RLTY: Dirt Cheap Closed-End Fund Yielding 9.4%

Summary

- Cohen & Steers Real Estate Opportunities and Income Fund launched in 2022, and as many of you know, that was a rough year for all equities; as such, the value of the fund has collapsed since being issued.

- RLTY is a closed-end real estate fund, as such, 100% of the fund's money is invested within the real estate sector.

- RLTY is now yielding 9.4% and is trading at a wide discount to peers.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

avdeev007

I’m weeks away from finishing my new book, REITs For Dummies, and next weekend I plan to write the chapter on exchange-traded funds ("ETFs"), Mutual Funds, and Closed End Funds.

I’ve covered a number of ETFs recently on Seeking Alpha, so I thought I would switch gears now and focus on a high-yielding closed-end fund.

For the newbies, a closed-end fund (or CEF) is organized as a publicly traded investment company by the SEC. Similar to a mutual fund, a CEF is a pooled investment fund with a manager who oversees it.

As such, a CEF will charge an annual expense ratio to cover the costs involved before the investor begins to see performance kick in.

CEFs start out by raising a fixed amount of capital with a fixed number of shares through an initial public offering (IPO). They are then structured, listed, and traded like stocks on a stock exchange, where they can make income and capital gain distributions to shareholders.

CEFs have several unique attributes.

Unlike regular stocks, they represent interest in specialized portfolios of securities that are actively managed by investment advisors and typically concentrate on a specific industry, geographic market, or sector.

The stock price of a CEF fluctuates according to market forces, such as supply and demand, as well as the changing values of the securities in the fund’s holdings.

Today I want to focus on Cohen & Steers Real Estate Opportunities and Income Fund (NYSE:RLTY), a CEF launched and managed by Cohen & Steers Capital Management, Inc.

The Basics

Cohen & Steers Real Estate Opportunities and Income Fund launched in 2022, and as many of you know, that was a rough year for all equities As such, the value of the RLTY fund has collapsed since being issued.

As stated in the fund’s prospectus, its objective is focused on high income investments within the real estate sector.

For its equity portion, the fund invests directly in stocks of companies operating across financials, diversified financials, mortgage real estate investment trusts (aka REITs), and real estate sectors. It uses derivatives such as options to create its portfolio. The market cap of particular securities is very broad.

For its fixed-income portion, the fund invests in fixed-income securities that are rated below investment grade. The fund uses the S&P 500 (SP500) as a benchmark for performance.

We have looked at numerous ETFs thus far that have varying expense ratios. We have learned that the more passively managed ETFs like Vanguard Real Estate ETF (VNQ) or Fidelity MSCI Real Estate Index ETF (FREL) have very low expense ratios below 0.10%.

RLTY, on the other hand, is a closed-end fund that has both a managed assets expense ratio as well as a common assets expense ratio.

- Managed Assets Expense Ratio: 1.59%

- Common Assets Expense Ratio: 2.07%.

The other thing that RLTY does is attempt to derive higher returns by utilizing leverage. As of this writing, RLTY has a leverage ratio of 34.88%, according to their website.

This percentage represents as a percentage of the fund’s managed assets as of the most recent month end. According to Cohen & Steers, leverage is created whenever a closed-end fund has investment exposure in excess of its net assets. As of this writing, the RLTY has $421.47 million in managed assets. Investing $10,000 into RLTY equates to an annual fee of $119 in year one.

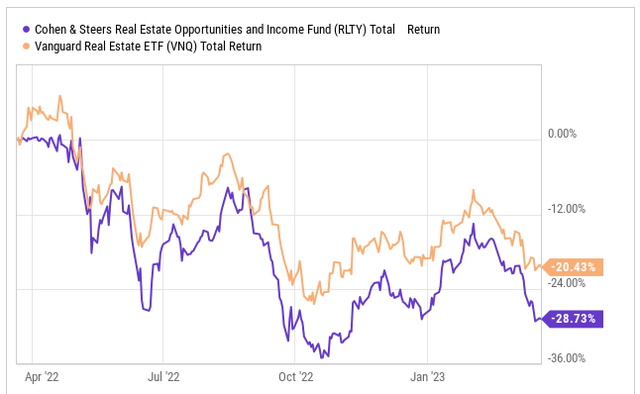

The popular Vanguard Real Estate ETF is viewed as the benchmark for the real estate sector. As such, we will compare the performance of RLTY to VNQ. Over the past 12 months, as RLY has only been around that long, RLTY has underperformed VNQ, generating a total return of -28% versus VNQ's -20%.

The S&P 500 (SPX), which the fund uses as a benchmark, has returned -9% over the same 12-month period, outperforming both VNQ and RLTY. They have been under pressure due to rising interest rates.

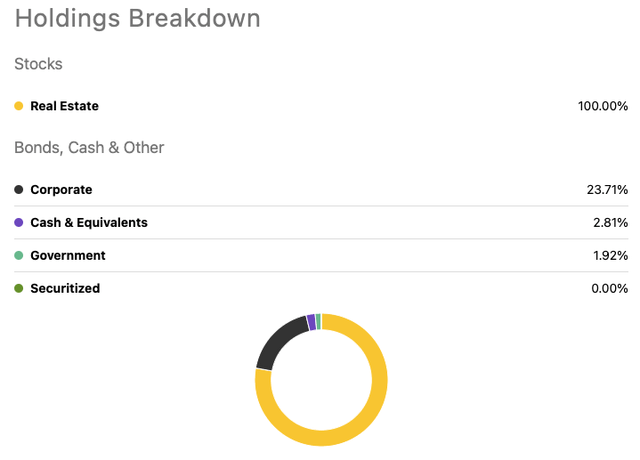

RLTY is a real estate fund, and as such, 100% of the fund's money is invested within the real estate sector. However, the fund does also invest outside of equities. In the chart below, you can see how that is broken out.

