Netflix: Recent Optimism Doesn't Change The Picture

Summary

- Shares of Netflix saw a nice move higher, driven by general optimism in the tech space and by the prospect that the firm is seeing growing subscriber numbers in Canada.

- While this is nice, it's important to keep in mind that the company continues to grow nonetheless, but its real growth is occurring outside of the US and Canada.

- The firm is fine, but NFLX shares are pricey and there are better prospects that can be had at this time.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Wachiwit

March 23rd proved to be a rather bullish day for investors in streaming giant Netflix (NASDAQ:NFLX). In response to a report that the company was seeing an uptick in gross subscribers in Canada, as well as on the back of a general rebound in major tech names, shares of the business roared higher, closing up 9% after temporarily climbing as much as 9.8%. While I applaud the optimism that investors have in the firm, and I do think that growth is likely to continue moving forward, it's difficult to really get behind the company from a fundamental perspective. The fact of the matter is that there are other opportunities in this space that are more logical for investors to be drawn to.

Growth continues

It seems that the move higher that shares of Netflix enjoyed was largely driven by two different things. The first was a general move higher in major technology stocks. Even though the Dow Jones Industrial Average went up only 0.23% and the S&P 500 rose just 0.30%, the NASDAQ managed to close 1.01% higher for the day. Leading the way were firms such as Facebook parent Meta Platforms (META), Google parent Alphabet (GOOG), Snap (SNAP), and more. There were also multiple streaming companies that appreciated during the day. The other driver behind the increase seems to have been optimism from a firm called YipitData. According to a report they put out, gross additions to Netflix's subscriber base in Canada have been coming in strong. However, no public data has been made available that I have seen that indicates the degree to which that strength exists.

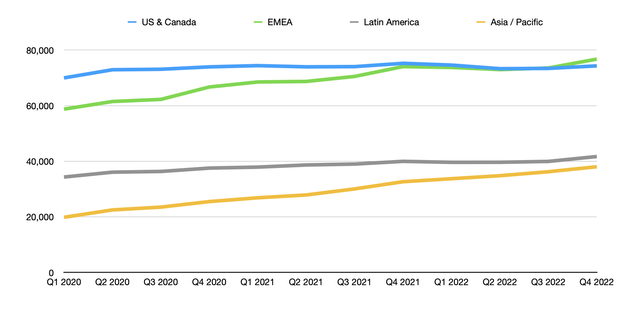

*Number of Subscribers by Quarter

While it's wonderful to see investors do well, my own view is that growth should not be all that surprising from this particular enterprise. Even though the streaming space has become bogged down with a large number of competitors, Netflix has demonstrated an ability to continue growing over time. Management does not break out data for Canada alone. Rather, they provide an aggregation for the US and Canada combined. During the latest quarter of the company's 2022 fiscal year, this region accounted for just under 74.3 million paid subscribers. That means that 32.2% of the 230.7 million paid subscribers the company has on its platform come from these two countries alone. Over the past couple of years, this region has seen a modest uptick in the number of subscribers. Back in the first quarter of 2020, for instance, it boasted just under 70 million subscribers from the region. This implies a 6.2% aggregate growth rate over the past three years.

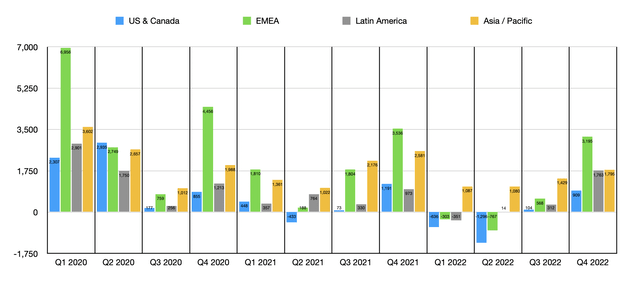

*Quarterly Subscriber Growth

This is not to say that everything is great. The US and Canada collectively represent the slowest growing region for the business. In fact, in three of the quarters between the first quarter of 2020 and the final quarter of 2022, the company reported sequential declines in its subscriber base. The most significant was in the second quarter of 2022 when the firm lost nearly 1.3 million. But in the two quarters since then, the firm has regained most of that decline, with net additions of just over 1 million.

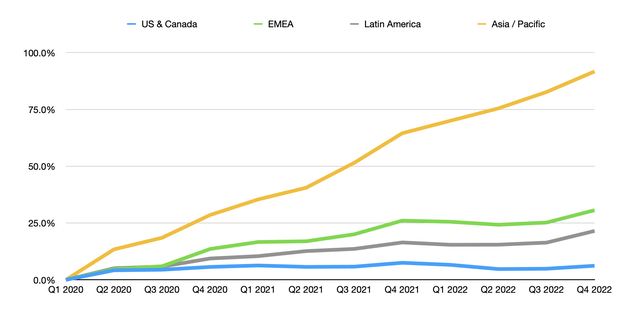

Interestingly, the US and Canada are the slowest-growing portions of the business. The fastest growth, not surprisingly, has come from the Asia Pacific region. From the first quarter of 2020 through the final quarter of 2022, the company nearly doubled the number of subscribers paying for its service. This number expanded from 19.8 million to 38 million. This should not be a surprise when you consider that a willingness to subscribe to a streaming platform would be heavily correlated with growth in the middle class. According to one source, there were about 2 billion people in Asia who were members of the middle class in 2020. By 2030, that number is expected to nearly double to 3.5 billion. It stands to reason, then, that growth for Netflix will continue for the foreseeable future.

