PJAN - Protected S&P 500 Exposure, Ideal For A Recession

Summary

- 2022 was a brutal year for equities, with the S&P 500 down over -18%.

- PJAN is an exchange traded fund that gives up some of the index upside in order to hedge the downside.

- The fund was down only -5% last year, and is closely tracking the index positive performance this year.

- The fund employs a protective collar options strategy, with the downside structured as a put spread.

- We find the tenor of the options overlay to be appropriate for today's environment, and the fund to be a robust option for recessionary environments.

Tasos Katopodis

Thesis

They say you cannot time the market. And that is correct. The Innovator U.S. Equity Power Buffer ETF (BATS:PJAN) is an exchange traded fund that offers investors exposure to the S&P 500 index, but with a protected downside. Investors who still want to have equity exposure in a recessionary environment, should have a close look at PJAN. The fund employs a protective collar strategy in order to mitigate the downside. In plain English, if the index plummets to 325 today (i.e. a -18% drop), the fund would lose only around -7%.

In the article we are going to go into detail around the options strategy employed, but an investor should be cautioned that PJAN is structured with a floor to its buffer. In order to make the math work, the fund does not protect any negative returns generated when the SPY is lower than 325. We are going to explain that a little further in the body of the article. In order to obtain this downside buffer, the fund wrote a call option at the 454 strike level, so PJAN will not participate in any gains above that point if the index rallies into the year end.

We have written about a CEF that aims to do something similar, but ETJ's roll strategy was erroneous for a high vol year such as 2022. PJAN takes the right approach for today's market with a 1-year time horizon for its collar components.

Options Overlay

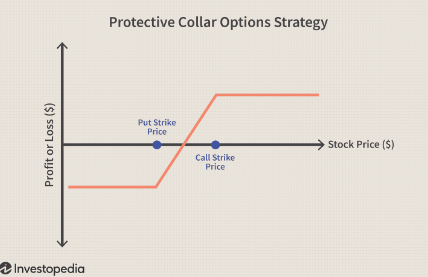

The fund enters into what is called a 'protective options collar strategy':

Collar Strategy (Investopedia)

A protective collar involves selling an out of the money high strike call, and buying an out of the money put. By doing so one ensures the downside is buffered to the put strike price, while the upside is also limited. This strategy is undertaken in order to protect the portfolio but also cheapen the cost of the entire structure versus just buying outright puts.

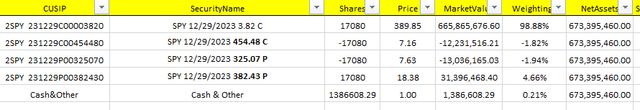

Let us have a look at how PJAN does this:

- firstly to note that all of the fund's options have a December 2023 maturity date

- the fund sold a $454 strike call, thus limiting the upside to that level in the S&P 500

- to protect the downside, the fund also bought a $382 strike put, thus buffering the downside

- the vehicle would have had 100% downside protection if the structure would have not been further enhanced

- in order to cheapen up the downside protection cost, PJAN also sold a $325 put

- basically the vehicle offers coverage if the index does not end the year lower than $325

- given the very low strike level for the sold put, that is a pretty good bet

There are two things to consider for this structure:

- Mark to market impact: every day the fund is marked to market. As the market trades the price action will be buffered by the options overlay. As we approach the maturity date of the options, the 'delta' component will have more of an impact than the time value or 'theta'. Basically translated into English, if the market moves to $300 today, the impact on PJAN will be more muted versus the market moving to $300 a week before options expiration.

- Where the index closes the year: the settlement for the options occurs at year end. If the S&P 500 closes above $325 but below $454, the fund would have fully realized the value of its collar

Performance

We can see the benefit of this protective collar from the fund's performance last year:

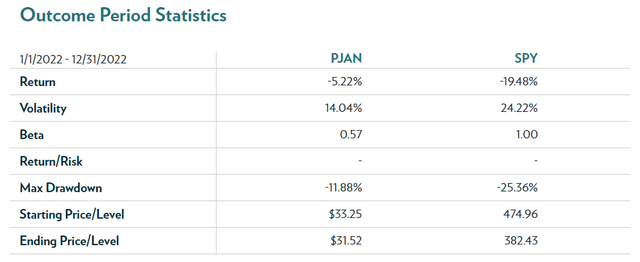

Period Statistics (Fund Website)

So in 2022, PJAN lost only -5%, but more importantly it had a very shallow drawdown of -11% and a low beta of 0.57. To translate that in English, each day the S&P 500 was down -1%, you should have expected PJAN to be down only -0.57%.

Expect something similar this year, with more of a buffer in the first eight months of the year. As we approach the maturity date of the options, we are going to see the pricing of the options being impacted more by 'delta' (i.e. the S&P 500 price) rather than time value or volatility.

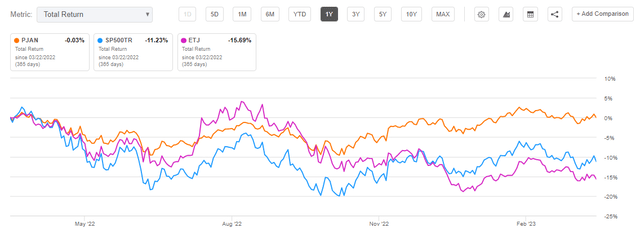

And this is how PJAN did last year versus the S&P 500 and the (ETJ) CEF:

We can see that on a 1-year lookback PJAN is flat, where the index is down -11% and ETJ is down -15%. It is very important to understand that PJAN's success is due to the way it constructed its protective collar, specifically the tenor of the collar options.

Conclusion

PJAN is an exchange traded fund. The vehicle employs a protective collar options strategy, with the downside structured as a put spread. This translates into the fund having modest downside losses as the market sells-off, up to a certain barrier. Currently the fund sold a $454 strike call, thus limiting the upside to that level in the S&P 500, while at the same time having bought a put at a $382 strike. The twist here is that the fund also sold a $325 put in order to cheapen the cost.

To translate the above in English, if the index plummets to 325 today (i.e. a -18% drop), the fund would lose only around approximately -7%. This structure works quite well, as we have seen historically: PJAN was down only -5% in 2022, and its maximum drawdown was -11%, versus -25% for the S&P 500.

We find PJAN to be structured correctly (with a 1-year tenor on the options collar), and an appropriate tool to use during recessionary times. For a retail investor who is still keen to retain exposure to the equity asset class but concerned about deep drawdowns, PJAN is an ideal instrument to use.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.