ECNS: Better Value On The China Reopening Trade Via The Small-Caps

Summary

- The near-term setup for Chinese stocks looks great, given the accelerated momentum post-reopening.

- Additionally, the financial reforms announced at this year's NPC also bode well for the country's long-term appeal as an investment destination.

- The iShares MSCI China Small-Cap ETF offers better value given the cheaper valuation and superior distribution relative to its large-cap counterparts.

Graeme Kennedy

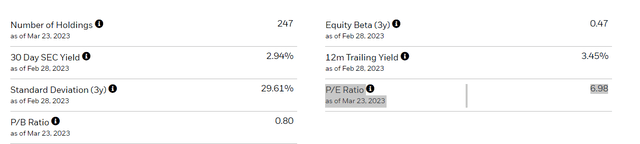

The Chinese economy continues to go from strength to strength, with a construction PMI surge to >60, accompanied by a decisive credit growth rebound following a series of rate cuts. Buoyed by the post-COVID reopening tailwinds, all signs point to a more bullish GDP print for this year despite the conservative ~5% target outlined at this month's National People Congress (NPC). Yet, the latest institutional reforms, particularly on the financial regulatory front, were just as important for China's mid-to-long-term economic prospects, in my view. Efforts to consolidate financial regulatory functions and improve the governance of state-owned capital, for instance, signal the government's intent to improve capital efficiency going forward. For investors looking for a higher-beta vehicle to ride the rebound, gaining small-cap exposure via the low-cost iShares MSCI China Small-Cap ETF (NYSEARCA:ECNS) makes sense. And at the current ~7x P/E valuation following the YTD decline, investors are arguably getting a better deal via the Chinese small-caps.

iShares

A Low-Cost and Well-Diversified Chinese Small-Cap Investment Vehicle

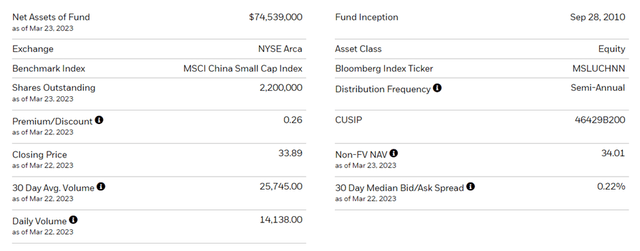

The US-listed iShares MSCI China Small-Cap ETF seeks to track, before fees and expenses, the performance of the MSCI China Small Cap Index, which comprises small-cap Chinese equities (~14% of the free float-adjusted market cap). The ETF held ~$75m of net assets at the time of writing and charged a 0.6% expense ratio, making it a cost-effective option for US investors looking to access small-cap Chinese equities. A summary of key facts about the ETF is listed in the graphic below:

iShares

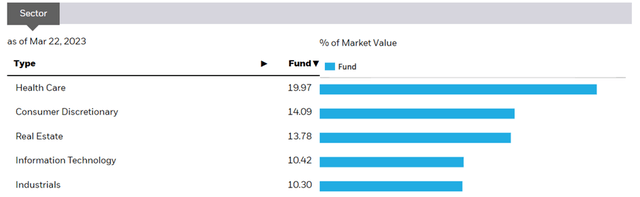

The fund is spread across 247 holdings, with a well-balanced sector allocation led by Health Care (20.0%), Consumer Discretionary (14.1%), and Real Estate (13.8%). Additional sectors with a >10% weightage include Information Technology (10.4%) and Industrials (10.3%). In total, the top-five sectors have a combined allocation of 68.6%.

iShares

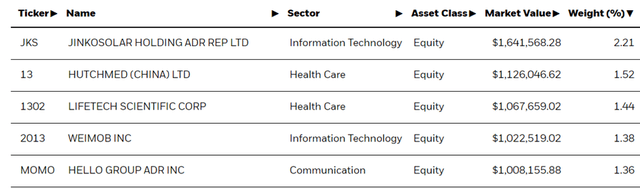

The single-stock allocation is similarly diversified, with no holding contributing more than 3% of the portfolio. Solar panel manufacturer JinkoSolar (JKS) is the largest holding at 2.2% of the portfolio, followed by biopharmaceutical company HUTCHMED (HCM) at 1.5%, and medical devices company LifeTech Scientific (OTCPK:LFTSF) at 1.4%. Rounding out the top-five stock holdings are WeChat-based software provider Weimob (OTCPK:WEMXF) at 1.4% and mobile-based social and entertainment services company Hello Group (MOMO) at 1.4%. In total, the top five holdings account for ~8% of the overall portfolio.

