Alvopetro: A Sustainable 11% Dividend Yield From This Natural Gas Producer

Summary

- Alvopetro Energy produces natural gas in Brazil. It sells the gas to a local company, thereby receiving premium prices north of $10/mcf.

- Prices are locked in for six month periods. This provides excellent near-term cash flow visibility.

- The dividend was recently hiked again, the stock now yields 11% and this requires just about 40% of the AFF.

- The anticipated growth capex + dividend should be fully funded by the incoming cash flows.

- The fair value based on the PV15 calculation of the 2P reserves is roughly 50% higher than the current share price.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Drs Producoes

Introduction

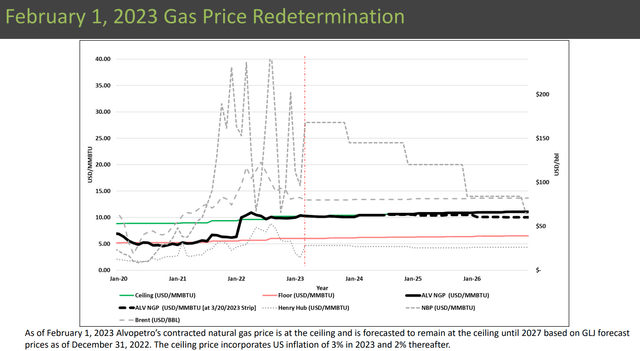

The last time I provided an update on Alvopetro Energy (OTCQX:ALVOF) (TSXV:ALV:CA), the Canadian company focusing on producing natural gas in Brazil, was in the summer of last year. I was still bullish on the stock as the pricing mechanism in Brazil is pretty interesting: the company's agreement with Bahiagas calls for two price determinations per year and the natural gas price is reset on February 1 and August 1 every year. Thanks to the high natural gas price last summer, Alvopetro was still able to sell its natural gas price at a double digit price level throughout the entire second half of the year.

Alvopetro's website does not contain 'unique' URLs for the press releases but you can find all news releases here. The financial statements and Annual Information Form can be found here.

The very strong natural gas price in 2022 provided a major boost to the financial results

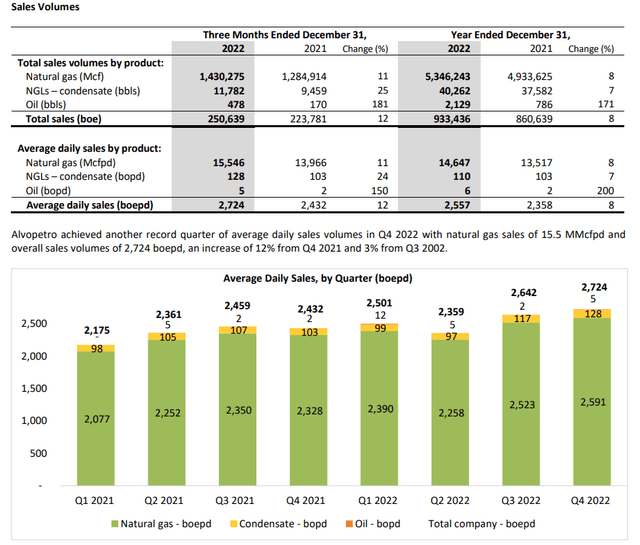

Alvopetro isn't a large producer but its profitability is very strong. IN the final quarter of 2022, the company sold an average of just over 2,700 barrels of oil-equivalent per day, of which approximately 95% consisted of natural gas with the remainder NGLs and condensate. There's very little oil, and the average production of oil is just 5 barrels per day (not a typo). Needless to say Alvopetro's financial performance is closely correlated to the natural gas markets in Brazil.

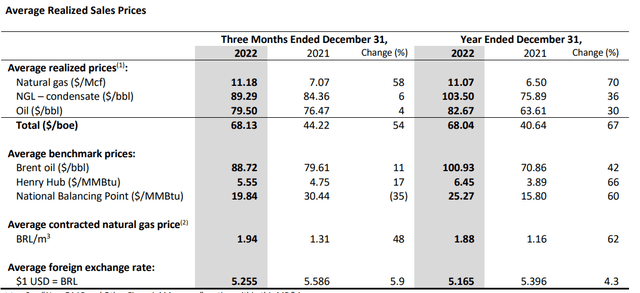

The average realized natural gas price during the final quarter of the year was US$11.18/Mcf which brought the full-year average to $11.07. That's a 70% increase compared to the average realized price in 2021. Combined with a higher production rate, it goes without saying the financial results of Alvopetro are suddenly looking much stronger.

