BioLife Solutions Is Set To Finally Absorb Its Acquisitions

Summary

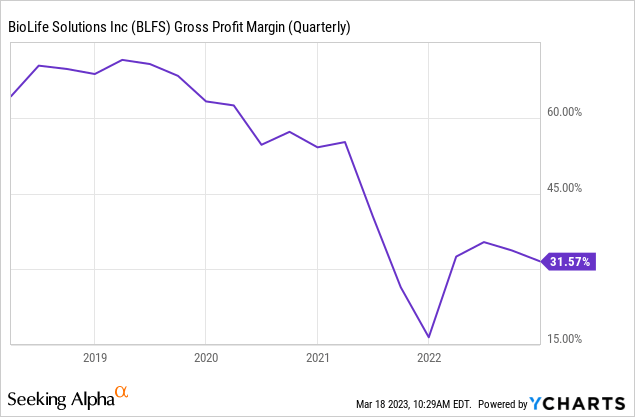

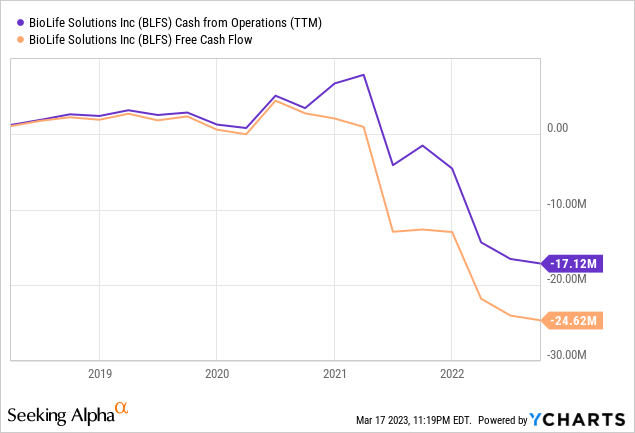

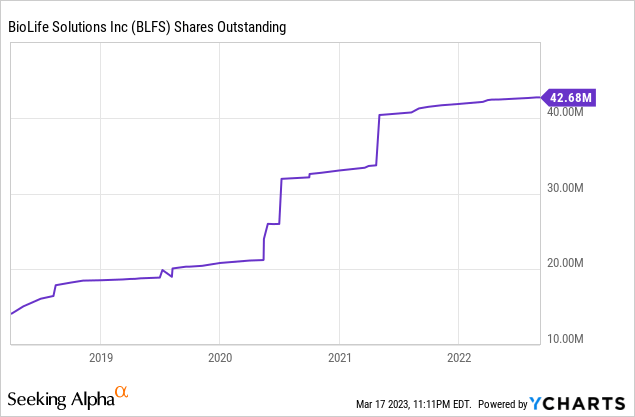

- An acquisition spree has produced a host of problems, costs, write-offs, a collapse in gross margins and profits, cash bleed, and significant dilution.

- While only the evo and Sexton acquisitions have been a real success, the problems at some of the others now seem to be largely in the rearview mirror.

- With most of the growth automatically coming from existing customers and the CGT market still in the early innings, the company is set to be a long-term compounder.

- Looking for more investing ideas like this one? Get them exclusively at SHU Growth Portfolio. Learn More »

onurdongel

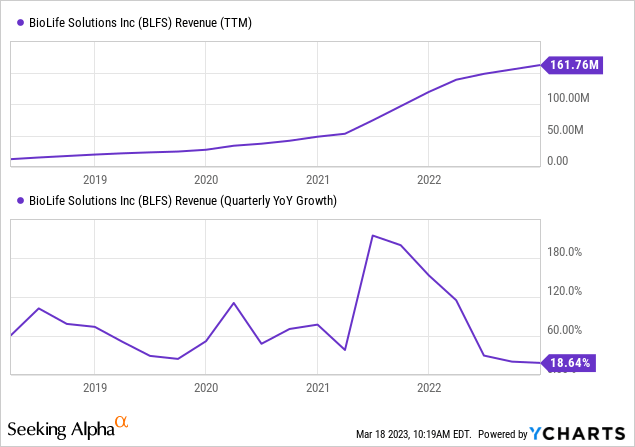

BioLife (NASDAQ:BLFS) is a producer of biopreservation media for the CGT (gene and cell therapy) industry, which is still in the early innings of significant growth. The company was doing very well with that high-margin business, winning market share and having customers with growth baked in.

But then the company started to go on an acquisition spree, and while we were keen on two of these (evo cold chain transport services and Sexton), some of these others have produced way more costs and problems than benefits and have brought the company losses, cash outflows, write-offs, dilution, and lower margins.

But it looks like most of these problems are now behind us so with growth likely to continue (much of it baked in, as we'll argue below), shareholders are still reaping rewards here.

Growth is baked in

From the Q4CC:

To make the point on revenue differentiation in Q4, about 60% of total revenue was recurring high margin with instruments comprising the rest. As a reminder, we expect this to increase to 70% or more by the end of 2025.

