GoGold: The Excellent Drill Results At Los Ricos South Continue

Summary

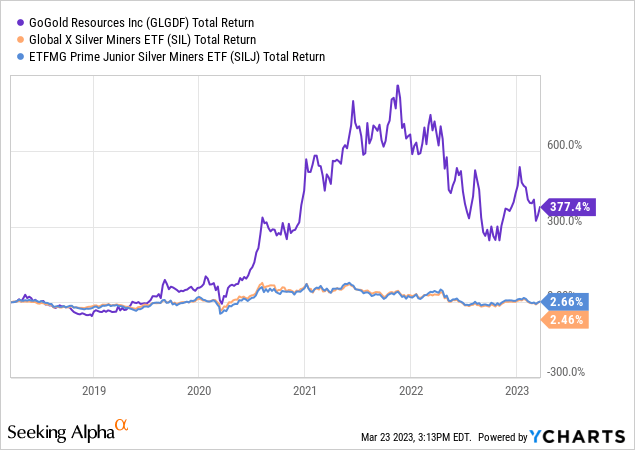

- GoGold has outperformed most peers over the last 5 years but has underperformed over the last year.

- The drilling at Los Ricos South continues to be extremely good, which is why I have increased my estimated value of the asset.

- There is a PEA on Los Ricos North due to be released around mid-April, which could be a very good near-term catalyst for the company.

- This idea was discussed in more depth with members of my private investing community, Off The Beaten Path. Learn More »

La_Corivo/iStock via Getty Images

Investment Thesis

I have written many articles on GoGold Resources over the last 5 years, which can be found here. GoGold (TSX:GGD:CA) is a Canadian listed gold & silver producing and development company that operates in Mexico. It also has an OTC listing (OTCQX:GLGDF) in the U.S.

The stock price has outperformed most precious metals miners over the last 5 years, but has lately underperformed due to weakness in the price of silver, but primarily due to the exclusion from the VanEck Vectors Gold Miners ETF (GDX) during the fall. The GDX exclusion was discussed in more details in my last article on the company.

GoGold is primarily a development company and is one of few precious metals mining companies with more than 50% of projected revenues coming from silver, which likely makes it more sensitive to silver price movements than the average silver miner, which often has a higher percentage of gold or base metal production.

Figure 1 & 2

However, GoGold has recently continued to improve the fundamentals of the company. Where we have seen excellent drill results from the new Eagle zone at Los Ricos South, which has led me to increase the valuation of the asset. Los Ricos North has also delivered solid drill results, even if they have been less spectacular compared to Los Ricos South.

Los Ricos North

GoGold was during much of 2022 working on the Phase II drilling at Los Ricos North, which is expected to go into an updated resource and preliminary economic assessment. The PEA was originally planned to be released in Q1-23, but the latest planned release date is according to investor relations somewhere around mid-April this year.

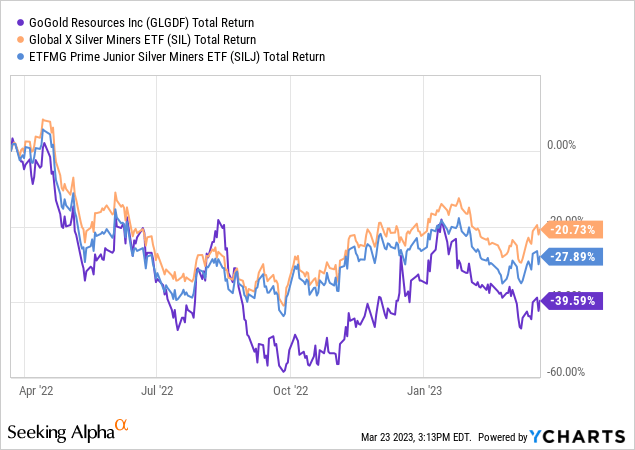

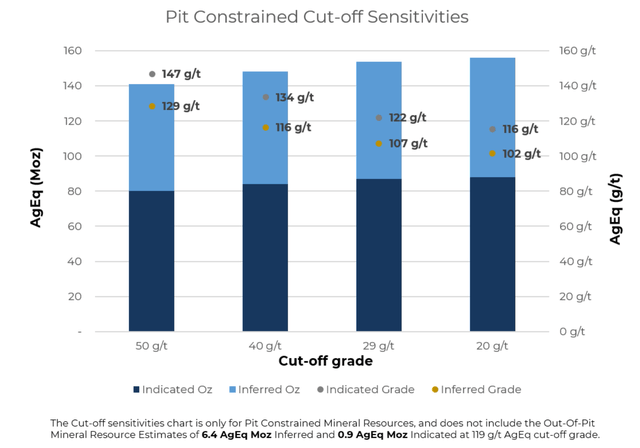

Los Ricos North is larger in terms of ounces than Los Ricos South, at least prior to the addition of the Eagle zone at Los Ricos South. However, the average grade is slightly lower, but still good for an open-pit heap leach project.

