Western Copper Implies Potential Downside As The Metal Turns Bearish

Summary

- Western Copper and Gold Corporation shares could potentially be trading significantly below current levels as analysts forecast lower gold and copper prices.

- The current surge in gold and copper, the metals this Canadian explorer hopes to one day mine in the Yukon Territory, doesn't seem well poised for a sustained bull market.

- Investing in Western Copper and Gold Corporation also involves a significant investment risk.

robas

Consider Trimming Your Position in Western Copper and Gold Corporation Stock as Copper and Gold Could Fall Sharply

Western Copper and Gold Corporation (TSX:WRN:CA) (NYSE:WRN), headquartered in Vancouver, British Columbia (Canada), the country of traditionally operating base and precious metal mines, is a publicly traded operator looking for highly profitable metal production in Canada.

Western doesn't yet have any metal processing operations, but its stock price continues to suffer from fluctuations in the market value of gold and copper, the two commodities the company hopes to mine one day.

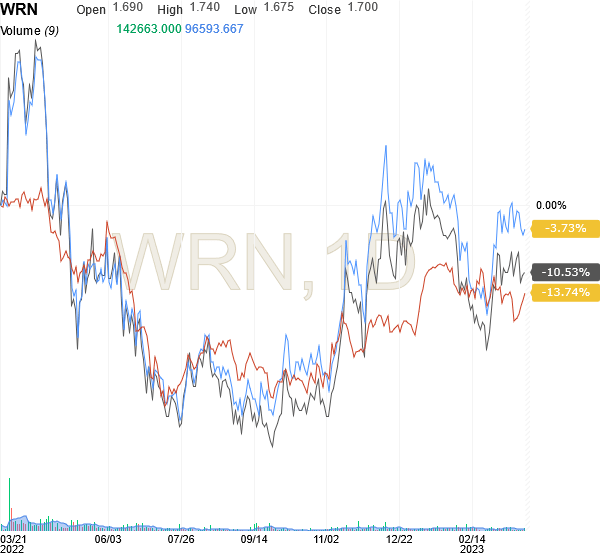

Western's stock price is correlated with the copper and gold markets (the chart below gives an idea of this) and with lower expected copper and gold prices throughout the year, Western's stock price should not be different.

This should happen in the coming weeks based on macroeconomic factors that will support analysts' downside forecasts for gold and copper.

Investing.com's chart shows Western Copper and Gold Corporation (WRN:CA has a light blue curve while WRN has a dark gray curve) versus copper futures as a benchmark for copper prices (copper-red curve).

Source: Investing.com

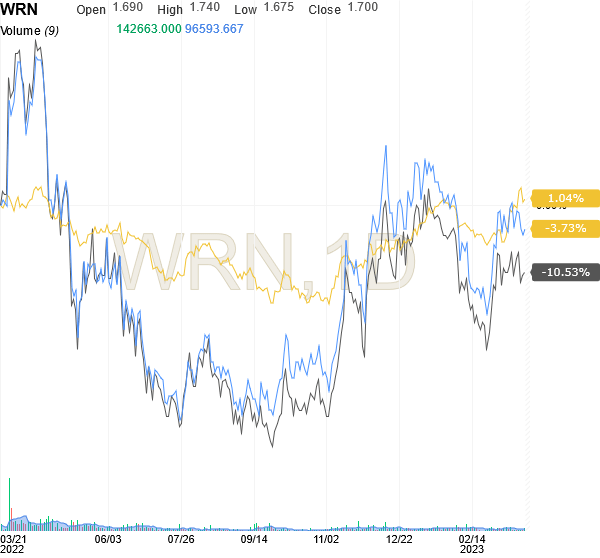

Investing.com's chart shows Western Copper and Gold Corporation (WRN:CA has a light blue curve while WRN has a dark gray curve) versus gold futures as a benchmark for gold prices (yellow curve).

Source: Investing.com

In addition to the returns, these securities have produced over the 12 months ended March 22, the chart above these lines shows the similar trend that Western and the two commodities have developed over the period.