The company has multiple ways to keep growth going:

- Raking in new customers

- Expanding sales to existing customers

- New products and services

- Geographical expansion

Most of the growth in FY22 came from existing customers and that isn't expected to change in FY23. Nevertheless, the company is raking in new customers as well.

New customers

The company added roughly 200 new customer sites in each quarter last year (Q4CC):

building a phenomenal pipeline of early-stage customers that we will nurture and support to drive future growth... New Q4 customer sites by product line included 15 now using biopreservation media, 7 new ThawSTAR users, 12 new evo cold chain end users, 13 new cryogenic freezers and accessory customers, 139 new Stirling ULT freezer and accessory customers, 26 new BioStorage customers and 5 new Cell Processing customers now using Sexton products. For Cell Processes in Q4, we received confirmation that our solutions will be used in at least 27 additional clinical trials for new cell and gene therapies. We estimate that our biopreservation media products have been used in or are planned to be used in over 600 customer clinical applications.

That adds up, and it keeps adding up because they're doing this basically every quarter.

Expanding sales to existing customers

The Q4CC sums it up nicely:

We see five strong catalysts that can support our growth estimates by increasing the total manufactured doses that our solutions are embedded in. These are approval of new cell and gene therapies, approvals of existing commercial therapies as first or second-line treatment, approvals of existing commercial therapies for additional indications, approvals of existing commercial therapies in new geographies, and finally, an eventual shift to allogeneic therapies.

One has to realize that customers, especially those of their biopreservation media, start small, usually at stage 1 clinical trials (or even pre-clinical). As they move across the clinical phase, trials get larger and so does the demand for preservation media (and possibly other BioLife products).

A step change occurs when therapies get approved for commercial use, greatly increasing demand to $500K-$2M per year per approved therapy. The company already has 12 of these and another 10 of their clients can gain approval for 10 additional therapies before the end of 2024.

The same economics actually apply to the Sexton products as well (Q4CC):

We estimate that annual revenue for Sexton reagents and consumables used in approved customer therapies also ranges from $500,000 to $2 million for both CellSeal and HPL Media.

Statistics are on the company's side, with ever more clinical trials as customers, ever more therapies will get approved. Then there are the other opportunities mentioned in the quote above, as well as cross-selling opportunities.

Geographical expansion is occurring mostly in Asia Pacific where they are rationalizing their network of distributors.

Then there is the arrival of allogeneic therapies which opens up the possibility of mass adoption of CGT (cell and gene therapy), from Cell Culture Disk:

Allogeneic therapies are manufactured in large batches from unrelated donor tissues (such as bone marrow) whereas autologous therapies are manufactured as a single lot from the patient being treated... While both therapies use similar technologies common to the growth of cells, the scale is different. Allogeneic therapies are "off the shelf", used to treat many patients (sometimes thousands) and more time is available to quality control the product prior to administration. Autologous therapies are "custom" products for each patient and the chain of identity of the patient samples is critical to assure the right product is returned to the patient.

And when asked, here is CEO Mike Rice (Q4CC):

we firmly believe that there will be an eventual shift to predominant allogeneic therapies as more biology is understood. And the infrastructure to support massive production of doses that can be administered to unrelated recipients relative to the donor gets all flushed out in the system. So that's certainly an upside lever and a catalyst for us that we think is going to be meaningful. And I'll just remind our listeners that we are involved in the leading allogeneic cell therapy developers today.

Allogeneic therapies are already to start invading pre-clinical and early-stage clinical trials so this could give the demand for the company's products a serious boost, if not take it to a whole new level, years down the line.

Basically, existing customers are like a train in motion, they will keep increasing the demand for BioLife products for years to come.

Cross-selling

The company embarked on an M&A drive taking over 5 different companies to increase the size of CGT wallet spending:

These products and services all sell to the same client base so there are a lot of opportunities for cross-selling like:

- Within cell processing, biopreservation clients also use the Sexton media vials and film machines and vice-versa.

- Between freezers and storage services as capex-constrained customers switch from the first to the latter as a stop-gap measure.

But management is also bringing new products and services online this year.

Problems and headwinds

To date, this has created more problems than benefits:

- Most of these acquired companies produced lower gross margins.

- There were significant acquisition and integration costs to absorb, leading to significant dilution.

- One of the acquired companies, Sterling, turned out to have serious quality and supply chain issues, leading to reduced revenue growth, serious write-downs, and additional costs.

There were also other problems and headwinds

- The bags from their supplier not being certified as particulate free so they are having particulates. Therefore the company has a lot of scrap and had to engage with another supplier which will reduce scrap, which will improve gross margins.

- Covid related revenues are winding down pretty rapidly

They didn't say a whole lot about Sterling, which has caused so much problems recently (Q4CC):

our team is focused on supply chain optimization, producing scrap, and approving efficiency in the plant to right size the workforce with a focus on getting things done right the first time. We're shipping from inventory and our quality metrics are at an all-time high level.