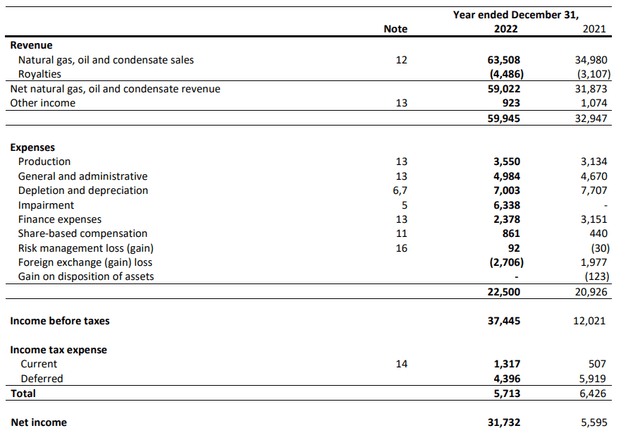

The full-year revenue came in at $63.5M (the company reports its financial results in US Dollars despite being Canadian) resulting in a net revenue of almost $60M after deducting the royalty payments. That's almost 90% higher than the revenue generated in 2021. The 'other income' includes a tax credit granted by the Brazilian government to producers of natural gas.

As you can see in the image above, the production costs are extremely low at just $3.6M. There are a bunch of other operating expenses (mainly included in the G&A expenses) but the total cost basis of running the company was $22.5M. And excluding the one-time items (impairment charges and the FX gain), the underlying operating expenses are less than $19M, including the normalized $7M in depletion and depreciation expenses and including the finance expenses.

The net income in 2022 was $31.7M for an EPS of $0.92 per share. That's still in US Dollars which means the Canadian Dollar equivalent was approximately C$1.25 (using an exchange rate of 1.35 CAD per USD).

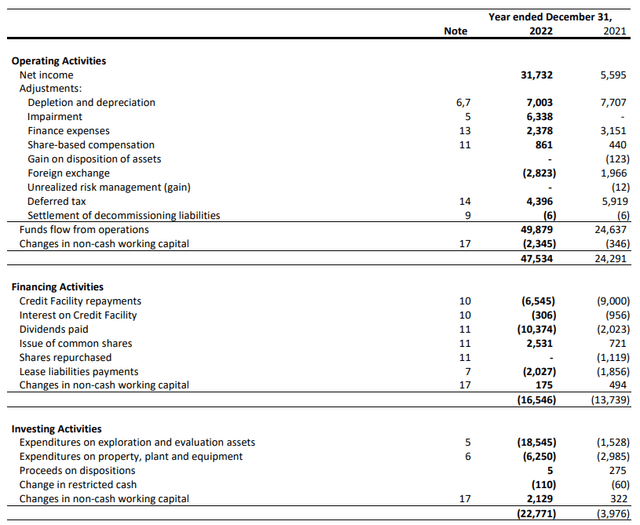

The cash flow result is even better than what the income statement is telling us. That's not really a surprise considering Alvopetro recorded an impairment charge of in excess of $6M which obviously weighs on the reported net income.

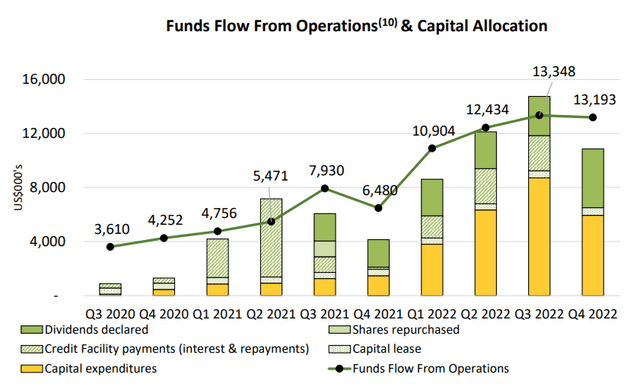

Alvopetro's operating cash flow before changes in the working capital position came in at $50M and after deducting the $0.3M interest expenses and the $2M in lease payments, the adjusted operating cash flow was $47.5M.

