Vanguard Financials ETF: A Gamble For Dip Buyers

Summary

- The price drop of Vanguard Financials ETF does not seem to be a buying opportunity given that the fundamentals of the financial sector are likely to continue to worsen.

- Despite the failure of several regional banks, the Fed's policy of continuing to raise interest rates increases the risk of contagion.

- A looming recession and challenging consumer financial markets would add to the challenges.

MF3d

A drop of more than 10% in Vanguard Financials ETF's (NYSEARCA:VFH) price does not represent a buying opportunity because the financial sector is expected to perform poorly in the months ahead. After the recent collapse of regional banks, investing in the financial sector seems like a gamble because many factors, such as the worsening banking crisis, the increased risk of bad debts, and a sharp decline in their potential for earnings growth, have not yet been factored in. A recession is another risk that could have a significant impact on the overall performance of the financial sector. Given this, it appears prudent to avoid the financial sector until there are clear indications that negative events have been fully priced in.

A Contagion Risk

The most concerning indicator is the risk of financial contagion, which means that financial problems could spread to other banks or the entire financial system. Although the Fed's strategy of creating a fund to provide liquidity to struggling banks in the aftermath of Silicon Valley Bank (SIVB) and a few others appears to have temporarily stabilized the situation, it appears to be a band-aid solution to boost a false sense of confidence. The fundamentals of the financial sector have not changed since the Fed raised interest rates by 0.25% again despite the banking crisis, with plans to raise them further in the coming months and refrain from cutting rates this year. This means that fixed-income securities held by banks, which were a major contributor to the banking crisis, are likely to experience increased volatility in the coming months. This is because bond prices fall when interest rates rise.

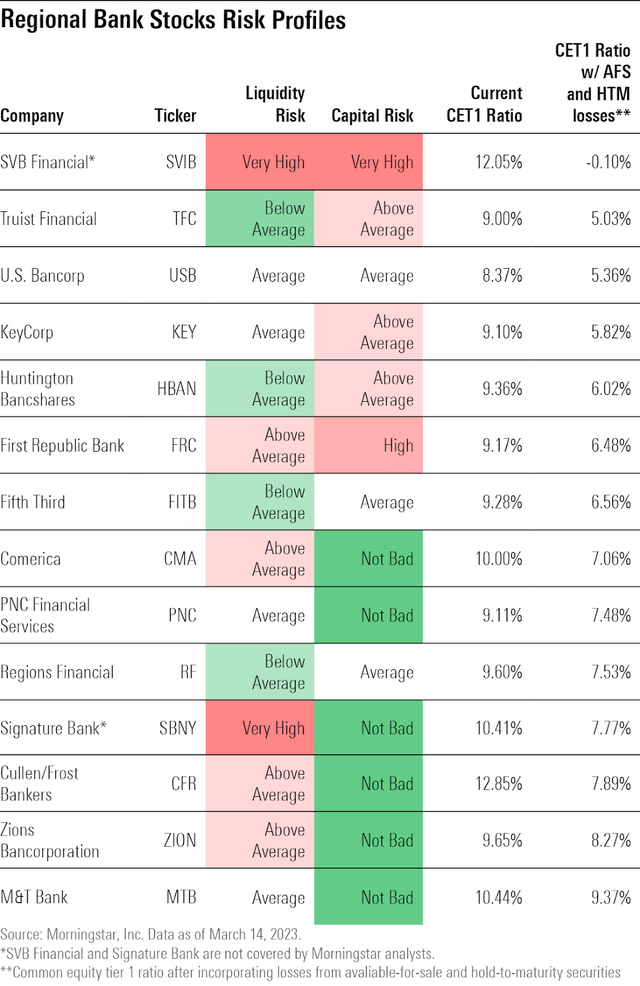

The Fed's announcement to establish a fund to increase bank liquidity has also been met with opposition from many market analysts and fund managers. Instilling false confidence, according to Bill Ackman of Pershing Square, is a bad move because it increases the risk of financial contagion. According to Luke Ellis, CEO of the $143 billion hedge fund Man Group, the banking system's turmoil could last another two years, with smaller regional banks more likely to fail. Furthermore, he believes that many smaller banks will be acquired by larger financial institutions within the next 12 to 24 months. Morningstar has assigned a high-risk rating to the regional banks compared to diversified banks. Regional banks make up 13.9% of VFH's portfolio, whereas diversified banks account for over 21%.

Regional Banks Risk Profile (Morningstar.com)

Along with regional banks, large banks have also suffered significant losses as bond portfolios plunged in the last year. For example, Bank of America (BAC) reported $109 billion in unrealized losses on its bond portfolio by the end of 2022. The fact that large banks currently have enough liquidity to meet their obligations without having to sell securities makes them safe. However, liquidity issues can spread quickly and have far-reaching consequences. The 2008 financial crisis was a notable example of how quickly risk can spread throughout the financial system in a short time.