So it looks like things are improving there and it's a significant part of their gross margin guidance, which management believes will reach 50% at the end of 2024.

The slump in gross margin is the result of their acquisition binge, getting it back to 50% would be quite an accomplishment as some of the acquired businesses produce inherently lower gross margins.

The funny thing is, it looks like basically all these problems are winding down and maybe only macro headwinds will remain as a headwind, although it remains to be seen how much impact that has on the sector, which isn't particularly cyclical.

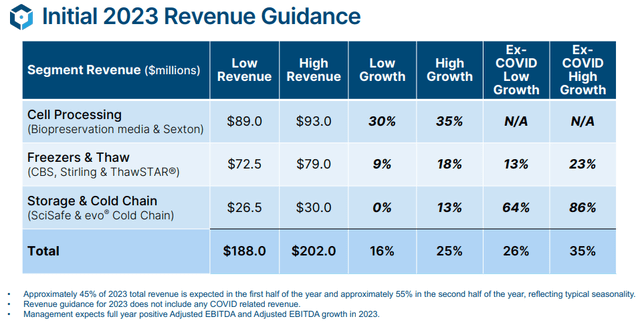

In any case, guidance for revenue growth (16%-25%) is lower for this year, although the picture change when Covid-related revenue is ignored (26%-35%).

Management stands by its end-of-2024 projection of $250M in revenue, 50% gross margin and 30% adjusted EBITDA margin.

Financials

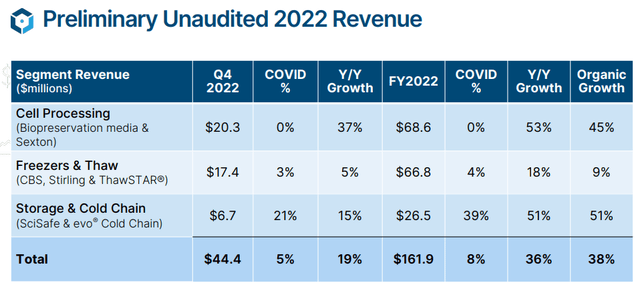

Some of these figures have changed fractionally since the Q4 figures came out (Q4 revenue was $44.3M, Cell processing revenue was $20.2M and its growth was 36%, for instance) but not materially.

We highlight evo, as that business always had world-class potential and it's doing very well (Q4CC):

Q4 evo shipments of over 2,000 were up well over 100% over the same quarter last year. Of these, we estimate approximately 75% were for approved therapies and the rest were for clinical trials. Total evo shipments for the full year 2022 were nearly 10,000, again, a doubling over 2021. We're collecting a huge amount of shipment information that is shaping our innovation and development of our transport containers and evo IS cloud app.

Here is another illustration that the acquisitions have brought quite a bit of short-term pain:

Valuation

A main gripe we have with the company is the following:

With 46.1M shares fully diluted (there are quite some options outstanding as several executives requested to be paid in stock in 2022), the market cap at $21.5 is $991M, with $26.3M in debt and $64.1M in cash and equivalents the EV is $953M.

With an expected revenue of $195M (midpoint of guidance), the shares are selling at 4.9x EV/S. Analysts expect earnings still to be negative ($0.74 EPS loss) but turn positive ($0.01) in 2024.

If we assume that the company will reach its end of 2024 goal of $250M revenue and 30% adjusted EBITDA margin that would give BLFS stock an EV/EBITDA of 12.7x, not really cheap still, but this company has all the characteristics of a long-term compounder.

Conclusion

A host of acquisitions have brought the company a host of trouble, cash outflows, significantly lower gross margins, large dilution of shareholders, and a host of acquisition and integration costs and problems to solve (most notably at Sterling), producing large write-downs.

With hindsight, the company would have done much better if it had stopped at the first acquisition, that of evo, which is now starting to deliver on its promise to become a world-class cold chain transport service solution.

Its original preservation media and evo are still the fastest growing parts and preservation media is their highest margin business and the business with the highest future sales already baked in from existing customers.

But hindsight is 50/50, and here we are. While we were not too keen on these freezer businesses, these are winning a considerable amount of new customers and we expect most of these problems with Sterling will wither away this year.

Given that the company keeps winning an impressive amount of new customers, has plenty of cross-selling opportunities, with a lot of future revenue growth already baked into existing customers, we have little doubt that the company will keep growing at a 20% rate.

And with most of the problems and costs in the rearview mirror, financials will improve faster so shareholders still have a lot to look forward to.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.

This article was written by

I'm a retired academic with three decades of experience in the financial markets.

Providing a marketplace service Shareholdersunite Portfolio

Finding the next Roku while navigating the high-risk, high reward landscape.

Looking to find small companies with multi-bagger potential whilst mitigating the risks through a portfolio approach.

Disclosure: I/we have a beneficial long position in the shares of BLFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.