We see the total capex was $25M, resulting in an underlying free cash flow of $22.5M. While that is indeed lower than the reported net income, investors should be fully aware Alvopetro has been investing in growth. You can clearly see how Alvopetro's capital expenditures increased this year. Which obviously is totally fine as the incoming cash flows were strong enough to cover these increased capex commitments.

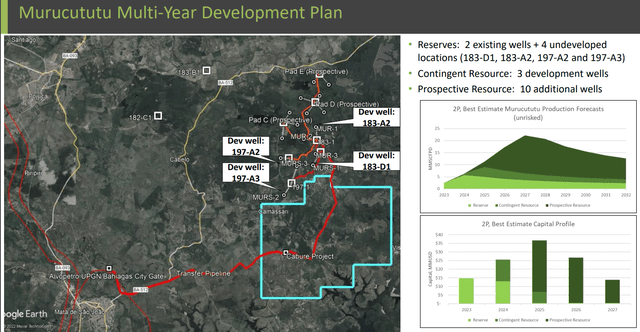

The majority of the growth capex was spent on the Murucututu project where several wells were drilled and where the infrastructure was put in place to get the natural gas to the market. The total capex budget for 2023 is estimated at $30M including $16M to be spent on Murucututu where the production will start to ramp up from Q2 2023 on.

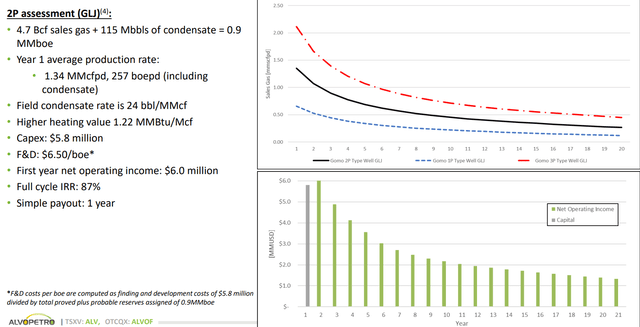

Those new wells should have very strong economics with a payback period measured in months rather than years. As you can see below, the undiscounted NOI of a typical well is approximately $60M over a 20 year calculated life for an initial investment of less than $6M to drill said well.

The capex program isn't an issue at all as Alvopetro's balance sheet has a balance sheet with a net cash position while the recently hiked quarterly dividend of $0.14 is costing the company less than $21M per year right now.

The reserves update is satisfying, and the high natural gas price environment is continuing

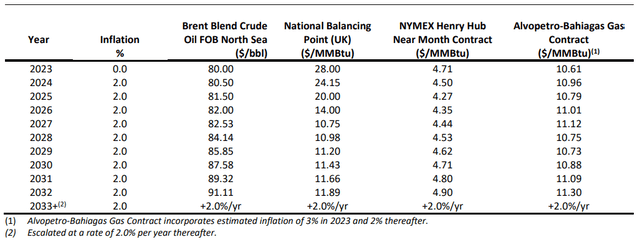

The main element to consider here is that the natural gas price received by Alvopetro is currently close to the ceiling level and the company anticipates the price to remain at the ceiling level (indicating a price of in excess of US$10) for the next few years based on the natural gas price at the end of 2022. As a reminder, the Bahiagas price is determined based on a blend of the Henry Hub, UK National Balancing gas price and the Brent oil price. Unfortunately the updated Annual Information Form does not disclose the exact formula so I'm not 100% sure what the recent decrease in the Henry Hub and Brent oil price means for the company.

Alvopetro is for sure safe in the next contract period from February 1 until July 31st. A recent update confirmed the received natural gas price will be $11.88/mcf, which is even higher than the average received price in 2022. Additionally, the production rate has been steadily increasing with an average output of almost 2,900 boe/day in February. That's a 4% MoM increase and a 5% increase compared to the average production in Q4 2022. The price and production increase in Q1, followed by the gas flows from the Murucututu gas field which will commence closer to the summer should further boost the operating cash flow towards $50-60M, which means the $30M capex program is completely self-funded.

