Ideaya Biosciences Has A Strong Pipeline And Looks Investible

Summary

- IDEAYA Biosciences, Inc.'s platform is synthetic lethality targeting cancer.

- The company has produced solid proof of concept data from multiple programs.

- Cash is strong, and big pharma is interested in IDEAYA Biosciences, Inc. and its work.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Sharamand

IDEAYA Biosciences, Inc. (NASDAQ:IDYA) uses the technology of synthetic lethality to target cancer cells. Synthetic lethality is defined by the company through citing the Columbia University geneticist Calvin Bridges, who in 1922 said that "certain combinations of gene mutations resulted in lethality despite the fact the single mutations in either gene were viable." The company is achieving this sort of synthetic lethality of cancer cells by targeting DNA damage repair, or DDR, pathways or tumor metabolism pathways using small molecules.

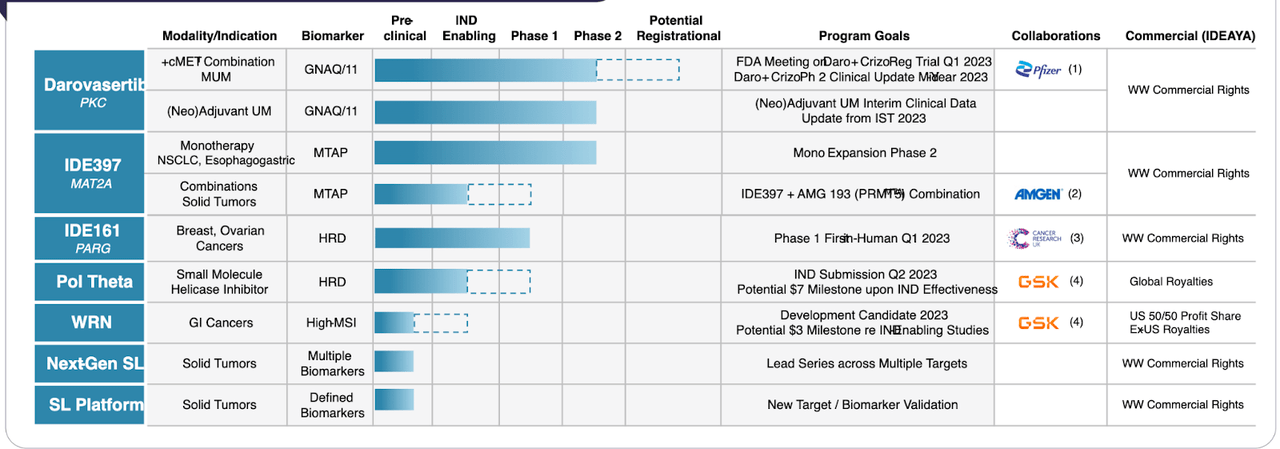

The pipeline looks like this:

IDEAYA pipeline (IDEAYA website)

Lead candidate is Darovasertib, described as a "selective small molecule inhibitor of PKC, a protein kinase that functions downstream of the GTPases GNAQ and GNA11." The molecule is licensed from Novartis, who did a phase 1 trial in metastatic uveal melanoma ("MUM"), a cancer of the eye with a high frequency of GNAQ or GNA11 gene mutations. While researching, I found something interesting. Under Novartis, this molecule was known as LXS196, a name whose origin I cannot yet fathom. Under IDEAYA the name changed to IDE196, or the generic name darovasertib. This molecule is a Protein Kinase C or PKC inhibitor targeting the two pairs of mutations GNAQ and GNA11 in MUM. Novartis conducted a phase 1 trial, starting in 2016 and ending in 2022. It licensed the molecule to IDEAYA in 2019.

The interesting thing I found is that Novartis launched a phase 1 trial of DYP688 in 2022 targeting MUM. DYP688 is a PKC inhibitor - just like LSX196 - and it also targets the two genetic mutations GNAQ and GNA11. So I am wondering: how does this work? They out-licensed one molecule, and now they are testing a similarly functioning molecule? I must be missing something.

Coming back to darovasertib, MUM is a difficult cancer, according to a 2019 study. Although UM itself is highly curable, when it metastasizes, it quickly leads to death:

Although overall survival (OS) of Uveal Melanoma (UM) patients is relatively high, reaching about 80% at 5 years, with high-risk UM patients frequently developing a metastatic disease, which has a severe prognosis. In about 90% of cases, metastases involve the liver, and untreated patients have a mean survival time of about 2 months, reaching about 6 months in treated patients

There were no standard treatments available. A number of pathways have been targeted, but despite often positive preclinical data, most molecules have failed in the clinic. In 2019, the FDA approved tebentafusp, known as Kimmtrack, for MUM. Kimmtrack is developed by Immunocore (IMCR). According to the study referenced below:

A Phase III trial of tebentafusp compared to investigator choice pembrolizumab, ipilimumab or darcarbazine control in HLA-A*02:01-positive patients demonstrated a 1-year overall survival benefit of 73% compared to 59% in the control group [8]. However, given that HLA-A*02:01-positive tumors represent up to 45% of the western population only, there remains a need to broaden therapeutic options targeting other molecular features unique to uveal melanoma.