Figure 3 - Source: GoGold Presentation - Los Ricos North

I have mentioned it in my most recent articles on GoGold and other Mexican mining discussions. That I continue to be skeptical about getting open-pit projects permitted in Mexico due to government communication and that we have seen some projects get stuck in the permitting stage, despite good local support.

Los Ricos North is further behind Los Ricos South in the development pipeline. So, this might be less of an issue once this asset gets to the permitting stage. Regardless, I have been relatively conservative in my estimated value of Los Ricos North, at 125% of the Los Ricos South PEA. This is even though the asset has substantially more resource ounces than Los Ricos South in the PEA. The Phase II drilling at Los Ricos North is also comprised of about 100 mineralized drill holes with good grades, not included in the table below.

Figure 4 - Source: GoGold Presentation - Los Ricos Total Resource Ounces

Los Ricos South

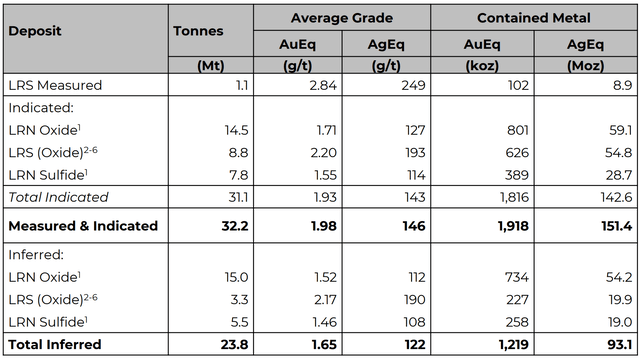

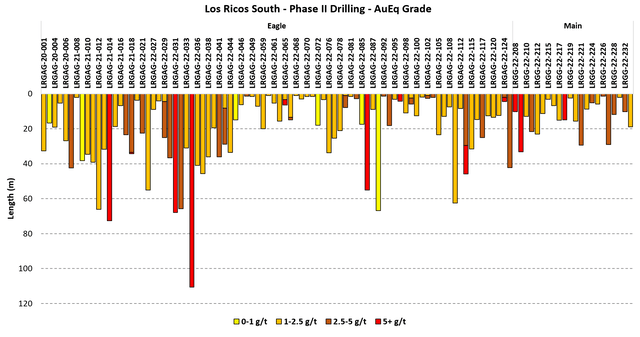

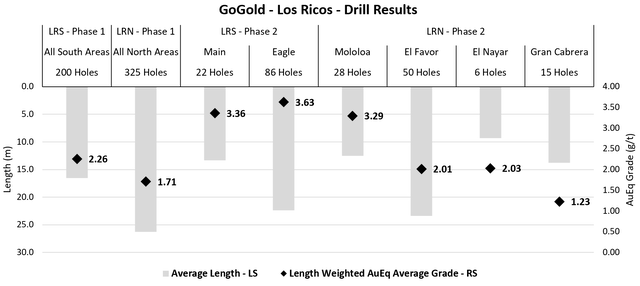

GoGold released a PEA on Los Ricos South in early 2021, with good economics. An updated PEA and PFS are due to be released later in 2023, where the Phase II drilling at Los Ricos South has been exceptionally good as seen in the charts below. The length weighted average AuEq grade at Eagle is 3.62 g/t, with good lengths. Note that this is without assuming a higher underground cut-off, which would boost the grade further.

Figure 5 - Source: My Calculations - Data from Press Releases Figure 6 - Source: My Calculations - Data from Press Releases

With the addition of the Eagle zone, this is looking more and more like a high-grade underground bulk-mining project. Which would likely make it easier to permit. The market has yet to take into account the amount of ounces the updated PEA will add to Los Ricos South nor when we consider that higher grade projects often trade closer to NAV.

Management has lately claimed that the resources at Los Ricos South are likely to double with the next update, which I think the data today supports. So, I have revised the value of Los Ricos South up to 175% of the NPV in the PEA, which is not an overly aggressive number. We also have somewhere around 2-3 months of additional drill results to go into the updated PEA at Los Ricos South.