iShares

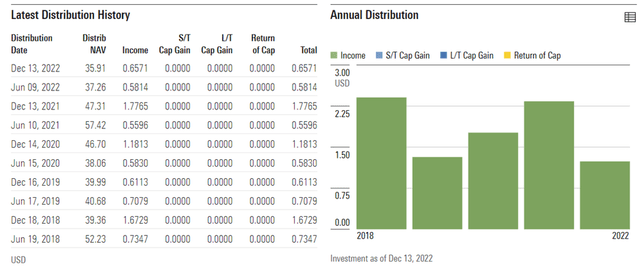

On a YTD basis, the ETF has declined by 6.4% and has compounded at a lackluster 0.4% rate in market price and NAV terms since its inception in 2010. Last year's ~25% drawdown was a key contributor to the fund's poor track record, though returns have been typically volatile through the cycles. On a three, five, and ten-year basis, annualized returns stand at -1.0%, -3.3%, and 2.4%, respectively. Distribution has been a strong point, however, with the trailing twelve-month yield at a solid 3.5%. So, despite ECNS' volatility, it does offer a nice income supplement for investors.

Morningstar

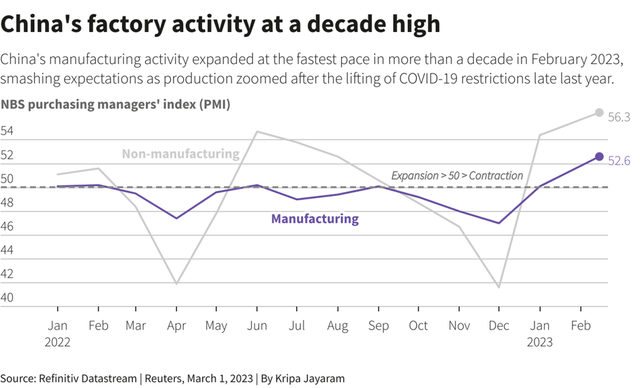

The Reopening Recovery is Gaining Momentum

The economic data is starting to catch up with investor optimism about the Chinese reopening. February PMI numbers were the key highlight thus far, with manufacturing and construction PMI indicating significant expansion and a return of business confidence. Meanwhile, the services PMI, a leading gauge of momentum in the worst-hit part of the economy through COVID, also came in well ahead of the trend. At the heart of the rebound was a broad-based expansion in new orders (particularly export orders) at the fastest rate since pre-COVID levels. Alongside the accelerating credit growth (proxied by TSF data) and continued monetary easing, all signs point to a 'V-shaped' economic recovery in the coming months.

Reuters

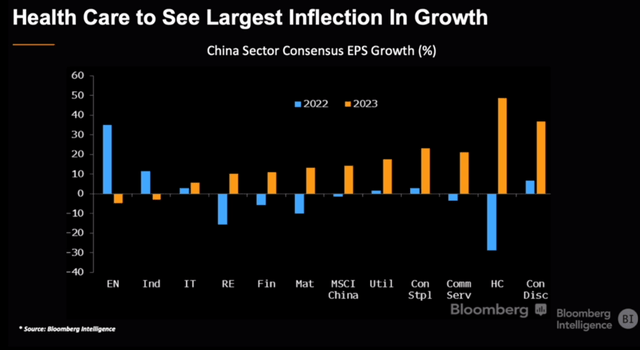

While the lower-than-expected NPC growth targets and the lack of major fiscal stimulus dampened investor sentiment, the strength of the post-reopening recovery means growth should outperform anyway. In the meantime, the government's focus on narrowing its deficit seems prudent, particularly given the troubles at off-budget financing channels such as the local government financing vehicles (LGFVs) and the need for balance sheet repair at troubled developers. Also helping the fiscal room will be a reversal of last year's tax rebates, which should ensure a sufficient backstop against any regional/sector-specific stress going forward. While most of the earnings revisions have occurred in the services sector, this should broaden out as the reopening progresses; ECNS' well-diversified portfolio should, thus, catch up with its larger peers eventually. In the near term, the fund's outsized healthcare exposure will be worth monitoring, given the size of the earnings revisions recently seen at large-cap healthcare names like Alibaba Health (OTCPK:ALBHF), JD Health (OTCPK:JDHIF), and Ping An (OTCPK:PNGAY).