Darovasertib aims to fulfill this lacunae. A Nature article published on the 1st of this month claims there is "finally some progress" while discussing Darovasertib's trial data. The article says that the molecule is well tolerated and showed signals of early efficacy. Other molecules targeting the PKC pathway have been tried, but failed. For example, sotrastaurin, a pan-inhibitor of PKC isoforms showed drug activity but did not result in high response rates. Darovasertib is more selective, and the study has shown a dose limiting toxicity at 500mg+ doses, with the DLT being hypotension, resolvable with IV fluids. Preclinical models predicted this DLT, and the hypothesis is that Darovasertib PKCα, which plays a role in vascular tone.

Anyway, the study referenced in Nature is here. Data is this:

Clinical activity was observed in 6/66 (9.1%) evaluable patients achieving response (CR/PR), with a median duration of response of 10.15 months (range: 2.99-41.95); 45/66 had stable disease (SD') per RECIST v1.1. At 300 mg BID, the recommended dose for expansion, 2/18 (11.1%) evaluable patients achieved PR and 12/18 (66.7%) had SD.

In its introduction, the study authors provide the key unmet medical need for this new molecule:

However, only a minor improvement in PFS and no improvement in overall response rate (ORR) was demonstrated [with Kimmtrack].

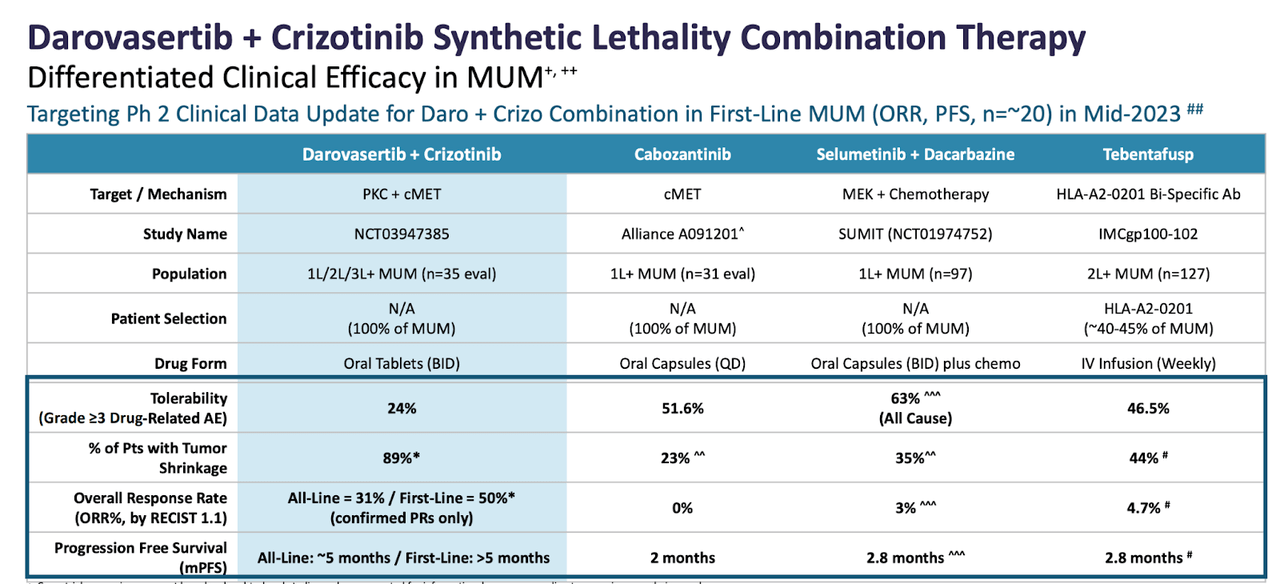

They also provide a comparative data chart:

IDE196 comparison (IDEAYA website)

There are 13k targeted patients for both indications together for Darovasertib. Peak revenue figures go beyond $1bn (see page 17). The key catalyst ahead is this:

Planning regulatory update on potential registration-enabling clinical trial for darovasertib / crizotinib combination in MUM following scheduled FDA meeting in Q1 2023

Besides this indication, Darovasertib also has a phase 2 trial in neoadjuvant UM. The other phase 2 molecule is IDE397, a MAT2A inhibiting agent targeting NSCLC and Esophagogastric cancers. This molecule has also seen a positive phase 1 trial, where there were strong ctDNA-based molecular responses in a variety of tumors.

IDEAYA has major collaborations with Pfizer (PFE), Amgen (AMGN), and GSK plc (GSK), totaling $2bn in potential milestones.

Financials

IDYA has a market cap of $689mn and a cash balance of $373mn. The company should get some milestone payments from GSK in the coming months. Research and development (R&D) expenses for the three months ended December 31, 2022 totaled $24.7 million while general and administrative (G&A) expenses totaled $5.8 million. That gives them a 10-12 quarter runway, enough to get them to a very solid position should the FDA meeting turn out well.

Bottom Line

I like IDEAYA Biosciences, Inc. Admittedly, the company has a lot of things ongoing, making research a little complicated. This overview piece barely touches on the outlines. I plan to do more research over the coming months and keep sharing that here. Right now, considering the regulatory update up ahead, I think a pilot position in IDEAYA Biosciences, Inc. is warranted.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.