Parral

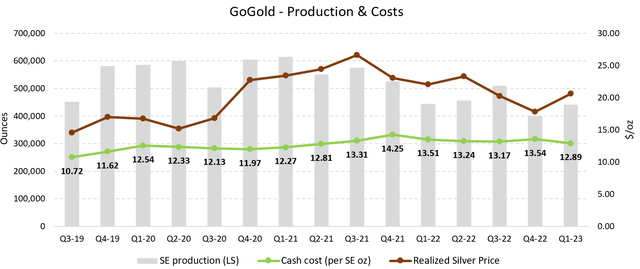

Parral is a small operating asset in Mexico, with about 2Moz of silver equivalent production per year. Given the limited size of the operation, it accounts for a relatively small portion of GoGold's total value, but it has been an important source of cash flow over the years, to minimize equity dilution when developing the larger Los Ricos projects.

Figure 7 - Source: GoGold Quarterly Reports

Over the last 3 years, we have seen costs increase for most precious metals mining companies, for some of them substantially. However, GoGold has managed to keep cash costs at Parral relatively flat during the period, which is very impressive.

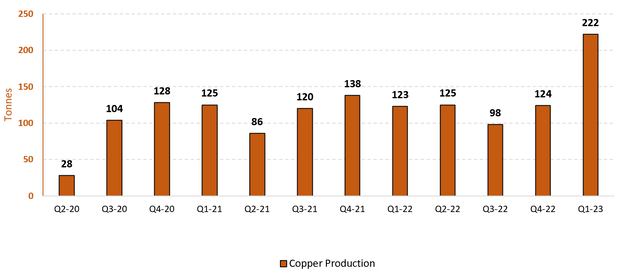

One reason we haven't seen more of a cost increase at Parral is because GoGold relies on longer-term contracts for trucking the material to the heap leach, where the contracts are typically signed for two years at a time. Another reason is the SART plant, which naturally boosts overall silver equivalent production with the addition of copper, but the SART plant also regenerates the cyanide and that means less cyanide has to be purchased. The increasing cost of cyanide in 2022 has for other miners with heap leach operations been a material part of recent cost increases.

Figure 8 - Source: GoGold Quarterly Reports

Valuation and Conclusion

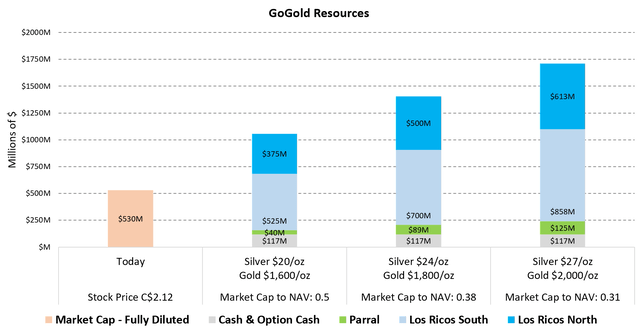

In the figure below, I used the latest share price and financials for GoGold. Parral is valued by discounting the cash flows from the remaining 7 years of operations. Los Ricos South is today assumed to be worth 175% of the initial PEA and we should get a better estimate on this figure in Q2 or Q3 2023, with an updated PEA. For Los Ricos North, I have roughly estimated the value to 125% of the LRS PEA. We will get more precise estimates for Los Ricos North in April once that PEA is released.

Figure 9 - Source: My Estimates

As the chart above illustrates, GoGold is presently very cheap, even when using a relatively conservative Los Ricos North estimate, with a market cap to NPV around 0.35 for gold & silver spot prices.

GoGold also has most of the initial capital cost for Los Ricos South covered by a large cash position, above $100M. So, provided GoGold can get the permit for Los Ricos South later in 2023, the company is less dependent on other external factors to get the project across the finishing line.

While metal prices are always a potential risk for mining companies, with the large cash position, I would argue the permitting process for Los Ricos South is the biggest risk factor today.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article and are interested in the more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio has generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and 9% YTD in 2023.

This article was written by

I enjoy my anonymity, where I write under the name Bang For The Buck. I hold a BSc and MSc in Financial Economics, but most of my value-based investment knowledge comes from independent learning where I am a perpetual student. I primarily focus on turnaround stories, with attractive valuations, in cyclical industries. I have a significant portion of my portfolio exposed to the precious metals industry due to current monetary and fiscal policies.

I publish regular articles on Seeking Alpha and offer a Marketplace service called Off The Beaten Path where subscribers receives real-time updates on the portfolio, in-depth portfolio reports, and frequent updates on holdings companies. As the name suggest, I primarily invest in industries and companies that are underappreciated, which I have found provides more attractive returns.

I am always happy to respond to comments and questions in my articles during the first few days. More in-depth and ongoing discussions are had inside Off The Beaten Path.

Disclosure: I/we have a beneficial long position in the shares of GLGDF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.