Bloomberg

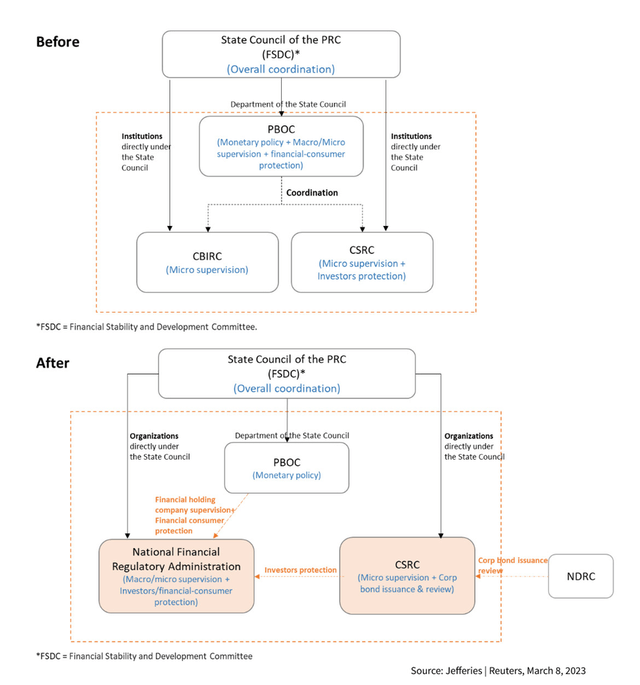

Game-Changing Regulatory Reform Bodes Well for Long-Term Competitiveness

Beyond the near-term momentum, China's long-term setup also looks compelling following the announcement of institutional reforms to restructure its financial regulatory functions and build resilience against systematic shocks. Progress on the formation of a new super-regulator, the 'National Financial Regulatory Administration' (NFRA), will be key as China looks to lay the regulatory environment to enhance the competitiveness of its financial system while also maintaining oversight of the country's financial conglomerates. The regulatory changes also mark an important step ahead of the potential restructuring of a growing list of distressed developers and LGFVs.

Reuters

Elsewhere, the post-NPC reforms will also entail a more powerful securities regulator (CSRC or the 'China Securities Regulatory Commission'), as it gains oversight of state-owned bond issuances (previously under the National Development and Reform Commission's (NDRC) purview). As always, the execution here is key; the hope is that this facilitates a more integrated onshore bond market over time. Also positive was the improved governance of state-owned capital via the separation of ownership, management, and regulation, which should enable better capital efficiency. Overall, the announced reforms highlight China's commitment to structurally improving its capital markets' competitiveness and bode well for its appeal as a destination for investment flows.

Better Value on the China Reopening Trade via the Small-Caps

With Chinese economic data starting to catch up to investor optimism around the post-COVID reopening, the prospect for a bullish GDP growth print this year looks good. While most headlines have focused on the lack of fiscal stimulus and the below-par growth target unveiled at this year's NPC meeting, I would point to the encouraging financial reform efforts in the pipeline. Not only do these efforts better position China's competitiveness from a mid-to-long-term standpoint, but they also set up a potential large-scale restructuring of troubled developers and LGFV debt, a key overhang on investor sentiment thus far. Of the numerous low-cost vehicles available for investors looking to ride the reopening wave, ECNS stands out for its focus on small-caps, which offer a higher beta play on the theme. Relative to its large-cap peers, the earnings valuation and yield are also more attractive following the drawdown in recent months; hence, adding small-cap exposure makes a lot of sense here. As economic growth continues to broaden out, expect an ECNS ETF re-rating as the fund benefits from upward earnings revisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.