23, 2023, closing price of $802.16 per share Regeneron had a market capitalization approaching $90 million but a forward P/E ratio of just 19.41. That is not an excessive price, it could even be characterized as undervalued, if Regeneron generates strong revenue and profit growth going forward. Dupixent looks like a growth driver. Libtayo is a growth driver at a lower level. Regen-Cov will fade away, most likely. The big question remaining is the future of Eylea. I think the deciders in this case will be the insurers. If cutting the cost of macular degeneration by having less frequent injections compensates for continuing to pay for Eylea instead of a competitor or a biosimilar, Eylea is safe. I do not think that is the case. I think Eylea revenue will erode, but not as quickly if it would have without the new dosing schedule. The rest of the pipeline looks great. If Regeneron paid a dividend I could rationale calling it a buy, but given the uncertainty, I am staying neutral at this moment at the current stock price.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMGN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.