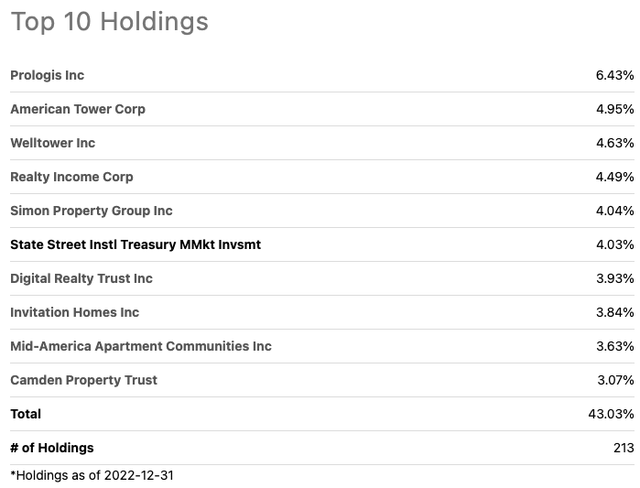

Next, let’s take a look at the fund's top 10 positions and their weightings:

These top 10 positions make up 43% of the portfolio. In totality, the fund has 213 total holdings.

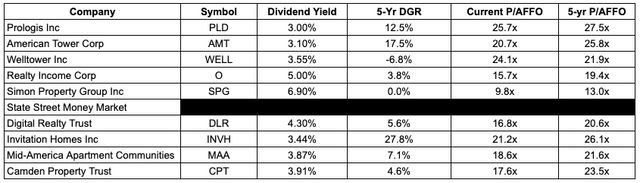

Let’s take a look at the dividend stats as well as valuation and five-year average as it relates to these top positions.

Looking at the top 10 positions above, we can see a lot of similarities at the top of the list with that of VNQ or even FREL, which is a Fidelity MSCI Real Estate ETF we recently looked at.

The bottom three positions within the top 10 are all new when compared to those other ETFs. Looking at the chart above and knowing the pressure that the real estate sector has been under, it should come as no surprise for the REITs to be trading below their five-year historical average.

Now that we have looked closer at the performance and position, let’s take a closer look at RLTY’s dividend. RLTY currently pays an annual dividend of $1.25 over the past 12 months, which equates to a high dividend yield of 9.6%. RLTY also pays out their dividend on a monthly basis.

In terms of distributions, these types of CEFs with a larger exposure to securities must rely on share price appreciation and eventually capital gains. As mentioned, the fund started in early 2022, so those gains have been non-existent. Thus, the RLTY fund has not truly earned its distribution as of the end of 2022. If this continues, a distribution cut could be on the horizon (unlikely IMO).

Investor Takeaway

As we saw, RLTY is a closed-end fund, or CEF. For those of you new to CEFs, they start out by raising a fixed amount of capital with a fixed number of shares through an IPO.

They are then structured, listed, and traded like stocks on a stock exchange, where they can make income and capital gain distributions to shareholders.

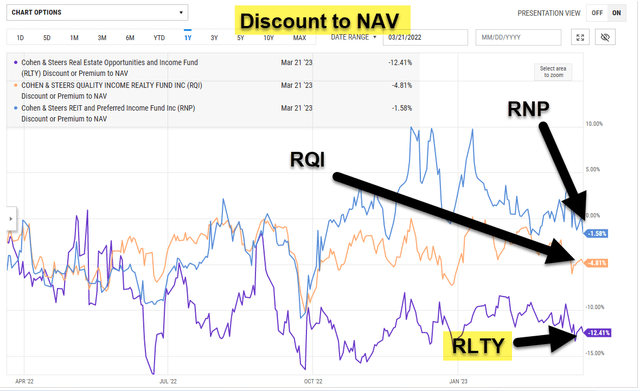

These CEFs are actively managed and tend to come with higher income, but also come with plenty of risks due to leverage. Because they trade throughout the day, CEFs can trade below their NAV, which is what we are seeing with RLTY. However, if the market turns around, particularly the real estate market for this fund, it could prove to be a great opportunity.

YCharts (RLTY AV discount is -12.4%)

One last point, this one regarding the Fund Manager, Cohen & Steers, Inc.

I consider this firm a world class asset manager. Its founders, Marty Cohen and Bob Steers, are legendary in that they created and managed the first mutual fund specializing in real estate securities in 1985 and the first CEF in 1988. Their company listed on the NYSE under the ticker (CNS) in 2004.

Cohen & Steers' other real estate-focused funds include the Cohen & Steers Quality Income Realty Fund (RQI) and Cohen & Steers REIT and Preferred and Income Fund (RNP). We’ll be looking at these tickers in a few days.

As noted in my disclosure, I plan to purchase shares in RLTY within the next 48 hours. Here’s a list of my recent ETF articles:

- Pacer US Cash Cows 100 ETF (COWZ) 1.9% Yield

- Vanguard Real Estate ETF (VNQ) 3.8% Yield

- JPMorgan Equity Premium Income ETF (JEPI) 11.9% Yield

- InfraCap Equity Income Fund ETF (ICAP) 8.6% Yield

- iShares U.S. Real Estate ETF (IYR) 2.8% Yield

- Schwab U.S. Dividend Equity ETF (SCHD) 3.4% Yield

- The Fidelity Covington Trust MSCI Real Estate Index ETF (FREL) 3.4% Yield.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 15,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RLTY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.