Investors should therefore consider the possibility of selling part of their position in Western, if that allows for a good profit margin, and possibly use the resulting funds for investments that seem to have a greater chance of growth than the current rise in metals, which instead not appear so well grounded.

Analysts' Expectations for Copper and Gold

According to the below estimates for gold and copper, Western shares could fall sharply if they follow the commodities in question i.e. if analysts are correct in their prediction of lower prices.

Regarding copper, analysts expect a price of $3.96 per pound to form before the end of Q1 2023 and a price of $3.70 per pound to form before the end of 2023, reflecting declines of 3.3% and 9.7% from the price of $4.0957 per pound being traded through Copper Futures - May 23 (HGK2023) as of this writing.

Regarding gold, analysts expect a price of $ 1,844.68 per troy ounce to form before the end of Q1 2023 and a price of $ 1,779.15 per troy ounce to form before the end of 2023, reflecting declines of 7.2% and 10.4% from the price of $1,986.75 per ounce being traded through Gold Futures - Apr 23 (GCJ2023) as of this writing.

About Western Copper and Gold Corporation

The company is listed on the North American stock exchanges of the Toronto Stock Exchange and the NYSE American and its share capital, divided into approximately 152.86 million shares outstanding, trades under the symbols (WRN:CA) and (WRN), respectively.

As of December 30, 2022, Western Copper and Gold Corporation had approximately CA$ 22.71 million (or ≈ US$16.6 million) in cash and short-term investments and no relevant debt to advance its own mining project to operate a copper and gold deposit in Canada.

Prominent shareholders include Rio Tinto Canada, i.e., Rio Tinto ADR (RIO), a London-based metals and mining giant with a 7.8% stake. Rio Tinto is eligible for an officer on Western's board of directors if it increases its ownership to at least 12.5%.

Osisko Gold Royalties Ltd (OR:CA) (OR) will instead be entitled to the applicable royalty of 2.75% of the Net Smelter Return [NSR].

Western Copper and Gold Corporation owns the Casino project and surrounding property in the Yukon Territory, which appears to be a large copper-gold project in a fast-growing mining district.

According to the Casino metallic project Feasibility Study released in 2022, the deposit consists of 46% copper, 34% gold, 4% silver and 17% molybdenum and more specifically, the mineral asset hosts 7.6 billion pounds of copper in Measured and Indicated Resources and 14.8 million ounces of gold in Measured and Indicated Resources.

A total of 2,491 tons of measured and indicated resources are characterized by the following grades of metal concentration: 0.14% copper and 0.19 grams of gold per ton of mineral.

The Casino metals mining project will be an open pit mine where the concentrator will process 120,000 tonnes per day of material to recover copper and gold and operate a heap leach plant which will recover the metals from processing 25,000 tonnes per day of oxide.

According to the economic analysis section of the feasibility study, the project should generate an internal rate of return of 17.7% (which is not a high rate considering investors typically expect a rate of 25-30% for a profitable mine), based on price assumptions of $1,700 per ounce of gold and $3.60 per pound of copper.

These price assumptions should be reasonable as they are the closest approximation that the feasibility study proposes to the average prices for copper and gold over the last 5 years to March 22, 2023.

The 5-year average gold price is ≈ $1,635 per ounce, while the 5-year average copper price is ≈ $3.38 per pound, and in line with these assumptions, Western hopes to recoup its initial outlay in 3 years and 5 months from the start of commercial production.

The project has a net present value of CA$2.221 billion (or ≈ US$1.62 billion), which has been computed at an 8% rate of discount, which seems more realistic than other companies' projects using a 5% interest rate amid a high-yield environment due to the Federal Reserve's monetary tightening to combat elevated inflation.

The mine is currently under construction and once operational the company will produce the metals for more than 25 years.

The Stock Valuation

It is a fact that the share price currently makes it possible to become the owner of the Casino project and pay 6x less than the Casino could be worth, but is it objectively realistic that the share price of this stock on the stock exchange will rise so much?