Challenges for Consumer Finance

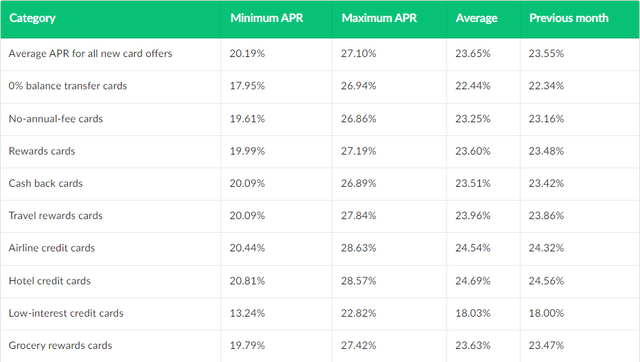

Credit Card Interest Rates (LendingTree)

In addition to challenging conditions for regional and diversified banks' investment portfolios, struggling consumer finance markets may have a negative impact on the overall performance of the financial sector and related ETFs such as the Vanguard Financials ETF. The consumer finance industry represents 5.2% of VFH's portfolio. Consumer finance has been the financial sector's hardest-hit segment, with credit card interest rates currently at an all-time high of more than 23%. Moreover, as the Fed intends to raise the federal funds rate, additional increases are anticipated in 2023 and this situation could impact the demand for new credit and the risk of default. The results for the fourth quarter made this abundantly clear. In the fourth quarter, Capital One Financial (COF) reported credit losses of $2.42 billion compared to $381 million in the same period last year. One of the largest credit card issuers, Discover Financial (DFS), also foresaw challenging times ahead and predicted that its full-year net charge-off rate could rise to 3.5%-3.9%. Diversified banks also have exposure to the consumer financial markets. For instance, due to the risk of potential losses in its credit card and point-of-sale loan portfolios, Goldman (GS) recorded a $972 million provision for credit losses, which was 50% higher than analysts anticipated.

Recession Could Make Things Worse

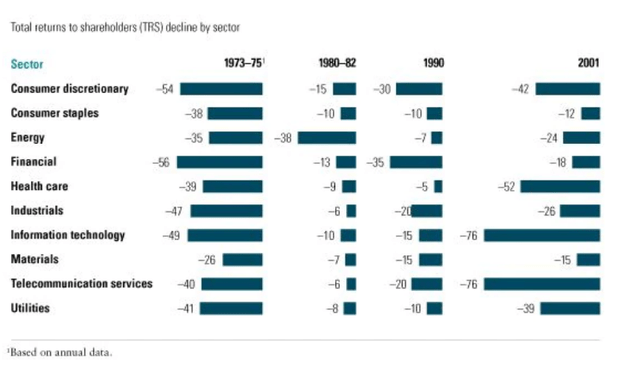

Financial Sector Performance in Recession (mckinsey.com)

The financial sector may be significantly impacted by the impending recession. In a recession, there is little demand for new loans, little spending power, and a high risk of bad debts. In the first two months of 2023, the US economy grew quickly, but the Fed's interest rate policy and banking crisis could stifle future growth. The Fed Chairman stated that the banking crisis would have the same impact as at least one quarter-point rate hike. However, market observers such as Torsten Slok, chief economist at investment manager Apollo, believe the recent disruptions could have the same impact as the Fed raising interest rates by 1.5 percentage points. In response to increased uncertainty about the economic impact of bank stress, Goldman Sachs increased its estimate of the likelihood of a US recession to 35% from 25% over the next 12 months. As the likelihood of a recession in the United States grows, history shows that the financial sector performs poorly both before and during a recession, which isn't good news for investors looking to buy hard-hit financial sector ETFs like Vanguard Financials ETF.

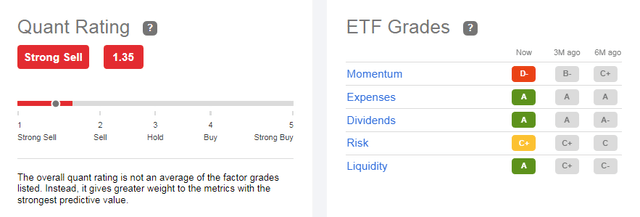

Quant Ratings

Quantitative analysis, which removes emotions from investment analysis and focuses on real data for analysis, is one of the best methods for price prediction. The Vanguard Financials ETF received a strong sell rating from the Seeking Alpha quant system, which focuses on five important factors. VFH's negative D grade on the momentum factor indicates that the ETF is at high risk of extending the share price downtrend. Another important factor in quant ratings is the risk factor, which is flashing a warning signal. The ETF has an overall quant score of 1.35 and is ranked 12th out of 26 in its sub-asset class.

In Conclusion

ETFs like Vanguard Financials that provide more comprehensive coverage of the financial sector are subject to a great deal of uncertainty because a number of risks have not yet been factored into their price. Even if the banking crisis stabilizes and the risk of contagion declines, banks are likely to face a high risk of new regulations and strict lending policies, which do not bode well for their financial growth. Furthermore, slowing economic growth and a recession would increase the number of bad debts and unrealized losses significantly. Overall, buying the Vanguard Financials ETF after the recent selloff is tantamount to gambling.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.