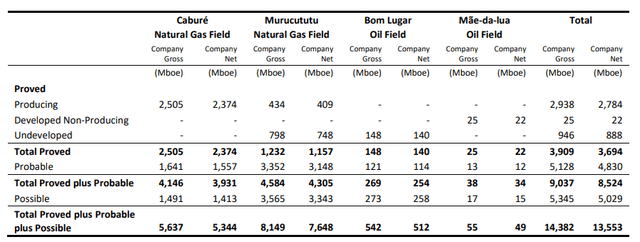

It's also interesting to see the total reserves of Alvopetro increased in 2022 despite having produced about 1 Million barrels of oil-equivalent in 2022. Whereas the total 2P reserves came in at 8.2M barrels on a net basis in 2021, this increased to 8.5M barrels as of the end of 2022 which results in a Reserve Life Index of approximately 8 years. Almost 60% of the 2P reserves is located on the Murucututu field which further explains why the development of this area is important to Alvopetro.

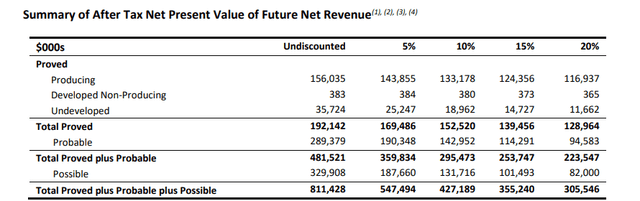

The after-tax PV10% of all gas fields comes in at $427M, and even if you would use a discount rate of 20%, the after-tax net present value comes in at $305M (this excludes interest expenses and G&A expenses). Note, this is based on the 3P reserves. The PV10 value of the 2P reserves is $295M.

It's important to note the average natural gas price used for these calculations is lower than the current spot price. The independent consultants used a Bahiagas price of $10.61 per MMbtu (which is approximately $11/Mcf). The current natural gas price to be received by Alvopetro in the current six month block is about 8% higher.

The after tax PV10 of $427M compares pretty nicely to the$353M calculation at the end of 2021, so Alvopetro clearly added value by replenishing reserves while the higher natural gas price obviously also doesn't hurt.

Investment thesis

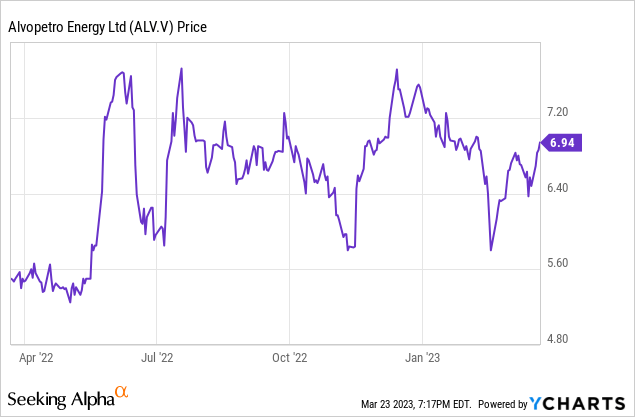

Using the net cash position of $20M and the PV10 calculation of $295M, the fair value of Alvopetro right now is $315M which is in excess of C$430M or approximately C$12/share. Right now, at the current share price of C$7, Alvopetro is valued at just 58% of its PV10 value and just 75% of its PV20 value. This clearly shows the stock is undervalued and even if you would use a discount rate of 20% to discount the future cash flows, there would still be an easy 30% upside from the current share price. Taking the middle road and applying a 15% discount rate would still result in a fair value of C$10.3/share at the current realized natural gas price, for an upside potential of 50% from the current market cap of C$255M (which is just US$185M).

The dividend is generous as the $0.14 per share per quarter is the equivalent of C$0.77 per share per year for a dividend yield of approximately 11%. This yield is completely sustainable, even if you take the anticipated 30M in (growth) capital expenditures into consideration.

The focus on this year should be to convert the possible reserves into the 2P reserves category

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I still don't have a long position in Alvopetro but I should go long in the next month or so.