Anything is possible in the equity markets, but it is much more reasonable to expect that not only will Western shares remain far off the Casino project's NPV level, but they could fall dramatically under the pressure of some macroeconomic factors unfavorable to the metals.

To bring the asset into the operational phase, Western will likely require more funds than the total liquidity currently available in the form of cash and short-term securities, which the company believes is sufficient to sustain exploration and development activities for up to 12 months.

Western's share price could have an opportunity to narrow the gap to the Casino project's NPV when the mine begins to generate income according to the feasibility study, assuming the metal price environment remains supportive.

Western will be focused on raising the funds needed to complete the Casino gold-copper mine project, but not without impacting the market sentiment that will develop for this stock going forward.

If Western raises money by issuing new equity, the net present value of the casino project will dilute on a larger base of shares outstanding and therefore the stock will become less attractive to the stock market.

While the rise in borrowing costs due to monetary tightening versus elevated inflation poses a significant risk for the exploration company, which may struggle to raise funds this way and jeopardize this project's chances of success.

As of this writing, the stock price is trading on the North American stock exchanges as follows:

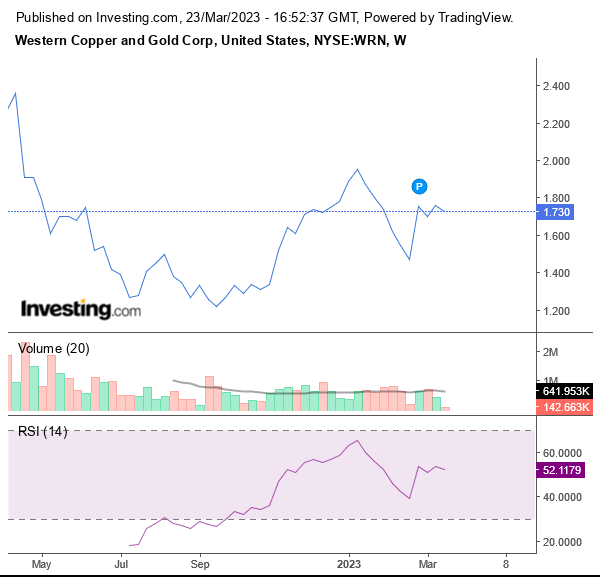

On the NYSE American, Western Copper and Gold Corporation (WRN) has a stock price of $1.73 for a market cap of $261.25 million and a 52-week range of $1.16 to $2.40.

Source: Investing.com

The stock trades above 50-Day Moving Average of $1.7174 and above the 200-Day Moving Average of $1.5234.

The stock has a 14-day relative strength index of 52.1179, which means that shares are neither oversold nor overbought.

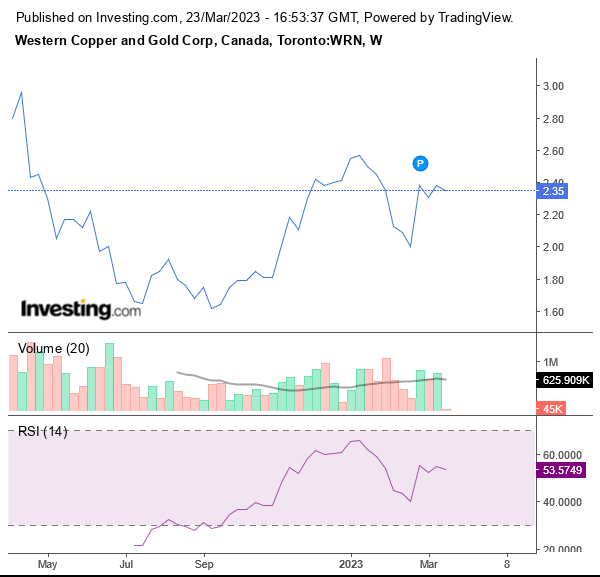

On the Toronto Stock Exchange, Western Copper and Gold Corporation (WRN:CA) has a stock price of CA$2.35 for a market cap of CA$359.29 million and a 52-week range of CA$1.56 to CA$3.