*Cumulative Subscriber Growth

The company has also seen attractive growth elsewhere. Over the same window of time, the number of subscribers who are paying for the company's services throughout the EMEA (Europe, Middle East, and Africa) regions shot up 30.6% from 58.7 million to 76.7 million. This makes these regions, collectively, the largest for the enterprise. This is not to say that there aren't other rapidly growing regions for the business. In Latin America, for instance, user growth totaled 21.5% over this window of time, taking the number of paid users up from 34.3 million to 41.7 million. Management has said that overall growth will probably be modest this year relative to last year. But with the global middle class expected to rise from 7.7 billion in 2020 to 8.4 billion in 2030, there does seem to be good upside potential, not only for Netflix, but for all the streaming companies with global ambitions. After all, with the rise in population should also be a surge in spending. In 2020, the middle class spent $44 trillion, representing about 68.8% of all consumer spending. By 2030, this number should grow to $62 trillion, accounting for 68.1% of all consumer spending for that year.

There are better opportunities out there

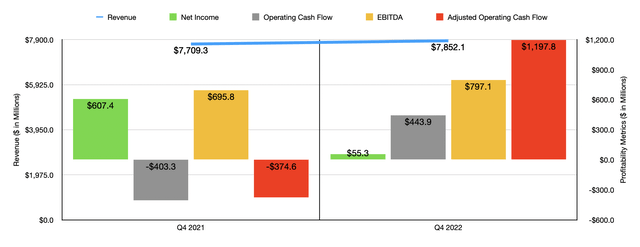

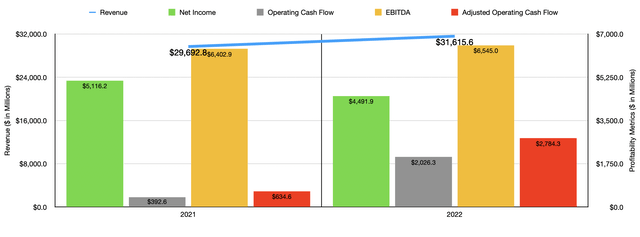

To be clear, I'm not saying that investors would be wise to buy stock in Netflix. The company may be a solid firm that is continuing to generate upside, but I would say that there are better opportunities that can be had in the market today. In the chart above, you can see data covering the most recent quarter, which is the final quarter of the 2022 fiscal year. And in the chart below, you can see the same thing but for the entirety of both 2021 and 2022. What you'll notice here is a company that is continuing to grow its top line, but that has a history of mixed bottom line results.

Using data from the 2022 fiscal year, I decided to value the company. For full transparency, I don't put a great deal of faith into valuing this firm from an operating cash flow perspective. But I did include that metric since I normally do include it for the companies I look at. On a price-to-earnings basis, the firm is trading at a multiple of 31.8. The price to adjusted operating cash flow multiple, which makes an adjustment to operating cash flow based on changes in working capital, comes out to 51.2. And the EV to EBITDA multiple is a rather lofty 23.1.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Netflix | 31.8 | 51.2 | 23.1 |

| Warner Bros. Discovery (WBD) | 6.5 | 6.6 | 5.8 |

| Paramount Global (PARA) | 13.0 | 61.6 | 10.4 |

| The Walt Disney Company (DIS) | 52.6 | 33.4 | 18.5 |

I also compared the company to three similar firms. Two of these are what you could call pure plays or close to pure plays in the content space. The other, The Walt Disney Company, is undeniably the leader in the streaming market, but it is obviously a very diverse entertainment company with significant operations that span theme parks, hotels, cruises, and more. As you can see in the table above, the pricing for these companies ranges materially. But one thing that's worth pointing out is that each of the firms is cheaper than Netflix using at least two of the three metrics, with Warner Bros. Discovery being cheaper across all three. As I've written in the past, one of my favorite companies on the market today is The Walt Disney Company. Although it's a bit pricier in the grand scheme of things than the other two, I like the diversity in operations that it brings and the stability of its brand is unparalleled. But when it comes to it versus Netflix, there is no competition. In addition to being larger than Netflix from a streaming subscriber perspective, the firm is cheaper than Netflix on both the price to operating cash flow basis and on the EV to EBITDA basis. To get an industry leader with an entire ecosystem of businesses at a discount to what you would pay for Netflix seems like a no-brainer to me.

Takeaway

It's great to see some optimism for shareholders of Netflix. Ultimately, however, I don't believe that the company is the most compelling opportunity on the market right now. Shares look pricey even though the firm continues to grow. If the stock were meaningfully cheaper, I would consider it to be a better prospect. But that simply is not the case. And absent some change that makes the company fundamentally more appealing, I would make the case that there are definitely better prospects to be had right now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.