GLD: Option Trading Confirms A Breakout

Summary

- Last week, we wrote an article on why we think GLD has started a 30% advance to $230. This was based on the level of short selling by future traders.

- This article will expand on that and show that option purchases by GLD traders seem to confirm this buy signal.

- Interestingly, the same option data indicates we are a long way from a top in the current gold move.

sankai/iStock via Getty Images

Last week we wrote this article, which explained why we think NYSEARCA:GLD has started a 30% advance to $230. This conclusion was based on short selling levels of future traders and was a follow-up article to our August buy signal.

This new article will expand on that and look at GLD from another angle; it will show that option trading in GLD seems to confirm this and also be pointing to a large price move.

But first, I'll show you the futures chart from the last article that led to the original buy signal.

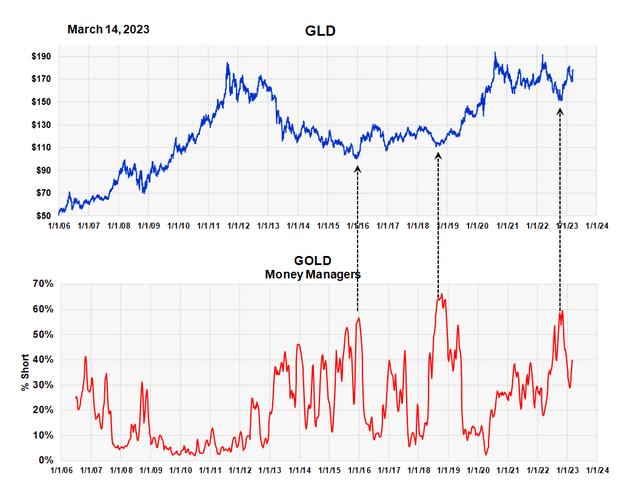

COT data on short positions in gold futures (Michael McDonald)

This long-term chart, which goes back to 2006, is based on commitment of traders data from the futures exchange. It shows that high levels of short selling by money managers in gold of around 50% to 60% occur just prior to major price moves.

The three green arrows show this. These signals are not short-term price moves, but intermediate to long-term ones. This was all explained in the first article.

This buy signal was confirmed by another signal based on the puts to calls ratio in GLD, which is what this article is about.

Option Trading in GLD Also Points To Higher Prices

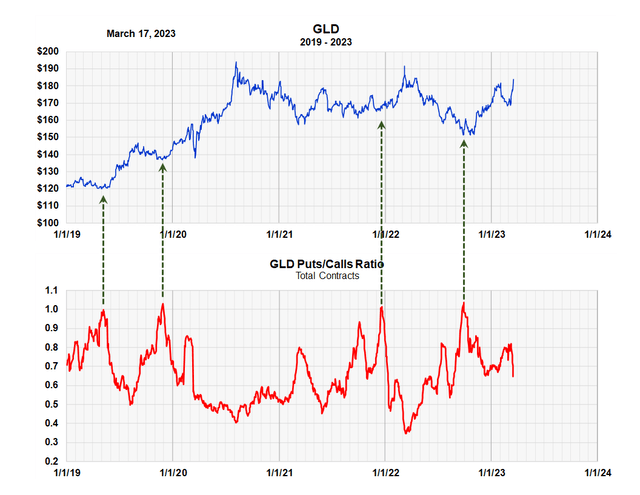

Puts to Calls Ratio in GOLD (Michael McDonald)

This graph plots the puts to calls ratio in GLD. The data comes from the CBOE. Normally, there is more "call" buying than "put" buying, but when the ratio gets to one to one, or higher, which is not very often, it generally occurs just prior to a rally in GLD. This is very clear from the chart.

The puts to calls ratio was developed by Marty Zweig in 1971 and has a wonderful, 50 year track record indicating major moves in the overall stock market. It also has a good track record at locating tops and bottoms of some ETFs and sectors and we find it very useful for GLD.

We think the high ratio of 1.04 in October, which is indicated by the last arrow on the right and occurred coincidental with high short selling by futures traders, was a confirming signal. In other words, two different metrics of investors sentiment gave strong buy signals at the same time.

Remember, the puts and calls ratio shown above measures what investors are doing in GLD, while the commitment of traders data measures what future trader are doing in gold futures.

The Ratio of Contracts Confirmed by the Ratio of Trades

The puts to calls ratio is the ratio of the number of "put" and "call" contracts. It doesn't tell us, however, how many traders are involved. It could be that all the calls were purchased by one wealthy buyer.

Because of this we also calculate the ratio of the number of put and call trades. This provides a better look at how many traders are involved and how statistically broad the ratio is. We prefer it when the two ratios are about the same. This gives us confidence that the ratio of contracts truly reflects the opinions of many traders.

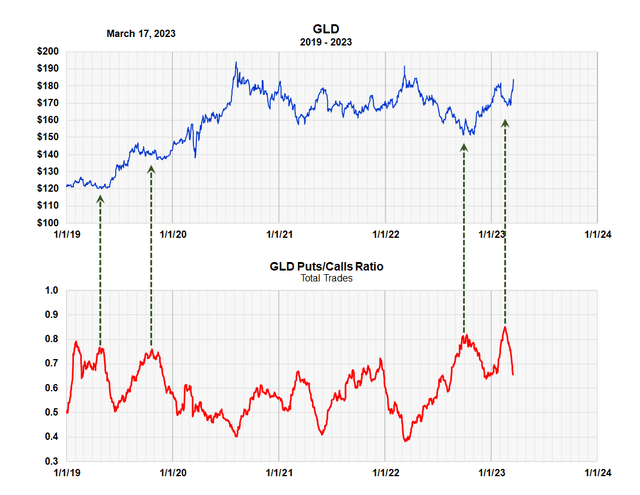

The chart below is the ratio of the number of put and call trades in GLD.

Puts to Calls Ratio of Trades (Michael McDonald)

Studying both charts shows the two current ratios - the ratio of contracts and the ratio of trades - are almost identical at .65, which is good.

When is the top in GLD?

Options statistics can also provide insight into when a price move might be ending. The previous chart was the ratio of the number of put and call trades in GLD. The chart below graphs the actual numbers that go into the ratio.

Daily number of put and call trades in GLD (Michael McDonald)

The red line plots the average number of call trades in GLD per day. It can vary from 5,000 call trades to 40,000, or more. The important thing to notice is that major price tops in GLD often occur when there is a large surge in call buyers in GLD. We've indicated that with two arrows, which point to peak levels in the number of call trades.

The lack of a surge in call buying with the current move gives us confidence it has farther to go.

Summary

As we said, we expect this price move in GLD to carry forward to $230. However, we also have an eye on this statistic. Right now, there is no worry; the price target stands.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.