Source: Investing.com

The stock trades above the 50-Day Moving Average of CA$2.3208 and above the 200-Day Moving Average of CA$2.0366.

The stock has a 14-day relative strength index of 53.5749 which means that shares are neither oversold nor overbought.

However, Western Copper and Gold Corporation stock prices may not be on solid pillars and face a significant risk of deflation. They are currently benefiting from bullish gold and copper on fears of a financial crisis and a fleeting possibility that the US Federal Reserve [Fed] may be nearing the end of its rate hike policy.

Fears that the financial crisis could spread beyond Silicon Valley Bank, Signature Bank (SBNY) and troubles at Credit Suisse Group AG (CS) are positively impacting demand for safe-haven gold as the metal is said to provide headwind protection in the event of a domino effect between banks. While rumors that the cost of money will now rise less than expected are leading to bullish market sentiment for copper as demand for the base metal would benefit from an increase in energy transition projects, since these would then be cheaper than expected to finance.

In support of the selling argument of some shares of Western Copper and Gold Corporation’s stock, the following expectations are presented, which see the above gold and copper catalysts as too short-lived factors for a sustained bull market and will phase out once the market realizes that the reality is somewhat different.

First of all, the crisis of the two US regional banks and Credit Suisse should not have a domino effect on other institutions, since economists and politicians in the US and the EU have repeatedly highlighted the robustness of the banking system and its ability to prevent another crisis like the financial crisis of 2008. Fed Chairman Jerome Powell noted last Wednesday, March 22, that savers can count on the soundness of the US banking system, which is also resilient to financial crises, following the decision to raise federal funds rates by 25 basis points to 4.75% to 5%.

Interest rates will continue to rise as inflation, currently at 6% in the US and 8.5% in the Euro-zone, is still far from the central bank target of 2% and, more important, is quite resilient, especially in the core.

So the interest rate will continue to rise, rewarding investments in fixed-income assets at the expense of gold, which does not generate income.

In addition, the increased cost of money will make infrastructure construction, urbanization and energy transition projects more expensive, affecting copper demand.

Furthermore, the disinflation process and an economic slowdown rather than a recession, as initially feared, will not favor demand for gold for hedging purposes.

Also, in terms of investing in physical gold or gold-backed securities to protect against headwinds from fears of higher inflation, it is not certain that this is driving the current momentum in gold now.

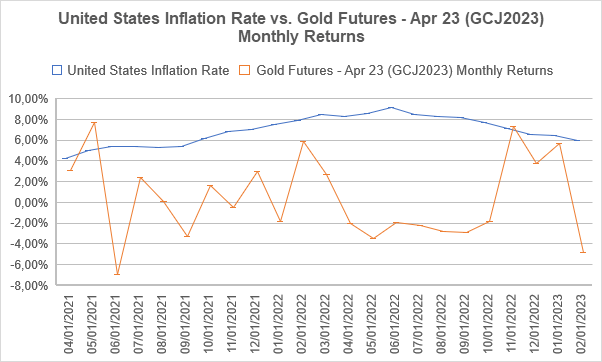

The chart below casts doubts on the relationship between gold and inflation, using the former as a hedging tool against the latter when elevated, in the sense that investors may not always have included the precious metal in their strategy against the rapid increase in prices of goods and services.

Data Source: Investing.com and Trading Economics

As such, gold as a hedge against the effects of the rapid rise in prices for goods and services is less likely now that inflation is falling than it was a few months ago when inflation was significantly higher. This aspect influences the probability of gold prices reaching higher levels.

Conclusion

Analysts' estimates for lower gold and copper prices are likely, so Western Copper and Gold Corporation shares could potentially be trading below current levels.

The current surge in gold and copper, the metals Western plans to mine at Casino in the Yukon Territory, doesn't appear to be on solid pillars and could revert anytime soon.

The holding in Western Copper and Gold Corporation carries significant investment risk related to the availability of funds to support the development of the mineral project and the impact of how capital is raised on the attractiveness of the project and the market value of the shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.